Largest Medicare Advantage Plans 2025

Navigating the world of Medicare can be overwhelming, but finding the right Medicare Advantage plan is essential to ensure you receive the best coverage and benefits tailored to your needs.

In this guide, we’ll explore the largest Medicare Advantage plans in 2025, comparing their offerings and discussing key factors to consider when making your choice. By understanding the differences between plans and providers, you can make an informed decision and secure the most suitable healthcare coverage for your unique situation.

Key Takeaways

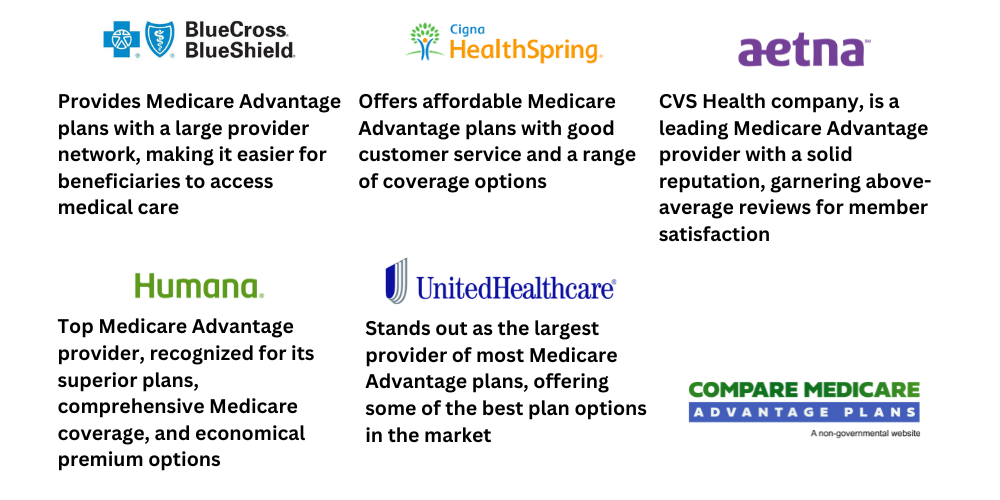

- UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, and Cigna are projected to be the five largest providers of Medicare Advantage plans in 2025.

- Factors such as premiums, out-of-pocket costs, and provider networks should be considered when selecting a plan.

- Comparing Medicare Advantage vs Original/Medigap is important for choosing the best-fit coverage option in 2025. SNPs offer customized benefits for certain health conditions.

Compare Plans in One Step!

Enter Zip Code

Largest Medicare Advantage Plans in 2025

UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, and Cigna are projected to be the most significant players in the Medicare Advantage market in 2025.

These providers offer an array of coverage options and benefits. Thus it’s beneficial to analyze their offerings for the best alignment with your healthcare needs.

Next, we’ll detail each provider’s Medicare Advantage options, examining their pros and cons.

UnitedHealthcare

UnitedHealthcare stands out as the largest provider of most Medicare Advantage plans, offering some of the best plan options in the market. Their plans are available in 48 states and Washington, D.C., making them one of the most widespread Medicare Advantage plans nationwide.

One of the key advantages of United Healthcare’s Medicare Advantage plans is the plethora of supplementary programs and discounts they offer. These include:

- Vision

- Dental

- Free gym memberships

- Mental fitness

- A credit toward over-the-counter products

However, a potential downside is the restricted provider network, which may limit your choice of healthcare providers.

With a 4 out of 5-star rating from CMS, United Healthcare demonstrates its quality and dedication to customer satisfaction. The provider offers:

- An average annual drug deductible of $103

- Coverage gap benefits

- Partnerships with entities like Select Health, Kroger, Alignment Health, and Rite Aid to augment their offerings.

Four plans co-branded with Instacart are available in 13 counties in California and Nevada, and the cost of insulin for most plans is $35 monthly. Keep in mind that the Medicare Part B premium is not included in these plans.

Humana

Humana is another top Medicare Advantage provider, recognized for its superior plans, comprehensive Medicare coverage, and economical premium options. Their Medicare Advantage plan is available in 49 states, Washington, D.C., and Puerto Rico, providing a wide range of options for beneficiaries.

In 2025, Humana is offering approximately 9,400 plans with no Part C premium, which are available in most states, excluding Maryland and Wyoming.

Impressively, 91% of Humana’s $0 premium plans include drug coverage. Moreover, there is no additional Part D premium charged for these plans. However, you should verify whether your preferred medical providers are included in the network of the plan you choose.

Humana has an average overall Medicare star rating of 4.3 out of 5, showcasing its commitment to quality healthcare services. Their plans provide coverage to 89% of counties in the United States, ensuring that approximately 92% of individuals eligible for Medicare have access to at least one Humana plan.

For more information regarding Humana Medicare Advantage Plans available in your area, visit their website.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) provides Medicare Advantage plans with a large provider network, making it easier for beneficiaries to access medical care. With an overall good rating of 3.7 stars out of 5, BCBS is a reliable choice for Medicare Advantage coverage.

While BCBS Medicare Advantage plans are typically more costly than plans from other providers, they may be advantageous if you require coverage at a wide variety of medical offices and see multiple doctors.

You should be aware that each BCBS company operates independently, leading to significant differences in plan offerings, customer satisfaction, and extra benefits between companies. The lists of in-network providers may also differ from plan to plan, so it’s beneficial to scrutinize your options.

BCBS Medicare Advantage plans offer comprehensive coverage of Part A and B services, as well as additional benefits such as:

- Wellness programs

- Hearing aids

- Dental coverage

- Vision coverage

- Prescription drug coverage

In many states and Puerto Rico, they also provide $0-premium plans, making them an attractive option for beneficiaries seeking affordable yet comprehensive coverage.

Aetna

Aetna, a CVS Health company, is a leading Medicare Advantage provider with a solid reputation, garnering above-average reviews for member satisfaction. They offer several Medicare Advantage plans, including HMO-POS plans, PPO plans, and Dual Special Needs Plans (DSNP).

Aetna’s Medicare Advantage plans provide coverage for medical and prescription drug expenses, as well as other benefits and services tailored to individual needs.

With 87% of Aetna Medicare Advantage members in 4-star plans or higher for 2025, you can trust the quality of their offerings. For more information about Aetna’s Medicare Advantage plans, visit their website.

Besides comprehensive coverage, Aetna’s Medicare Advantage plans offer a variety of extra benefits like hearing, vision, and dental coverage, gym memberships, and other personalized services and benefits that align with your needs.

Their focus on providing tailored coverage and benefits makes Aetna a reliable choice for those seeking a Medicare Advantage plan.

Cigna

Cigna offers affordable Medicare Advantage plans with good customer service and a range of coverage options. They provide both HMO and PPO plans, catering to various preferences and needs.

Cigna’s Medicare Advantage plans provide comprehensive coverage, including:

- Dental

- Vision

- Prescription coverage

- Additional benefits such as hearing and fitness benefits

- $0 copays for primary care when visiting in-network providers

Their commitment to affordability and customer satisfaction makes Cigna an attractive choice for beneficiaries seeking a Medicare Advantage plan.

With competitive Medicare Advantage rates, Cigna is a strong contender for the most cost-effective plan in 2025. Cigna provides both HMO and PPO options, giving beneficiaries a range of choices when selecting the plan that aligns best with their needs.

Key Factors to Consider When Choosing a Medicare Advantage Plan

When choosing a Medicare Advantage plan, you should weigh factors that directly affect your healthcare experience and costs such as:

- Monthly premiums

- Out-of-pocket costs

- Provider networks

- Additional benefits

A careful review of these factors will help you select a plan that aligns with your healthcare needs and financial circumstances.

You should also take into account the plan’s ratings and reviews from both the Centers for Medicare & Medicaid Services (CMS) and other rating agencies such as A.M. Best and J.D. Power. These ratings can give you an idea about the plan’s quality and customer satisfaction, aiding you in making a decision based on sufficient information.

Remember to examine the plan’s benefits in detail and confirm that all medications are included in the formulary. Also, consider aspects like:

- the size of the provider network

- monthly premium costs

- coverage for services such as physical rehabilitation, ambulance use, dental care, and vision services

By thoroughly evaluating these factors, you can find the best Medicare Advantage plan that meets your unique needs and explore the best Medicare Advantage plans available in your area.

Comparing Medicare Advantage Plans: HMO, PPO, PFFS, SNP

When examining Medicare Advantage options, it’s necessary to understand the differences between the four plan types:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

Each plan type has its own set of rules and coverage options, so it’s crucial to select the one that best aligns with your healthcare needs and preferences.

HMO plans typically require you to choose a primary care physician and obtain referrals for specialist care, while PPO plans allow for greater flexibility in provider selection.

PFFS plans to determine how much they will pay doctors and other healthcare providers, allowing beneficiaries to receive plan-covered services from any eligible provider in the US. SNPs are designed to meet the needs of beneficiaries with particular health conditions or circumstances, providing tailored coverage and benefits.

By familiarizing yourself with the nuances of each plan type, you can make an informed decision when selecting the Medicare Advantage plan that best suits your healthcare needs.

How to Enroll in a Medicare Advantage Plan

To enroll in a Medicare Advantage plan, you first need to obtain approval for Original Medicare from Social Security.

Once approved, you can enroll in a Medicare Advantage plan via Medicare.gov, directly with the insurance provider, or with assistance from a broker. The Medicare Advantage program offers an annual enrollment period, which starts on January 1. It ends on March 31 annually.

Outside of the annual enrollment period, you may still be eligible to enroll in a Medicare Advantage plan during a Special Enrollment Period (SEP) if you have experienced a qualifying life event or if your current plan’s contract terms have changed or your current health plan coverage has been lost.

Make sure to review your eligibility and the timing of your enrollment to ensure a smooth transition to your new plan.

When choosing a Medicare Advantage plan, it’s necessary to consider the following factors:

- Compare options available in your service area

- Consider monthly premiums

- Evaluate out-of-pocket costs

- Review provider networks

- Look for additional benefits

By carefully evaluating these factors and understanding the enrollment process, you can make an informed decision when choosing a Medicare Advantage plan.

The Impact of CMS Star Ratings on Medicare Advantage Plans

CMS Star Ratings significantly influence enrollment decisions and affect the performance of Medicare Advantage plans.

These ratings, on a scale from 1 to 5 stars (with 5 stars being the highest), evaluate the quality of Medicare Advantage plans and can offer useful information when comparing options.

In 2023, 73% of Medicare Advantage enrollment is in plans with 4+ stars. Quality performance scores have been shown to impact enrollment performance, with contracts experiencing a decrease in their star rating demonstrating suppressed enrollment growth of 6.7% in 2023, while those with no change in their star ratings saw 9.0% growth, and contracts with an increase in their star ratings witnessed 13.8% growth.

These statistics highlight the importance of considering CMS Star Ratings when selecting a Medicare Advantage plan.

It’s also worth noting that some Medicare Advantage plans, such as CVS (Aetna) and Centene, have experienced a decrease in their quality scores compared to their pre-pandemic levels, while others, such as Blue Cross Blue Shield Michigan and Highmark Health, have seen a marked improvement.

By taking these ratings into account, you can make a more informed decision when choosing a Medicare Advantage plan that meets your healthcare needs and expectations.

Extra Benefits Offered by Top Medicare Advantage Plans

Leading Medicare Advantage plans offer extra benefits that can improve your healthcare experience and provide more coverage. Some of these benefits include:

- Vision coverage

- Dental coverage

- Hearing coverage

- Fitness coverage

- Telehealth services

These additional benefits can make a significant difference in the overall value and appeal of a Medicare Advantage plan for Medicare Advantage enrollees, including Medicare beneficiaries.

Fitness coverage benefits can include:

- Gym memberships

- Fitness programs

- Medically necessary physical therapy

- Weight-loss counseling

- Group physical activity

Telehealth services enable beneficiaries to access healthcare providers through real-time audio and video communication technology for various services, including mental health services, from the comfort of their own homes.

When comparing Medicare Advantage plans, it’s essential to consider these extra benefits and how they can impact your healthcare experience. By selecting a plan that offers additional benefits tailored to your needs, you can maximize the value of your Medicare Advantage plan and ensure comprehensive coverage.

Medicare Advantage vs. Original Medicare: Pros and Cons

Medicare Advantage plans and Original Medicare each have distinct advantages and disadvantages. Medicare Advantage plans provide additional benefits and coverage options compared to Original Medicare but may have more restrictive provider networks and prior authorization requirements.

Original Medicare offers cost savings and provider flexibility, but one of the drawbacks is the potential for high out-of-pocket costs, including prescription drug costs. Medicare Advantage plans, on the other hand, provide similar coverage to Original Medicare with the added benefit of additional features such as prescription drug coverage and extra services.

When choosing between Medicare Advantage and Original Medicare, it’s necessary to balance the pros and cons of each to find the best fit for your healthcare needs and financial situation. By understanding the differences between the two options, you can make an informed decision that aligns with your unique circumstances.

Medicare Advantage vs. Medigap: Key Differences and Considerations

If you’re considering supplemental coverage for Original Medicare, it’s necessary to understand the key differences between Medicare Advantage and Medigap plans.

Medigap plans provide extra coverage for those enrolled in Original Medicare but exclude prescription drugs, while Medicare Advantage plans are an alternative to Original Medicare, typically including additional benefits and no monthly premiums.

Medigap plans generally have higher premiums, ranging from $50 to $1,000 per month, but lower out-of-pocket expenses than Medicare Advantage plans, which can range from $0 to $100 per month.

Additionally, Medigap plans do not have networks like Medicare Advantage plans, allowing you to visit any doctor or specialist who accepts Medicare.

When assessing your options for supplemental coverage, it’s necessary to understand the key differences between Medicare Advantage and Medigap plans. By comparing the coverage, costs, and flexibility of each option, you can make an informed decision that best meets your healthcare needs and financial situation.

Special Needs Plans (SNPs) in Medicare Advantage

Special Needs Plans (SNPs) are a subtype of Medicare Advantage plans, specifically designed to cater to beneficiaries with specific health conditions or circumstances by providing customized coverage and benefits.

These plans are available to individuals who meet the criteria of having an additional qualifying condition or being eligible for both Medicare and Medicaid.

In 2024, Special Needs Plan enrollment saw a 20% increase, highlighting the growing demand for tailored coverage options. SNPs offer specialized coverage, additional benefits, and care coordination, making them an attractive choice for beneficiaries with specific health conditions or circumstances.

However, it’s important to consider potential limitations when evaluating SNPs, such as limited eligibility, network restrictions, and condition-specific coverage. By understanding the unique features and restrictions of SNPs, you can make an informed decision when selecting a Medicare Advantage plan that best suits your healthcare needs.

Summary

In conclusion, understanding the various Medicare Advantage plans and their offerings is crucial for finding the best coverage for your unique healthcare needs.

By comparing the largest Medicare Advantage providers, considering key factors such as premiums, provider networks, and additional benefits, and exploring the differences between plan types, you can make an informed decision that aligns with your healthcare preferences and financial situation.

With the right Medicare Advantage plan, you can ensure comprehensive coverage and peace of mind as you navigate your healthcare journey.

Frequently Asked Questions

→ Which Medicare Advantage plan has the largest network?

UnitedHealthcare offers the largest Medicare Advantage network, with 1.3 million physicians and care professionals and 6,500 hospitals and care facilities nationwide. Its plans are highly rated and offer a broad array of options.

→ Who has the best Medicare Advantage plan in 2025?

Humana has the best Medicare Advantage plan for 2025 due to its good ratings, affordable cost, and excellent coverage with no monthly cost. AARP/UHC sells the most popular plans while Blue Cross Blue Shield is accepted by most doctors.

→ Why are people leaving Medicare Advantage plans?

People are leaving Medicare Advantage plans due to allegations of billing fraud and high denial rates, as well as slow payments from insurers. This has been confirmed by lawmakers and federal government probes.

→ What is the difference between Original Medicare and Medicare Advantage plans?

Original Medicare consists of Parts A and B coverage, while Medicare Advantage plans are offered by private insurers and provide the same coverage as Original Medicare plus prescription drug coverage.

→ How do I enroll in a Medicare Advantage plan?

To enroll in a Medicare Advantage plan, you must first be approved for Original Medicare by Social Security.

Once approved, you can then enroll through Medicare.gov, with the insurance provider directly, or with the help of a broker. The annual enrollment period for Medicare Advantage runs from January 1 to March 31.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.