Medicare Advantage Plans PPO vs HMO

Choosing the right Medicare Advantage plan can greatly impact your healthcare experience and expenses. Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans are the two primary types of Medicare Advantage plans.

This article will help you navigate the differences and similarities of Medicare Advantage plans PPO vs HMO in 2025, empowering you to make the best choice for your healthcare needs.

Key Takeaways

- Comparing HMO and PPO Medicare Advantage plans is beneficial for determining which best suits an individual’s healthcare needs.

- Provider networks, costs, coverage options, customer service & plan support should be considered when choosing between the two plans.

- Regional availability and enrollment process must be verified with the plan representative before selecting a plan.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans

Medicare Advantage plans, which are offered through private insurance companies with a Medicare contract, are an alternative to Original Medicare, offering additional benefits and coverage.

The two primary types of Medicare Advantage plans are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). One popular option among these plans is the Medicare Advantage HMO, which has its own unique features and provider networks.

This section offers a detailed analysis of the characteristics of HMO and PPO plans, enhancing your comprehension of available options.

Health Maintenance Organization (HMO)

Health Maintenance Organizations (HMO) originated in the United States in 1929 with the aim of harmonizing financial and care-quality incentives. HMO plans have the following features:

- Focus on managed care with in-network providers

- Require a primary care physician to coordinate all care

- Lower out-of-pocket expenses

- Limitation of using only in-network healthcare providers, except in cases of medical emergency

In an HMO plan, you might need a referral from your primary care physician before seeing a specialist. If you seek care from out-of-network providers, you may have to bear the entire cost, except in genuine emergency situations such as urgent care or dialysis.

Preferred Provider Organization (PPO)

Preferred Provider Organization (PPO) Medicare Advantage Plans offer an alternative option for those seeking more flexibility in choosing healthcare providers.

A Medicare PPO plan has its own network of doctors and hospitals but allows you to see both in-network and out-of-network providers. Though using in-network providers will generally result in lower out-of-pocket costs, PPO plans offer the freedom to choose providers outside the network without a referral.

One of the main advantages of PPO plans is the flexibility to visit specialists without needing a referral from a primary care physician. This flexibility, however, may come with higher costs compared to HMO plans.

Comparing HMO and PPO Plans

Having discussed the basics of HMO and PPO plans, we can now draw comparisons based on flexibility, provider networks, and costs. This comparative analysis aids in evaluating the plan type that aligns best with your unique healthcare needs and preferences.

Flexibility in Choosing Providers

PPO plans extend a greater level of flexibility in provider selection, enabling the choice of both in-network and out-of-network providers. This flexibility, however, accompanies a trade-off as out-of-network providers might incur higher out-of-pocket expenses compared to HMO plans.

On the other hand, HMO plans typically have lower costs and fixed copayments for most services but restrict you to using only in-network healthcare providers.

This limitation in provider choice may be a factor to consider when determining which plan type is the right fit for your healthcare needs.

Provider Networks

Both HMO and PPO plans have provider networks, which consist of medical practitioners, hospitals, and other healthcare providers that have a contractual agreement with a health plan to provide Medicare coverage to its members.

The main difference between the two plan types lies in their approach to out-of-network coverage. PPO plans extend out-of-network coverage at a higher cost, granting the freedom to consult any doctor or specialist without needing a referral.

In contrast, HMO plans require you to stay within a designated network of providers. If you seek care from out-of-network providers, you may be responsible for the full cost, except in cases of medical emergencies.

Costs and Cost-Sharing

HMO plans typically feature lower monthly premiums in comparison to PPO plans. The average cost of an HMO plan is approximately $427 per month, whereas the average cost of a PPO plan is approximately $512 per month.

In HMO plans, copayments are established amounts that you pay for each visit or service, while coinsurance rates indicate the proportion of the total cost for which you are responsible.

PPO plans, while offering more flexibility in provider choice, usually come with higher costs.

When consulting out-of-network providers, the cost share might be higher, necessitating an evaluation of the trade-off between flexibility and costs when selecting between HMO and PPO Medicare Advantage plans.

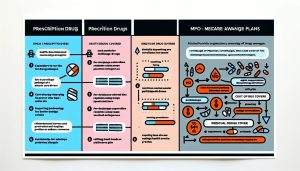

Prescription Drug Coverage in HMO and PPO Plans

Considering prescription drug coverage is a significant factor when comparing HMO and PPO plans. Both plan types can provide medical and prescription drug coverage in a single plan.

Alignment Health Plan’s HMO and PPO plans include prescription drug coverage. This means that regardless of which plan type you choose, you can expect to have access to medication coverage.

Reviewing the specific drug coverage and costs linked to each plan is necessary to make a well-considered decision.

The Role of Primary Care Providers

Primary care providers, who are essential health care providers, play a crucial role in coordinating medical care within Medicare Advantage plans.

In Medicare HMO plans, the primary care provider is responsible for providing general medical care, helping plan members obtain necessary services, and referring them to specialists.

In Medicare PPO plans, the primary care provider serves a similar role by providing preventive care, managing chronic conditions, and coordinating healthcare services for patients.

They act as the initial point of contact for most health issues and ensure that patients receive appropriate care and referrals to specialists when necessary.

Out-of-Network Services and Emergency Care

Comprehending the coverage of out-of-network services and out of network care in HMO and PPO plans is crucial for making a well-considered decision.

HMO plans do not provide coverage for out-of-network services, except in emergency situations. If you receive care from out-of-network providers, you may have to bear the entire cost, except in genuine emergencies such as urgent care or dialysis.

On the other hand, PPO plans do offer out-of-network coverage for medical emergencies. This allows you to access care from any provider in the event of an emergency, albeit at a higher cost compared to in-network services.

Making the Right Choice: Factors to Consider

Selecting between HMO and PPO Medicare Advantage plans involves considering factors like provider networks, costs, and coverage options.

The size and scope of a provider network can influence your access to healthcare services and the selection of healthcare providers available to you.

In terms of costs, PPO plans generally have higher out-of-pocket costs and premiums compared to HMO plans, so weigh the trade-off between flexibility and costs.

Also, consider the out-of-pocket maximum for each plan type, as this determines the maximum amount you will be responsible for paying for covered services in a year.

Considering these factors and comprehending the differences between HMO and PPO plans will aid in making the optimal choice for your healthcare needs.

Availability and Enrollment in Medicare Advantage Plans

Medicare Advantage plans vary regionally, typically requiring enrollment in the program for the relevant state and county. You can then explore the qualified medical professionals within that region’s network of care.

For example, to be eligible for an HMO plan from Aetna, you must reside in the coverage area where that plan is offered.

It is possible to transition from a Medicare HMO to a Medicare PPO during the Medicare Annual Enrollment Period, Medicare Open Enrollment Period, or a Special Enrollment Period based on certain life events that affect your coverage.

As the enrollment process for Medicare Advantage plans might differ, verifying the process with the plan representative becomes crucial.

Customer Service and Plan Support

Assessing the customer service and support provided by different Medicare Advantage plan providers also aids in making a well-considered decision. Exemplary customer service in Medicare Advantage plans may include:

- Prompt and responsive assistance

- Consideration for member requirements

- Cost-effective payment alternatives

- A focus on personalized care

Assess the customer service of a Medicare Advantage plan provider by analyzing the results of the Consumer Assessment of Healthcare Providers & Systems (CAHPS) survey, which gauges customer satisfaction and experiences with healthcare providers.

Additionally, consider overall customer satisfaction ratings and feedback from members of Medicare Advantage plans.

Summary

In conclusion, understanding the differences between HMO and PPO Medicare Advantage plans is essential for making an informed decision about your healthcare coverage.

By comparing factors such as provider networks, costs, prescription drug coverage, the role of primary care providers, and out-of-network services, you can identify the plan type that best suits your individual healthcare needs and preferences.

Take the time to thoroughly research and evaluate your options, ensuring that you make the most suitable choice for your healthcare journey.

Frequently Asked Questions

→ Is it better to have an HMO or PPO for a Medicare Advantage Plan?

An HMO is better for those who don’t mind using a primary care physician to coordinate their care and prefer lower costs, while a PPO may be better for those who have existing doctors or medical teams outside the plan network.

→ Why would a person choose a PPO over an HMO?

A PPO offers more choice and flexibility than an HMO, allowing for visits to out-of-network providers, though at an added cost. You also won’t need a primary care physician or referral from that doctor to see a specialist with a PPO.

→ What does the PPO mean on Medicare Advantage?

A Preferred Provider Organization (PPO) is a Medicare Advantage Plan that works with private companies to administer benefits and provides a network of doctors, specialists, hospitals, and other healthcare providers.

→ What is the role of primary care providers in coordinating care in HMO and PPO plans?

Primary care providers are essential for coordinating medical care within Medicare Advantage plans, managing chronic conditions, and providing general medical care services for patients.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.