Humana Medicare Advantage Plans Oklahoma 2025

Choosing the right Medicare Advantage Plan is a critical decision that could significantly impact your health and financial well-being.

When it comes to potential options, Humana, a top-ranking health insurance company, will likely stand out with its diverse range of Humana Medicare Advantage plans in Oklahoma for 2025.

Throughout this article, we’ll delve into some of the details of these plans, from potential features to costs, and even compare Humana with other providers. Let’s embark on this journey to find the best Medicare Advantage plan for you.

Key Takeaways

- Based on data from previous years, Humana will likely have a variety of Medicare Advantage plans in Oklahoma in 2025, that could potentially cover at least 94% of U.S. counties, with possible benefits that may be tailored to veterans and others with specific health needs.

- Some of Humana’s Medicare Advantage plans may incorporate comprehensive benefits, potentially including coverage for Medicare Part A and B services, Part D prescription drugs, and possible benefits such as dental, vision, and hearing services.

Compare Plans in One Step!

Enter Zip Code

Understanding the Potential Humana Medicare Advantage Plans in Oklahoma for 2025

Humana Insurance Company, with its excellent financial strength and a top-ranking position in customer experience quality, might be a force to reckon with in the health insurance sector, as it could provide coverage to approximately 8.7 million Medicare members.

The design of these plans will likely be based on a thorough analysis of the preferences and requirements of individuals eligible for Medicare.

In a unique collaboration with USAA, Humana could potentially implement the Humana USAA Honor with Rx plan, designed specifically for U.S. military veterans.

Possible Features of Humana Medicare Advantage Plans

A possible attraction to some of Humana’s Medicare Advantage Plans may be the extensive coverage they could potentially provide. Not only could Humana provide coverage for Medicare Part A and Part B services, but some plans may also include Part D for prescription drugs.

Moreover, some of these plans may also offer supplementary benefits such as:

- Dental coverage

- Vision benefits, which could include annual eye exams, a yearly allowance towards eye wear, and screenings for glaucoma and diabetic-related eye health issues

Plan Types: HMO, PPO, and PFFS Explained

Humana provides an assortment of Medicare Advantage plans, including a variety of Humana plan options:

- HMO plans

- PPO plans

- PFFS plans

- Dual-Eligible Special Needs Plans (D-SNPs) for those eligible for both Medicare and state Medicaid program

Each plan type comes with its own set of features and benefits to cater to the diverse needs of Medicare beneficiaries.

For instance, there are different types of Medicare plans available, including:

- HMO plans offer Medicare benefits and require members to use healthcare providers within a specific network

- PPO plans, which offer more flexibility by allowing members to seek care from providers outside of the network

- PFFS plans, which allow members to choose any doctor who accepts Medicare patients and may offer lower-cost preferred pharmacies for prescription drug coverage.

These different plans cater to different needs and preferences.

Enrollment Insights for Humana Plans in Oklahoma

The decision to enroll in a Medicare Advantage plan could be significant for numerous Medicare beneficiaries.

Among the multitude of possible plans, the HumanaChoice H5216-316 (PPO) and Humana HMO/HMOPOS plans will likely emerge as some of the most favored Humana Medicare Advantage plans in Oklahoma.

These Medicare Advantage HMO plans could be available to all eligible individuals, underscoring Humana’s commitment to diversity.

When comparing Medicare Advantage HMO PPO options, it’s essential to consider the potential benefits and coverage that could be offered by each plan.

The Potential Cost Structure of Humana’s Plans

Assessing the potential out-of-pocket expenses could be an important factor when selecting the appropriate plan. Possible factors to consider may include:

- Co-pays

- Coinsurance

- Deductibles

- In-network and out-of-network out-of-pocket maximums

- Possible benefits

These factors should be considered when choosing a plan.

Possible Premium Considerations

Several factors will likely determine the premium costs of certain Humana Medicare Advantage Plans, such as the rating area of the county, the health condition of the enrollee, and the specific coverage details of Medicare Parts A, B, C, and D. An annual review of these premiums may be conducted, and changes could be made accordingly. Importantly, these changes may also apply to all enrollees.

Out-of-Pocket Expenses

To comprehend the potential out-of-pocket expenses for some of Humana’s Medicare Advantage Plans, meticulous examination of the individual plan details or direct consultation with Humana may be necessary.

It’s important to be aware that certain services such as hospital stays, surgeries, and specialty medications may result in higher out-of-pocket expenses due to certain deductibles, copayments, and coinsurance for these services.

However, there is a silver lining. Some of Humana’s Medicare Advantage Plans in Oklahoma might offer some of the following benefits:

- An annual limit on out-of-pocket costs for all Part A and Part B-covered services

- Once this limit is met, the plan might provide full coverage for all covered services

- Exemptions or deductions that could potentially lower out-of-pocket expenses

Specific details should be sought directly from Humana.

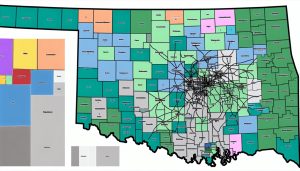

Humana’s Network and Coverage Area

Humana’s provider network in Oklahoma will likely be comprehensive, possibly ensuring beneficiaries may have access to a wide array of healthcare services and providers.

This network could potentially include a diverse range of specialists and major hospitals, possibly enabling members to access specialized care and hospital services within the network.

Certain Humana Medicare Advantage Plans may also be available in multiple counties throughout Oklahoma, including:

- Adair

- Bryan

- Caddo

- Canadian

- Carter

- Cherokee

Plan availability varies by ZIP code, so it’s advisable to check specifics for your location.

Star Ratings and Quality Measures

Humana’s performance in terms of overall star ratings and quality measures is commendable. In previous years, their Medicare Advantage plans have achieved an average star rating of 4.34, surpassing the overall average for Medicare Advantage plans from other providers, which was 4.04 stars.

Moreover, at least 92% of Humana’s Medicare Advantage members who are in rated contracts are in contracts with 4 stars or more.

Humana’s customer satisfaction level will likely also exceed the industry average in several major Medicare markets. This is evidenced by J.D. Power’s most recent study, showcasing Humana’s commitment to delivering quality care and exceptional service.

Possible Special Benefits for Specific Groups

Humana might offer certain special benefits for various groups.

For veterans, Humana may provide the Humana USAA Honor plans, which will likely be designed to complement the potential veteran benefits, and might provide a comprehensive healthcare package for those who have served in the military.

For individuals with chronic health conditions, Humana might offer Chronic Condition Special Needs Plans (C-SNPs) and Medicare Advantage D-SNPs, which could potentially offer tailored care and coverage for conditions like diabetes and cardiovascular disorders.

Senior citizens and individuals requiring prescription drugs regularly may also avail of special benefits.

Comparing Humana to Other Providers in OK

When comparing Humana to other providers in Oklahoma, it’s important to note that some of Humana’s Medicare Advantage plans will likely achieve top rankings as the best overall Medicare Advantage company.

These plans could potentially provide competitive costs and benefits in comparison to other providers in the state.

The availability of some of Humana’s Medicare Advantage Plans in Oklahoma may vary by ZIP code, and the plans could potentially be compared based on doctors, possible costs, and benefits using tools available on their website.

How to Choose the Best Medicare Advantage Plan for You

Selecting the most suitable Medicare Advantage plan will likely require a careful assessment of your healthcare requirements and a detailed evaluation of the possible benefits that might be provided by various plans.

Potential factors to consider may include:

- Coverage

- Costs

- Current health status and healthcare utilization

- Network of providers

- Prescription drug requirements

- Quality and access indicators of the plans

Taking these factors into account could help you make an informed decision about the best Medicare Advantage plan for you.

Assessing Your Health Care Needs

When assessing your potential healthcare needs, certain factors like in-network doctors, prescription coverage, and possible benefits such as dental, vision, and hearing should be considered.

Access to a network of healthcare providers and facilities that may be included in the health insurance plan could potentially substantially reduce out-of-pocket expenses and enhance the coordination of care.

The possibility of having prescription coverage might be another significant factor, especially for individuals who require regular medications.

Furthermore, if you have a chronic illness, additional benefits that may be designed specifically for individuals with chronic conditions, such as disease management programs, preventive services, and other support services, may be beneficial.

Evaluating Possible Plan Benefits

In terms of evaluating the potential plan benefits, it’s essential to contemplate some of the following factors:

- The plan’s total costs

- Whether your doctor is included in the network

- Potential coverage of your prescriptions

- Possible provision of dental coverage

- Any other additional benefits that may be offered by the plan.

For instance, some of Humana’s Medicare Advantage Plans in Oklahoma could potentially offer coverage for all the services provided by traditional Medicare Part A and Part B, along with possible benefits such as Medicaid services, prescription drug coverage, dental care, vision care, and hearing care.

Furthermore, some of these Humana Special Needs Plans may also encompass dental, vision, and hearing benefits.

Accessing Support from Our Licensed Agents

Although the process of choosing a Medicare Advantage plan may be daunting, you are not alone in this journey.

Our licensed agents can provide invaluable assistance, offering their expertise to help you find the best plan tailored to your needs.

Whether you have questions about the potential Medicare Advantage Plans in Oklahoma or need personalized recommendations, you can reach out to one of our licensed agents by dialing 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Summary

Some of Humana’s Medicare Advantage Plans in Oklahoma for 2025 will likely offer diverse options that could meet the unique needs of Medicare beneficiaries. With the possibility of having comprehensive coverage, competitive costs, and additional benefits for specific groups, these plans could stand out in the market.

Whether you’re assessing your healthcare needs, comparing possible plan benefits, or seeking support from licensed insurance agents, remember that the right plan is one that best aligns with your health and financial circumstances.

Frequently Asked Questions

→ What is new in Humana in 2025?

In 2025, some of the Humana Medicare Advantage plans may include dental, vision, and hearing benefits. For additional details about the plans for the 2025 calendar year, be sure to keep checking back to this website for updates.

→ What is the best Medicare Advantage plan?

Based on data from previous years, the best Medicare Advantage plan will likely be with Humana, as it could offer a good balance between quality coverage and affordable costs, which might make it appealing to beneficiaries.

→ What are the advantages of Humana Medicare Advantage?

Some of the advantages of Humana Medicare Advantage could include its broad range of choices for doctors and higher costs for complex medical needs.

→ What are the potential features of Humana Medicare Advantage Plans in Oklahoma?

Some of the Humana Medicare Advantage Plans in Oklahoma might offer comprehensive coverage for Medicare Part A and Part B services, and could potentially include prescription drug benefits, and additional benefits like dental coverage, vision benefits, and hearing services.

ZRN Health & Financial Services, LLC, a Texas limited liability company