Medicare Advantage Plans 2025

As we get closer to the year 2025, the Medicare Advantage landscape continues to evolve, presenting beneficiaries with a wealth of coverage options.

Although specific details of Medicare Advantage plans in 2025 aren’t available yet, some changes have been released that will affect those on these plans moving into 2025.

And when they become available, our website is an easy way for you to compare Medicare Advantage plans for 2025, and you can even enroll online yourself.

Key Takeaways

- Learn about changes to Medicare Advantage plans in 2025

- See which costs will be affected for 2025

- When you can enroll in a Medicare Advantage plan for 2025

Overview of Medicare Advantage Plans for 2025

One big change to Medicare Advantage plans in 2025 is to those plans that include Medicare Part D prescription drug plans (MAPD).

The recent Inflation Reduction Act law has changed the annual out-of-pocket costs for people on Medicare Part D in 2025. There is now a maximum out-of-pocket cost of $2000 per year.

Elimination of the Coverage Gap

Another big change in 2025 is the elimination of the Medicare Part D coverage gap phase. This is the phase that occurs when Medicare enrollees have spent a certain amount of covered prescriptions. In previous years, once that amount has been reached enrollees would enter the coverage gap, often resulting in much higher costs for their covered prescription drugs.

Expanded Coverage Areas for 2025

In recent years, the landscape of Medicare Advantage plans evolved with expansions into new counties and states, presenting beneficiaries with a broader array of choices.

This expansion included those who may be eligible for both Medicare and their state Medicaid program, offering them increased flexibility. Aetna, for instance, extended its plans to cover 46 states and Washington, DC, resulting in the addition of 255 new county options, which in turn offered coverage to approximately 2.2 million more beneficiaries.

As a result, in 2024 Aetna offered coverage in a total of 2,269 counties.

UnitedHealthcare’s Medicare Advantage plans also widened their coverage, encompassing an additional 110 counties in 2025, covering 96% of the overall coverage area.

Wellcare’s 2024 expansion of Medicare Advantage plans had potentially reached 48 million Medicare-eligible adults nationwide, with coverage for behavioral healthcare services potentially included.

These expansions offered beneficiaries a more extensive range of choices, ensuring they were able to select a plan that aligns with their unique healthcare needs and preferences.

New Benefits

Though new or expanded benefits for Medicare Advantage plans in 2025 have not been released yet, there could be changes to both existing and possibly new plans.

It is possible that many Medicare Advantage plans in 2025 will continue to offer additional benefits beyond what Original Medicare offers, such as fitness benefits, low or no copay for certain Medicare Part D covered prescriptions, and the possibility of coverage for dental, vision, and hearing services, as well as allowances for everyday living costs.

These benefits help Medicare Advantage members ensure that they receive comprehensive and tailored healthcare services.

Possible Additional Benefits

In previous years, some Medicare Advantage insurance companies have demonstrated their commitment to better serving their members by implementing significant enhancements to their services. Some additional benefits in plans in the past have included:

- Dental Coverage: Some Medicare Advantage plans have more extensive dental coverage, addressing the oral health needs of their beneficiaries.

- Vision Coverage: Vision-related services and benefits have expanded with certain carriers to cater to the visual healthcare requirements of plan members.

- Hearing Coverage: Some plans began to offer more comprehensive hearing coverage, including discounted hearing exams and hearing aids.

- Improved Mental Healthcare Coverage: Enhanced coverage for mental healthcare services ensures that beneficiaries have better access to the mental health support they need.

Though 2025 additional benefits from insurance carriers aren’t known yet, once they are you can enter your zip code above to begin comparing plans in your area.

Member Experience

To streamline the member experience and make it more convenient, Medicare Advantage providers in the past have embraced digital enhancements, such as:

- Digital Health Education: Enrollees are now provided with digital health education resources, which improves access to telehealth services and boosts digital health literacy.

- Online Hubs: Online hubs have been introduced, simplifying the member experience by providing easy access to information about Medicare Advantage plans and their benefits.

- Enhanced Plan Comparison: Beneficiaries now have the ability to compare and select from a broader range of plans offered by different providers, empowering them to make more informed choices.

- Virtual Visits: Virtual visits are now offered, providing members with convenient access to healthcare services from the comfort of their homes.

- Reduced Cost-Sharing: Cost-sharing has been reduced, making healthcare more affordable for plan members.

- Additional Supplemental Benefits: Many plans now include supplemental benefits such as dental, vision, and hearing exams, further enriching the overall healthcare experience.

These digital enhancements are designed to improve the overall accessibility and user-friendliness of Medicare Advantage plans, ensuring that beneficiaries can make the most of their coverage while enjoying a modern and convenient healthcare experience.

View plans & rates

Enter Zip Code

Best Medicare Advantage Plans for 2025

Though there will be no one “best” Medicare Advantage plan in 2025 for everyone, there are certain insurance companies that have historically provided plans that the majority of those seeking a Medicare Advantage plan have enrolled in.

Some of those companies include:

- UnitedHealthcare

- Humana

- Cigna

- Anthem

- Aetna

- Wellcare

- Blue Cross Blue Shield

In the past some of these providers have expanded their coverage areas, enhancing their offerings to meet the diverse requirements of Medicare consumers.

By conducting a thorough comparison of the leading Medicare Advantage providers, you can ensure that you choose a plan that strikes the right balance between coverage, benefits, and services, tailored to your specific healthcare needs.

Let’s delve into a detailed analysis of each provider’s offerings, considering factors like coverage areas, benefits, and services

UnitedHealthcare Medicare Advantage Plans 2025

UnitedHealthcare, a major player in the Medicare Advantage market, had expanded its coverage area for 2024, providing access to 96% of all Medicare consumers. The company’s Medicare Advantage plans offer:

- Expanded coverage area to reach 96% of all Medicare consumers.

- Enhanced benefits for a more comprehensive offering.

Humana Medicare Advantage Plans 2025

Humana Medicare Advantage plans often offer comprehensive healthcare coverage to eligible individuals, providing a valuable alternative to traditional Medicare.

With options tailored to specific needs, beneficiaries can choose from a range of plan types, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Humana’s commitment to member well-being extends to health and wellness resources, making their Medicare Advantage plans a robust and holistic healthcare solution for seniors.

- Available across 49 states, Washington, DC, and Puerto Rico.

- Certain beneficiaries may not pay monthly premiums.

- Dual-eligible special needs plans are available.

Aetna Medicare Advantage Plans 2025

Aetna’s Medicare Advantage plans often offer comprehensive healthcare solutions for eligible individuals, offering a refreshing departure from traditional Medicare.

These plans offer the essential coverage of Medicare Parts A and Medicare Part B, sometimes with additional perks, such as prescription drug coverage, dental, optical, and even fitness programs.

- Expanded coverage to 46 states and Washington, DC.

- Added 255 new counties, totaling 2,269 counties with plans.

- The possibility of additional benefits, including fitness benefits

- Aetna Medicare payment card for in-network copayments.

Wellcare Medicare Advantage Plans 2025

Wellcare’s Medicare Advantage plans are a standout option for those seeking comprehensive healthcare coverage.

These plans seamlessly integrate Medicare Parts A and Medicare Part B while often including added benefits like prescription drug coverage, as well as dental, vision, and wellness programs.

Wellcare prioritizes member well-being by offering telehealth services and promoting preventive health measures through wellness programs. This makes its Medicare Advantage plans a robust and proactive choice for seniors looking for comprehensive and personalized healthcare coverage.

- Focuses on affordability and comprehensive coverage.

- Savings with $0 or low monthly premiums.

- Possible additional benefits are available at no extra cost for qualifying members.

These providers offer a wide range of Medicare Advantage plans with various benefits and coverage options.

Evaluating their offerings and coverage areas will help you choose a plan that aligns with your specific healthcare needs and preferences.

Navigating the Medicare Advantage Market in 2025

To maximize the benefits of your 2025 Medicare Advantage plan, it’s crucial to understand the market’s various aspects, including premiums and cost-sharing, star ratings, and enrollment periods.

This knowledge will empower you to make informed decisions about your healthcare coverage, ensuring you receive the best possible benefits and services.

Let’s delve into these critical aspects:

Understanding Premiums and Cost-Sharing: The estimated average monthly premium for Medicare Advantage plans in 2025 is approximately $18.50, representing a modest increase of 64 cents from the previous year.

However, it’s essential to recognize that premium costs may vary depending on the insurer and the level of coverage provided.

Cost-sharing in 2025 Medicare Advantage plans encompasses various elements, including:

- Premiums: The regular monthly payment for your Medicare Advantage plan.

- Deductibles are the amount you must pay out of pocket for covered healthcare services before your plan starts to pay.

- Copayments: Fixed amounts you pay for specific medical services or prescription drugs.

- Coinsurance: A percentage of the cost of a covered healthcare service that you are responsible for.

The specific cost-sharing structure is determined by the particular Medicare Advantage plan chosen by the beneficiary.

Reviewing the details of each plan is crucial to making an informed decision. This allows beneficiaries to better understand the cost-sharing requirements and select a plan that aligns with their financial and healthcare needs.

It’s worth noting that not all enrollees will experience an increase in their costs, even if Medicare Advantage premiums rise in 2025.

Understanding the factors influencing premium costs, such as projected increases in healthcare spending and changes in the Part B standard premium and deductible, can help you make informed choices about your Medicare Advantage coverage and anticipate potential fluctuations in premium expenses.

To make the most of your 2025 Medicare Advantage plan, consider various key factors, including star ratings, enrollment periods, benefit eligibility, and the utilization of extra benefits.

Understanding these aspects will help you optimize your healthcare coverage and receive the best possible services and benefits from your Medicare Advantage plan.

Star Ratings:

- The Centers for Medicare and Medicaid Services (CMS) assesses several factors, such as the quality of care, customer service, and member experience, to determine the plan’s overall star rating.

- Star ratings range from one to five stars, with five stars indicating exceptional performance.

- By comparing the star ratings of various Medicare Advantage plans, you can choose a plan that offers high-quality services and benefits.

- It’s important to note that star ratings are updated annually, with finalized ratings released in October of each year. Staying informed about these ratings will help you make informed decisions about your healthcare coverage.

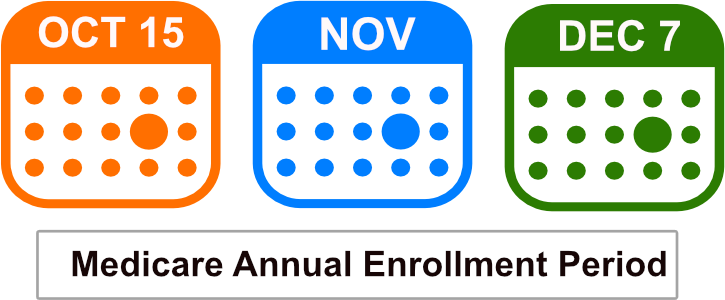

Enrollment Periods:

- There are two primary enrollment periods to be aware of when enrolling in a Medicare Advantage plan.

- The Initial Enrollment Period spans seven months, including three months before, the month of, and three months after becoming eligible for Medicare. This is the window for enrolling in a Medicare Advantage plan for the first time.

- The Annual Enrollment Period for Medicare Advantage is from October 15th to December 7th each year. During this period, you can make changes to your Medicare Advantage plan, including switching to a different plan or enrolling in one for the first time.

- Understanding these enrollment periods and their associated eligibility criteria is essential to enrolling in a Medicare Advantage plan that meets your healthcare needs and preferences.

Medicare Advantage Plan Benefit Eligibility in 2025

- Verifying your eligibility for Medicare Advantage plans during enrollment periods is vital to ensure you meet the plan criteria and can access the provided benefits.

- You can confirm benefit eligibility by referring to resources from the Centers for Medicare & Medicaid Services (CMS), such as their official website, fact sheets, or the Medicare and You publication.

- Insurance providers like UnitedHealthcare, Humana, and Blue Cross Blue Shield also offer resources and plan options for Medicare Advantage in 2025.

Utilizing Extra Benefits:

- Many Medicare Advantage plans in 2025 provide additional benefits, including vision coverage, fitness programs, hearing coverage, and dental coverage.

- To maximize these extra offerings, be sure to use the supplementary coverage provided by your plan, such as prescription drugs, vision, hearing, dental, or wellness services.

- By understanding and using your plan’s extra benefits effectively, you can optimize your healthcare coverage and receive comprehensive care.

- Additionally, stay informed about any updates or changes to your Medicare Advantage plan in 2025 that may affect your benefits to ensure you continue to receive tailored healthcare services.

By following these steps and considering these factors, you can make the most of your Medicare Advantage plan in 2025 and ensure that you receive comprehensive and personalized healthcare services.

By staying informed and actively utilizing your plan’s extra benefits, you can ensure that you receive comprehensive and tailored healthcare services.

Understanding Coverage Limitations

- While Medicare Advantage plans offer a wide range of benefits and services, it’s crucial to be aware of any potential constraints and restrictions associated with your plan. This includes considerations such as provider networks and service limitations.

- Provider networks in Medicare Advantage plans determine which healthcare providers are included in the plan’s network. Coverage may be limited or not covered at all for out-of-network providers.

- It’s important to understand that Medicare Advantage premiums may see increases in 2025, although not all enrollees will be affected.

- Understanding the factors influencing premium costs and the potential limitations of your plan will enable you to make informed decisions about your healthcare coverage and ensure that you receive the best possible benefits and services.

Summary

By comparing top providers, understanding the market dynamics, and maximizing your plan benefits, you can make informed decisions about your healthcare coverage and ensure that you receive high-quality care.

Staying informed, exploring your options, and actively engaging with your Medicare Advantage plan in 2025 will help you make the most of your healthcare coverage.

Begin comparing Medicare Advantage plans in 2025 when they’re available by entering your zip code above.

Frequently Asked Questions

What will the Medicare premium be for 2025?

What will the Medicare premium be for 2025?

The standard monthly premium for Medicare Part B enrollees in 2025 has not been released yet. Keep checking back for more details.

![]()

What are the changes to Medicare Advantage plans in 2025?

In 2025, Medicare Advantage plans will likely have changes in the average monthly premiums as well as various changes in coverage. There are also changes to the Medicare Part D prescription drug program in 2025 that will affect Medicare Advantage plans that include Medicare Part D prescription drugs.

![]()

What is the Medicare Advantage Annual Enrollment Period (AEP) for 2025?

AEP, also known as the Medicare Open Enrollment Period for 2025, runs from October 15th to December 7th of 2024. During this time, Medicare beneficiaries can make changes to their Medicare Advantage plans, such as switching to a different plan or returning to Original Medicare.

![]()

Can I enroll in a Medicare Advantage plan in 2025 if I have end-stage renal disease (ESRD)?

In most cases, individuals with ESRD are eligible to enroll in a Medicare Advantage plan, but there may be restrictions or specific plans designed for ESRD patients. It’s essential to check plan availability and requirements in your area.

![]()

What is the difference between the 2025 Initial Enrollment Period (IEP) and the Medicare Advantage Open Enrollment Period (OEP)?

The IEP is the initial seven-month period when you first become eligible for Medicare (around your 65th birthday). The OEP, on the other hand, allows existing Medicare Advantage beneficiaries to switch plans or return to Original Medicare annually from January 1st to March 31st.

![]()

Can I switch from a Medicare Advantage plan to a Medigap (Medicare Supplement) plan in 2025?

Yes, you can switch from a Medicare Advantage plan to a Medigap plan, but it’s important to do so during specific enrollment periods and meet eligibility requirements. A guaranteed issue right may apply to ensure you can obtain a Medigap plan without underwriting.

![]()

What is the Medicare Advantage Special Enrollment Period (SEP)?