Best Medicare Advantage Plans Ohio 2025

There are several different Medicare Advantage plans in Ohio offered in 2025 to choose from. Our website helps provide the resources available that can help you find the perfect plan to suit your needs.

This blog post will guide you through the essentials of Medicare Advantage plans in Ohio, their benefits, types, enrollment process, financial assistance, and available resources to help you make an informed decision.

Key Takeaways

- Ohio Medicare Advantage plans provide enhanced benefits that may go beyond Original Medicare, including prescription drug coverage and additional routine examinations.

- Choosing a plan in Ohio can offer comprehensive coverage at an affordable rate.

- Comparing plans involves evaluating aspects such as cost, provider networks, and financial assistance for eligible beneficiaries to find the best option available.

Compare Plans in Ohio Now!

Enter Zip Code

Ohio Medicare Advantage Plans Overview

Medicare Advantage is a federal health insurance program that provides coverage for U.S. adults aged 65 and over, as well as younger individuals with specific disabilities and medical conditions.

In Ohio, there are over 216 Medicare Advantage plans available from private health insurance providers, offering additional benefits compared to Original Medicare.

As 42% of eligible Ohio residents have chosen Medicare Advantage plans, you should evaluate your options by considering:

- Coverage

- Costs

- Quality ratings

- Provider networks

- Additional benefits

- Plan types

This will help you make an informed choice.

Ohio Medicare Advantage plans offer benefits that may go beyond Original Medicare, possibly including prescription drug coverage, routine examinations, and dental, vision, and hearing benefits, frequently at a more economical rate.

We will further examine these added benefits in the subsequent part.

Benefits of Choosing a Medicare Advantage Plan

Many Medicare Advantage plans in Ohio include prescription drug coverage, giving seniors access to essential medications at an affordable price.

These plans may offer additional benefits, such as routine examinations, and dental, vision, and hearing benefits, which are typically not covered by Original Medicare.

The cost of Medicare Advantage plans in Ohio can be lower than Original Medicare, providing seniors with comprehensive coverage and extra benefits at a more affordable rate. This makes Medicare Advantage an attractive option for those seeking cost savings and increased convenience in managing their healthcare.

You need to scrutinize the plan details or get in touch with the Medicare Advantage plan provider for specifics about the frequency of routine exams and the scope of dental, vision, and hearing benefits provided.

Grasping these extra benefits will assist in selecting a plan that satisfies your specific healthcare requirements.

Types of Medicare Advantage Plans Available in Ohio

Ohio Medicare Advantage plans fall into four main categories:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-for-Service Plans (PFFSs)

- Special Needs Plans (SNPs)

Each plan type offers varying levels of flexibility, price, and additional benefits, making it essential to understand the differences between them.

HMO and PPO plans are the most common types of Medicare Advantage plans, with the following characteristics:

- HMOs typically have lower costs but require members to choose in-network care providers.

- PPOs offer more flexibility in provider choice but may come with higher costs.

- PFFS plans allow beneficiaries to see any provider that accepts the plan’s terms.

- SNPs cater to those with specific medical conditions or needs, providing targeted benefits tailored to their situation.

When deciding on a Medicare Advantage plan in Ohio, it’s imperative to take into account the plan type and its features to find a plan that best matches your healthcare needs and budget.

How to Enroll in an Ohio Medicare Advantage Plan

Eligibility for enrollment in Ohio Medicare Advantage plans is based on:

- Age: Individuals 65 years of age or older

- Disability: Those receiving disability benefits for 24 months

- Medical condition: Those with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS)

These individuals are eligible for Medicare in Ohio.

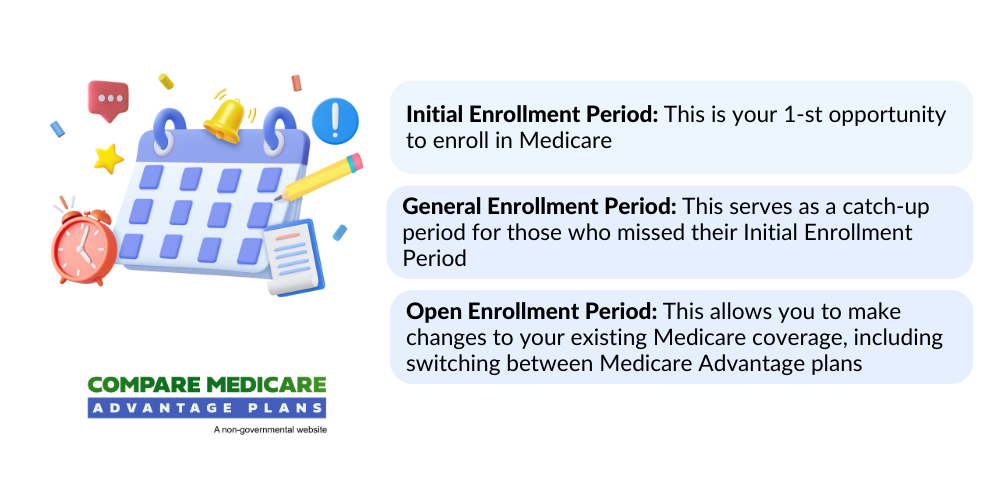

There are specific enrollment periods for Medicare Advantage plans in Ohio, such as:

- Initial Enrollment Period: occurs when an individual first becomes eligible for Medicare

- Medicare Annual Enrollment Period: runs from January 1 to March 31 each year

- Special Enrollment Period: individuals may qualify for this period if they experience a life event like losing a job or relocating to an area not serviced by their current insurance carrier

To determine eligibility for a Special Enrollment Period, contact 1-800-MEDICARE.

By grasping the eligibility criteria and enrollment periods, you can ensure a seamless transition to a Medicare Advantage plan that satisfies your needs.

Comparing Medicare Advantage Plans in Ohio

When examining Medicare Advantage plans in Ohio, you should evaluate aspects like:

- Coverage

- Cost

- Convenience

- Provider networks

You can use the plan finder tool on Medicare’s website to compare the costs and coverage of various Medicare plans in your area.

Coverage among Medicare Advantage plans in Ohio can vary, with some plans offering additional benefits not covered by Original Medicare, such as:

- Fitness programs

- Dental services

- Vision services

- Hearing services

Additionally, the type of plan, whether it’s an HMO or PPO, can impact the coverage and provider network available.

To comprehend and compare provider networks in Ohio’s Medicare Advantage plans, examine the different health insurance companies that offer them and contrast their ratings.

Evaluate the specific plans each company provides and compare their benefits and coverage options to find a plan that fits your healthcare needs. It’s essential to compare Medicare Advantage plans to make an informed decision.

Prescription Drug Coverage in Ohio Medicare Advantage Plans

Prescription drug coverage is an essential component of many Medicare Advantage plans in Ohio, as it includes various prescription drugs. Most HMO and PPO plans, as well as all SNP plans, offer prescription drug coverage similar to that of Medicare Part D. However, the extent of coverage, cost, and convenience may vary among plans.

PFFS plans may or may not provide prescription drug coverage, making it necessary to carefully review the plan details before selecting a PFFS plan.

In addition to Medicare Advantage plans, there are 24 stand-alone Medicare Part D plans available in Ohio for 2023, providing another option for prescription drug coverage.

When choosing a Medicare Advantage plan in Ohio, it’s imperative to consider the prescription drug coverage the plan offers and verify that it satisfies your medication requirements.

Financial Assistance for Medicare Beneficiaries in Ohio

Financial assistance for Ohio Medicare beneficiaries is available through the state’s Medicaid program, which can help cover premiums and services for eligible individuals.

To qualify for Medicaid, applicants must meet specific income and resource/asset level requirements, such as possessing no more than $2,000 of countable assets and meeting the equity limit for a home, which is $603,000 in 2021.

Medicaid offers coverage to Medicare beneficiaries through the Qualified Medicare Beneficiary (QMB) program, which assists with Medicare premiums, deductibles, and coinsurance.

To apply for Medicaid and receive financial assistance, visit your local county Job and Family Services office or call the Medicaid Consumer Hotline at (800) 324-8680. Ensure you meet the citizenship, Social Security Number, and residency requirements before applying.

Ohio Medicare Resources and Support

Various resources and support are available for Medicare beneficiaries in Ohio. The Ohio Senior Health Insurance Information Program and the Medicare Rights Center are two organizations that provide trained, unbiased counselors to help you make informed decisions about Medicare Advantage plans.

In addition to these organizations, Medicare.gov and CMS’s website are valuable resources for understanding the different components of Medicare coverage and comparing plans available in your ZIP code.

Our website, Comparemedicareadvantageplans.org, is also a good resource that can help you make an informed decision about the best Medicare Advantage plan for your needs. Call one of our licensed insurance agents for Medicare Advantage plan assistance at 1-833-641-4938 (TTY 711), Monday-Friday, 8 a.m.–9 p.m. EST.

Feel free to utilize these resources and support organizations to aid in navigating the complexities of Medicare Advantage plans in Ohio and ensure you choose a plan that meets your healthcare needs and budget.

Top-Rated Medicare Advantage Plans in Ohio

Several top-rated Medicare Advantage plans in Ohio have received five-star ratings from CMS, indicating excellent performance in customer service, member experience, and quality of care.

Some of these Medicare Advantage HMO plans include Devoted Health’s Devoted CORE Ohio (HMO) Devoted GIVEBACK Ohio (HMO), and PrimeTime Health Plan.

However, plan availability varies by ZIP code and county, so it’s necessary to verify which of these top-rated plans are available in your area using our website, Comparemedicareadvantageplans.org plan finder tool by entering your ZIP code.

Considering the ratings and performance of Medicare Advantage plans in Ohio can help you select a plan that provides high-quality care and customer service, ensuring a positive healthcare experience.

Summary

In conclusion, understanding the various Medicare Advantage plans available in Ohio, their benefits, types, enrollment process, and available resources can help you make an informed decision about your healthcare coverage.

By weighing factors such as coverage, cost, convenience, and provider networks, you can find a plan that meets your unique healthcare needs and budget.

Don’t hesitate to utilize the resources and support available to Ohio Medicare beneficiaries to ensure a smooth and positive healthcare journey.

Frequently Asked Questions

→ What are 4 types of Medicare Advantage plans in Ohio for 2025?

Medicare Advantage Plans come in four main varieties: Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, and Special Needs plans (SNPs).

→ How much is Medicare Advantage in Ohio?

In Ohio, the average Medicare Advantage premium is $16.03 per month in 2023 and $16.63 per month in 2024. There are 224 Medicare Advantage plans available in Ohio.

→ What types of Medicare Advantage plans are available in Ohio?

In Ohio, Medicare Advantage plans are available in the form of HMOs, PPOs, PFFSs, and SNPs.

Compare Medicare Advantage Plans by County:

Compare Medicare Advantage Plans by City:

Compare Medicare Advantage Plans by Company:

ZRN Health & Financial Services, LLC, a Texas limited liability company