Healthfirst Medicare Advantage Plans 2025

With so many different companies offering Medicare Advantage plans in 2025, it’s hard to know even where to start.

Well, Healthfirst is here to make it easier for you. With a variety of Healthfirst Medicare Advantage plans tailored to fit your needs, Healthfirst Medicare Advantage plans offer comprehensive coverage and additional benefits to eligible individuals in New York.

Let’s explore these healthfirst medicare advantage plans and discover how Healthfirst can help you achieve better health and well-being.

Key Takeaways

- Healthfirst offers multiple Medicare Advantage Plans with comprehensive benefits and services.

- Eligibility requirements vary but include having Parts A & B of Medicare and residency in the service area.

- Healthfirst has achieved a 4/5 Star Rating for 2024, demonstrating its commitment to providing high-quality plans.

Compare Plans in One Step!

Enter Zip Code

Overview of Healthfirst Medicare Advantage Plans

Healthfirst is a leading health plan provider in New York, offering several Medicare Advantage plans that cater to various needs and preferences, including the Healthfirst Medicare Plan. These plans are designed to provide comprehensive coverage while ensuring that you have access to a wide network of healthcare providers.

With options like the Signature PPO and HMO plans, 65 Plus Plan, and Enhanced Benefits Plan, Healthfirst has something for everyone.

The Medicare Advantage plans offered by our company include the following options:

- Signature (PPO) Plan: This plan provides flexibility, low or no premiums, and comprehensive dental, vision, and hearing benefits.

- Signature (HMO) Plan: Similar to the PPO plan, this option also offers flexibility, low or no premiums, and comprehensive dental, vision, and hearing benefits.

- 65 Plus (HMO) Plan: This plan focuses on hospital, medical, and drug coverage with a $0 monthly premium.

- Enhanced Benefits Plan (HMO): Tailored for those qualifying for full Extra Help, this plan offers a $0 premium and low or no co-pays.

Each plan has its unique features and benefits, but not all plans may suit your needs. Let’s take a closer look at each one to help you make an informed decision.

Signature (PPO) Plan

The Signature (PPO) plan offers:

- Flexibility and personalized benefits for Medicare beneficiaries

- A broad network of providers, allowing you to choose in-network or out-of-network providers for your care

- A $700/year Flex card for out-of-pocket expenses

- Comprehensive dental benefits

- Hearing and vision benefits

- A care management team

- Access to healthy foods through the OTC Plus card

Prescription drug coverage is also included in the Signature (PPO) plan, ensuring that you have access to the medications you need. The $700/year Flex card helps cover out-of-pocket expenses, subject to contract renewal, making it easier to manage your healthcare costs. With the Signature (PPO) plan, you can enjoy greater flexibility and comprehensive benefits to support your overall health and well-being.

Signature (HMO) Plan

The Healthfirst Signature HMO plan offers the following benefits:

- $0 premium

- Flexible benefits

- Low or no co-pays

- Option to customize your plan with a Choice Extra Benefit, such as a $70/quarter OTC card or up to $200 in dental services

This allows you to tailor the plan to your specific needs.

Available in several New York counties, the Signature (HMO) plan offers comprehensive coverage, including:

- Dental

- Hearing

- Vision

- OTC Plus card

- Transportation

- Enhanced benefit Medicare Part D plan

Rated 3.5 stars for the contract year 2022, this Medicare contract plan provides valuable benefits and services to meet your healthcare needs.

65 Plus (HMO) Plan

The 65 Plus (HMO) plan is designed for Medicare-eligible individuals who value comprehensive coverage with a $0 monthly premium. This plan offers a range of add-on optional benefits such as acupuncture and podiatry, as well as coverage for non-Medicare-covered services and Part D and Part B drugs, including chemotherapy.

With the 65 Plus (HMO) plan, you can also enjoy a $0 copay for up to 84 meals delivered to your residence for a period of up to 28 days following a transition from the hospital to home or from a skilled nursing facility. Additional benefits in this plan make it a well-rounded option for those seeking comprehensive care and support in their healthcare journey.

Enhanced Benefits Plan (HMO)

For individuals who qualify for full Extra Help, the Enhanced Benefits Plan (HMO) offers the following benefits:

- $0 premium

- Prescription drug coverage

- OTC Plus card

- Low or no copays

This Medicare Advantage plan provides the benefits of Original Medicare in addition to additional benefits such as prescription drugs, dental, hearing, vision, and over-the-counter items.

The monthly premium for the plan is $0 for those who are eligible for full Extra Help, making it an accessible and cost-effective option for individuals who require additional support. With comprehensive benefits and services, the Enhanced Benefits Plan (HMO) is a practical choice for those in need of tailored healthcare solutions.

Special Needs Plans (D-SNP)

For Medicare-eligible individuals with specific needs, Healthfirst offers Special Needs Plans (D-SNP). These plans are designed for those receiving full Medicaid benefits or cost-sharing assistance, providing targeted care, and limiting costs while offering additional support and benefits, including prescription drug coverage.

We will now examine Healthfirst’s D-SNP offerings in more detail.

Life Improvement Plan (HMO D-SNP)

The Life Improvement Plan (HMO D-SNP) is tailored for Medicare-eligible individuals receiving full Medicaid benefits or cost-sharing assistance from Medicaid. This plan offers:

- $0 monthly plan premium

- $0 for all covered prescription drugs

- OTC Plus card

- Low or no copays

It provides comprehensive coverage and support to those who need it the most.

Additional benefits of the Life Improvement Plan (HMO D-SNP) include coverage for preventive dental care, improved Medicare Part D prescription drug coverage, and supplemental benefits such as gym memberships and eyeglasses.

With a focus on addressing the specific healthcare needs of individuals with special needs, the Life Improvement Plan (HMO D-SNP) provides targeted care and valuable benefits.

CompleteCare (HMO D-SNP)

The CompleteCare (HMO D-SNP) plan is a Medicare Advantage Special Needs Plan designed for those with Medicare Parts A and B, full Medicaid benefits, and requiring nursing home-level care. This plan offers the following benefits:

- $0 monthly premium

- Prescription drug coverage

- OTC Plus card

- No co-pays

With these comprehensive support and services, the CompleteCare plan provides access care, offering comprehensive support and services to those in need.

Eligibility for the CompleteCare (HMO D-SNP) plan requires meeting specific criteria set by the plan and provider. The plan offers full Medicaid benefits, including preventive dental care, hospital, medical, and prescription costs, with minimal or no out-of-pocket expenses.

The CompleteCare (HMO D-SNP) plan is an excellent choice for those seeking targeted care and support in their healthcare journey.

Connection Plan (HMO D-SNP)

The Connection Plan (HMO D-SNP) is designed for new Medicare eligibles, offering a $0 monthly premium and an OTC Plus card. This Medicare Advantage Prescription Drug plan caters to individuals who are dual-eligible for both Medicare and Medicaid and reside within the plan’s service area.

With coverage for:

- prescription drugs

- dental

- hearing

- vision

- Over-the-counter (OTC) allowances

The Connection Plan (HMO D-SNP) provides comprehensive benefits and services for those new to Medicare. This plan is an excellent option for those seeking a smooth transition into Medicare coverage with additional support and benefits.

Dental, Vision, and Hearing Coverage

Healthfirst Medicare Advantage plans include:

- Medical coverage

- Dental coverage

- Vision coverage

- Hearing coverage

These additional services are provided to cater to the overall health and well-being of Healthfirst members.

Dental Services

Healthfirst Medicare Advantage plans provide a range of dental services to cater to your oral health needs. From preventive care, such as cleaning and exams, to diagnostic services like x-rays, Healthfirst has you covered.

Restorative treatments are also included in Healthfirst’s dental services, with coverage for basic treatments like fillings and more extensive procedures like crowns. With a focus on comprehensive dental care, Healthfirst ensures that your oral health is well taken care of.

Vision Services

In addition to dental coverage, Healthfirst Medicare Advantage plans provide vision services, ensuring that your eyes receive the care they need. With coverage for routine eye exams and eyewear, you can maintain optimal eye health throughout your Medicare journey.

Healthfirst offers a generous allowance of $400 for the purchase of eyeglass frames, eyeglass lenses, and contact lenses, helping to minimize out-of-pocket expenses while providing quality vision care.

With comprehensive vision services, Healthfirst ensures that your eyesight remains a top priority.

Hearing Services

Hearing is an essential aspect of overall health, and Healthfirst recognizes this by offering comprehensive hearing services in their Medicare Advantage plans. These services include routine hearing exams as well as coverage for hearing aids.

Through their partnership with NationsHearing, Healthfirst provides cost-efficient hearing tests and hearing aids to members, meeting your hearing needs at affordable prices.

With coverage for hearing aid batteries and accessories, Healthfirst makes sure that you have access to the hearing support you need.

Enrollment Process and Eligibility

While it is straightforward to enroll in a Healthfirst Medicare Advantage plan, understanding the eligibility requirements before applying is important. We will now examine the enrollment process and the necessary qualifications to join one of Healthfirst’s plans.

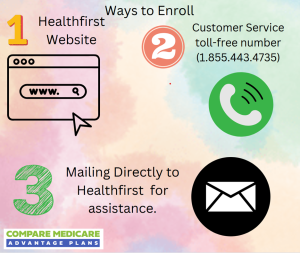

How to Enroll

Healthfirst offers multiple ways to enroll in their Medicare Advantage plans, ensuring that you can apply using the method most convenient for you. You can enroll in the following ways:

Healthfirst offers multiple ways to enroll in their Medicare Advantage plans, ensuring that you can apply using the method most convenient for you. You can enroll in the following ways:

- Online through the Healthfirst website

- By phone through their Customer Service toll-free number (1.855.443.4735)

- By mail by contacting Healthfirst directly for the required enrollment forms and instructions.

If you need assistance with the enrollment process, there are guides and tutorials available on the Healthfirst website, the NYC Medicare website, and the Medicare.gov website. These resources can help you navigate the enrollment process with ease.

Eligibility Requirements

Eligibility requirements for Healthfirst Medicare Advantage plans vary by plan, but some general criteria must be met. These include being a resident of the plan’s service area, having Medicare Parts A and B, and not having End-Stage Renal Disease (ESRD) – with some exceptions.

It’s essential to review the specific eligibility requirements for each plan, as some may require full Medicaid benefits or other qualifications. By understanding the eligibility criteria, you can ensure that you select the most suitable Healthfirst Medicare Advantage plan for your needs.

Star Ratings and Plan Performance

Considering the Star Ratings assigned by the Centers for Medicare & Medicaid Services (CMS) is important when comparing Medicare Advantage plans. Healthfirst’s Medicare Advantage plans are rated based on these Star Ratings, which measure plan performance and quality.

We will now examine the Star Ratings system and Healthfirst’s 2024 Star Ratings.

Understanding Star Ratings

Medicare Star Ratings are designed to help consumers compare the quality of Medicare health and drug plans easily. The ratings range from 1 to 5 stars, with 5 stars being considered excellent.

CMS determines the Medicare Star Ratings by assessing the performance of Medicare plans annually, focusing on various aspects such as health outcomes, customer service, and the overall quality of care provided by the plans.

These ratings are essential for comparing plans and making informed decisions about your healthcare coverage. By understanding the Star Ratings, you can choose a Medicare Advantage plan that aligns with your needs and offers the best quality care.

Healthfirst’s 2024 Star Ratings

Healthfirst’s commitment to providing high-quality Medicare Advantage plans and services is reflected in its 2024 Star Ratings. With a 4-star Rating out of 5, Healthfirst is among the top-performing Medicare Advantage providers.

The 2024 Star Ratings are influenced by:

- the introduction of new measures

- the retirement of certain measures

- changes in methodology

- enhancements in performance

By maintaining high Star Ratings, Healthfirst showcases its dedication to offering comprehensive coverage and exceptional service to its members.

Summary

In conclusion, Healthfirst offers a variety of Medicare Advantage plans that cater to different needs and preferences, providing comprehensive coverage and additional benefits to eligible individuals in New York.

With dental, vision, and hearing coverage, Special Needs Plans, and impressive Star Ratings, Healthfirst is committed to delivering high-quality healthcare solutions. Explore Healthfirst’s plans and find the perfect fit for your healthcare journey.

Frequently Asked Questions

→ Who has the highest star-rated Medicare Advantage plans?

Humana Insurance Company has the highest star-rated Medicare Advantage plans.

→ How do I know which Medicare Advantage plan is best?

Comparison shopping is the best way to determine which Medicare Advantage plan is right for you. Evaluate each plan’s coverage and cost to find the one that best meets your needs.

Be sure to read the fine print and understand all the details before making your decision.

→ How much are most Medicare Advantage plans?

Most Medicare Advantage plans vary in cost, with the average estimated premium for 2024 being $18.50 per month.

However, some plans may have no premiums, while others could cost up to $200 per month. Co-pays and deductibles also factor into the total cost of the plan.

→ What is the NYC Medicare Advantage plan?

The NYC Medicare Advantage Plus Plan is a contract with Medicare to provide health care services which include those previously covered by original Medicare and additional services from the Senior Care program.

→ What sets Healthfirst apart from other Medicare Advantage plan providers?

Healthfirst offers a variety of comprehensive Medicare Advantage plans tailored to individual needs, plus additional benefits such as dental, vision, and hearing services, setting them apart from other plan providers.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.