When is Open Enrollment for Medicare Advantage Plans in 2025

Navigating the potential Medicare Advantage plans could be overwhelming, but with the right knowledge and resources, you can confidently make informed decisions about your healthcare coverage.

This comprehensive guide will walk you through everything you need to know about open enrollment for Medicare Advantage plans in 2025, what to consider when choosing a plan, and the tools and resources that may be available to help you compare plans and find the best fit for your needs.

Key Takeaways

- Mark your calendar for the three key Medicare enrollment periods to obtain optimal coverage.

- Navigate Medicare Advantage Plans carefully, considering the potential cost and coverage, provider networks, and possible benefits.

- Utilize resources such as this website, SHIP programs & insurance agents, and brokers to make an informed decision that meets individual needs.

Compare Plans in One Step!

Enter Zip Code

Key Medicare Enrollment Periods: Mark Your Calendar

Comprehending the key Medicare enrollment periods will likely be fundamental for obtaining the optimal coverage suitable for your unique needs.

There are three primary enrollment periods you should be mindful of:

- the Initial Enrollment Period

- the General Enrollment Period

- and the Open Enrollment Period

Each period serves a different purpose, and it’s essential to know when they occur and how they could impact your Medicare coverage options.

The different enrollment periods for Medicare are:

- Initial Enrollment Period: This is your first opportunity to enroll in Medicare.

- General Enrollment Period: This serves as a catch-up period for those who missed their Initial Enrollment Period.

- Open Enrollment Period: This allows you to make changes to your existing Medicare coverage, including switching between Medicare Advantage plans.

Familiarizing yourself with these periods could help you make timely decisions and ensure your healthcare coverage aligns with your needs and preferences.

Initial Enrollment Period

The Initial Enrollment Period is a seven-month window during which you can sign up for Medicare. It begins three months before the month of your 65th birthday and ends three months after that month.

If you become eligible for Medicare due to disability, the Initial Enrollment Period is also applicable, surrounding your disability eligibility date.

Enrolling during your Initial Enrollment Period is indispensable to prevent any possible penalties that might occur due to late enrollment.

If you fail to enroll during this period, you may be subject to a penalty on the Medicare Part B premium for each full year of delay. However, if you meet certain criteria for a special enrollment period, you may still be able to sign up without penalty.

General Enrollment Period

If you missed your Initial Enrollment Period, the General Enrollment Period offers a second chance to sign up for Medicare. This annual period runs from January 1 to March 31 and allows you to enroll in all components of Medicare.

However, keep in mind that enrolling during the General Enrollment Period may result in a penalty for late enrollment.

To circumvent penalties, staying updated about your enrollment deadlines and acting on time is paramount.

Annual Election Period (AEP)

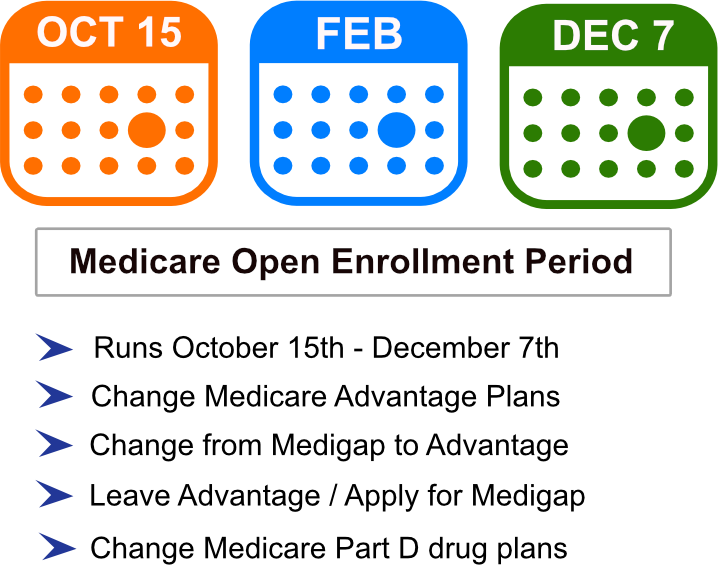

The Open Enrollment Period occurs annually from October 15 to December 7 and provides an opportunity for Medicare beneficiaries to make changes to their existing coverage.

During this period, you can switch between Medicare Advantage plans, change from a Medicare Advantage plan to Original Medicare, or make adjustments to your prescription drug coverage.

It’s important to evaluate your current coverage during the Open Enrollment Period and make any necessary changes to ensure you have the most suitable plan for your needs and budget.

Navigating Medicare Advantage Plans: What to Consider

While choosing a Medicare Advantage plan, you might want to consider the potential factors that could influence your healthcare experience. These potential factors may include costs and coverage, provider networks, and additional benefits that could be offered by the plan.

Taking the time to carefully assess these aspects could help you make informed decisions about your Medicare coverage and ensure you choose a plan that aligns with your needs and preferences.

Potential Costs and Coverage

Premiums, deductibles, and out-of-pocket spending limits may significantly differ among various Medicare Advantage plans, thus affecting costs and coverage.

Another vital aspect to bear in mind could be the coverage each plan provides. While all Medicare Advantage plan combine Part A and Part B coverage into one plan, some may offer additional benefits not available through traditional Medicare, such as dental, vision, and hearing services.

Be sure to examine the specifics of each plan’s potential coverage and weigh the possible costs and benefits when making your decision.

Provider Networks

The availability of healthcare providers and services within a Medicare Advantage plan will likely be largely determined by the provider networks.

A larger provider network may offer more options for beneficiaries to obtain care with their preferred providers and access a wider range of healthcare services.

On the other hand, a smaller provider network may limit your choices and potentially lead to reduced accessibility to certain healthcare providers or services.

You should verify if your preferred healthcare providers, including your primary care provider, are included in the network of the Medicare Advantage plan you are considering is vital.

You can do this by visiting the plan’s website and using their searchable directory or by contacting the plan directly to inquire about doctors who accept the Medicare Advantage plan. Carefully evaluating provider networks could help you choose a plan that best meets your healthcare needs and preferences.

Potential Benefits

In addition to the standard coverage provided by Medicare Advantage plans, some plans may offer extra benefits, such as dental, vision, and hearing services. These possible benefits may enhance your Medicare health experience and provide added value to your plan.

When comparing Medicare Advantage plans, it’s important to assess the extra benefits that may be offered by each plan and consider how they could align with your healthcare needs and priorities.

Comparing Medicare Advantage Plans: Tools and Resources

Several tools and resources are available to assist you in making a well-informed decision about your Medicare Advantage plan by comparing various plans. These may include our website, State Health Insurance Assistance Programs (SHIP), and insurance agents and brokers.

By utilizing these resources, you can gather the information and personalized guidance necessary to choose the best plan for your unique needs and preferences.

Our Website

This website could be an invaluable tool for comparing the potential Medicare Advantage plan benefits, prescription drug coverage, and costs, including Medicare drug plan options.

By entering your zip code into any of the zip code boxes on this website, you can:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your situation

Utilizing this resource could help you make an informed decision and ensure you select the best plan for your needs.

State Health Insurance Assistance Programs (SHIP)

State Health Insurance Assistance Programs (SHIP) provide free, unbiased counseling and assistance to Medicare beneficiaries that could help them understand their coverage options and make informed decisions.

SHIP counselors may also offer personalized, one-on-one assistance to help individuals navigate the complexities of Medicare Advantage plans and choose the best coverage for their needs.

To connect with a SHIP counselor in your state, you can call the toll-free number, 877-839-2675, or visit the federal SHIP Locator website.

Insurance Agents and Brokers

Insurance agents and brokers, being licensed professionals, are capable of providing personalized guidance and recommendations tailored to your specific needs and preferences.

They have access to information about different Medicare Advantage plans and can help you navigate the complexities of selecting the most suitable plan for your circumstances.

However, it’s important to note that agents and brokers may receive commissions for enrolling individuals in Medicare Advantage plans, which may affect their recommendations.

While engaging with an agent or broker, you may want to research and verify their certification and credentials to ensure the advice you receive is accurate and unbiased.

Special Enrollment Periods: Making Changes Outside of Open Enrollment

In some cases, you may need to make changes to your Medicare coverage outside of the Open Enrollment Period. Special Enrollment Periods allow for this flexibility, triggered by qualifying life events or during the Medicare Advantage Open Enrollment Period.

Comprehension of these periods and the qualifying circumstances could assist you in making timely modifications to your Medicare coverage, possibly ensuring the maintenance of the most appropriate plan for your skilled nursing facility care needs.

Qualifying Life Events

Qualifying life events, such as moving or losing employer-sponsored coverage, can trigger a Special Enrollment Period for beneficiaries to make changes to their Medicare coverage.

These events may create a need for you to adjust your coverage or switch plans, and the Special Enrollment Period provides an opportunity to do so outside of the regular Open Enrollment Period.

Typically, upon the occurrence of a qualifying life event, you have a window of up to 60 days from the event to submit an application and enroll in a plan. Once the enrollment is complete, the plan will begin at the start of the following month.

It’s important to be aware of these time-sensitive opportunities and act accordingly to maintain suitable coverage.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31, allows beneficiaries enrolled in a Medicare Advantage plan the opportunity to switch to another plan or return to Original Medicare.

This Medicare Open Enrollment Period could provide an additional opportunity to make changes to your Medicare coverage outside of the regular enrollment period.

Be sure to keep track of these enrollment periods and make any necessary changes to your coverage as needed.

Possible Financial Assistance Options for Low-Income Beneficiaries

Financial assistance options may be available for low-income traditional Medicare beneficiaries to aid with potential premiums, deductibles, and out-of-pocket costs.

Some options may include Medicaid, Medicare Savings Programs, and the Part D Low-Income Subsidy. Understanding these programs and their eligibility requirements could help low-income beneficiaries access the healthcare services they need without excessive financial burden.

Medicaid

Medicaid is a government-funded health insurance program that could provide healthcare coverage for certain low-income individuals and families.

For eligible Medicare beneficiaries, Medicaid may serve as a secondary payer, potentially covering any residual costs for items and services that may not be covered by Medicare.

Eligibility for Medicaid as a low-income Medicare beneficiary will likely depend on your income and whether you meet the specific requirements for various programs, such as the Qualified Medicare Beneficiary (QMB) program.

To apply for Medicaid, you may visit your local county social service office or call the state Medicaid program. Even if your eligibility is uncertain, reaching out to explore your options for savings is pivotal.

Medicare Savings Programs

Medicare Savings Programs (MSPs) have been designed to help low-income beneficiaries cover some of their Medicare costs.

Medicare Savings Programs (MSPs) have been designed to help low-income beneficiaries cover some of their Medicare costs.

These programs will likely be part of Medicaid and could cater to those with limited income who meet certain criteria. The available MSPs might include:

- Qualified Medicare Beneficiary (QMB) Program

- Specified Low-Income

- Medicare Beneficiary (SLMB) Program

- Qualified Individual (QI) Program

- Qualified Disabled and Working Individuals (QDWI) Program

MSPs could help eligible beneficiaries pay for potential Medicare premiums, deductibles, and co-payments, possibly reducing their overall healthcare expenses. A visit to your local county social service office in person may allow you to apply for a Medicare Savings Program.

Part D Low-Income Subsidy

The Part D Low-Income Subsidy, colloquially known as Extra Help, may also aid Medicare enrollees in defraying their prescription drug costs. This might include helping with Part D plan premiums, deductibles, and copayments for those with low incomes and limited assets.

To apply for Extra Help, you can apply for Medicare or the Social Security Administration. This program could potentially reduce out-of-pocket costs for prescription drugs, so low-income beneficiaries could have access to the medications they need.

Summary

Navigating the potential Medicare Advantage plans could be a daunting task, but with the right knowledge and resources, you can confidently make informed decisions about your healthcare coverage.

Understanding the enrollment periods, potential factors to consider when choosing a plan, and available tools and resources could help you find the best coverage for your unique needs.

Frequently Asked Questions

→ What is the Medicare enrollment period for 2025?

Each year, Medicare open enrollment begins on October 15 and ends on December 7. Make sure to take advantage of this period to review and change your Medicare plans.

→ What is the effective date for Medicare Advantage open enrollment?

The Medicare Advantage Open Enrollment Period takes place annually from January 1 to March 31, allowing enrollees to make changes to their coverage.

→ Why are people choosing Medicare Advantage plans?

People may choose a Medicare Advantage plan due to the lack of prior authorization and quick payments from insurers.

→ What is the difference between the Initial Enrollment Period and the General Enrollment Period?

The Initial Enrollment Period is a seven-month window surrounding an individual’s 65th birthday or disability eligibility date, while the General Enrollment Period is an annual period from January 1 to March 31 that allows those who missed their Initial Enrollment Period to enroll in Medicare.

ZRN Health & Financial Services, LLC, a Texas limited liability company