Humana Medicare Advantage Plans New Mexico 2025

Healthcare coverage could be a cornerstone of a worry-free retirement, and the potential Humana Medicare Advantage Plans in New Mexico for 2025 could be the ideal solution for you. With a potential blend of affordability and comprehensive coverage, these plans may be designed to meet the diverse needs of Medicare-eligible consumers.

Let’s delve into the potential features, benefits, and enrollment process of these plans, and explore how they could provide the healthcare coverage you need.

Key Takeaways

- Humana could potentially offer region-specific Medicare Advantage plans in New Mexico for 2025, which might include prescription drugs and additional benefits such as dental, vision, and hearing.

- Enrollment in Humana’s Medicare Advantage plans requires meeting Medicare-set eligibility, with enrollment opportunities during the initial enrollment period around one’s 65th birthday and the annual election period from October 15 to December 7 each year.

- A majority of Humana’s Medicare Advantage plans in New Mexico are highly rated, with a significant percentage of 4.5-star rated plans, potentially including customer service and additional benefits.

Compare Plans in One Step!

Enter Zip Code

Overview of the Potential Humana Medicare Advantage Plans in New Mexico 2025

Humana Insurance Company could potentially offer Medicare Advantage plans as an alternative to original Medicare coverage. These plans will likely be meticulously crafted, based on in-depth research aimed at understanding the preferences and requirements of Medicare-eligible consumers.

Some of the Medicare Advantage plans that might be offered by Humana may be regionally limited, which means that individuals might only be able to enroll in a plan that is accessible in their area.

Potential Features of Humana Plans

Some of Humana’s Medicare Advantage plans in New Mexico may offer coverage options that might not be included in Original Medicare. These will likely include prescription drug coverage and other services, which may be common features in certain Medicare Advantage plans.

This means that some of the Humana plans could potentially provide more encompassing coverage, which might allow members to get more out of their healthcare plans.

Some of these plans might encompass a range of benefits including:

- Outpatient care

- Prescription drugs

- Dental

- Vision

- Hearing

- Short-term rehabilitation

- Ambulance services

These potential benefits will likely be approved by the Centers for Medicare & Medicaid Services, possibly ensuring that members could receive quality care and services.

In terms of provider networks, Humana is classified as a Medicare Advantage HMO, PPO, and PFFS organization with a Medicare contract.

This means that Humana will likely have a wide array of providers in their network, possibly enriching the scope of healthcare services accessible to members.

Enrollment Process and Eligibility

Specific eligibility requirements govern enrollment in Humana Medicare Advantage plans in New Mexico. These requirements are set by Medicare, and enrollment may also be subject to contract renewal. This means that you need to meet certain criteria and conditions to be able to enroll in these plans.

Regarding the enrollment period, New Mexico residents have the chance to enroll in a Medicare plan during the initial enrollment window. This begins three months before their 65th birthday and continues for three months after.

Additionally, there is a fall open enrollment period from October 15 through December 7 each year. This is known as the Medicare Advantage and Prescription Drug Plan Annual Election Period, which is the time for Medicare Advantage enrollment.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Analyzing Humana’s Top-Rated Medicare Advantage Plans in New Mexico

When choosing a Medicare Advantage Plan, considering the potential costs and benefits, along with the ratings and performance of the plan, is paramount. Ratings for Medicare Advantage plans are determined based on up to 40 unique quality and performance measures.

These may include member experience with the health plan, personal reviews of the plan, and overall performance and quality scores calculated across various criteria.

A majority of Humana’s Medicare Advantage plans in New Mexico may have showcased impressive performance metrics. A significant percentage of members will likely be enrolled in plans rated 4 stars and above, with at least 61% of members in Humana plans rated 4.5 stars and above.

Plan Ratings and Performance

Information regarding the star ratings for Medicare Advantage plans can be accessed on each plan detail page on the U.S. News website.

These ratings may be based on quality and performance measures and are not influenced by factors such as national origin, age, disability, or sex. The highest rating achieved by Medicare Advantage plans in New Mexico in previous years has been 4.5 stars.

These ratings could potentially be important as they could suggest that plan members may experience improved care, customer service, and phone support.

Prioritizing a plan with a high CMS 5-Star Score could be crucial as it might guarantee superior quality and performance of the Medicare Advantage plan, possibly ensuring that the plan could effectively serve Medicare beneficiaries.

Comparing Potential Costs and Coverage

Some of Humana’s highly rated Medicare Advantage plans in New Mexico might provide coverage for:

- Routine dental benefits

- Vision benefits

- Hearing benefits

- Benefits of Original Medicare Parts A and B

Some of these plans may also offer coverage for prescription drugs, which may be available at lower cost preferred pharmacies.

When comparing the potential coverage options for certain Humana’s Medicare Advantage plans, it’s important to consider the services that might be covered, provider networks, and possible costs.

Possible Benefits of Choosing a Humana Medicare Advantage Plan in New Mexico

Opting for a Humana Medicare Advantage plan in New Mexico could potentially bring a host of possible benefits. Aside from comprehensive coverage, some of these plans might also offer certain prescription drug benefits and additional services, which could greatly enhance your healthcare experience.

Prescription Drug Benefits

Some Humana Medicare Advantage Plans in New Mexico may provide prescription drug benefits, potentially encompassing a Part D prescription drug plan that may be integrated within a Medicare Advantage plan.

This means that members might be able to enjoy the potential convenience and cost-effectiveness of having their prescription drug coverage integrated with their health coverage.

Specific details about the covered drugs may be accessed by signing in to MyHumana or utilizing the search tool on their website. This resource might also provide information on specialty medications.

Other Potential Benefits and Services

Apart from the standard coverage, some of the Mexico Medicare Advantage Plans, such as Humana Medicare Advantage Plans in New Mexico, could potentially provide additional benefits which may include potential prescription savings, dental, vision, and hearing coverage.

These potential benefits might significantly enhance your healthcare experience and possibly provide added value to your plan.

How to Choose the Right Humana Medicare Advantage Plan for You

Selecting the appropriate Humana Medicare Advantage plan requires a thorough analysis of several factors, which may include your potential healthcare needs and provider networks. Let’s delve into some of these factors to help you make an informed decision.

Assessing Your Healthcare Needs

Evaluating your healthcare needs may be a vital step in selecting the appropriate Humana Medicare Advantage plan. This process could potentially ensure that the plan you select may be able to provide the necessary medical services, align with your financial constraints, and potentially integrate some of your preferred healthcare providers and prescription drugs.

Offering Medicare Advantage plans tailored to your needs, Humana will likely be committed to helping you make the best decision for your healthcare.

When assessing your healthcare needs, you should consider:

- Your possible coverage requirements

- Preferred healthcare providers and hospitals

- Budget for healthcare costs

- The potential addition of prescription medication coverage

- Any additional benefits that might contribute to your health and well-being

If you have chronic illnesses, these potential considerations might significantly affect your choice of a Medicare Advantage plan.

To gauge and compare your current and future healthcare needs, a thorough evaluation of your current healthcare situation is necessary, considering potential factors such as specific health conditions, preferred doctors, and hospitals.

It’s also essential to compare the possible coverage, costs, and your current budget.

Considering Possible Plan Networks and Provider Availability

The healthcare provider network is a significant factor in the selection of a Medicare Advantage Plan. This may dictate the accessibility of doctors, hospitals, and healthcare services, as well as the potential coverage of preferred healthcare providers under a plan.

To verify the inclusion of your doctors and healthcare providers for a particular Humana Medicare Advantage plan network in New Mexico, you may utilize Humana’s provider search tool available on their website.

This tool may enable you to locate healthcare providers based on location, specialty, or name, and might be able to ascertain their participation in your plan’s network.

When assessing provider availability in certain Humana Medicare Advantage plans, it’s important to consider these potential factors:

- Network size

- Provider types

- Geographic coverage

- Out-of-network coverage

- Prescription drug coverage

Enrollment Periods and Making Changes to Your Plan

Comprehending the enrollment periods and the process of making changes to your Humana Medicare Advantage plan is essential. Let’s examine these time frames and the conditions that allow for modifications to your plan.

Initial Enrollment and Annual Election Periods

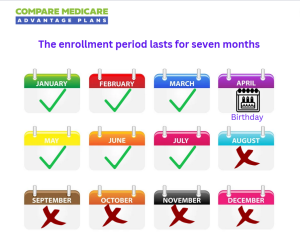

The initial enrollment period for Humana Medicare Advantage plans spans over 7 months, starting 3 months before your 65th birthday, including the birthday month, and continuing for 3 months after.

The initial enrollment period for Humana Medicare Advantage plans spans over 7 months, starting 3 months before your 65th birthday, including the birthday month, and continuing for 3 months after.

If you fail to enroll during this period, you may face penalties, such as a 1% penalty per month added to your premium.

The annual election period, on the other hand, takes place from October 15 to December 7 annually. During this period, you can enroll in, switch, or drop plans, and the coverage for the new plan becomes effective on January 1 of the following year.

Special Enrollment Periods

Special Enrollment Periods (SEPs) for Humana’s Medicare Advantage Plans will likely be available outside of the Initial Coverage Election Period (ICEP) or the Medicare Advantage Open Enrollment Period.

This means that you may be able to modify your plan outside of these established time frames if you meet certain criteria such as:

- Relocating to a new area

- Losing your current coverage

- Qualifying for Extra Help

- Becoming eligible for Medicaid

- Moving into or out of a nursing home

During a SEP, allowable modifications might include:

- Enrolling in a Humana Medicare Advantage Plan if not already enrolled

- Switching from one Humana Medicare Advantage Plan to another

- Disenrolling from a Humana Medicare Advantage Plan and returning to Original Medicare

- Adding or dropping prescription drug coverage if applicable.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Summary

Some of the Humana Medicare Advantage Plans in New Mexico could potentially offer a comprehensive alternative to Original Medicare coverage, with a possible range of coverage options, benefits, and a wide provider network.

Some of these plans may be meticulously crafted to meet the diverse needs of Medicare-eligible consumers, with strong performance metrics and competitive costs.

Choosing the right plan involves careful assessment of your healthcare needs, consideration of provider networks, and understanding the enrollment periods.

With the right plan, you may enjoy comprehensive healthcare coverage that aligns with your financial constraints and healthcare needs, providing peace of mind in your retirement.

Frequently Asked Questions

→ What is new for Humana 2025?

In 2025, some of the Humana Medicare Advantage Plans may include enhanced dental, vision, and hearing coverage. For additional details about the plans for the 2025 calendar year, be sure to keep checking back to this website for updates.

→ What are the advantages of Humana Medicare Advantage?

Some of the biggest advantages of Humana Medicare Advantage will likely be its broad range of choices for doctors and medical offices compared to Original Medicare and potentially reduced overall costs for those with complex medical needs.

→ What are the potential features of Humana Medicare Advantage Plans?

Some of the Humana Medicare Advantage Plans may offer a range of benefits that could include outpatient care, prescription drugs, dental, vision, hearing, short-term rehabilitation, ambulance services, and other additional perks.

These plans could potentially provide comprehensive coverage for various healthcare needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.