Are Medicare Advantage Plans Private Insurance?

Are you exploring your potential Medicare options and come across the Medicare Advantage Plans? These plans have become an increasingly popular choice among Medicare beneficiaries.

This article will take a closer look at the details of these plans, specifically addressing the question, “Are Medicare Advantage Plans private insurance?”

This article will also compare them to Original Medicare, and potentially offer guidance on how to evaluate and choose the right plan for your unique needs.

Additionally, this will also discuss important factors to consider, such as the possibility of having prescription drug coverage, plan quality and performance, and special needs plans. By the end of this article, you could have a better understanding of Medicare Advantage Plans and be well-equipped to make an informed decision about your healthcare coverage.

Key Takeaways

- Medicare Advantage Plans are private insurance options regulated by the federal government, that may include additional benefits and varying costs that might go beyond those provided by Original Medicare.

- It is essential to carefully compare these plans based on their coverage differences, possible cost-sharing and out-of-pocket costs, provider network restrictions, possible inclusion of prescription drug coverage plan quality & performance, and special needs plans.

- Certain financial implications such as premiums & deductibles should be considered when choosing a Medicare Advantage Plan to ensure it meets one’s healthcare needs & financial situation.

Compare Plans in One Step!

Enter Zip Code

The Nature of Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, are private insurance options for Medicare beneficiaries that may offer additional benefits and varying costs.

These plans are required to provide the same benefits as Medicare Part A (hospital insurance) and Part B (medical insurance), and they may often encompass benefits that might not be covered by Original Medicare, such as routine dental care, eye exams, glasses, and hearing aids.

With Medicare Advantage, you could potentially get your hospital, medical, and often prescription drug coverage through a single insurance provider, possibly making it more convenient than Original Medicare and a valid alternative to Medicare Supplement Insurance.

Though offered by private insurers, Medicare Advantage Plans are regulated by the federal government. This means that these plans must adhere to rules established by Medicare to ensure quality and compliance with healthcare standards.

Private Insurers Offering Medicare Advantage Plans

Some notable private insurers that may offer Medicare Advantage Plans include:

- Aetna

- Humana

- UnitedHealthcare

- Blue Cross Blue Shield

These companies will likely provide these plans and receive a set sum every month for the care associated with the plans. Policyholders may still be charged out-of-pocket costs. Insurers may also have the authority to set their own rules relating to service provision within the plan’s network.

This could potentially include requiring referrals or provider networks for non-urgent care and emergency services.

Aetna may offer Medicare Advantage plans that might encompass:

- Medical and prescription drug coverage

- Dental, vision, and hearing benefits

- Other advantages and services tailored to individual requirements

Some of Humana’s Medicare Advantage plans provide all the benefits of Original Medicare Parts A and B and might include coverage for prescription drugs. Certain plans may also come with additional benefits including routine dental, vision, and hearing coverage.

Government Oversight and Regulation

Medicare Advantage Plans are subject to government oversight and regulation, which will likely ensure quality and compliance with Medicare standards. The Centers for Medicare and Medicaid Services (CMS) may also play an integral role in the oversight and regulation of these plans.

The CMS will likely enforce requirements and regulations to make sure that these plans comply with quality standards and provide adequate coverage to beneficiaries. Besides, the CMS may also carry out audits and data validation to guarantee accurate payment and avert fraud and misuse within the Medicare Advantage program.

Medicare-approved private companies that could offer Medicare Advantage Plans must adhere to specific regulations set by the CMS. Some of these regulations may encompass rules about:

- Acceptable coverage criteria for basic benefits

- Minimum procedures for organization determinations

- Federal standards such as providing an out-of-pocket limit

Comparing Medicare Advantage Plans and Original Medicare

Medicare Advantage Plans will likely differ from Original Medicare in terms of coverage, cost-sharing, and provider network restrictions.

While Medicare Advantage Plans amalgamate Part A and Part B coverage into one plan, Original Medicare might have distinct coverage for Part A and Part B. Original Medicare may not cover certain benefits such as dental, vision, and hearing. However, certain Medicare Advantage Plans may provide coverage for these services.

Some of the cost-sharing structures in certain Medicare Advantage Plans may vary depending on the plan and could potentially include deductibles, premiums, and coinsurance for services. Original Medicare could also have their cost-sharing requirements.

Additionally, some of the Medicare Advantage Plans might possess more stringent provider networks than Original Medicare, which could result in fewer choices of providers for enrollees and may necessitate referrals when seeking specialist care.

Possible Coverage Differences

Under Medicare Advantage, you will likely receive all the services for which you are eligible under Original Medicare. However, Original Medicare does not cover several care services such as dental, vision, and hearing.

Fortunately, some Medicare Advantage plans might include these additional care services. This potential coverage could be a significant advantage for many individuals, as it may help cover expenses that Original Medicare does not.

Some of the Medicare Advantage Plans may provide coverage for:

- Dental services, including routine cleanings, fillings, and dentures

- Vision services, including eye exams, glasses, and contact lenses

- Hearing services, including hearing exams and hearing aids

However, the specific coverage may also vary depending on the plan. Examining the details of each Medicare Advantage plan is crucial to understand the specific coverage provided.

Cost-sharing and Possible Out-of-Pocket Costs

Cost-sharing and certain out-of-pocket costs might denote the amount of money that policyholders must pay for medical services, such as deductibles, copayments, and coinsurance.

These costs will likely differ between Medicare Advantage Plans and Original Medicare, with some Medicare Advantage Plans having an out-of-pocket limit. This limit could potentially provide financial protection for beneficiaries, as it could cap the amount they would have to pay for covered services in a given year.

In contrast, Original Medicare also has out-of-pocket costs, such as deductibles and coinsurance, but there might not be any limits on these costs. The specific out-of-pocket costs for Medicare Advantage Plans may vary depending on the chosen plan, but generally, these costs might include deductibles, copayments, and coinsurance.

Reviewing the specific out-of-pocket costs and potential benefits for each Medicare Advantage plan is key to finding the most cost-effective option for your situation.

Provider Network Restrictions

Certain Medicare Advantage Plans could have limited provider networks, which may require enrollees to use in-network doctors and facilities. In-network doctors have consented to provide services at predetermined rates and abide by the plan’s regulations, while out-of-network doctors do not have a contract with the plan and may have varying payment rates and coverage restrictions.

Generally, it may be more cost-effective for beneficiaries to receive care from in-network doctors, as they could incur lower out-of-pocket costs.

In contrast, Original Medicare does not have such stringent provider network restrictions and will likely allow beneficiaries to see any provider who accepts Medicare.

This flexibility could be an advantage for individuals who may want more freedom in choosing their healthcare providers. However, the potential benefits, cost-sharing structure, and out-of-pocket limits that may be provided by certain Medicare Advantage Plans may still make them an appealing choice for many beneficiaries.

Evaluating Medicare Advantage Plan Options

When evaluating the potential Medicare Advantage Plan options, it’s important to compare Medicare Advantage plans, considering factors like possible inclusion of prescription drug coverage, plan quality and performance, and special needs plans.

Each plan may have unique offerings and cost structures, so it’s essential to compare plans carefully to find the one that best suits your healthcare needs and financial situation.

Prescription Drug Coverage

Prescription drug coverage could be an important factor when choosing a Medicare Advantage Plan, as it may vary between plans. People who are members of Medicare Advantage plans could potentially have access to prescription drugs as part of the package.

This may be common in certain Medicare Advantage plans. However, reviewing the formulary, cost-sharing, and coverage restrictions of each plan is important to ensure that your medications may be covered and at a reasonable cost.

Additionally, when assessing prescription drug coverage in a given Medicare Advantage plan, it is prudent to consider possible factors such as preferred pharmacies, drug tiers, and maximum out-of-pocket costs.

By carefully evaluating these factors, you could make an informed decision about which Medicare Advantage Plan might offer the most suitable prescription drug coverage for your needs.

Assessing Plan Quality and Performance

Medicare Advantage Plans will likely be evaluated for quality and performance through a star rating system. These plans could be assessed on up to 40 distinct quality and performance measures, which may include preventive care, customer satisfaction, and healthcare outcomes.

The star ratings could provide consumers with the means to compare the quality of different Medicare Advantage plans and make informed decisions regarding their healthcare options.

When evaluating Medicare Advantage plans, reviewing the CMS Star Ratings and member experience data for each plan may be crucial.

This information could help you determine which plans are performing well in terms of quality and customer satisfaction. By considering plan quality and performance, you can make a more informed decision when choosing a Medicare Advantage Plan.

Special Needs Plans and Other Unique Offerings

Special Needs Plans (SNPs) and other specialized plans may provide customized coverage tailored to specific health conditions or situations.

To enroll in a Special Needs Plan, one must meet specific eligibility criteria, such as having chronic, severe, or disabling medical conditions, being institutionalized, or being dual eligible (eligible for both Medicare and Medicaid).

Some of the Special Needs Plans may also customize coverage to accommodate particular conditions or circumstances by potentially providing specialized coverage for those with qualifying conditions, such as chronic illnesses.

Certain plans may provide tailored care plans and services that might be tailored to the specific needs of their members. They could also cover prescription drugs typically prescribed for the specific illness or condition.

By exploring Special Needs Plans and other potential offerings, you can find a Medicare Advantage Plan that caters to your specific healthcare needs. Some of the Medicare Advantage plans may offer a variety of options that could suit different individual requirements.

Enrollment and Switching Considerations

Enrollment in Medicare Advantage Plans is subject to initial and open enrollment periods, and transitioning between plans may have implications. It’s important to be aware of these periods and the potential effects of switching plans on your healthcare coverage and costs.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

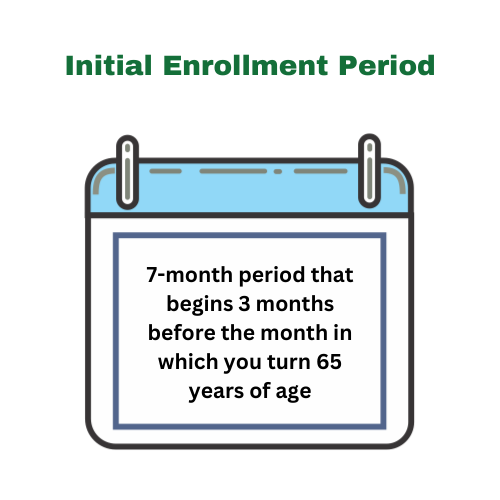

Initial and Open Enrollment Periods

Enroll in a Medicare Advantage Plan during the initial enrollment period or the annual open enrollment period.

The initial enrollment period typically begins two months prior and extends one month after the contract expiration. You have a two-month window to enroll in a Medicare Advantage Plan after having signed up for Part A and B coverage.

The annual open enrollment period for Medicare Advantage Plans lasts from October 15th to December 7th.

During this period, individuals have the option to make alterations to their health and drug plans, switch or join Medicare plans, and adjust prescription drug coverage. Being aware of these enrollment periods and making any necessary changes to your plan during these designated times is crucial.

Transitioning Between Plans

Switching between Medicare Advantage Plans or back to Original Medicare may affect eligibility for Medigap policies and other coverage options.

If you transition out of your Medicare Advantage plan within the first year, you may enroll in a Medigap policy. However, if you switch out of your Medicare Advantage plan after the first year, insurers may deny you a Medigap policy if you have health issues or require a waiting period before covering pre-existing conditions.

It’s important to consider the potential implications of transitioning between plans when making changes to your healthcare coverage. By understanding the enrollment periods and the potential effects of switching plans, you can make more informed decisions about your Medicare coverage options.

Potential Financial Implications of Choosing a Medicare Advantage Plan

Some of the potential financial implications of choosing a Medicare Advantage Plan might involve premiums, deductibles, and cost-effectiveness. It’s essential to consider these factors when selecting a plan to ensure that it meets your healthcare needs and financial situation.

Premiums and Deductibles

It is not uncommon for premiums and deductibles for Medicare Advantage Plans to rise over time, as the annual deductible for Medicare Part B beneficiaries will likely grow in recent years, and the average monthly premium for a Medicare Advantage plan could also vary from year to year.

For individuals with Medicare, it’s crucial to review their coverage annually to understand any changes in costs.

Cost-Effectiveness Analysis

To analyze the cost-effectiveness of a Medicare Advantage Plan, members may want to consider out-of-pocket costs, network restrictions, and potential savings compared to Original Medicare. Some of the Medicare Advantage Plans may have varying out-of-pocket costs, but they could also offer lower expenses than Original Medicare.

This could potentially make them an attractive option for many people. Certain Medicare Advantage Plans may also provide extra benefits that might not be included in Original Medicare. These could include coverage for dental, vision, and hearing services.

However, certain network restrictions in Medicare Advantage Plans may impact their cost-effectiveness by potentially restricting provider choice and reducing access to certain providers or specialists.

By carefully evaluating these possible factors and comparing some of the costs and benefits of Medicare Advantage Plans to those of Original Medicare, you can determine the most cost-effective healthcare coverage option for your unique needs.

Summary

Some of the Medicare Advantage Plans could offer a popular alternative to Original Medicare, possibly providing additional benefits and varying costs while being regulated by the government for quality and compliance.

By understanding the nature of these plans, comparing them to Original Medicare, and carefully evaluating plan options, you could make an informed decision about the best healthcare coverage for your unique needs.

Remember, when selecting a Medicare Advantage Plan, it’s crucial to consider potential factors such as prescription drug coverage, plan quality and performance, special needs plans, and the financial implications of premiums and deductibles.

By doing so, you’ll likely be well-equipped to navigate the world of Medicare coverage and find a plan that suits your healthcare needs and financial situation.

Frequently Asked Questions

→ What parts of Medicare may be considered private insurance?

Medicare Part C, also known as Medicare Advantage, is a type of private insurance plan that covers most of Part A and Part B benefits. It may also include extra benefits such as vision, hearing, dental care, and drug coverage (Part D).

→ Why are people choosing Medicare Advantage plans?

The lack of prior authorization denial rates and quick payments from insurers may have led to many people choosing Medicare Advantage plans.

→ What additional benefits could Medicare Advantage Plans offer compared to Original Medicare?

Some of the Medicare Advantage Plans may provide additional benefits such as dental, vision, and hearing coverage that may not be offered by Original Medicare.

→ How do out-of-pocket costs for Medicare Advantage Plans compare to those of Original Medicare?

Certain out-of-pocket costs for some of the Medicare Advantage Plans may be lower than those of Original Medicare, and they could have an out-of-pocket limit to cap costs.

→ How can I evaluate the quality and performance of a Medicare Advantage Plan?

Evaluating the quality and performance of a Medicare Advantage Plan may be done by reviewing CMS Star Ratings and member experience data.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.