Secure Horizons Medicare Advantage Plans for 2025

Selecting the right Medicare plan in 2025 will likely be an important task for those on Medicare. Some of the Secure Horizons, now rebranded under UnitedHealth Group, could offer a variety of Medicare plans that may cater to your unique needs.

This article will explore the world of Secure Horizons and explore the various plans they might offer their financial strength, and possible benefits.

Key Takeaways

- Secure Horizons, now AARP Medicare Complete, will likely offer a variety of Medicare plans and potential benefits.

- Evaluating the financial strength ratings for assurance in rates and claim payments.

- Compare with other insurance carriers to select the best plan for individual healthcare needs.

Compare Plans in One Step!

Enter Zip Code

Understanding Secure Horizons: A Background

Secure Horizons, founded in 1985, has had a strong reputation for providing comprehensive Medicare plans.

After being acquired by UnitedHealthcare, Secure Horizons rebranded as AARP Medicare Complete and will likely continue to offer Medicare Supplement, Medicare Advantage, and Prescription Drug coverage plans under a Medicare contract with the federal government.

Medicare Supplement Plans

Some of the Medicare Supplement plans, also known as Medigap plans, may be designed to fill the gaps in Original Medicare coverage.

These plans, now available as AARP Medicare Supplement plans, could offer fixed monthly premiums when you use your healthcare coverage with primary care providers. Secure Horizons may also offer a range of Medicare Supplement plans, which may include the F and G plans available in certain states.

Some of the potential coverage, costs, and customer satisfaction will likely be among the various factors Medicare uses to evaluate plans.

So, why choose a Medicare Supplement plan? These plans, also known as Medicare Supplement Insurance, could help cover some of your Medicare co-payments, allowing you to concentrate on your health without the stress of unexpected expenses.

With a variety of plans to choose from, you can find the perfect fit for your unique healthcare needs.

Medicare Advantage Plans

Medicare Advantage plans, rebranded as AARP Medicare Complete, are regulated by the federal government and might offer additional benefits.

These plans will likely be designed to provide more comprehensive benefits than traditional Medicare Advantage Plans, as these plans could potentially maximize your healthcare coverage.

Prescription Drug Coverage

Secure Horizons might provide Prescription Drug coverage through Part D plans, which could offer cost savings at preferred pharmacies.

By employing preferred pharmacies within the Secure Horizons network, you may be able to enjoy discounted prices and exclusive benefits for plan members, such as lower co-payments for medications.

Secure Horizons’ Medicare Part D plan will likely aim to cover prescription drug costs and potentially minimize out-of-pocket expenses.

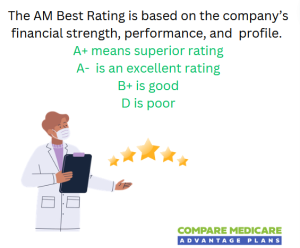

Evaluating Secure Horizons Financial Strength

When it comes to financial strength, Secure Horizons could stand tall among the competition. A.M. Best assigned a rating of A- with a positive outlook, Standard & Poor’s assigned a rating of A+ with a stable outlook, and Moody’s assigned a rating of A3 with a stable outlook to UnitedHealthcare in 2023.

When it comes to financial strength, Secure Horizons could stand tall among the competition. A.M. Best assigned a rating of A- with a positive outlook, Standard & Poor’s assigned a rating of A+ with a stable outlook, and Moody’s assigned a rating of A3 with a stable outlook to UnitedHealthcare in 2023.

These ratings could reflect Secure Horizons’ strong financial foundation, which may promise stability in rates and claim payments.

Members could have peace of mind knowing that Secure Horizons is a reliable insurance provider capable of fulfilling its financial obligations and paying out claims when needed.

Possible Benefits of Secure Horizons Plans

Some of the Secure Horizons plans may offer a plethora of additional benefits that could go beyond traditional medical coverage. These benefits may include:

- Dental services

- Hearing services

For example, Secure Horizons dental coverage may encompass preventive services, such as routine cleanings, fluoride treatments, fillings, crowns, root canals, extractions, and dentures.

Moreover, hearing coverage may also comprise up to 2 hearing aids annually, and vision benefits will likely include routine eye exams and an allowance for contacts or designer frames with standard lenses.

Comparing Secure Horizons with Other Insurance Carriers

Comparing Secure Horizons with other insurance carriers might be crucial for making an informed choice about your healthcare coverage.

Potential factors such as coverage, cost, and possible benefits could greatly impact your decision-making process and overall satisfaction with your chosen plan.

By evaluating and comparing the potential offerings through various insurance companies, Medicare will likely evaluate plans based on potential offerings from:

- Secure Horizons

- UnitedHealthcare

- Accendo Insurance Company

- American Medical Security Life Insurance Company

You can make a well-informed decision that suits your unique needs and budget.

The Enrollment Process for Secure Horizons Medicare Plans

Enrolling in a Secure Horizons Medicare plan is simple. Just reach out to licensed insurance agents for assistance by calling them at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Submitting your details such as:

- Name

- Address

- Date of birth

- Medicare information

Working with a reliable insurance carrier could allow for a smooth enrollment process and may set you on the path to superior healthcare coverage.

For any inquiries or assistance, our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

You can reach them at 1-844-350-0776 (TTY user 711) Mon-Fri 8am-9pm Est.

Tips for Choosing the Right Plan

Choosing the right Secure Horizons plan will likely start ]with evaluating your healthcare needs and budget. Consider potential factors such as:

- Coverage

- Costs

- Provider networks

- Additional benefits

- Prescription drug coverage

- Travel coverage

It is also crucial to spend time being familiar with the specific details of the plans and their potential benefits.

By thoroughly comparing your options, you can select a Secure Horizons Medicare plan that provides the necessary coverage and benefits that could accommodate your healthcare requirements.

Customer Service and Support

Secure Horizons provides superior customer service and support, aiding you in understanding your Medicare plan options and resolving any concerns or questions. You can contact their customer service department at 800-577-5623, available from 8 a.m. to 8 p.m. daily, including weekends.

Their plan experts can help you navigate your coverage and answer any queries you may have regarding their Medicare Advantage plans.

Summary

Secure Horizons will likely offer a variety of Medicare plans, which could ensure that you find the perfect fit for your healthcare needs. With a strong financial foundation, comprehensive coverage options, and exceptional customer service, Secure Horizons will likely stand out as a reliable Medicare insurance provider.

Take the time to compare plans and evaluate your individual needs to make the best decision for your health and well-being.

Frequently Asked Questions

→ Is Secure Horizons the same as UnitedHealthcare?

Secure Horizons is a division of UnitedHealthcare and has since been rebranded as AARP Medicare Complete plans.

This rebranding hasn’t affected the benefits customers receive, and it still requires individuals to select a primary care provider from the network.

→ What is Secure Horizon?

Secure Horizon is a fixed index annuity providing protection, which may offer enhanced growth opportunities and tax deferral for modern retirement portfolios.

→ Who owns Secure Horizons insurance?

UnitedHealthcare owns Secure Horizons insurance.

→ What types of Medicare plans could Secure Horizons offer?

Secure Horizons could offer a variety of Medicare plans, which may include Medicare Supplement (Medigap), Medicare Advantage, and Medicare Part D plans, all under a contract with the federal government.

→ How can I enroll in a Secure Horizons Medicare plan?

To enroll in a Secure Horizons Medicare plan, contact licensed insurance agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

ZRN Health & Financial Services, LLC, a Texas limited liability company