Humana Medicare Advantage Plans South Dakota 2025

Navigating the landscape of Medicare Advantage plans may feel like a daunting task. However, it could become much simpler when you use a trusted provider like Humana.

By potentially offering a range of plans that could be tailored to the unique needs of the residents of South Dakota, Humana might be a popular choice for many. But why is that so? And how can you choose the best Humana Medicare Advantage plan for 2025 that could suit your needs?

This article aims to be a comprehensive guide, offering some insights into the potential Humana Medicare Advantage plans in South Dakota, highlighting the possible plan types, potential features, and how they compare to other providers.

We also delve into the enrollment process, offer tips for choosing the best plan, and provide a list of resources that may be available to South Dakota residents.

This guide targets anyone looking to understand Humana’s potential offerings in South Dakota, particularly those who may be interested in Humana Medicare Advantage plans in South Dakota for 2025, whether you’re a Medicare-eligible individual, a caregiver, or a health insurance advisor.

Key Takeaways

- Humana offers a variety of Medicare Advantage plans in South Dakota, including HMO, PPO, and PFFS, which cover benefits of Original Medicare Part A and Part B, with some plans providing additional benefits such as prescription drugs and emergency international coverage.

- Some of the Humana Medicare Advantage plans in South Dakota may offer competitive premium rates and out-of-pocket costs, and beneficiaries should compare these with other providers in the market based on their individual health needs and financial situation.

- Enrollment in Humana Medicare Advantage Plans in South Dakota requires eligibility for Medicare Part A and Part B, with an annual enrollment period running from October 15th to December 7th, and accessibility to enrollment by calling a licensed agent at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Compare Plans in One Step!

Enter Zip Code

Possible Humana Medicare Advantage Plans in South Dakota

While Humana will likely be recognized for its offering of various Medicare Advantage plans, bear in mind that not all plans may be available in each state, including South Dakota.

Humana will likely design their Medicare Advantage plans with due diligence, potentially conducting thorough research into the preferences and needs of Medicare-eligible consumers, ensuring they provide the best health care options.

Although Humana might not offer every plan in South Dakota, residents may still use the plan finder tool to determine the availability of certain Humana Medicare Advantage plans in their area and compare the pay structure.

Regardless of the specific plan, all Humana Medicare Advantage plans in South Dakota incorporate the benefits provided by Original Medicare, namely Part A and Part B benefits.

Types of Humana Medicare Advantage Plans

Humana offers various types of Medicare Advantage plans in South Dakota, namely the HumanaChoice Medicare Advantage PPO Plan and Humana Medicare Advantage D-SNPs, among others.

Each of these plans represents distinct categories provided by Humana, namely Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS), each with varying network limitations and cost-sharing agreements, including coverage for services like physical therapy.

It’s essential to understand the differences in benefits and coverage among Humana’s Medicare Advantage plans.

Here are the key points:

- HMO plans necessitate a primary care physician and referrals for specialist care

- PFFS plans offer greater overall provider choice

- All these plans include coverage for prescription drugs

- Geographically, these plans are accessible in 85 percent of counties within South Dakota, with some plans offering worldwide emergency coverage.

Potential Features of Humana Plans

Some of the Humana Medicare Advantage plans may stand out with the possibility of offering comprehensive coverage for certain inpatient and outpatient services included in Medicare Part A and Part B, except for clinical trials. This could potentially ensure that members may receive comprehensive healthcare coverage, including options for dual-eligible special needs individuals.

Moreover, some of Humana’s plans may also offer added benefits such as dental, vision, and hearing care, which may not be covered by Original Medicare. Some plans will likely provide free language interpreter services to ensure effective communication with healthcare providers.

Humana could potentially offer some of the following benefits in South Dakota:

- Extensive provider network, possibly ensuring access to a wide range of healthcare professionals and facilities

- Non-discriminatory coverage for all plan members.

- Prescription drug coverage that could be on par with other Medicare Advantage plans

- Partnerships with potentially lower-cost preferred pharmacies could help beneficiaries save on certain prescription costs

Comparing Humana to Other Providers in South Dakota

Although Humana will likely be favored by numerous South Dakota residents, it’s vital to juxtapose their potential Medicare Advantage plans with those from alternative providers. This comparison should focus on aspects such as the possible premium rates, out-of-pocket costs, and coverage options.

Some of Humana’s premium rates will likely be quite competitive. Moreover, their coverage options could potentially encompass some of the benefits of Medicare Parts A and B, along with possible benefits such as dental, vision, and hearing coverage.

However, to truly understand how some of Humana’s potential out-of-pocket costs might compare to other providers, beneficiaries should review the plan details and compare them with other available options in the market.

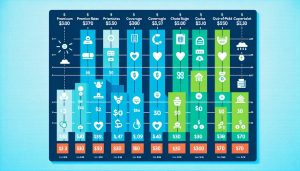

Possible Premium Rates and Out-of-Pocket Costs

In assessing the potential premium rates for certain Humana Medicare Advantage plans in South Dakota and contrasting them with other providers, it could be invaluable to evaluate the potential benefits, costs, and coverage of Medicare Advantage plans from various insurers.

Some of the out-of-pocket expenses for Humana’s Medicare Advantage Plans in South Dakota may vary depending on the specific plan. Some of these expenses might also be offered by other providers, although the exact specifics may depend on individual plan features and coverage choices.

Other potential factors that may contribute to the determination of premium rates and out-of-pocket costs for Medicare Advantage Plans could include:

- An individual’s health status and healthcare usage

- The extent and premiums of the possible coverage

- The potential benefits and cost-sharing features of the specific Medicare Advantage plan

- The bench-marking metrics will likely be established for plans in different areas.

Possible Coverage Options and Benefits

As for the coverage options and benefits, some of Humana’s Medicare Advantage Plans in South Dakota may provide coverage that might encompass all the benefits of Medicare Parts A and B.

In addition, Humana may also offer supplementary benefits, which may include dental, vision, hearing, and prescription drug coverage.

Certain aspects of Humana’s potential medical coverage in South Dakota could include its comprehensive drug coverage, which will likely encompass a wide range of medications and potentially include dental, vision, and hearing coverage in certain Medicare Advantage plans.

Humana will likely set itself apart by potentially offering a Healthy Options Allowance and possibly giving priority to certain prescription savings. Additionally, they may also offer additional services including dental, vision, and hearing coverage, which might be encompassed in certain Medicare Advantage plans in South Dakota.

Enrollment Process for Humana Medicare Advantage Plans

If you are contemplating the potential Humana’s Medicare Advantage plans, it’s essential to comprehend the enrollment process. To enroll in these plans, individuals must meet specific criteria, including:

- Being eligible for Medicare will likely encompass individuals who are 65 years or older, or individuals under 65 who qualify due to a disability or end-stage renal disease.

- Some plans may also require eligibility for both Medicare and Medicaid.

- Additionally, individuals must reside in a state where Humana provides Medicare Advantage plans.

The designated enrollment period for Humana Medicare Advantage Plans is from October 15th to December 7th each year. During this period, individuals can join, switch, or change Medicare health and drug plans.

To enroll, it may be necessary to provide certain documentation, such as a member ID, enrollment form, Medicare card, proof of age and residency, proof of income (if applicable), and any other pertinent documentation that might be requested.

To enroll, you can call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Eligibility Requirements

Regarding eligibility for Humana Medicare Advantage plans in South Dakota, the following criteria must be met:

- Enrollment in Medicare Part A and Part B is a prerequisite.

- Some plans may also require eligibility for dual-eligible special needs individuals.

- Individuals with pre-existing conditions might still qualify for a Humana Medicare Advantage plan.

Enrollment in Humana Medicare Advantage plans in South Dakota requires:

- Participation in Medicare Part A and Part B

- Continuous coverage that may not be specified as an eligibility requirement

- There are no age limitations for enrolling in a Humana Medicare Advantage plan in South Dakota

How to Enroll

If you’re ready to enroll in a Humana Medicare Advantage Plan, just call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

To enroll, it is necessary to provide personal details including date of birth, address, and Medicare number. Registration for a Humana Medicare Advantage Plan is typically carried out during the designated enrollment period, which runs from October 15th to December 7th each year.

However, certain circumstances may allow you to enroll outside of this period.

Possible Resources for South Dakota Residents

Securing the appropriate Medicare Advantage plan is vital, and the potential availability of supplementary resources might help simplify the process.

South Dakota residents seeking Medicare-related information will likely have access to some of the following resources for guidance:

- South Dakota Department of Social Services

- SHINE (Senior Health Information and Insurance Education)

- AARP

- South Dakota Foundation for Medical Care

- State Health Insurance Assistance Programs

- Medicare Rights Center

These organizations could offer valuable information on Medicare, and will likely be available in states such as California, Connecticut, DC, Delaware, and others.

The state of South Dakota may also offer various Medicare Savings Plans that could assist seniors with limited income and assets in covering potential Medicare expenses.

Residents may apply for assistance with certain Medicare costs by visiting the South Dakota Department of Social Services website or by seeking local resources and support at websites that could be specifically dedicated to aiding with senior care and Medicare.

State-Specific Medicare Resources

The South Dakota State Health Insurance Program (SHIP) could serve as a crucial resource by potentially offering complimentary and impartial information, counseling, and support to Medicare beneficiaries and their families within the state.

Through SHIP, residents may be able to:

- Gain a comprehensive understanding of their Medicare benefits

- Receive guidance in the enrollment process

- Make well-informed decisions regarding their healthcare coverage.

Residents of South Dakota seeking additional information about Medicare-related services may visit the South Dakota SHIP website.

In addition, SHINE (Serving Health Insurance Needs of Elders) and Lutheran Social Services will likely be prominent local non-profit organizations that could aid individuals in need of help with Medicare plans.

Potential Financial Assistance Programs

Financial assistance could be a lifeline for Medicare beneficiaries with limited income and resources. South Dakota could potentially offer various financial assistance programs that may help cover certain Medicare costs.

The primary programs might include some of the Medicare Savings Programs, which could provide premium and cost-sharing assistance, and the Low-Income Subsidy program, which could potentially offer significant help with certain prescription drug costs for eligible individuals.

These program’s goals will likely be to alleviate expenses related to the Medicare drug plan, which may include possible premiums, deductibles, and coinsurance. Residents of South Dakota may apply for the Medicare Savings Program by completing the Medicaid application process.

To potentially qualify for South Dakota’s Medicaid as a Medicare beneficiary, individuals must possess a South Dakota Medicaid identification card, which must be presented to Medicaid providers in the state when seeking services.

Non-profit organizations in South Dakota may also be available to potentially provide financial aid to individuals dealing with certain Medicare expenses.

Tips for Choosing the Best Humana Medicare Advantage Plan in South Dakota

Selecting the optimal Medicare Advantage plan is an individual decision that necessitates considering your unique healthcare needs. The consideration of these needs could influence your choice of specific plan features and possible benefits.

For instance, individuals with healthcare needs may prioritize plans that will likely provide comprehensive coverage for services such as dental, vision, and hearing.

Moreover, individuals with chronic conditions or medication needs may seek plans that could offer an extensive network of healthcare providers and prescription drug coverage.

However, while making your selection, it’s important to avoid possible errors such as:

- Underestimating the potential costs

- Disregarding the provider network

- Not thoroughly examining the plan’s coverage

- Neglecting to compare different plans

- Disregarding plan ratings and reviews

Assessing Your Healthcare Needs

In assessing personal healthcare needs for certain Medicare Advantage plans some important factors may include:

- Health status

- Healthcare usage

- Supplemental coverage

- Possible Premiums

- Potential Medicare Advantage plan benefits

- Specific healthcare services and medications that may be required

- Healthcare provider network

The utilization of medication or having a chronic illness could potentially hold considerable importance in the selection of a Humana Medicare Advantage plan. If you take specific medications regularly, it may be crucial to assess all available options and opt for a plan that could offer necessary coverage for certain medications.

Your lifestyle and personal health habits will likely also play a pivotal role in determining the necessary level of coverage and services from a Medicare Advantage plan.

Comparing Potential Plan Options

Comparing the potential Humana’s Medicare Advantage plans will likely be fundamental to making a well-informed decision. Humana offers various plans in South Dakota, including the HumanaChoice Medicare Advantage PPO Plan.

Each plan type – HMO, PPO, and PFFS – comes with its own set of benefits and requirements, and understanding these can help you select a plan that best suits your needs.

The coverage options may also vary across different Humana Medicare Advantage Plans, with certain plans providing additional benefits such as:

- dental

- vision

- hearing

The disparity in certain costs among the different Humana Medicare Advantage Plans in South Dakota could be quite significant.

Therefore, it might be wise to utilize resources such as our website to obtain a comprehensive comparison of costs. To do so, just input your zip code into the zip code box anywhere on this website. You can then:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your situation

Summary

This comprehensive guide explored some of the potential Humana Medicare Advantage plans in South Dakota, delving into the plan types, potential features, and how they could compare to other providers.

We’ve also discussed the enrollment process, provided tips for choosing the best plan based on your personal healthcare needs, and listed additional resources that may be available to South Dakota residents.

Navigating through Medicare Advantage plans may be challenging, but with the right knowledge and resources, you could make an informed decision that best suits your healthcare needs and budget.

Remember to assess your potential healthcare needs carefully, compare different plan options, and consider the possible costs before choosing. Your health is your greatest wealth, and choosing the right Medicare Advantage plan is a crucial step in taking care of it.

Frequently Asked Questions

→ What is new in Humana in 2025?

In 2025, some of the Humana Medicare Advantage plans may include dental, vision, and hearing benefits, possibly providing an improved range of coverage options for beneficiaries. For additional details about the plans for the 2025 calendar year, be sure to keep checking back to this website for updates.

→ What are the advantages of Humana Medicare Advantage?

Some of the advantages of Humana Medicare Advantage could include its broad range of choices for doctors and medical offices compared to Original Medicare. Additionally, some of these plans may be cheaper for individuals with complex medical needs.

→ What types of Humana Medicare Advantage plans are available in South Dakota?

In South Dakota, Humana offers different types of Medicare Advantage plans, such as HumanaChoice Medicare Advantage PPO Plan and Humana Medicare Advantage D-SNPs, among others. Choose the plan that best suits your needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company