Aetna Medicare Advantage Plans Washington 2025

Choosing the right Aetna Medicare Advantage plan in Washington requires understanding your options. In this article, we simplify this decision by detailing Aetna Medicare Advantage plans in Washington, including Aetna’s HMO, PPO, and SNP plans. We’ll compare the potential benefits, help you gauge their suitability for your healthcare needs, and ensure you’re well-informed to navigate Aetna’s offerings effectively.

Key Takeaways

- Aetna offers a variety of Medicare Advantage plans in Washington, including HMO, PPO, and SNP plans, each with different levels of network restriction, flexibility, and out-of-pocket costs.

- All Aetna Medicare Advantage plans in Washington include Original Medicare benefits and often prescription drug coverage.

- Residents of Washington can use Medicare.gov, CMS’s website, and the State Health Insurance Assistance Program (SHIP) to navigate and enroll in Medicare Advantage plans, making informed decisions using resources like this website’s Plan Finder tool.

Compare Plans in One Step!

Enter Zip Code

Overview of Aetna Medicare Advantage Plans in Washington

Aetna offers a wide array of Medicare Advantage plans in Washington, each designed to cater to diverse healthcare preferences and needs. These options range from Health Maintenance Organization (HMO) plans, and Preferred Provider Organization (PPO) plans to Special Needs Plans (SNPs), offering flexibility and choice to beneficiaries. But what do these plans entail, and how do they differ?

Navigating this health coverage labyrinth can be challenging. As such, we’ll explore the unique features, potential benefits, and considerations of these plans to help you understand them better.

Aetna Medicare Advantage HMO

An HMO plan is like a well-orchestrated symphony, where all the healthcare providers work in harmony to deliver coordinated care. In Aetna’s Medicare Advantage HMO plans, members are required to use a network of doctors and hospitals, except in emergencies. A primary care provider serves as the maestro, directing your healthcare and often providing referrals for hospital care and specialist visits.

Although this plan might appear restrictive, it does come with a unique set of advantages. HMO plans are often associated with lower premiums and out-of-pocket expenses compared to PPO plans. Plus, there’s the HMO-POS variant that offers the flexibility to access both in-network and out-of-network providers for routine dental care.

Aetna Medicare Advantage PPO

If you value flexibility and freedom in choosing your healthcare providers, Aetna’s Medicare Advantage PPO plans could be your ideal match. These plans offer:

- The liberty to visit any Medicare-accepting provider nationwide, without the need for referrals

- No necessity for a primary care provider

- The ability to see specialists without any referrals.

Nonetheless, this increased freedom is often associated with higher costs. Choosing out-of-network providers is possible but it generally comes at a higher cost. Broad-network PPO plans, offering greater provider flexibility, often come with higher average premiums compared to narrow-network plans.

Aetna Medicare Advantage SNP

For individuals with specific diseases or those eligible for both Medicare and Medicaid, Aetna offers Special Needs Plans (SNPs) as part of their Medicare plans. These plans provide targeted support to fulfill unique healthcare needs.

Aetna’s Dual Special Needs Plans (D-SNPs) are tailored for members eligible for both Medicaid benefits and Medicare. Moreover, Aetna offers Medicare Advantage SNPs that focus on the management of specific chronic conditions. These plans provide custom-tailored care plans and medication regimens for illnesses like diabetes or heart failure, ensuring that your health needs are met in the most personalized way.

Comparing Aetna Medicare Advantage Plans to Other Providers in Washington

In the bustling marketplace of Medicare Advantage plans in Washington, there are seventeen private health insurance providers offering Medicare Advantage plans, including:

- Aetna

- Humana

- Kaiser Permanente

- UnitedHealthcare

Given these numerous options, one might wonder how Aetna compares to the competition. To aid in your decision-making, we’ll evaluate Aetna’s offerings, focusing on network size, provider access, and any additional benefits and perks.

Network Size and Provider Access

When choosing your Medicare Advantage plan, the size of the provider network is akin to the size of a shopping mall. The larger it is, the more options you have. Access to in-network providers is a critical consideration as it can affect the range of healthcare options available to you.

A large network means a wider selection of doctors, specialists, and hospitals, potentially offering more flexibility in managing your health. Conversely, a smaller network might limit your options but could also mean more coordinated care. The choice ultimately depends on your individual healthcare needs and preferences.

Additional Benefits and Perks

Beyond the essential health coverage, Aetna’s Medicare Advantage plans in Washington come with an impressive array of potential additional benefits. These plans may include dental, vision, and hearing coverage.

Essential Components of Aetna Medicare Advantage Plans

At the core of Aetna’s Medicare Advantage plans in Washington are two key components: Original Medicare benefits and prescription drug coverage. All Aetna Medicare Advantage plans include the benefits offered by Original Medicare, covering hospital and medical services.

In addition, most Aetna Medicare Advantage plans offer the following benefits:

- Prescription drug coverage (Part D)

- Dental coverage

- Vision coverage

- Hearing coverage

These additional benefits enhance the value of Aetna’s plans, providing comprehensive health coverage that goes beyond the basics.

Prescription Drug Coverage (Part D)

Prescription drug costs can be a significant healthcare expense. Recognizing this, Aetna may offer Medicare Advantage plans with prescription drug coverage, referred to as MA-PD plans. These combine health and prescription drug benefits into a single plan, simplifying the management of healthcare costs.

Part D coverage varies between Aetna Medicare Advantage plans, each having its own list of covered drugs, known as a formulary. This also affects cost-sharing for medications.

Some Aetna plans even provide the convenience of prescription mail-order delivery and potential gap coverage, providing extra benefits in the Medicare Part D coverage gap, commonly called the ‘donut hole’.

Original Medicare Benefits

One of the fundamental pillars of Aetna’s Medicare Advantage plans is the inclusion of Original Medicare benefits. These cover hospital and medical services — the basics of any healthcare plan. This way, every Aetna Medicare Advantage plan holder is guaranteed a solid foundation of health coverage, upon which potential additional benefits are built.

Navigating Medicare Resources and Enrollment in Washington

With a firm understanding of Aetna’s Medicare Advantage plans, you’re ready to navigate the enrollment process. Thankfully, Washington residents have access to various resources for Medicare information and enrollment, including Medicare.gov, the Medicare hotline, and the State Health Insurance Assistance Program (SHIP).

Next, we’ll explore these resources in detail, shedding light on how they can assist you in your healthcare journey and improve health outcomes.

Medicare.gov and CMS’s Website

When it comes to reliable information about Aetna Medicare Advantage plans in Washington, Medicare.gov is a treasure trove. This website is a key resource for gathering information about Medicare Advantage plans, comparing options, and enrolling in a plan that suits your needs.

The Centers for Medicare & Medicaid Services (CMS) website complements Medicare.gov, providing a wealth of information about Medicare and Medicaid services. Together, these websites offer a comprehensive view of your Medicare Advantage options and guide you through the enrollment process.

State Health Insurance Assistance Program (SHIP)

For personalized assistance with Medicare-related questions and decisions, Washington residents can turn to the Statewide Health Insurance Benefits Advisors (SHIBA). Operating under the Washington State Office of the Insurance Commissioner, SHIBA offers free, personalized health care coverage counseling to individuals of all ages.

Navigating healthcare decisions and Medicare coverage can be complex. That’s where SHIBA comes in, offering trained volunteers who can guide you through the process, helping you make informed decisions about your health coverage.

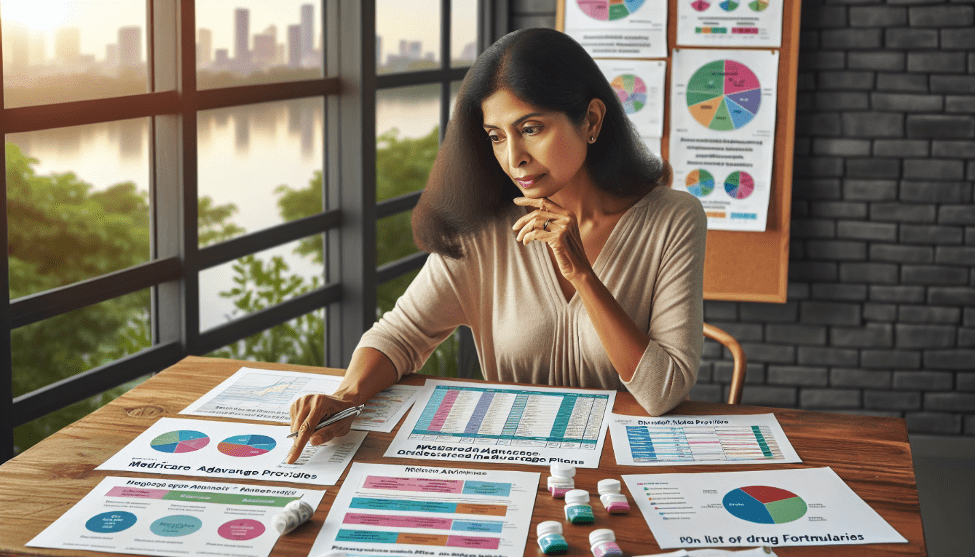

Tips for Choosing the Right Aetna Medicare Advantage Plan in Washington

The decision to choose the right Medicare Advantage plan should not be taken lightly. It’s important to consider factors such as in-network providers, drug formularies, and deductibles. Additionally, using tools like this website’s Plan Finder can aid you in finding the best plan for your healthcare needs.

By entering your ZIP code into the Plan Finder tool, you can view available Aetna Medicare Advantage plans in your area. This tool allows you to compare different plans based on costs, coverage options, and ratings, making it easier to identify the plan that best meets your healthcare needs.

Summary

Navigating the world of Medicare Advantage plans can be challenging, but with the right information and resources, it becomes a manageable task. From understanding the distinct features of Aetna’s HMO, PPO, and SNP plans, to comparing Aetna’s offerings with other providers, and appreciating the essential components of these plans, you are now equipped to make an informed decision.

Remember, your healthcare journey is personal and unique, and the best plan for you is the one that fits your needs, preferences, and lifestyle.

Frequently Asked Questions

→ Why are people going to Medicare Advantage plans?

People are going to Medicare Advantage plans because they offer lower-cost options for comprehensive coverage.

→ What is the difference between Aetna Medicare and Aetna Medicare Advantage?

The main difference between Aetna Medicare and Aetna Medicare Advantage is that Aetna Medicare Advantage plans, also known as Part C plans, are run by private insurance companies and may include extra benefits that Original Medicare doesn’t.

→ What types of Medicare Advantage plans does Aetna offer in Washington?

Aetna offers Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), and Special Needs Plans (SNPs) in Washington, providing a range of options for Medicare Advantage coverage.

→ What are the additional benefits of Aetna’s Medicare Advantage plans?

Aetna’s Medicare Advantage plans offer additional benefits which may include dental, vision, hearing, and prescription drug coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company