Best Medicare Advantage Plans Missouri 2025

Choosing the right Medicare Advantage Plan in Missouri for 2025 is easier than you might think. By understanding the types of Medicare Advantage Plans Missouri offers, enrollment periods, and cost considerations, you can confidently select a plan that best meets your individual needs.

This comprehensive guide will provide valuable insights and tips to help you make an informed decision about your Medicare Advantage Plan in Missouri.

Key Takeaways

- Medicare Advantage Plans in Missouri offer comprehensive coverage and additional benefits.

- Residents of Missouri have multiple Medicare Advantage Plan providers to choose from, providing them with the ability to select a plan that best suits their healthcare needs.

- Prospective enrollees should be aware of Initial Enrollment Periods, Annual Open Enrollment Periods, and Special Enrollment Periods to make informed decisions about their coverage options.

Compare Plans in Missouri Now!

Enter Zip Code

Overview of Medicare Advantage in Missouri

Medicare Advantage Plans in Missouri offer a range of benefits and options for eligible residents. These comprehensive plans encompass Medicare Part A (hospital insurance) and Part B (outpatient care) benefits, which are part of Original Medicare.

They often include Part D (prescription drug coverage) and additional benefits not offered by Original Medicare.

With 126 Medicare Advantage plans to choose from in 2023, Missouri residents have plenty of options to find the coverage that best suits their needs.

Key Features of Medicare Advantage Plans

Medicare Advantage Plans in Missouri, offered by private Medicare-approved insurance companies, provide more than just Original Medicare coverage. They often include additional benefits, such as a Medicare prescription drug plan, possibly along with:

- Dental

- Vision

- Hearing Health

- Prescriptions

- Over-the-counter medicines

- Transportation

- Fitness memberships

These Medicare plans, including a prescription drug plan, are designed to offer comprehensive coverage for various healthcare needs, enabling beneficiaries to enjoy all the benefits of Original Medicare and more.

When choosing a Medicare Advantage Plan, one should evaluate the available coverage options offered by most Medicare Advantage plans, including:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Other plans offered by insurance companies such as Aetna, Anthem, Blue Cross & Blue Shield, Cigna, Humana, UnitedHealthcare, and Wellcare

Understanding these options will help you make an informed decision about your Medicare Advantage coverage in Missouri.

Missouri Medicare Advantage Plan Providers

Several providers are offering Medicare Advantage Plans in Missouri, such as:

- Aetna Medicare

- Anthem

- Blue Cross & Blue Shield

- Cigna

- Humana

These providers offer various plan options with differing benefits and costs, giving Missouri residents the flexibility to choose a plan that best meets their personal healthcare needs.

Comparing and studying each provider’s offerings is key to choosing the right Medicare Advantage Plan.

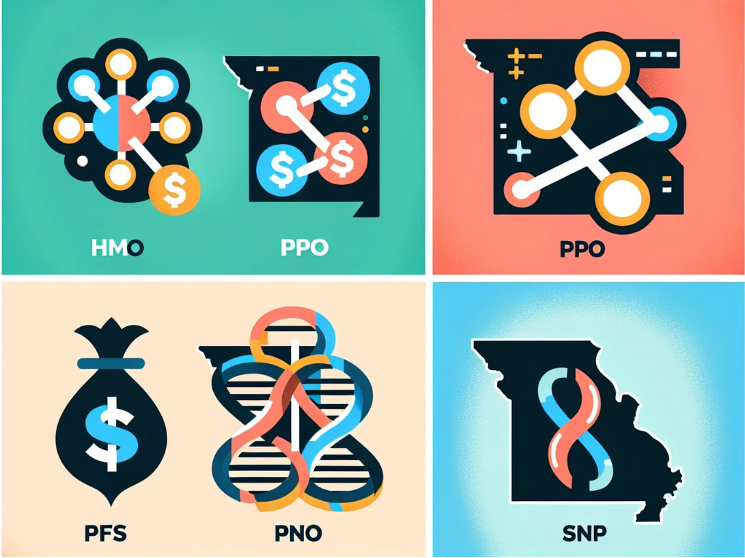

Types of Medicare Advantage Plans Available in Missouri

Missouri offers different Medicare Advantage Plans for its citizens. These include:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNP)

Each plan type offers different benefits and coverage options, catering to the diverse healthcare needs of Missouri residents. Understanding these plan types helps in selecting the Medicare Advantage Plan that best fits your specific needs.

Remember, all Medicare Advantage Plans in Missouri provide coverage identical to Original Medicare, guaranteeing comprehensive healthcare coverage.

However, additional benefits and coverage options vary depending on the plan type, so it’s essential to carefully review each plan to find the one that best meets your healthcare requirements.

Health Maintenance Organization (HMO) Plans

Health Maintenance Organization (HMO) Plans in Missouri require beneficiaries to select a primary care physician (PCP) within the HMO network and obtain referrals from the PCP to see specialists.

These plans typically feature a network of doctors, hospitals, and other healthcare providers that must be utilized to receive coverage, except in cases of emergency.

HMO plans focus on preventive care services, offering coverage for a wide range of preventive services and emphasizing the importance of regular check-ups to maintain overall health.

Preferred Provider Organization (PPO) Plans

Preferred Provider Organization (PPO) Plans in Missouri offer more flexibility in choosing healthcare providers compared to HMO plans. PPO plans allow beneficiaries to see specialists without a referral and visit providers outside of the network, although at a higher cost.

This flexibility makes PPO plans an attractive option for individuals who prefer greater freedom of choice when it comes to their healthcare providers.

Private Fee-for-Service (PFFS) Plans

Private Fee-for-Service (PFFS) Plans in Missouri are a type of Medicare Advantage Plan that allows beneficiaries to see any Medicare-approved healthcare provider or hospital that accepts the plan’s payment terms and conditions.

PFFS plans do not require the selection of a primary care physician or referrals for specialists, providing even more flexibility for individuals seeking a Medicare Advantage Plan that accommodates their healthcare needs.

Special Needs Plans (SNP)

Special Needs Plans (SNP) in Missouri are designed for individuals with specific health conditions or those who qualify for both Medicare and Medicaid.

These plans provide tailored coverage and benefits to meet the unique healthcare needs of their target population.

If you have a chronic health condition or are eligible for both Medicare and Medicaid, an SNP may be the right choice for your Medicare Advantage coverage in Missouri.

Enrollment Periods for Medicare Advantage Plans in Missouri

When pondering on a Medicare Advantage Plan in Missouri, awareness of the enrollment periods is necessary.

There are three enrollment periods available: the Initial Enrollment Period, the Annual Open Enrollment Period, and Special Enrollment Periods.

Understanding these enrollment periods will help you make an informed decision about when to enroll in a Medicare Advantage Plan and ensure that you don’t miss any crucial deadlines.

Initial Enrollment Period

The Initial Enrollment Period for Medicare Advantage Plans in Missouri is available three months before and after turning 65. During this period, you can apply for a Medicare Advantage Plan. Contact our licensed insurance agent for free consultation and assistance at 1-833-641-4938 (TTY 711), Monday-Friday, 8 a.m.–9 p.m. EST.

Benefiting from this enrollment period is key to securing the coverage you need as soon as you qualify for Medicare.

Annual Open Enrollment Period

The Annual Open Enrollment Period for Medicare Advantage Plans in Missouri occurs from October 15 to December 7 every year. During this time, you can join a Medicare Advantage Plan, switch to another plan, or add or drop drug coverage.

Keeping abreast of the Annual Open Enrollment Period allows you to adjust your Medicare Advantage Plan to continue meeting your healthcare needs, making Medicare Advantage enrollment an essential process.

Special Enrollment Periods

Special Enrollment Periods for Medicare Advantage Plans in Missouri may be available depending on certain circumstances, such as a new disability, changes to one’s eligibility, or relocation to an area where the current plan is not offered.

These periods provide an opportunity for individuals who experience specific life events or changes to enroll in a Medicare Advantage Plan outside of the Initial and Annual Open Enrollment Periods.

Awareness of Special Enrollment Periods guarantees that you have access to Medicare Advantage coverage when it is most needed.

Cost Considerations for Missouri Medicare Advantage Plans

Cost is an important factor to consider when selecting a Medicare Advantage Plan in Missouri.

Understanding the average monthly premiums and out-of-pocket costs associated with the various plans can help you make an informed decision about which plan is the most affordable and suitable for your individual needs.

Average Monthly Premiums

The average monthly premium for Medicare Advantage Plans in Missouri varies from $7.67 to $18.95, depending on the plan. Comparing and studying the premiums of different plans can help you find the most cost-effective option for your healthcare needs.

Remember, all individuals eligible for Medicare in Missouri have access to at least one $0 premium plan.

Deductibles and Out-of-Pocket Costs

Deductibles and out-of-pocket costs for Medicare Advantage Plans in Missouri can vary depending on the plan and coverage. On average, the out-of-pocket limit for Medicare Advantage enrollees can be around $4,835 for in-network services and $8,659 for both in-network and out-of-network services.

Considering these costs is necessary when choosing a Medicare Advantage Plan, as they can significantly affect your overall healthcare expenses.

Tips for Selecting the Right Medicare Advantage Plan in Missouri

To choose the right Medicare Advantage Plan in Missouri, evaluating your personal health care needs, comparing plan benefits and costs, and reviewing provider networks are important steps.

By considering these factors, you can select a plan that offers the best value and meets your healthcare requirements.

Assessing Personal Health Care Needs

When choosing a Medicare Advantage Plan in Missouri, evaluating your personal healthcare needs is essential to finding a plan that best fits your healthcare requirements. Consider your current health status, any ongoing medical conditions or treatments, and the type of care you anticipate needing in the future.

Assessing your personal health care needs helps you choose a plan that provides the necessary coverage and benefits for effective health management.

Comparing Plan Benefits and Costs

To find the best value for your needs in Missouri Medicare Advantage Plans, comparing plan benefits and costs is important.

To find the best value for your needs in Missouri Medicare Advantage Plans, comparing plan benefits and costs is important.

Research the top-rated plans from reliable sources and carefully analyze the coverage and costs, including premiums, deductibles, copayments, and out-of-pocket maximums.

Additionally, consider the specific benefits offered by each plan, and any restrictions or limitations, and use online tools or resources provided by Medicare to compare plans side by side.

Evaluating Provider Networks

Evaluating provider networks is a critical step in choosing the right Medicare Advantage Plan in Missouri. Ensure that your preferred doctors and specialists are included in the plan’s network, as this can significantly impact your access to care and overall healthcare experience.

If your preferred providers are not included in the network, consider whether you are willing to switch providers or if a different plan with an expanded provider network might better suit your needs.

Missouri Medicare Advantage Resources

Missouri Medicare Advantage resources, like the State Health Insurance Assistance Program (SHIP) and Medicare.gov, can assist residents in making knowledgeable decisions about their coverage options.

These resources provide valuable information and assistance to ensure that you can confidently choose the right Medicare Advantage Plan for your needs in Missouri.

State Health Insurance Assistance Program (SHIP)

The State Health Insurance Assistance Program (SHIP) in Missouri offers the following services:

- Free, unbiased, and confidential assistance to Medicare beneficiaries and their caregivers

- Personalized health insurance counseling

- One-on-one assistance

- Counseling and education to help residents make informed decisions about the best Medicare plan for their needs.

Medicare.gov

Medicare.gov is the official website of the U.S. government’s Medicare program and provides a wealth of information and resources for Missouri residents seeking Medicare Advantage plans. The website allows you to compare different plans, understand your coverage options, and find resources to help you make informed decisions about your healthcare.

By using Medicare.gov, you can ensure that you have all the information you need to select the best Medicare Advantage Plan in Missouri.

For a free consultation, you may also speak with a licensed insurance agent by calling 1-833-641-4938 (TTY 711), Monday-Friday, 8 a.m.–9 p.m. EST.

Summary

In conclusion, selecting the right Medicare Advantage Plan in Missouri is a crucial decision that requires careful consideration of your personal healthcare needs, plan benefits and costs, and provider networks.

By utilizing the resources provided by the State Health Insurance Assistance Program (SHIP) and Medicare.gov or by contacting a licensed insurance agent, you can confidently choose a plan that offers the best value and meets your healthcare requirements.

Remember to stay informed about the various enrollment periods to ensure you don’t miss any important deadlines, and don’t hesitate to seek assistance from knowledgeable professionals if needed.

Frequently Asked Questions

→ What are 4 types of Medicare Advantage plans?

→ Which is cheaper, Medicare Supplement or Medicare Advantage?

Overall, Medicare Advantage tends to be cheaper than Medicare Supplement plans due to its lower monthly premiums ranging from $0 to $100. On the other hand, Medicare Supplement plan premiums can range anywhere between $50 and $1,000 per month.

→ Does Missouri have Medicare Advantage plans?

Yes, Missouri has UHC Medicare Advantage plans available, which are required to cover at least the same benefits as Original Medicare.

→ What additional benefits can I expect from a Medicare Advantage Plan in Missouri?

You can enjoy additional benefits in some plans such as dental, vision, hearing health, prescriptions, over-the-counter medicines, transportation, and fitness memberships with a Medicare Advantage Plan in Missouri.

Compare Medicare Advantage Plans by County:

Compare Medicare Advantage Plans by City:

Compare Medicare Advantage Plans by Company:

ZRN Health & Financial Services, LLC, a Texas limited liability company