Humana Medicare Advantage HMO 2025 Plans

Learning about Medicare and trying to choose the right Medicare Advantage plan each year might feel like a maze.

However, when it comes to exploring your potential Medicare options, Humana Medicare Advantage HMO plans may emerge as a beacon of hope.

This article will discuss the potential Humana Medicare Plans and help you decide if their options are right for you in 2025.

Key Takeaways

- Some of Humana’s Medicare Advantage HMO plans may provide medical services, prescription drug coverage, and sometimes additional benefits such as dental, vision care, and hearing services.

- Financial assistance options may be available to make healthcare more affordable for members with disabilities or military and veteran status. Enrollment can be done by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Compare Plans in One Step!

Enter Zip Code

Understanding Humana Medicare Advantage HMO

As one of the leading providers of Medicare Advantage HMO plans, Humana will likely play a pivotal role in delivering comprehensive health coverage.

Some of Humana’s Medicare Advantage HMO plans may stand out in the crowd, possibly offering a bounty of benefits and services.

Some of the potential factors that might make some of Humana’s plans so unique will likely lie in the individual features, benefits, and costs of each plan.

What is a Medicare Advantage HMO?

With an Medicare Advantage HMO, you could have all your healthcare needs under one plan.

It’s a type of Medicare Advantage plan, functioning as a traditional Health Maintenance Organization (HMO).

Medicare Advantage HMO operates smoothly, necessitating members to use providers within the plan’s network, except in emergencies.

The uniqueness of these plans lies in the balance between cost and flexibility. While they typically have lower monthly premiums and out-of-pocket costs, they may have more restrictions compared to Medicare Advantage HMO PPO plans.

The Role of Humana in Medicare Advantage HMOs

Humana will likely provide Medicare Advantage HMO plans. As a Medicare Advantage HMO organization with a Medicare contract, Humana will likely offer comprehensive plans that may encompass many benefits, which may include medical and prescription drug coverage.

Humana’s strategy for managing certain Medicare Advantage HMO plans may include:

- Providing a wide selection of providers, allowing members the freedom to select a primary care physician from their network

- Offering versatile plans that meet the needs of beneficiaries

- Having a comprehensive network of providers

These potential factors could make Humana a preferred choice among beneficiaries.

Coverage Details: What to Expect from Your Humana Medicare Advantage HMO

Humana Medicare Advantage HMO plans might not just be about basic healthcare coverage. Some plans may go the extra mile, potentially offering additional benefits and services. Some Humana Medicare Advantage HMO plans may include hospital, medical, and prescription drug coverage under one plan.

Some plans may even offer a diverse range of additional benefits, such as potential prescription savings, and even coverage for routine dental, vision, and hearing care.

Medical Services Covered

At the heart of Humana Medicare Advantage HMO plans will likely be a comprehensive range of medical services. From preventive care services to specialist services, these plans could provide extensive coverage.

Prescription Drug Coverage

Certain Humana’s Medicare Advantage HMO plans may offer comprehensive prescription drug coverage. These plans may provide extensive coverage for both generic and brand-name prescription drugs, which may include those that are commonly prescribed, as well as rare brand-name drugs.

Humana may also cover some of the potential costs of prescription drugs. Certain plans may offer potential prescription savings through lower-cost preferred pharmacies and may even provide an allowance to help members save on over-the-counter products, such as vitamins and pain relievers.

Potential Benefits

Some of the Humana Medicare Advantage HMO plans in 2025 may offer more than just healthcare coverage. Certain plans may provide additional benefits that could potentially enhance your wellness journey, including:

- Potential prescription savings

- Dental, vision, and hearing coverage

With certain Humana Medicare Advantage HMO plans, you could potentially enjoy all these benefits under one plan.

What might set Humana apart could be its commitment to comprehensive coverage. Their plans will likely be designed to cater to your unique healthcare needs, possibly offering a range of benefits and low-premium plans. The aim will likely be to provide the health coverage you need at an affordable price.

Possible Costs and Savings: Understanding the Financial Aspects of Humana Medicare Advantage HMO

Healthcare costs may be difficult to understand. But with Humana’s Medicare Advantage HMO plans, you could get a clear picture of your healthcare expenses.

Some potential features of Humana’s plans might include:

- Transparent pricing without any hidden costs

- Premiums and deductibles

- Copays for doctor visits and prescription drugs

- Financial assistance options

Some of these plans may also offer potential prescription savings, possibly helping you cut down on your medication costs. Additionally, Humana may offer a variety of financial assistance programs that could make healthcare more affordable.

Premiums, Deductibles, and Copays

When it comes to healthcare costs, clarity is key. That’s why Humana will likely provide transparent pricing for its potential Medicare Advantage HMO plans.

Deductibles for Humana Medicare Advantage HMO plans may vary depending on the plan and coverage. For instance, there could be a deductible for each benefit period or an annual deductible for certain services.

Copays, on the other hand, are fixed amounts that you may be required to pay as your portion of the cost of medical services or supplies.

Financial Assistance Options

Healthcare costs might feel like a burden. But with some of Humana’s financial assistance options, you could lighten this load. Humana will likely offer a variety of financial assistance programs, such as Extra Help, Medicare Savings Program (MSP), and Healthy Options Allowance, that could help you cover some of the costs of your Medicare Advantage HMO plan.

Humana may also offer special assistance programs for those with status military or veteran, as well as disabled individuals, which could potentially provide lower premiums, reduced out-of-pocket costs, and additional coverage options.

Cost Comparison: HMO vs. PPO

When it comes to choosing a Medicare Advantage plan, members may wonder if HMO or PPO is better.

Understanding the costs that may be associated with each could help you make an informed decision.

Generally, HMO plans from Humana have lower deductibles, copays, and out-of-pocket maximums than PPO plans.

Prescription drug costs may vary between HMO and PPO plans. It’s important to compare individual plans to understand the differences in drug costs.

Ultimately, the goal is to choose the plan that best fits your healthcare needs and budget.

Enrollment Process: Joining a Humana Medicare Advantage HMO Plan

Enrolling in a Humana Medicare Advantage HMO plan is a straightforward process.

Enrolling in a Humana Medicare Advantage HMO plan is a straightforward process.

However, it’s important to understand the eligibility requirements, enrollment periods, and steps to enroll.

Whether you’re new to Medicare or looking to switch from another plan, Humana makes the enrollment process easy and hassle-free.

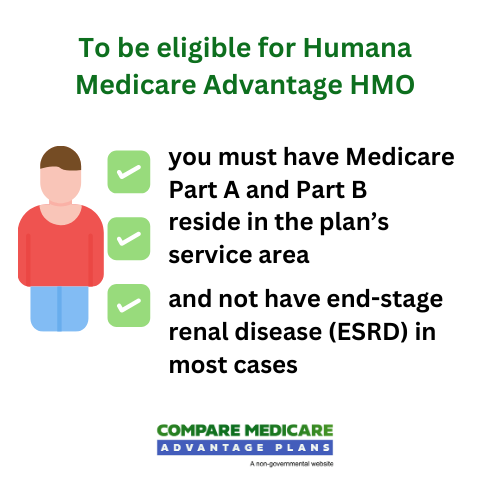

Eligibility Requirements

Before considering Humana Medicare Advantage HMO, it is important to verify if you meet the eligibility requirements. To be eligible, you must have Medicare Part A and Part B, reside in the plan’s service area, and not have end-stage renal disease (ESRD).

The minimum age requirement for the Humana Medicare Advantage HMO plan is 65 years and above. Non-U.S. citizens are also eligible to apply for a Humana Medicare Advantage HMO plan.

Enrollment Periods

Just like the changing seasons, Humana’s enrollment periods offer different opportunities to join a Medicare Advantage HMO plan. You have:

- the Initial Coverage Election Period (ICEP)

- Open Enrollment Period

- Special Enrollment Period

Each enrollment period serves a unique purpose. The ICEP allows individuals to enroll in a plan when they first become eligible for Medicare.

The Open Enrollment Period, on the other hand, is a time when you can make changes to your existing plan.

The Special Enrollment Period allows individuals to switch to a different Medicare Advantage plan or return to Original Medicare.

How to Enroll

Ready to enroll in a Humana Medicare Advantage HMO plan? You can enroll by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

If you’re transitioning from another Medicare plan, you can still join a Humana Medicare Advantage HMO plan.

Nondiscrimination and Accessibility: Humana's Commitment to Inclusivity

Humana is committed to providing equal access to its Medicare Advantage HMO plans for all members, regardless of color, national origin, age, disability, or sex.

They also offer free language interpreter services and make their plans accessible to members with disabilities.

Free Language Interpreter Services

Language should never be a barrier to accessing healthcare.

Language should never be a barrier to accessing healthcare.

That’s why Humana offers free language interpreter services to its members.

Whether you speak English, Spanish, Mandarin, or any other language, you can access these services for free.

To access these services, you need to contact Humana Customer Care at the number printed on your member ID card.

Accessibility for Members with Disabilities

Humana believes in equal access to healthcare for all, including members with disabilities. Whether you have a visual impairment, hearing impairment, or any other disability, Humana will likely have you covered.

They offer accessible resources to improve the web experience and provide communication assistance, including free language interpreter services.

Humana may also offer Special Needs Plans and Chronic Special Needs Plans for individuals with chronic conditions who require additional support.

Summary

Navigating the healthcare landscape might feel like a daunting task. But with Humana Medicare Advantage HMO plans, you could explore your potential options with ease.

From understanding the basics of Medicare Advantage HMOs to exploring the possible coverage details, costs, savings, and the enrollment process. Remember, healthcare is not just about managing illnesses; it’s about promoting overall well-being.

Frequently Asked Questions

→ What is the difference between an HMO and a Medigap plan?

HMOs are a type of Medicare Advantage Plan that requires you to choose a PCP, while a Medicare Supplement plan does not require one.

HMOs may also limit your healthcare coverage to providers in the network, while a Medicare Supplement plan may allow you to receive care from any provider.

→ Is Humana Medicare and Humana Medicare Advantage the same?

Humana Medicare Advantage is a private insurance plan offered by Humana contracted by the federal government to provide Medicare services. It is different from Original Medicare in that it might cover additional wellness programs and support, excluding hospice care.

→ Does Humana offer free language interpreter services?

Yes, Humana offers free language interpreter services to its members, allowing them access to these services by contacting Customer Care at the number printed on their ID card.

ZRN Health & Financial Services, LLC, a Texas limited liability company