Humana Medicare Advantage PPO Plans

The potential Humana Medicare Advantage PPO Plans will likely be able to offer healthcare freedom and flexibility to their members.

This article will cover the potential benefits of Humana’s Medicare Advantage PPO plans for 2025. These plans could offer members the liberty to choose their doctors and specialists, coupled with comprehensive coverage that could cater to their unique healthcare needs.

Key Takeaways

- Humana Medicare Advantage PPO Plans will likely offer a combination of coverage from Medicare Parts A, B, and sometimes Part D and other additional benefits.

- When comparing PPO and HMO plans, the former offers more flexibility but at a higher cost while the latter has lower premiums and deductibles with possible network restrictions.

- Humana provides non-discriminatory healthcare services in several languages with free interpreter services available via phone call.

Compare Plans in One Step!

Enter Zip Code

Understanding Humana Medicare Advantage PPO Plans

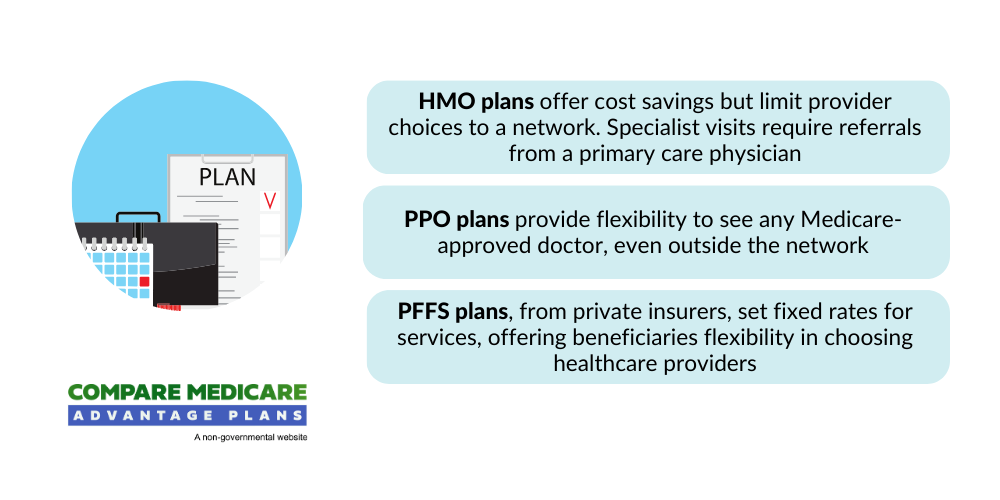

Humana, a notable provider of Medicare Advantage HMO, PPO, and PFFS plans, will likely offer various Medicare Advantage PPO Plans.

These plans will likely consolidate the advantages of Medicare Parts A and B, and sometimes Part D, into a single plan. These plans could be available in numerous states.

Some plans may provide broader coverage than Original Medicare, possibly including benefits like dental and vision that might not be covered by Original Medicare.

Humana offers the following plan types:

- PPO plans, which provide greater freedom in selecting healthcare providers

- HMO plans require the selection of a primary care physician and referrals for specialist care

- PFFS plans, which do not have a network of participating providers

Each plan type has distinct benefits and potential factors to consider.

How PPO Plans Work

A PPO plan in health insurance can link you to a network of healthcare providers for medical care.

Consider having a health insurance guide, which could lead you to medical services from providers outside of your network. This is the core functioning of a Medicare Advantage PPO plan. It covers Medicare-covered services and sometimes additional benefits, such as dental and vision, that may not be covered by Medicare.

In-network providers in a PPO plan have consented to provide services at a reduced rate. Conversely, the out-of-network providers might levy the full rate, possibly with a higher rate.

With a Medicare Advantage PPO plan, you can see any doctor or specialist within the network without the need for a referral.

Comparing PPO and HMO

Before deciding on a plan, members should compare PPO and HMO plans. PPO plans allow you a broader network of doctors and hospitals to choose from and do not necessitate referrals to see specialists.

However, HMO plans, have a more restricted network, require a referral from a primary care physician, and may not cover out-of-network care, except in cases of emergency.

Regarding cost-sharing, PPO plans may provide more flexibility and options for out-of-network care, albeit at a greater cost. HMO plans, on the other hand, may offer lower premiums and deductibles, but necessitate staying within the network for care.

Coverage and Benefits of Humana Medicare Advantage PPO Plans

Humana Medicare Advantage PPO plans could potentially provide a broad range of benefits to its members. In addition to the flexibility of selecting a physician who is best suited for your medical requirements, some plans may also provide prescription drug coverage, with the potential for significant savings on medications.

Some of the Humana Medicare Advantage PPO plans may also accompany numerous extra benefits. These include:

- Dental coverage

- Vision coverage

- Hearing coverage

Prescription Drug Coverage

Consider having a safety buffer for your prescription drug requirements – that’s what the Humana Medicare Advantage PPO plans could provide. Some plans might include prescription drug coverage, similar to that of a standard Medicare Part D plan, possibly providing coverage for a wide range of prescription drugs.

However, every safety net might have some gaps. Certain medications under the Humana Medicare Advantage PPO plan’s drug coverage may require prior authorization or have quantity limits.

Humana could offer multiple ways to save on medications, such as potential prescription savings options, discounts on medicines, and potential savings on over-the-counter drugs.

Possible Benefits

Beyond the regular Medicare-covered services, some Humana Medicare Advantage PPO Plans may offer several extra benefits.

Some plans may offer various vision benefits such as:

- annual eye exams

- an annual allowance for eyeglasses or contact lenses

- glaucoma screenings

- diabetic eye exams

Certain plans may even offer various dental and hearing coverage.

Potential Costs and Savings with Humana Medicare Advantage PPO Plans

When choosing a plan, you’ll likely want a comprehensive understanding of the potential costs that could be tied to Humana’s PPO plans. The average costs may vary depending on the specific plan and location.

Keep in mind that there may be other costs to consider, such as co-pays and deductibles.

Keep in mind that there may be other costs to consider, such as co-pays and deductibles.

However, there may be ways to optimize your savings with Humana’s PPO plans.

Premiums will likely be determined based on a variety of potential factors, such as the specific plan selected, geographic location, and age.

Generally, PPO plans might have higher monthly premiums compared to other Medicare Advantage plans. However, using preferred (in-network) providers could help lower your out-of-pocket costs.

Out-of-Pocket Maximums

Out-of-pocket maximums in a PPO plan will likely function as a financial safety buffer, possibly shielding you from exorbitant medical expenses.

The out-of-pocket maximum is the maximum amount of money that an individual must pay for covered in-network services in a calendar year.

Once you reach this limit, your health insurance company will likely shoulder 100% of the in-network expenses for the rest of the year.

Saving with Preferred Providers

Opting for preferred providers in Humana PPO plans could offer several benefits:

- You obtain the same caliber of services as out-of-network providers

- You can potentially pay less for your healthcare services

- Preferred providers have negotiated rates with Humana, which are typically lower than those of out-of-network providers

Staying within the lower-cost preferred pharmacies network could help you take advantage of these negotiated rates and potentially save money on your healthcare expenses.

You may also use the Humana online provider search tool to locate doctors and healthcare providers that may be in-network and preferred by Humana.

Navigating Dual Eligible Special Needs Plans (D-SNP)

A Dual Eligible Special Needs Plan (D-SNP) is a type of Medicare Advantage plan that might provide additional benefits and services, such as:

- coverage for prescription drugs

- dental services

- vision services

- hearing services

These plans will likely be designed to meet the unique needs of dual-eligible individuals.

Some plans may provide comprehensive coverage for hospital, medical, and prescription costs. They could also offer provider networks and specialized services that could aid in meeting the needs of dual-eligible individuals.

If you meet the criteria of being entitled to both Medicare (Parts A & B) and medical assistance from Medicaid, a D-SNP could be a great fit for you.

Non-Discrimination and Accessibility in Humana Medicare Advantage PPO Plans

Humana’s pledge to non-discrimination and accessibility allows all members to avail of quality healthcare services without prejudice.

Humana is dedicated to providing non-discriminatory and accessible services to all of its members, protecting their members from discrimination such as:

- race

- national origin

- age

- disability

- sex

- military or veteran status

- religion

Humana Inc. and its subsidiaries adhere to all relevant federal civil rights laws, ensuring that their services are accessible and equitable for all members.

Free Language Interpreter Services

Similar to how a translator assists in bridging language gaps, Humana’s complimentary language interpreter services ensure effective communication with healthcare providers.

These services are available in numerous languages, providing oral and video interpretation.

Accessing these services is as easy as a phone call. Humana members can simply call the number on the back of their member ID card or call (TTY: 711) to access language interpreter services.

Compliance with Anti-Discrimination Laws

Adherence to anti-discrimination laws serves as a moral compass for Humana. These laws prohibit discrimination based on:

- color

- national origin

- age

- disability

- sex

Humana adheres to these laws by providing language assistance services and accommodations for individuals with disabilities, ensuring equal access to their Medicare Advantage PPO plans.

Enrolling in a Humana Medicare Advantage PPO Plan

To register for a Humana Medicare Advantage PPO Plan, you must fulfill certain qualifications:

- Age 65 or older

- Younger than 65 with a qualifying disability

- With end-stage renal disease (ESRD), permanent kidney failure necessitates dialysis or a kidney transplant.

There are specific enrollment periods for Humana Medicare Advantage PPO Plans.

The Open Enrollment Period runs from October 15th to December 7th annually, and the Medicare Advantage OEP runs from January 1st to March 31st.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Summary

Navigating the healthcare landscape may be difficult. The potential Humana Medicare Advantage PPO Plans could offer greater flexibility in selecting healthcare providers, comprehensive coverage, and potential benefits that could cater to your unique healthcare needs.

By understanding the possible costs that may be associated with these plans and utilizing preferred providers, you could potentially maximize your savings.

Humana’s commitment to non-discrimination and accessibility ensures healthcare is open for all. So, step into a world of healthcare freedom with Humana Medicare Advantage PPO Plans – your journey to better health starts here.

Frequently Asked Questions

→ What is the difference between Humana HMO and PPO?

Humana HMOs have smaller networks than PPOs, require referrals to see specialists, and come with lower monthly premiums and out-of-pocket costs.

PPOs have larger networks, more flexibility to use providers in or out of the network without a referral, and generally higher premiums.

→ Is Humana Choice PPO a Medicare replacement plan?

Humana Choice PPO is a type of Medicare Advantage (Medicare Part C) plan, and thus is a Medicare replacement plan. It covers the same benefits as Original Medicare (Part A and Part B), plus may include prescription drug coverage and other benefits.

→ Is Humana Medicare and Humana Medicare Advantage the same?

Humana is a private insurance company that works along with Original Medicare with their Medigap policies and could serve as an alternative to Original Medicare with their Medicare Advantage plans.

Humana Medicare Advantage is a private insurance plan offered by Humana and covers the same healthcare services as Original Medicare, except for hospice care. Some plans may also provide additional benefits.

→ What is a Humana Medicare Advantage PPO Plan?

Humana Medicare Advantage PPO Plans are comprehensive healthcare solutions that combine the benefits of Medicare Parts A, B, and sometimes Part D, as well as additional coverage like dental and vision.

→ What are the additional benefits that could be offered by Humana’s PPO plans?

Some of Humana’s PPO plans may offer additional benefits such as prescription savings, and dental, vision, and hearing coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company