Best Medicare Advantage Plans Utah 2025

Navigating the world of healthcare options may be challenging, especially when it comes to selecting the right Medicare Advantage plan.

For Utah residents, the choice is even more crucial, as some of these Medicare Advantage plans in Utah may offer additional benefits and coverage beyond Original Medicare.

With different types of plans available, understanding the nuances of each option may be essential to finding the best fit for your unique healthcare needs.

This comprehensive guide could help you explore and compare the potential Medicare Advantage plans in Utah so that you can make an informed decision for your future.

Key Takeaways

- Some Medicare Advantage plans in Utah may provide comprehensive healthcare coverage and possibly include additional benefits such as prescription drugs, dental, vision, and hearing coverage.

- Eligibility criteria for these plans include enrollment in Medicare Part A & B, being a resident of the state and not having End-Stage Renal Disease (ESRD).

- To select an appropriate plan it is important to analyze the potential coverage options and assess costs, which may include premiums, deductibles, and copays. Evaluate plan ratings & customer reviews. Seek assistance from SHIP or Medicaid Services for Medicare Beneficiaries.

Compare Plans in Utah Now!

Enter Zip Code

Exploring Medicare Advantage Plans in Utah

Some Medicare Advantage plans in Utah may be offered by a variety of private insurance companies. These plans could provide all the coverage of Original Medicare (Part A and Part B) and may provide additional benefits, such as:

- Prescription drug coverage

- Dental coverage

- Vision coverage

- Hearing coverage

Some of these plans may be designed to offer more comprehensive healthcare options than Original Medicare, possibly catering to the diverse healthcare needs of Utah residents.

Understanding the potential differences between Medicare Advantage plans and Original Medicare, as well as the types of plans that may be available in Utah, could be key to making the right decision for your healthcare coverage.

Top Providers of Medicare Advantage Plans in Utah

Several leading insurance providers may offer Medicare Advantage plans in Utah, each with varying plan options and coverage levels. Some of the top providers may include:

- Anthem

- Blue Cross & Blue Shield

- Cigna

- Humana

- UnitedHealthcare

- Wellcare

These companies will likely offer a range of plan types, such as Health Maintenance Organization (HMO) plans and Preferred Provider Organization (PPO) plans, to cater to the specific needs of individuals in Utah.

By putting your zip code into any of the zip code boxes on this website, you could compare potential plan options, coverage, and costs from various providers, supporting you in making an informed choice when selecting a plan that aligns with your healthcare needs and preferences.

Medicare Advantage Plan Types in Utah

Medicare Advantage plans are available to beneficiaries in Utah. These plans include:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-For-Service (PFFS)

- Special Needs Plan (SNP)

Each plan type will likely offer different coverage options and provider networks, making it essential to understand the distinctions between them when selecting the most suitable plan for your needs.

HMO and PPO plans emphasize coordinated care within a network of healthcare providers. HMO plans typically require you to select a primary care physician and obtain referrals for specialist care, while PPO plans offer more flexibility in choosing providers, both within and outside the plan’s network.

PFFS plans, on the other hand, allow you to see any provider that accepts the plan’s terms and conditions, offering a greater degree of choice in selecting healthcare providers.

Lastly, SNP plans may cater to specific groups of individuals, such as those with certain chronic conditions or those eligible for both Medicare and Medicaid.

Evaluating the plan types and respective coverage options available in Utah is necessary for determining the plan most suited to your healthcare needs.

Possible Benefits of Medicare Advantage Plans

One of the possible advantages of some Medicare Advantage plans may be the additional benefits that could potentially be offered beyond Original Medicare, making Medicare Advantage differ in coverage.

Some of these plans may include coverage for outpatient prescription drugs, routine dental, vision, and hearing aid coverage. These potential benefits could significantly enhance the overall healthcare experience for Medicare beneficiaries in Utah.

Many Medicare Advantage plans in Utah may also incorporate prescription drug coverage, referred to as Part D.

This coverage may help pay for both generic and brand-name prescription drugs, possibly providing financial relief for individuals who may require regular medications.

Some of the possible benefits like dental and vision care may be able to greatly improve the quality of life for seniors and those with disabilities, possibly making some of the Medicare Advantage plans an attractive option for comprehensive healthcare coverage.

Prescription Drug Coverage in Utah Medicare Advantage Plans

Part D prescription drug coverage is a critical component of many Medicare Advantage plans in Utah.

This coverage could help beneficiaries with some of the costs of their prescription medications, potentially ensuring that they have access to the medications they need.

The specific coverage and potential costs that may be associated with prescription drug coverage may vary depending on the plan chosen, so it’s important to review the details of each plan to understand the extent to which prescription drug coverage may be provided.

The annual enrollment period for Medicare Part D prescription drug coverage runs from October 15 to December 7 each year.

During this time, eligible beneficiaries can either enroll in a new plan or make changes to their existing plan.

Understanding the potential prescription drug coverage options that may be provided with some of Utah’s Medicare Advantage plans may allow beneficiaries to make informed choices about their healthcare coverage and more effectively manage their medication-related expenses.

Potential Out-of-Pocket Costs and Cost-Sharing for Medicare Advantage Plans

Enrolling in a Medicare Advantage plan will likely involve various out-of-pocket costs, such as premiums, deductibles, and copays.

Some of these costs may differ depending on the specific plan chosen, possibly making it essential to compare plans and evaluate the potential costs associated with each. While some plans may charge a monthly premium in addition to the Medicare Part B premium, others may offer a lower or no additional premium.

The deductibles, copayments, and out-of-pocket maximums may also vary between plans.

Evaluating these potential costs will likely be a necessary step when choosing a Medicare Advantage plan in Utah, as they could greatly affect your total healthcare expenses.

Comparing the costs that may be associated with various plans might enable you to make an informed decision about which plan may best suit your healthcare needs and financial situation.

Enrolling in a Medicare Advantage Plan in Utah

The process of enrolling in a Medicare Advantage plan in Utah involves the following steps:

- Understand the eligibility requirements, which include being enrolled in both Medicare Part A and Part B, residing within the state, and not having End-Stage Renal Disease (ESRD).

- Determine if you are eligible based on age (65 and above) or a qualifying disability.

- Call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST to enroll in a plan.

By following these steps, you can enroll in a Medicare Advantage plan in Utah.

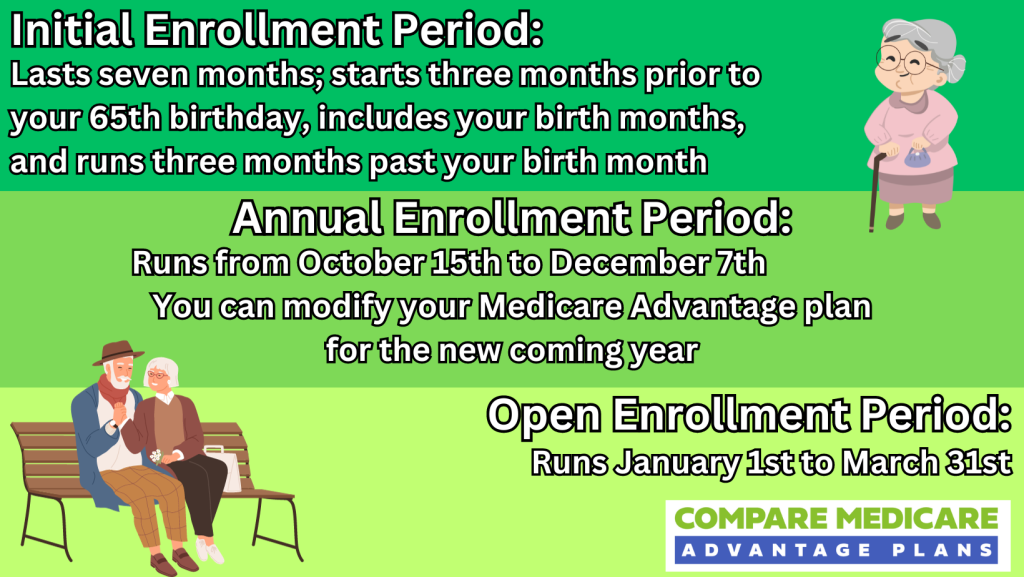

There may be several enrollment periods for Medicare Advantage plans in Utah, such as the initial enrollment period, open enrollment period, and special enrollment periods.

Navigating these periods and understanding when to enroll will ensure you can access the healthcare coverage you need through a Medicare Advantage plan in the state.

Eligibility Criteria for Medicare Advantage Plans

To be eligible for a Medicare Advantage plan, you must meet certain criteria. Here are the requirements:

- You must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance). These parts of Original Medicare could cover a range of healthcare services, such as inpatient hospital care, skilled nursing facilities, doctor visits, and outpatient care, which are essential for adequate Medicare coverage.

- You must be a resident of the state of Utah.

- You must not have End-Stage Renal Disease (ESRD).

Understanding these eligibility criteria is crucial when considering enrolling in a Medicare Advantage plan. By meeting these requirements, you may be able to confidently access some of the potential benefits and coverage that could be provided by a Medicare Advantage plan in Utah.

Enrollment Periods for Medicare Advantage Plans

There are several enrollment periods for Medicare Advantage plans in Utah, each with specific dates and guidelines.

The initial enrollment period is when you first become eligible for Medicare, usually around your 65th birthday or after receiving 24 months of Social Security or Railroad Retirement Board (RRB) Disability Insurance payments.

The open enrollment period, also known as the Annual Enrollment Period (AEP), runs from October 15 to December 7 each year, during which you can enroll in or make changes to your Medicare Advantage plan.

Special enrollment periods may also be available for certain situations, such as if you move out of your current plan’s service area or lose other qualified healthcare coverage.

Knowledge about the various enrollment periods and their respective deadlines may help prevent missing the opportunity to enroll in a Utah Medicare Advantage plan and secure necessary healthcare coverage.

How to Enroll in a Medicare Advantage Plan

Once you have determined your eligibility and explored the different Medicare Advantage plan options available in Utah, the next step is to enroll in the plan that best meets your needs.

To enroll in a Medicare Advantage plan, you will need information from your Medicare card, such as your Medicare ID and your Original Medicare (Part A and Part B) effective dates.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

After submitting your enrollment application, it’s crucial to review the plan details and ensure you understand the potential coverage and costs that may be associated with the plan you have chosen.

With confirmed enrollment, you will be set to access the additional benefits and coverage provided by a Medicare Advantage plan in Utah.

Comparing and Choosing a Medicare Advantage Plan in Utah

Selecting the right Medicare Advantage plan in Utah requires careful consideration of multiple factors, such as potential coverage, costs, and plan ratings.

By taking the time to compare different plans and assess their possible offerings, you may make a more informed decision about the plan that best aligns with your healthcare needs and financial situation.

Considering factors such as the potential coverage, network options, and possible benefits could help you identify the plan that may offer the most comprehensive and cost-effective healthcare coverage for your needs.

Analyzing Potential Coverage and Network Options

When comparing Medicare Advantage plans in Utah, it’s essential to carefully analyze the coverage and network options that may be available in each plan. Different plans may offer varying coverage levels and provider networks, possibly impacting your ability to access the healthcare services you need at an affordable cost.

For example, HMO and PPO plans may have more restricted provider networks, which could limit your choice of healthcare providers and facilities.

On the other hand, PFFS plans may offer more flexibility in provider choice, as long as the provider accepts the plan’s terms and conditions.

By examining the potential coverage and network options in different Medicare Advantage plans in Utah, you could make a more informed decision about which plan may offer the best balance of coverage and access to healthcare providers.

Assessing Costs: Potential Premiums, Deductibles, and Copays

Another important factor to consider when comparing Medicare Advantage plans in Utah could be the various costs associated with each plan, such as premiums, deductibles, and copays.

These costs may significantly impact your overall healthcare expenses, so it’s crucial to weigh the potential costs and benefits of each plan to find the most cost-effective option.

Some plans may include an annual deductible, which is the amount you must pay out of pocket before the plan begins covering medical expenses. Copayments for each medical service or prescription drug may also be required, the amount of which could vary depending on the specific service or drug.

Comparing the costs that may be associated with various plans could enable you to make an informed decision about which plan best suits your healthcare needs and financial situation.

Evaluating Plan Ratings and Customer Reviews

Evaluating plan ratings and customer reviews is an essential aspect of comparing Medicare Advantage plans in Utah.

Plan ratings, determined by the Centers for Medicare and Medicaid Services (CMS), will likely be based on factors such as:

- Member surveys

- Healthcare quality

- Customer service

- Patient outcomes

These ratings, represented on a 5-star scale, may provide valuable insights into the overall performance and quality of a plan, possibly helping you make a more informed decision when selecting a plan.

Customer reviews may also provide additional insights into the experiences of other plan members, possibly offering firsthand accounts of the plan’s reliability, coverage, and customer satisfaction.

Considering both plan ratings and customer reviews could allow for a comprehensive understanding of the various Medicare Advantage plan options in Utah, facilitating an informed decision about the plan that best meets your needs.

Utah Medicare Resources and Assistance Programs

Navigating the world of Medicare may be confusing, but there are resources and assistance programs that may be available to Utah residents to help with Medicare-related questions and concerns.

Some of these programs may offer valuable guidance and support, possibly ensuring you have the information you need to make informed decisions about your healthcare coverage.

Utah residents will likely have access to two key healthcare programs, the State Health Insurance Assistance Program (SHIP) and Medicaid Services for Medicare Beneficiaries.

These healthcare services could potentially provide free, unbiased counseling and assistance, helping individuals understand their health medicare options and make the most of their potential healthcare benefits.

State Health Insurance Assistance Program (SHIP)

Utah’s State Health Insurance Assistance Program (SHIP) is a national program that provides free one-on-one counseling and assistance to individuals with Medicare.

The SHIP program could offer impartial guidance, possibly helping beneficiaries navigate the complexities of Medicare and reduce out-of-pocket healthcare expenses.

If you’re unsure about your Medicare options or need assistance with enrolling in a plan, SHIP may be a valuable resource.

To access SHIP services in Utah, you can call 1-800-541-7735 or visit their website at https://daas.utah.gov/seniors/.

Their team of highly trained and certified counselors is available to assist with all aspects of Medicare, from understanding eligibility requirements to comparing possible plan options and costs.

Medicaid Services for Medicare Beneficiaries

Utah’s Medicaid program for Medicare beneficiaries, known as the Medicare Savings Program (MSP), may offer some financial assistance that might help qualified Medicare beneficiaries cover some of their Medicare premiums, deductibles, and coinsurance.

Utah’s Medicaid program for Medicare beneficiaries, known as the Medicare Savings Program (MSP), may offer some financial assistance that might help qualified Medicare beneficiaries cover some of their Medicare premiums, deductibles, and coinsurance.

The program will likely have various levels of support based on income and resource limits, possibly ensuring that those who need financial assistance the most may access the help they need.

To learn more about Utah’s Medicaid program and the potential financial assistance available for Medicare beneficiaries, you can visit the Utah Medicaid website at https://medicaid.utah.gov/who-eligible/.

By understanding the resources and assistance programs that may be available in Utah, you might be able to better manage your healthcare expenses and make the most of your Medicare benefits.

Summary

Selecting the right Medicare Advantage plan in Utah will likely require careful consideration of the potential coverage options, costs, and plan ratings.

By exploring the various plan types, providers, and possible benefits, you may make a more informed decision about the plan that may best suit your healthcare needs and financial situation.

Utilizing resources such as Utah’s SHIP program and Medicaid services could help you navigate the complexities of Medicare and make the most of your healthcare coverage.

With the right information and guidance, you may confidently choose the Medicare Advantage plan that could provide the best care and support for your unique needs.

Frequently Asked Questions

→ What are the advantages of a Medicare Advantage plan?

Some Medicare Advantage plans could be highly flexible, as you may be required to work with a network of healthcare providers and might have prior authorization for services.

Furthermore, you could potentially be covered far from where you live, and the out-of-pocket costs may be low. Moreover, plans often change each year, making it important to consider current and future needs.

→ What are the four types of Medicare Advantage plans in Utah for 2025?

There are 3 types of Medicare Advantage plans available, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS) plans, as well as Special Needs plans (SNPs).

→ Does Utah have Medicare Advantage plans?

Yes, Utah will likely have Medicare Advantage plans that may include providers such as Humana, Molina Healthcare, Regence Blue Cross BlueShield and Select Health.

→ How to apply for Medicare in Utah?

Call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. For free, personalized health insurance counseling, including help with appeals, call your State Health Insurance Assistance Program (SHIP).

→ What types of Medicare Advantage plans are available in Utah?

Utah may offer a range of Medicare Advantage plan options, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-For-Service (PFFS), and Special Needs Plan (SNP).

Compare Medicare Advantage Plans by Company:

ZRN Health & Financial Services, LLC, a Texas limited liability company