Best Medicare Advantage Dental Plans 2025

Are you looking to improve your oral health and considering a Medicare Advantage dental plan? You’re in the right place!

Navigating the world of dental coverage can be challenging, but with the right guidance, you’ll be able to find a plan that suits your needs and budget.

In this comprehensive overview, we will explore the ins and outs of Medicare Advantage dental plans, helping you make an informed decision for your dental care.

From understanding the basics of Medicare Advantage plans to comparing top providers and their offerings, this article will provide you with valuable insights.

We’ll dive into the types of dental benefits, network restrictions, optional supplemental dental benefits, and how to choose the right plan for you. So, let’s get started!

Key Takeaways

- Medicare Advantage plans can possibly offer varying levels of dental coverage, ranging from preventive care to more complex procedures.

- Assessing individual needs and comparing costs is important when selecting a plan. Consider network size, coverage options, cost-sharing requirements & customer satisfaction ratings.

- Optional supplemental benefits can provide additional comprehensive coverage for treatments with restrictions & limitations that must be taken into account.

Medicare Advantage Dental Plans Now

Enter Zip Code

The Basics of Medicare Advantage Dental Plans

Medicare Advantage (Part C) is an alternative to Original Medicare that may offer a variety of additional benefits, including dental, vision, and hearing services.

Unlike Original Medicare, which probably does not provide coverage for routine dental care, some Medicare Advantage plans may include dental coverage for a wide range of services, from preventive care to more complex procedures.

Medicare Advantage dental coverage in these plans varies, with some plans offering more comprehensive benefits than others.

Understanding the comprehensive dental benefits provided by Medicare Advantage plans is significant for making a knowledgeable choice about your dental care.

Some plans may require cost-sharing through copayments or coinsurance, while others may necessitate out-of-pocket payment for routine services. Some plans provide the following dental benefits:

- Preventive dental benefits as a standard feature

- Comprehensive dental coverage, with cost sharing of 50% for in-network care

- An annual cap on plan payments

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare that bundles and is paid for by the federal government.

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare that bundles and is paid for by the federal government.

It’s a private health insurance plan that provides Medicare-covered benefits, which possibly include vision, hearing, and routine dental services not covered by Original Medicare.

Top companies offering Medicare Advantage plans include:

- UnitedHealthcare

- Humana

- Blue Cross Blue Shield

- Aetna

- Cigna

- Anthem

These plans offer a comprehensive alternative to Original Medicare, with potential additional benefits and restrictions based on the specific plan you choose. It’s beneficial to study and contrast plan offerings to identify the most suitable option for your healthcare needs.

Dental Services in Medicare Advantage Plans

Dental services in Medicare Advantage plans can vary greatly, with some plans offering more comprehensive coverage than others.

Aetna Medicare Advantage plans, for example, typically provide comprehensive dental coverage, including preventive care like cleanings and X-rays, and more extensive services such as periodontics, extractions, and restorative services.

However, you must be mindful of any limitations and restrictions related to dental coverage in Medicare Advantage plans, such as frequency limits on cleanings, extractions, or x-rays, annual benefit caps, waiting periods, and networks of dentists that plan members must use.

It’s important to note that not all plans provide coverage for every dental service, and some may have limitations on specific procedures.

When choosing a Medicare Advantage dental plan, it’s necessary to examine the dental services offered, as well as any restrictions and limitations, to ensure you have access to the care you need.

When it comes to Medicare Advantage dental plans, some of the top providers include:

- UnitedHealthcare

- Cigna

- Aetna

- Wellcare

- Humana

Each of these providers offers different levels of coverage and member satisfaction, making it important to compare their offerings and find the best fit for your dental care needs. Our online plan finder found on this page can help you search and compare plans easily.

Some examples of Medicare dental providers and their offerings include:

- UnitedHealthcare: Provides the largest Medicare dental network with over 100,000 providers and is highly rated by its members.

- Cigna: May offer Medicare Advantage plans with preventive and comprehensive dental coverage, 24/7 telehealth access, and meal delivery, and most of the plans have a $0 premium.

- Aetna: May offer no-cost plans to most Medicare beneficiaries.

- Humana: May offer dental coverage with fewer than six services but has an above-industry-average customer satisfaction rating.

Each of these providers has distinct offerings, so it’s necessary to meticulously compare their plans to find the most suitable fit for your dental care needs.

Provider Comparison

To find the most suitable Medicare Advantage dental plan for your needs, it’s necessary to compare leading providers based on factors such as network size, coverage, cost, and member experience.

For example, UnitedHealthcare usually offers comprehensive dental coverage, has a large dental network, and higher member satisfaction rating. Cigna’s plans normally provide preventive and comprehensive dental coverage, have an above-average customer satisfaction rating, and most of the plans have a $0 premium.

Different providers may offer varying levels of coverage and cost-sharing requirements, so it’s important to carefully review each plan’s details to find the best fit for your needs.

For instance, Aetna and Humana have different coverage levels, with Aetna typically offering more comprehensive coverage and Humana offering fewer services.

By comparing top providers, you can make an informed decision and select a Medicare Advantage dental plan that best suits your dental care needs and budget.

Understanding Dental Benefits in Medicare Advantage Plans

When considering a Medicare Advantage dental plan, it’s important to understand the types of dental benefits offered.

Aetna Medicare Advantage plans will likely offer different types of dental benefits. These include network, direct member reimbursement allowance, and optional supplemental benefits.

The direct member reimbursement allowance is a fixed sum of money provided annually to members for dental care expenditures. Optional supplemental benefits can be added to the plan for an additional cost, offering more comprehensive coverage.

It’s beneficial to study dental care providers in your area to assess costs and optimally use your annual allowance, as the cost of certain dental procedures and services may vary among providers.

Additionally, members may utilize the direct member reimbursement allowance to visit any licensed dental provider in the U.S., allowing for greater flexibility in choosing a provider.

Comprehending the dental benefits provided by Medicare Advantage plans will assist you in making a knowledgeable choice about your dental care needs.

Preventive Services

Preventive services are an essential aspect of dental care, helping to maintain good oral health and detect potential issues before they become more serious.

Most Medicare Advantage dental plans provide comprehensive services, including preventive services such as:

- cleanings,

- oral exams,

- and X-rays, with minimal to no cost-sharing requirements.

This means that enrollees can access these certain dental services at little to no out-of-pocket cost, promoting regular dental check-ups and early detection of any dental issues.

While preventive services are often covered at 100%, coverage for restorative services, such as fillings and crowns, can vary depending on the specific plan.

It’s important to carefully review the details of each Medicare Advantage dental plan to understand the coverage for preventive and restorative services and any cost-sharing requirements.

Restorative Services

Restorative services are vital for maintaining and improving oral health, and addressing issues such as tooth decay, gum disease, and tooth loss. Medicare Advantage dental plans can possibly provide coverage for a variety of restorative services, including:

- Fillings

- Crowns

- Bridges

- Dentures

- Root canals

- Dental implants

However, coverage levels and limitations for these services can vary depending on the specific plan.

Some plans may require cost-sharing for restorative services, with coinsurance rates typically around 50%.

Additionally (according to their offerings in the past) restorative services not typically covered by Medicare Advantage dental plans include dental implants, dentures, and orthodontic treatments. It’s crucial to review the coverage levels and limitations for restorative services when selecting a Medicare Advantage dental plan, ensuring the plan meets your dental care needs.

Cost-Sharing Requirements

Cost-sharing requirements for dental services in Medicare Advantage plans may include:

Cost-sharing requirements for dental services in Medicare Advantage plans may include:

- Copayments: a fixed amount that an individual is responsible for paying for a covered service

- Coinsurance: the percentage of the cost of a covered service that the individual is responsible for paying

- Annual coverage limits: the maximum amount that the plan will pay for covered services within a calendar year.

The majority of Medicare Advantage dental plans have minimal to no cost sharing for preventive services, making it affordable for beneficiaries to access routine dental care.

However, cost sharing for restorative services can vary depending on the specific plan, with coinsurance rates typically around 50%.

Comprehending the cost-sharing requirements for dental services in a Medicare Advantage plan is significant in selecting a plan that aligns with your financial situation.

Navigating Network Restrictions and Limitations

Network restrictions and limitations in Medicare Advantage dental plans can affect which providers you can see and the cost of services.

Many plans may require enrollees to receive dental services from in-network providers, which can influence the selection of dental care providers.

These restrictions are implemented to help control costs and ensure that plan members receive care from approved providers.

To navigate network restrictions and limitations in Medicare Advantage dental plans, it is recommended to:

- Check the provider network to ensure that your preferred dental providers are included.

- Verify coverage for out-of-network care, as some plans may offer limited or no coverage for services received outside of the network.

- Use the Plan Finder tool on this website to compare different Medicare Advantage dental plans and their network options.

- Have an understanding of plan limitations, such as waiting periods for certain services or restrictions on the number of visits allowed.

By considering these factors, you can make a knowledgeable choice about your dental care and select a Medicare Advantage dental plan that provides access to the providers and services you need.

Adding Optional Supplemental Dental Benefits

If you’re looking for more comprehensive dental coverage, you may consider adding optional supplemental dental benefits to your Medicare Advantage plan for an additional premium.

These supplemental benefits can possibly offer more extensive coverage for dental procedures and treatments, such as fillings, crowns, and dentures.

When considering adding an optional supplemental benefit, such as dental benefits, it’s beneficial to review the details of each plan to comprehend the additional coverage offered and the associated costs.

As with any dental coverage, be aware of any limitations and restrictions, such as annual dollar limits and benefit maximums, that may affect your access to care and out-of-pocket costs.

How to Choose the Right Medicare Advantage Dental Plan

Choosing the suitable Medicare Advantage dental plan involves evaluating your dental care needs, comparing costs and coverage, and considering factors like network size and member satisfaction.

Begin by reviewing plan details and asking pertinent questions to make a knowledgeable choice based on your dental care needs and financial circumstances.

Keep in mind that the best Medicare Advantage dental plan for you will depend on your unique needs and preferences. Consider the following factors when selecting a plan:

- Coverage offered

- Network of dental providers

- Cost-sharing requirements

- Additional benefits

- Plan ratings

- Flexibility

- Prescription drug coverage

By considering these factors, you can make an informed decision and select a Medicare Advantage dental plan that best suits your dental care needs and budget. Also, consult with one of our licensed insurance agents to help you find a plan that meets your medication needs.

Assessing Your Dental Care Needs

As you evaluate Medicare Advantage dental plans, it’s beneficial to assess your dental care needs and consider preferred providers and budget.

Start by considering the types of dental services you require, such as preventive care, basic procedures, and major procedures. Additionally, examine the network of dentists and specialists available under the plan and ensure that your preferred dentist is included.

To make the most of your dental coverage, research dental care providers in your area to evaluate costs and optimally utilize your annual allowance, as the cost of certain dental procedures and services may vary among providers.

Having a clear understanding of your dental care needs will help you select a Medicare Advantage dental plan that provides the coverage and access to care that you require.

Comparing Costs and Coverage

As you compare Medicare Advantage dental plans, it’s beneficial to consider the costs and coverage associated with each plan. Here are some key points to keep in mind:

As you compare Medicare Advantage dental plans, it’s beneficial to consider the costs and coverage associated with each plan. Here are some key points to keep in mind:

- According to the offerings in the past, on average, beneficiaries in Medicare Advantage spend approximately $766 for dental services.

- Most plans have minimal to no cost-sharing for preventive services.

- Cost-sharing for restorative services can range from 20% to 70%, depending on the plan.

To find the most suitable plan for your needs, review the cost-sharing requirements, coverage levels, and limitations for each plan.

This and our online plan finder found on this page will help you understand the out-of-pocket costs associated with each plan and make an informed decision about which Medicare Advantage dental plan best suits your dental care needs and financial situation.

Enrollment Process for Medicare Advantage Dental Plans

The enrollment process for Medicare Advantage dental plans involves reviewing plan materials, evaluating your dental care needs and financial situation, and following the steps to enroll or add dental coverage to your plan.

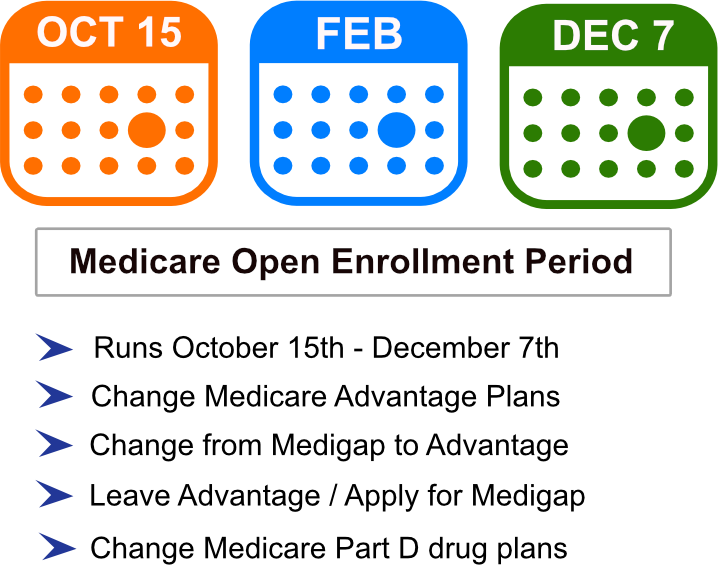

The enrollment period for Medicare Advantage dental plans occurs annually from October 15th to December 7th, giving you the opportunity to select a plan that includes dental benefits or add dental coverage to an existing plan.

To enroll in a Medicare Advantage dental plan, select a plan that includes dental benefits, which can be made when initially enrolling in your Medicare Advantage plan or within 30 days of your plan’s start date.

If you’re looking to add dental coverage to your existing Medicare Advantage Plan for 2025, you can contact one of our licensed insurance agents to help you find a plan that meets your specific medical needs to inquire about adding dental benefits or consider enrolling in a separate Medicare supplemental dental insurance plan.

Summary

In conclusion, choosing the right Medicare Advantage dental plan is essential for maintaining and improving your oral health.

By understanding the basics of Medicare Advantage plans, comparing top providers, navigating network restrictions and limitations, and considering optional supplemental dental benefits, you can make an informed decision that best suits your dental care needs and budget.

Don’t leave your oral health to chance – take control of your dental care by selecting a Medicare Advantage dental plan that provides the coverage, access, and affordability you need.

Frequently Asked Questions

→ What is the best dental plan for Medicare?

One of the best dental insurance for seniors on Medicare is UnitedHealthcare, offering Medicare Advantage plans with expansive networks, flexible premiums, and a wide range of plans from $0 to over $100 each month.

Other top carriers worth considering are Humana, Aetna, Delta Dental, and Manhattan Life.

→ Does Medicare Advantage cover root canals?

Medicare Advantage plans that include dental benefits may help cover root canals. However, Original Medicare (Part A and Part B) usually does not offer routine dental care benefits.

→ Does AARP Medicare Supplement Plan G cover dental?

In the past, AARP Medicare Supplement Plan G does not provide coverage for dental services, however, some insurance carriers may offer a separate dental and vision package that can be added to the plan for an additional premium.

→ What additional benefits are available through Medicare Advantage compared to Original Medicare?

Medicare Advantage may possibly offer additional benefits not covered by Original Medicare, such as vision, hearing, and routine dental services, giving seniors more comprehensive healthcare coverage.

→ Are all dental services covered by Medicare Advantage dental plans?

No, not all dental services are covered by Medicare Advantage dental plans as coverage varies between different plans.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.