Best Medicare Advantage Plans Rhode Island 2025

Comparing some of the Medicare Advantage Plans for 2025 may seem confusing at first, especially when considering the various options that may be available in Rhode Island. Fear not, this comprehensive guide could walk you through the ins and outs of Medicare Advantage Plans Rhode Island.

From understanding the possible benefits and coverage differences to enrollment eligibility and potential prescription drug options, you’ll be equipped with the knowledge to make the best decision for your healthcare needs.

Key Takeaways

- Rhode Island will likely offer a variety of Medicare Advantage Plans from private health insurance providers.

- Comparing plans may be essential to make an informed decision, as potential costs and coverage may vary significantly.

- Enrollment usually requires eligibility for Medicare Parts A and B with various enrollment periods. Stand-alone Part D or integrated prescription drug coverage options may be available within various plans.

Compare Plans in Rhode Island Now!

Enter Zip Code

Medicare Advantage Plans Overview in Rhode Island

Some Medicare Advantage Plans in Rhode Island may provide an alternative to Original Medicare, possibly furnishing further benefits and coverage through private insurers approved by Medicare.

Choosing a Medicare Advantage Plan in Rhode Island may require a comparison of Medicare Advantage plans, considering factors such as the potential costs, variations in coverage, and provider networks.

Some Medicare Advantage Plans in Rhode Island may provide coverage for some of the following benefits:

- Original Medicare Part A

- Original Medicare Part B

- May Contain Part D

- Sometimes additional benefits that may not be included in the Original Medicare

These plans, potentially offered by private hospital insurance providers in the state, may have consistent medical insurance plan availability throughout all counties. But please, check back around the fall!

Possible Benefits of Choosing a Medicare Advantage Plan

A Medicare Advantage Plan should include Parts A, B, and D, along with potential additional benefits like dental, vision, and hearing coverage.

Some Medicare Advantage Plans in Rhode Island may provide supplementary benefits, such as routine vision examinations that may include a stipend for eyeglasses, routine dental check-ups, and hearing tests.

In addition to the standard Medicare benefits, integrated prescription drug coverage may also be provided in some Medicare Advantage Plans.

This means beneficiaries could potentially have both medical services and prescription drugs under one plan, possibly allowing for coordinated care and cost management across both medical and prescription drug benefits.

Comparing Medicare Advantage Plans: Potential Key Factors to Consider

When selecting a Medicare Advantage Plan, one should take into account factors such as potential costs, coverage variations, and provider networks.

The potential costs and coverage options among different Medicare Advantage Plans may vary, making it essential to compare Medicare Advantage plans and evaluate Medicare Advantage coverage. Variations may be attributed to certain Medicare plans’ differences in:

- The specific benefits and services that may be covered

- The availability of network healthcare providers

- The possible cost-sharing requirements such as potential deductibles, copayments, and coinsurance

One must carefully examine the possible specifics of each plan to understand the coverage options and choose the one that best fits their healthcare needs. For this purpose, you can contact one of our licensed insurance agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Possible Costs Associated with Medicare Advantage Plans

For some Medicare Advantage Plans, costs could potentially include:

- Premiums

- Deductibles

- Copayments

- Out-of-pocket maximums

Certain premiums and deductibles may be distinct for medical and prescription drug coverage. It is important to note that costs that may be associated with certain Medicare Advantage Plans may vary depending on factors such as health status and healthcare use, potential supplemental coverage, possible premiums for that coverage, and any Medicare Advantage plan benefits that may be included.

Hence, it may become necessary to scrutinize different plans and their potential cost structures, which could enable you to make a well-informed choice regarding the plan that best aligns with your needs.

Coverage Differences Among Plans

Variations in coverage among certain plans may include potential supplementary benefits, prescription drug coverage, and limitations on the provider network.

Some of the Medicare Advantage Plans in Rhode Island may offer different levels of coverage for prescription drugs. Checking the extent of the plan’s coverage could be a key consideration when making a decision.

Certain plans may also provide more comprehensive coverage, possibly with a wider selection of medications, whereas others may feature more limited coverage. Assessing the specifics of each plan is necessary to understand the potential prescription drug coverage they might offer, as well as the associated costs and convenience.

Provider Networks and Accessibility

Provider networks in certain Medicare Advantage Plans will likely be comprised of doctors, hospitals, and other healthcare providers who have consented to supply services to plan members.

Some plans may feature a Medicare Advantage HMO network, requiring members to utilize doctors and hospitals within the network, whereas other plans may have a Preferred Provider Organization (PPO) network, permitting members to visit providers both within and outside of the network, with varying cost-sharing requirements.

The size and composition of provider networks may vary between different Medicare Advantage Plans, which could have an impact on the choices available to plan holders when deciding on their doctors and specialists.

It is recommended to evaluate the ratings and details of different Medicare Advantage plans in Rhode Island to understand some of the possible provider network restrictions and potentially ensure access to the desired healthcare services and providers. Our licensed insurance agents can help you with this! Just call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Understanding Enrollment and Eligibility for Medicare Advantage Plans

To be eligible for enrollment in Medicare Advantage Plans in Rhode Island, one must possess eligibility for Medicare Parts A and B, with certain enrollment periods and exceptions.

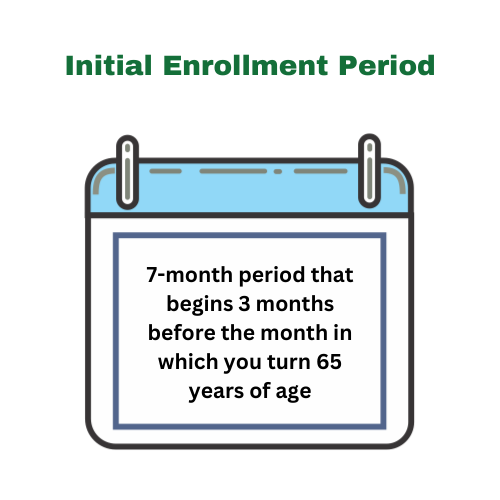

Individuals may enroll in a Medicare plan beginning three months before their 65th birthday month up to three months after their 65th birthday month.

Enrollment can occur during one’s Initial Enrollment Period and the Open Enrollment Period, which takes place between January 1 and March 31 of each year.

Initial Enrollment Period

The Initial Enrollment Period for Medicare Advantage Plans is seven months when an individual is first eligible for Medicare.

For those eligible due to age, this period commences three months before their sixty-fifth birthday, includes their birthday month, and concludes three months after their birthday month.

During this time, individuals may complete their Medicare Advantage enrollment.

Not participating in the Initial Enrollment Period may lead to a delay in sign-up and a monthly late enrollment penalty for the duration of their Part B coverage.

Prescription Drug Coverage Options within Medicare Advantage Plans

Some of the potential prescription drug coverage options within certain Medicare Advantage Plans may include stand-alone Part D plans and integrated coverage that may be within the plan.

Certain stand-alone Part D plans, commonly referred to as Medicare Part D plans, could be prescription drug plans that could be offered by private insurance companies approved by Medicare. These plans could be independent of other Medicare coverage options and could potentially assist beneficiaries in paying for some of their prescription medications.

The possibility of integrated prescription drug coverage, on the other hand, may combine prescription drug benefits within the Medicare Advantage Plan, possibly offering convenience and potentially lower costs.

This integrated approach could enable coordinated care and potential cost management across both medical and prescription drug benefits, possibly making it a favored choice among beneficiaries.

Stand-alone Part D Plans

Certain stand-alone Part D plans may offer prescription drug coverage separate from Medicare Advantage Plans.

These plans could be designed to help beneficiaries cover some of the costs of certain prescription medications and may require a monthly premium, with some plans potentially having an annual deductible, copayments, and coinsurance. There may also be 24 stand-alone Part D plans available in Rhode Island for 2023 coverage.

Stand-alone Part D plans could potentially provide coverage for a wide range of prescription drugs and may help guard against high drug costs.

Integrated Prescription Drug Coverage

Integrated prescription drug coverage in certain Medicare Advantage Plans will likely refer to potential the inclusion of prescription drug benefits within the overall coverage provided by the plan.

This means that some of the Medicare Advantage Plans that may offer integrated prescription drug coverage could potentially encompass both medical services and prescription drugs under a single plan, potentially providing a more streamlined and convenient experience for beneficiaries.

The integrated prescription drug coverage in Rhode Island Medicare Advantage Plans may be facilitated by the Neighborhood Health Plan of Rhode Island, through their Medicare-Medicaid Plan (MMP) known as ‘Neighborhood’.

This integrated coverage may not only provide convenience but could also lead to potentially lower costs when compared to other stand-alone Part D plans.

Rhode Island Medicare Advantage Resources

Some of the Rhode Island Medicare Advantage resources may include the State Health Insurance Assistance Program (SHIP) and the Rhode Island Office of the Health Insurance Commissioner.

Both could provide guidance and support for beneficiaries to make informed decisions about their Medicare Advantage Plans.

The Rhode Island State Health Insurance Assistance Program (SHIP) may furnish Medicare beneficiaries with data and aid concerning Medicare Advantage, possibly helping them identify the most suitable Medicare coverage at the most advantageous cost, while also providing information on available Medicaid services.

The Rhode Island Office of the Health Insurance Commissioner will likely offer a variety of possible resources and programs, encompassing consumer assistance, counseling programs, and collaboration with stakeholders.

State Health Insurance Assistance Program (SHIP)

The State Health Insurance Assistance Program (SHIP) in Rhode Island furnishes guidance to Medicare Advantage beneficiaries regarding plan selection, enrollment, coverage options, and the comprehension of potential benefits and costs.

They could provide one-on-one assistance, counseling, and education to aid beneficiaries in making informed decisions about their Medicare Advantage plans.

Individuals may contact the Rhode Island Senior Health Insurance Program (SHIP) by calling 401.462.0194 for more information and assistance.

This valuable resource may help you navigate the complexities of Medicare Advantage Plans in Rhode Island and could potentially ensure that you choose the best plan for your unique healthcare needs.

Rhode Island Office of the Health Insurance Commissioner

The Rhode Island Office of the Health Insurance Commissioner is a state agency that will likely be responsible for the oversight, regulation, and licensing of insurance companies that may offer coverage in the state, including some Medicare Advantage Plans.

For assistance or clarification regarding certain Medicare Advantage Plans, Rhode Island residents may contact the Office of the Health Insurance Commissioner by sending an email to cory.king@ohic.ri.gov or by calling 470-270-0101.

Utilizing the resources provided by the Health Insurance Commissioner may help you make well-informed decisions about your Medicare Advantage Plan options.

Summary

Understanding the various aspects of certain Medicare Advantage Plans in Rhode Island could be essential to making the best decision for your healthcare needs.

By considering factors such as potential costs, coverage differences, provider networks, and possible prescription drug coverage options, and utilizing resources like the State Health Insurance Assistance Program (SHIP) and the Rhode Island Office of the Health Insurance Commissioner, you may confidently navigate the complex world of Medicare Advantage Plans and find the perfect plan tailored to your unique needs.

Frequently Asked Questions

→ Is Medicare Advantage cheaper?

Overall, some Medicare Advantage plans may tend to be slightly cheaper than traditional Medicare. However, they may only be available in a small number of U.S. counties, which could limit access.

→ Who is the best person to talk to about Medicare?

The best person to talk to about Medicare will be one of our licensed agents. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies. . You can reach them at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

→ What types of Medicare Advantage Plans are available in Rhode Island?

In Rhode Island, Medicare Advantage Plans are offered by six private health insurance providers, including Blue Cross Blue Shield, Aetna Medicare, and others.

These providers offer a range of plans, such as health maintenance organization (HMO) and preferred provider organization (PPO) plans.

→ What potential additional benefits may be offered by Medicare Advantage Plans in Rhode Island?

Some Medicare Advantage Plans in Rhode Island could potentially provide extra benefits, such as routine vision exams, dental check-ups, hearing tests, and integrated prescription drug coverage.

Compare Medicare Plans By Company

ZRN Health & Financial Services, LLC, a Texas limited liability company