Aetna Medicare Advantage Plans 2025

Aetna’s Medicare Advantage plans for 2025 could have similar changes and expansions that they saw in 2024, aiming to provide more choices, flexibility, and enhanced benefits to Medicare beneficiaries.

With a variety of options that may include additional benefits beyond what Medicare Part A and Medicare Part B cover, it could be worth it to look at Aetna Medicare Advantage plans in your area for 2025.

Choosing the right Medicare Advantage plan in 2025 can indeed be a challenging task, but understanding the basics and knowing what to compare can greatly simplify the process. Here’s a guide to help you navigate through the options:

Understanding Basic Medicare Coverage

- Medicare Part A – Hospital Coverage: This part covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. It’s essential for covering significant medical events that require hospitalization.

- Medicare Part B – Medical Services: This covers two types of services – outpatient medically necessary services (services or supplies needed to diagnose or treat a medical condition) and preventive services (healthcare to prevent illnesses or detect them at an early stage).

Compare plans & rates

Enter Zip Code

Compare plans & rates in your area

Enter Zip Code

Aetna’s Medicare Advantage plans are designed with a strong focus on providing comprehensive and innovative benefits that cater to a wide array of health needs for their members.

These benefits aim not only to maintain overall health but also to offer targeted support for managing chronic conditions. Benefits vary by plan and may not be included in all plans.

Here’s an overview of some of these benefits:

Fitness Reimbursement

Fitness Reimbursement

Encouraging Physical Activity: This benefit promotes an active lifestyle by reimbursing costs associated with various fitness activities.

It’s designed to incentivize members to engage in physical exercises like swimming, golf, and other sports, contributing to their overall physical health

Dental, Vision, and Hearing Services

Dental, Vision, and Hearing Services

- Holistic Health Coverage: These services cover essential aspects of health that are often overlooked.

Regular dental, vision, and hearing check-ups are crucial for early detection of potential health issues and maintaining overall well-being.

Wellness Services

Wellness Services

- Preventive Health Measures: Wellness services may include programs and initiatives aimed at preventive healthcare.

These might involve health screenings, vaccinations, health education, and other activities focused on maintaining and improving health.

Chronic Disease Management

Chronic Disease Management

- Tailored Support for Chronic Conditions: This aspect of the plan offers resources and tools specifically designed to help members manage chronic diseases such as diabetes, heart disease, or respiratory conditions.

Effective management of these conditions can greatly improve the quality of life and reduce the risk of complications.

Additional Supportive Measures

- Personal Health Care: Personalized care plans are developed to meet the unique health needs of each member, ensuring that care is tailored to their specific conditions and health goals.

- Behavioral Health Plans: These plans address the mental and emotional aspects of health, recognizing the importance of psychological well-being in overall health management.

- Medical Management Capabilities: Aetna typically provides advanced capabilities in medical management, ensuring that members receive coordinated and efficient care. This includes the use of technology and data to improve care delivery and outcomes.

In summary, Aetna’s Medicare Advantage plans for 2025 will likely feature by their comprehensive approach to health, offering a range of innovative benefits that address both the physical and mental aspects of well-being.

This holistic approach is particularly beneficial for individuals with chronic conditions, as it provides them with the necessary resources and support to effectively manage their health.

Other companies offering Medicare Advantage plans in 2025 are Humana, Wellcare, United Healthcare, Cigna, and many more.

CVS Health Company Support

The collaboration between Aetna and CVS Health represents a strategic and innovative approach to enhancing Medicare Advantage offerings.

This partnership is centered around leveraging resources, technology, and care options to provide a more integrated and efficient healthcare experience for Medicare Advantage members.

Here’s a breakdown of how this collaboration benefits members:

Comprehensive Healthcare Coverage: CVS Health usually supports Aetna’s Medicare Advantage plans by providing extensive healthcare coverage options. This integration ensures that members have access to a broad spectrum of healthcare services.

Cost-Effective Care Options: The collaboration aims to offer more affordable care solutions. By combining the healthcare services of CVS with Aetna’s insurance coverage, members can access high-quality care at more reasonable costs.

Vast Healthcare Provider Network: Aetna’s vast network includes numerous healthcare providers, pharmacies, and care facilities. This wide network availability makes it easier for members to access the care they need when they need it.

Access to Health Information Technology Products

Integrated Care Models: The partnership provides integrated care models that streamline healthcare delivery. This integration ensures a more coordinated approach to patient care, enhancing the overall healthcare experience for members.

Medical Information and Analytics: The use of advanced medical information and analytics helps in better understanding patient needs and improving care strategies. This technology plays a crucial role in personalized healthcare and decision-making processes.

Care Coordination and Chronic Disease Management Tools: Specialized tools for care coordination and chronic disease management are available through this collaboration. These tools are essential for members with chronic conditions, as they provide structured support and management plans.

Health IT Solutions: Aetna accesses a variety of health IT solutions, enhancing their capability to offer improved dental, vision, and hearing benefits. These solutions also aid in reducing prescription drug expenses and ensure that members have access to affordable healthcare.

Impact on Medicare Advantage Members

- Enhanced Benefits: Members benefit from enhanced dental, vision, and hearing coverage, ensuring a comprehensive approach to health.

- Reduced Prescription Drug Costs: The collaboration aims to make prescription drugs more affordable, thereby reducing the overall healthcare expenses for members.

- Accessibility to Medicaid Services: For those eligible, the network includes Medicaid services, providing a safety net for a wider range of healthcare needs.

In summary, the Aetna and CVS Health collaboration is a significant step forward in redefining the healthcare experience for Medicare Advantage members.

By combining quality insurance coverage with convenient care options and advanced health technology, this partnership aims to deliver better health outcomes and higher member satisfaction.

Aetna’s Medicare Advantage plans have garnered significant recognition for their quality and customer satisfaction, as evidenced by their impressive CMS Medicare Star Ratings.

Impact on Customer Satisfaction and Health Outcomes

- Commitment to Excellence: Ratings reflect Aetna’s commitment to providing high-quality healthcare services. The company’s focus on customer satisfaction and the overall experience contributes to these favorable ratings.

- Promoting Better Health Outcomes: High-quality plans are typically associated with better health management, prevention, and treatment outcomes. Aetna’s focus on quality care likely contributes to more effective management of member health, particularly in preventive measures and chronic condition management.

- Enhanced Member Experiences: The high ratings suggest that members are satisfied with the services provided, including customer service, healthcare access, and plan benefits. This level of satisfaction is crucial for maintaining long-term member engagement and trust in the healthcare system.

Significance for Medicare Beneficiaries

- Trustworthy Choice for Medicare Coverage: For Medicare beneficiaries choosing a plan, Aetna’s high star ratings can be a significant factor. These ratings serve as a guide to help them identify plans that are recognized for quality and reliability.

- Assurance of Quality Care: Enrolling in a high-rated Medicare Advantage plan like those offered by Aetna can provide beneficiaries with confidence in the level of care and service they will receive.

In summary, Aetna’s Medicare Advantage plans usually stand out for their high-quality ratings and customer satisfaction, underscoring the company’s dedication to delivering superior healthcare experiences.

For Medicare beneficiaries, ratings are a reassuring indicator of the quality and effectiveness of Aetna’s healthcare services.

View plans & rates

Enter Zip Code

Summary

Aetna’s Medicare Advantage plans represent a significant advancement in providing healthcare to Medicare beneficiaries.

These plans are characterized by their comprehensive nature, innovative offerings, and a steadfast commitment to quality and customer satisfaction.

Aetna’s Medicare Advantage plans for 2025 are likely to offer comprehensive healthcare access for Medicare beneficiaries, offering a blend of expanded coverage, innovative benefits, and a focus on high-quality care.

Frequently Asked Questions

→ Question: What are the new features of Aetna Medicare Advantage plans for 2025?

Answer: Aetna’s Medicare Advantage plans for 2025 are anticipated to continue their trend of offering innovative benefits and comprehensive coverage.

While specific details may vary closer to 2025, beneficiaries can expect enhancements in areas like telehealth services, wellness programs, and perhaps even more personalized healthcare options, in line with Aetna’s commitment to evolving healthcare needs.

→ Question: Will Aetna expand its Medicare Advantage plans to more areas in 2025?

Answer: While specific expansion plans for 2025 are not yet confirmed, Aetna has shown a consistent pattern of extending its reach to new regions.

Given this trend, it’s likely that Aetna will continue to increase its coverage area, making Medicare Advantage plans accessible to a larger number of beneficiaries.

→ Question: How does Aetna ensure high-quality care in its Medicare Advantage plans?

Answer: Aetna focuses on quality and customer satisfaction, as evidenced by high CMS Medicare Star Ratings.

For 2025, Aetna is likely to continue investing in quality healthcare services, including efficient care coordination, comprehensive health coverage, and partnerships that enhance healthcare delivery, such as the ongoing collaboration with CVS Health.

→ Question: Will there be any changes to the fitness benefits in Aetna’s Medicare Advantage plans for 2025?

Answer: While the specifics for 2025 are not yet detailed, Aetna might enhance its fitness benefits, building on the fitness reimbursement programs from previous years.

These could include broader coverage for different types of physical activities and partnerships with fitness centers or wellness programs to encourage active lifestyles among beneficiaries.

→ Question: Can beneficiaries expect any improvements in prescription drug coverage in Aetna’s 2025 plans?

Answer: Aetna continuously strives to improve its Medicare Advantage plans, including prescription drug coverage.

For 2025, beneficiaries might see more cost-effective options, a wider range of covered medications, and possibly enhanced tools for managing prescriptions, aligning with Aetna’s commitment to providing comprehensive and affordable healthcare solutions.

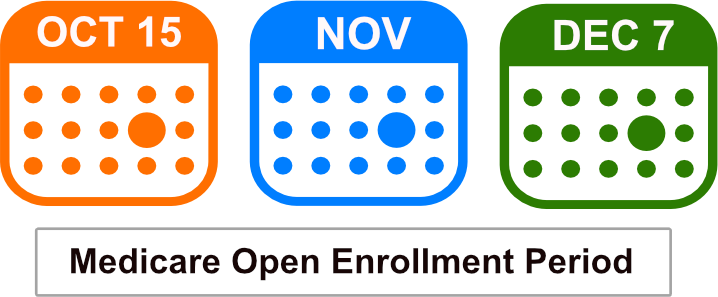

→ Question: What is the Medicare Annual Election Period?

Answer: The Medicare Annual Enrollment Period is an annual event that runs from October 15th to December 7th each year.

Changes to coverage will begin the following 1st of the new year. If you are currently enrolled in a Medicare Advantage plan you may switch to a different Medicare Advantage plan, or return to Original Medicare during this time.

Aetna Medicare Advantage Plans by State

ZRN Health & Financial Services, LLC, a Texas limited liability company

Fitness Reimbursement

Fitness Reimbursement Dental, Vision, and Hearing Services

Dental, Vision, and Hearing Services Wellness Services

Wellness Services Chronic Disease Management

Chronic Disease Management