Highmark Freedom Blue PPO

If you’re exploring the potential Medicare Advantage plans, Highmark Freedom Blue PPO could offer a mix of comprehensive coverage and flexibility.

You might be wondering about its potential benefits, costs, and services. This article breaks down everything from essential coverage details to managing prescriptions and navigating the possible plan costs. Discover if Highmark Freedom Blue PPO is your pathway to worry-free health care.

Key Takeaways

- Highmark Freedom Blue PPO is a Medicare Advantage plan that may offer extensive coverage including health, prescription drugs, dental, vision, and hearing care, with the flexibility to see doctors within or outside the network.

- The plan may also cover a wide range of preventive services and screenings, potentially offering a comprehensive prescription benefit package, and will likely have strategies in place to manage prescription costs.

- Members could potentially benefit from various perks likely a suite of support tools to manage healthcare needs, as well as the plan’s dedication to keeping out-of-pocket costs predictable.

Compare Plans in One Step!

Enter Zip Code

Understanding Highmark Freedom Blue PPO

Highmark Freedom Blue PPO, a legacy product of Blue Cross and Blue Shield since the 1930s, could potentially provide extensive coverage as a Medicare Advantage Preferred-Provider Organization (PPO). These plans could potentially provide coverage for:

- Prescription drugs

- Dental

- Vision

- Hearing

This plan will likely prioritize your choice, allowing you to select your healthcare provider, whether within or outside the network, particularly when traveling.

What Is Highmark Freedom Blue PPO?

Highmark Freedom Blue PPO may offer:

- A flexible and personalized healthcare experience

- The liberty to choose where you get your care

- Comprehensive coverage, both within and outside the network

Its utility is particularly noted while traveling, as it could ensure your health may be taken care of, wherever you might be.

The Connection with Medicare Advantage

You may be able to think of Highmark Freedom Blue PPO as a more enhanced version of Original Medicare. While Original Medicare covers hospital and nursing services and doctor visits, certain Medicare Advantage plans like Highmark Freedom Blue PPO may go the extra mile by potentially covering prescription drugs and additional benefits such as dental and vision care.

Qualifying for a Highmark Freedom Blue PPO plan requires you to have Medicare Part A benefits and enrollment in Part B. The plan might offer an option that may include affordable premiums and predictable out-of-pocket costs, possibly providing extensive coverage including health, prescription drugs, and routine dental needs.

Potential Features of Freedom Blue PPO Plans

Designed to cater to your needs, some of the Highmark Freedom Blue PPO plans may boast potential features such as network flexibility that could let you choose your healthcare provider within the Freedom Blue PPO network and the combined Blue Plan Medicare.

Some of these plans may offer a comprehensive package, possibly covering everything from doctor visits and hospital stays to outpatient services, emergency care, and preventive care.

Plus, some plans may go a step further by potentially covering health services, prescription drugs, and routine dental care.

These plans may even help with preventive healthcare by potentially covering health screenings and regular dental care, which may be essential for maintaining good health.

Coverage Details: What You Need to Know

Having understood the potential features of Highmark Freedom Blue PPO, you may want to examine the specifics of the coverage details. From preventive services and screenings to emergency care and specialized treatments, Highmark Freedom Blue PPO will likely have its members covered.

Preventive Services and Screenings

Preventive services and screenings have been designed to catch health problems early before they become severe. Highmark Freedom Blue PPO may cover a wide range of services and screenings such as:

- Abdominal aortic aneurysm screening

- Alcohol misuse counseling

- Bone mass measurement

- Various cancer screenings

- And many others

Emergency Care and Urgent Services

Given the unpredictability of health emergencies, a plan covering emergency care and urgent services could become indispensable. Highmark Freedom Blue PPO might stand out by potentially covering:

- Emergency services, even when you’re traveling outside the U.S.

- Urgent care is medical help for non-life-threatening issues that need quick attention.

- Ambulance services, both emergency and non-emergency situations are covered under the plan.

Specialized Treatment Coverage

Highmark Freedom Blue PPO may also extend its coverage to provide specialized treatments. The plan may include coverage for:

- Specialist visits

- Physical therapy

- Chronic disease management, including management programs and nutritional counseling

However, it’s important to note that there may be some possible limitations to the coverage of these specialized treatments.

Prescription Benefits in Focus

Despite prescription drugs potentially being a significant expense, Highmark Freedom Blue PPO may also provide a safety net.

The plan could potentially offer a broad range of prescription benefits, including a comprehensive formulary, coverage for both generic and brand-name drugs, and strategies that could help manage prescription costs.

Understanding the Formulary

Like any health plan, Highmark Freedom Blue PPO may place significant importance on the formulary. It’s essentially a list of prescription drugs that the plan covers. The formulary is arranged into a tier system, with different tiers for:

- Preferred brand drugs

- Non-preferred brand drugs

- Specialty drugs

The formulary will likely be continuously updated to keep up with medical practices and drug availability, possibly ensuring that you have the most current information. If your doctor prescribes a medication that’s not on the formulary, you could request an exception.

Generic vs. Brand-Name Prescriptions

Understanding the difference between generic and brand-name drugs may become essential when dealing with prescriptions. While generic drugs might have the same active ingredients as brand-name drugs, they may also have different inactive ingredients and might be cheaper.

Highmark Freedom Blue PPO will likely cover both generic and brand-name drugs, possibly giving you the freedom to choose based on your preferences and budget.

Managing Prescription Costs

Highmark Freedom Blue PPO may also acknowledge the challenges of managing prescription costs. That’s why it could offer several strategies that could help you manage these costs.

From Extra Help from Medicare for those who qualify to a collaboration with Free Market Health 3 for instant authorization for specialty drugs, Highmark Freedom Blue PPO will likely be committed to making prescriptions more affordable.

The plan may even offer a mail-order pharmacy service, which could save you some money.

Navigating Possible Costs with Highmark Freedom Blue PPO

A thorough understanding of the potential costs that may be associated with a health plan could be a prominent factor in making an informed decision. With Highmark Freedom Blue PPO, you’ll likely find a range of cost components, including:

- Premiums

- Deductibles

- Co-pays

- Out-of-pocket maximums

Premiums and Deductibles Explained

Any health plan’s cost components will likely include premiums and deductibles. Premiums are the regular payments you make to keep your insurance coverage active.

Deductibles, on the other hand, are the amount you have to pay out-of-pocket each year before your insurance starts to cover your healthcare costs.

Co-pays and Coinsurance

Your health plan may also involve cost-sharing aspects such as co-pays and coinsurance. Co-pays are a set amount you pay for specific medical services, while coinsurance is a percentage of the costs you share with your health plan.

The co-pay may also cover in-network dental services and routine eyeglass lenses. The coinsurance rates will likely depend on the specifics of the plan’s coverage.

Out-of-Pocket Maximums

The out-of-pocket maximum could act as a safety net that could limit your annual healthcare expenses. This potential limit may also include your deductibles, coinsurance, and co-pays, ensuring that you might not have to bear an excessive financial burden in a particular year.

This potential limit could help you budget your yearly healthcare expenses and may even provide financial protection against unexpected health issues.

Potential Perks and Support Services

Highmark Freedom Blue PPO may not only provide comprehensive coverage but it could also offer additional perks and support services for its members.

Member Support and Resources

Highmark Freedom Blue PPO takes pride in offering its members extensive support. Members could easily access various resources to manage their healthcare needs, including:

- A dedicated phone line for customer service

- Online tools like a digital ID card

- A ‘Find a Doctor’ feature

- A coverage check tool

Making an Informed Decision: Is Highmark Freedom Blue PPO Right for You?

With this information, you may wonder if Highmark Freedom Blue PPO suits your needs. To answer this, it’s essential to evaluate your healthcare needs, compare the Highmark Freedom Blue PPO with other plans, and understand the enrollment periods and eligibility requirements.

Assessing Your Healthcare Needs

When it comes to healthcare, one size doesn’t fit all. Each individual has unique healthcare needs, and it’s important to assess these needs to determine if Highmark Freedom Blue PPO may be a suitable option. You may want to consider:

- Your health status

- Your age

- Your cognitive ability

- The healthcare resources available to you

Taking stock of these potential factors could help you make an informed decision.

You may also check the coverage details provided by Highmark for various healthcare services to ensure they align with your health conditions. And remember, your healthcare needs may also be influenced by how frequently you need to visit the doctor.

Comparing Plans and Options

The decision to choose a healthcare plan will likely be significant and may also require careful consideration of your options.

With Highmark Freedom Blue PPO, you could have a plan that may offer extensive coverage for health, prescription drugs, and routine dental care. When comparing these plans to other Medicare Advantage or Medigap plans, you should consider the coverage, potential premiums, out-of-pocket costs, and plan ratings to determine which plan could offer the best value for you.

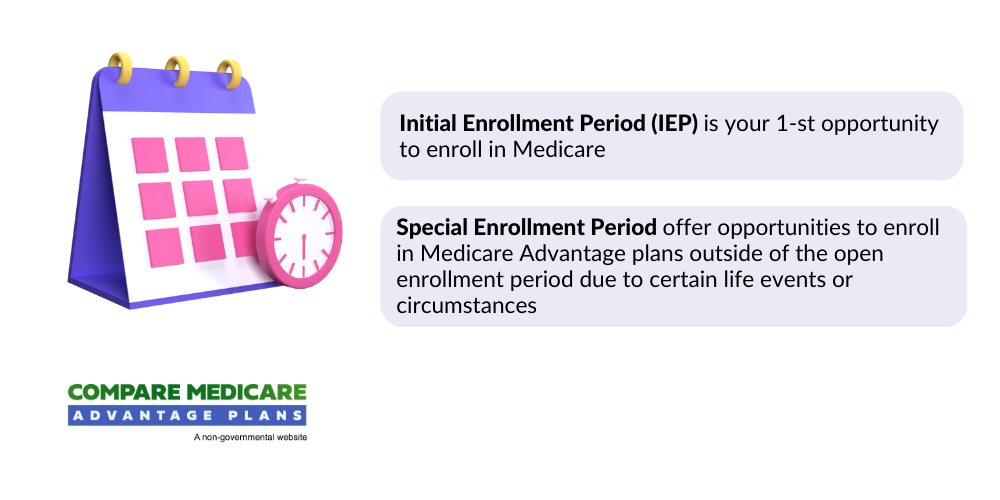

Enrollment Periods and Eligibility

Understanding the enrollment periods and eligibility requirements is a prerequisite to potentially benefit from the Highmark Freedom Blue PPO. As long as you have Medicare Part A benefits and are enrolled in Part B, you can sign up for Highmark Freedom Blue PPO plans.

You can enroll during the Initial Enrollment Period (IEP) or certain Special Enrollment Periods depending on qualifying life events. Note that the enrollment periods might vary for people with specific circumstances.

Summary

Navigating the world of health insurance might be daunting, but with the right information, you can make an informed decision. Highmark Freedom Blue PPO will likely offer comprehensive coverage, flexibility, and a host of additional perks and support services.

From preventive services and specialized treatments to possible prescription benefits and potential cost management strategies, Highmark Freedom Blue PPO could ensure that you are well-covered.

Frequently Asked Questions

→ What type of insurance is Freedom Blue?

Freedom Blue is a Medicare Advantage Preferred Provider Organization (PPO) plan that could provide coverage for various healthcare needs, which may include health, prescription drugs, dental, vision, and hearing services. You may also have the flexibility to receive care from doctors and hospitals of your choice, both in and out of the network, without needing referrals.

→ Is Highmark PPO Blue a Medicare plan?

Yes, Highmark PPO Blue is a Medicare plan with a contract, but enrollment depends on contract renewal.

→ How is Highmark Freedom Blue PPO different from Original Medicare?

Highmark Freedom Blue PPO may offer more benefits than Original Medicare, such as coverage for prescription drugs, dental, and vision care. It’s a part of Medicare Advantage, meaning it could give you extra coverage beyond what Original Medicare provides.

→ What are the coverage details for Highmark Freedom Blue PPO?

Highmark Freedom Blue PPO may offer coverage for preventive services, screenings, emergency care, and specialized treatments.

ZRN Health & Financial Services, LLC, a Texas limited liability company