Aetna Medicare Advantage Plans in North Carolina for 2025

Sorting through potential Medicare Advantage plans in North Carolina? Aetna will likely offer a selection that could match your lifestyle and health needs, including HMO and PPO options that may be packed with benefits. Get to know the specifics of Aetna’s Medicare Advantage plans in North Carolina for 2025 and pick the plan that gives you peace of mind.

Key Takeaways

- Aetna Medicare Advantage Plans in North Carolina offer HMO, PPO, and PFFS options that cover at least the same benefits as Original Medicare Part A and B and may include extra benefits such as dental, vision, and hearing coverage.

- Beneficiaries could compare and enroll in Aetna’s plans on this website and by phone, with a variety of plans available that could be tailored to different health needs and potential prescription requirements to ensure accessible healthcare coverage.

- Some of the Aetna Medicare Advantage Plans may provide comprehensive healthcare management, possibly including prescription drug coverage, a 24/7 nurse line, and support services that could extend to non-medical forms of care, reflecting a commitment to extensive member resources and high CMS star ratings.

Compare Plans in One Step!

Enter Zip Code

Exploring the Potential Aetna Medicare Advantage Plans in North Carolina

North Carolina’s Medicare beneficiaries will likely have a plethora of choices when it comes to selecting a Medicare Advantage plan, thanks to Aetna’s extensive offerings. From Health Maintenance Organization (HMO) to Preferred Provider Organization (PPO) and Private Fee-for-Service (PFFS) plans, Aetna strives to cater to the diverse healthcare needs of North Carolinians.

Each of these plans guarantees a minimum coverage equivalent to Original Medicare Part A and B, safeguarding enrollees’ access to vital healthcare services.

Understanding Medicare Advantage HMO and PPO Options

When it comes to Medicare Advantage plans, one size certainly does not fit all. That’s why Aetna offers both HMO and PPO plans, providing flexibility in choosing providers. Aetna’s PPO plans allow members the freedom to choose from any provider who accepts Medicare, providing flexibility in healthcare choices. While choosing in-network providers can result in lower costs, PPO members also have the option to seek care from out-of-network providers.

Contrastingly, Aetna’s HMO plans follow a more rigid structure, mandating that members use in-network providers for their healthcare needs, barring emergencies. Many of these HMO plans require members to select a primary care provider (PCP) and obtain a referral to see specialists. This setup encourages coordinated care, where your healthcare providers work together to manage your overall health.

The Potential Benefits of Aetna’s Medicare Advantage Plans

In addition to offering comprehensive health coverage, some of Aetna’s Medicare Advantage plans may come with a host of extra benefits that could go beyond Original Medicare. Some of these benefits include:

- Coverage for oral exams, cleanings, and X-rays

- Vision coverage that could include annual eye exams and allowances for eyeglasses or contacts

- Hearing benefits that might encompass an annual exam and hearing aid fitting

These possible benefits could provide you with the best coverage for your healthcare needs, possibly ensuring more comprehensive protection.

How to Access Aetna’s Secure Website for Plan Information

Aetna could potentially simplify healthcare plan management through its user-friendly and secure website, which will likely include the Aetna Medicare website. To access this platform, both current and prospective members need to create an account to access their plan information. Once logged in, members can view details about their coverage, which may include the status of claims and plan benefits.

Designed with user-friendliness in mind, Aetna’s secure website could potentially offer some of the following features:

- Easy access to information related to your health plans

- Convenient management of mail-order prescriptions through the Aetna Pharmacy section

- A one-stop-shop for all your healthcare needs

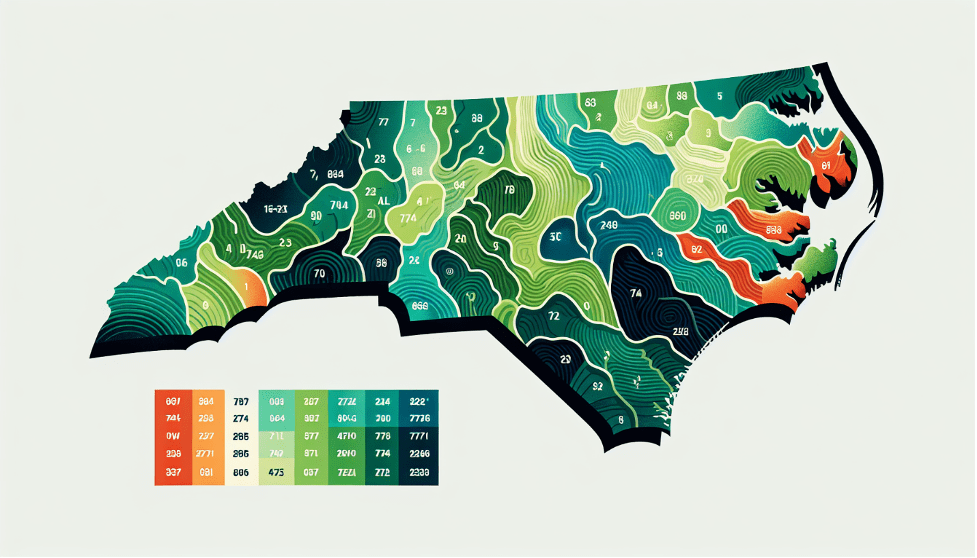

Navigating Coverage Areas: Aetna’s Plans by ZIP Code

Recognizing that healthcare needs differ, Aetna will likely offer coverage options that vary by ZIP code, which could enable members to select a plan that aligns with their specific healthcare requirements and preferences. Beneficiaries in North Carolina will likely have access to a variety of Aetna Medicare Advantage plans including HMO-POS, PPO, and Dual Special Needs Plans (D-SNP).

To determine the specific plan availability in your area, Aetna has made it easy with their online tool. Simply follow these steps:

- The tool will display relevant plan information.

- Use this information to explore your options and make an informed decision.

Find Your Fit: Matching Plans to Your Health Needs

Selecting a Medicare Advantage plan is a significant decision, particularly when considering personal health needs and potential prescription drug requirements. That’s where SilverScript Part D plans might come in. Potentially offered by Aetna, some of these plans could provide a range of formulary options, that may allow individuals to tailor their plan to their specific prescription drug needs.

With varying monthly premiums, deductibles, copays, and possible gap coverage, members might find a plan that suits their needs.

Enrolling in an Aetna Medicare Advantage Plan

After exploring some of Aetna’s Medicare Advantage plans and identifying the most suitable one, the subsequent step involves enrollment. To be eligible for a Medicare Advantage (Part C) plan, individuals must first be enrolled in Original Medicare Parts A and B.

Aetna has made the enrollment process as seamless as possible. Individuals can enroll in Aetna Medicare Advantage plans by calling 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. One of our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Prescription Drug Coverage with Aetna Medicare Plans

Prescription drug coverage could potentially become an integral part of beneficiaries’ healthcare plans. Some of the Aetna Medicare Advantage plans may include a comprehensive formulary that could list all covered prescription drugs, complete with details such as drug tiers, any potential requirements or limits, and mail-order availability.

This could help ensure that members could manage their prescription costs effectively by ensuring their new prescriptions are on their plan’s drug formulary, considering a smaller initial supply, and regularly reviewing their medications with healthcare professionals for necessity and redundancy.

For those who qualify, the Patient Access Network (PAN) Foundation might also provide financial assistance to cover certain medication costs. And, if you’re not eligible for this program, Aetna will likely offer alternative resources that could aid in managing your prescription costs, such as:

- Prescription discount programs

- Generic drug options

- Mail-order pharmacy services

- Medication therapy management programs

These resources could help make your medications more affordable and accessible.

Understanding Part D and Its Potential Integration with Medicare Advantage

Aetna’s commitment to providing comprehensive healthcare coverage will likely be evident in some of its Medicare Advantage plans that might include prescription drug coverage, also known as MAPD plans. This potential integration of Part D prescription drug coverage into certain Medicare Advantage could potentially ensure that members may have access to the prescription drugs they need under one convenient plan.

Managing Prescriptions: Aetna’s Mail-Order Service

Aetna may also provide a mail-order prescription service via CVS Caremark® Mail Service Pharmacy for convenience. This service could allow Aetna’s Medicare Advantage plan members to manage their prescriptions securely online, potentially saving them time and effort.

Aside from convenience, this mail-order service could also provide cost savings. By ordering a 90-day supply of medications, members may be able to reduce some of their costs. With the SilverScript Plus plan, members could potentially enjoy:

- Mail-order prescriptions typically arrive within 10 days

- Options for alternate delivery addresses or expedited shipping for an extra cost

And while returns on mail-order prescriptions may not be accepted, Aetna might be able to provide exceptions in certain cases, ensuring that members could be supported in managing their prescriptions.

Member Resources and Support Services

Membership in Aetna’s Medicare Advantage plans could grant access to a range of resources and support services that will likely be tailored to enhance your healthcare journey. From the Aetna HealthSM mobile app, which lets you manage your plan information at your fingertips, to educational resources that may be available through Medicare.gov and CMS’s website, Aetna could ensure you have all the information you need to make informed healthcare decisions.

One particularly helpful resource could be Aetna’s Medicare glossary. With this tool, you may easily navigate complex healthcare terminology, which could aid in informed decision-making. What’s more, Aetna’s commitment to excellence in healthcare coverage will likely be reflected in its ratings. Approximately 87 percent of its Medicare Advantage members have been enrolled in plans rated 4 stars or higher by CMS for 2024, demonstrating the high quality of care Aetna provides.

24/7 Access to Healthcare Professionals

Understanding that healthcare concerns can arise anytime, Aetna may also provide a 24/7 nurse line, ensuring uninterrupted access to healthcare advice and support for members. This service, known as the Informed Health Line®, may allow Aetna Medicare Advantage plan members to speak with a registered nurse anytime, ensuring that help is always just a phone call away.

Whether you need to learn more about a health condition, understand medical tests or procedures, or prepare for a doctor’s visit, the Informed Health Line® will likely be able to assist you. This nurse advice service is available 24 hours a day, 365 days a year, potentially providing peace of mind that you can always access medical guidance when you need it most.

Comparing Aetna to Other Providers in North Carolina

The decision to select a Medicare Advantage plan could be momentous, warranting careful evaluation of all available options. In North Carolina, Aetna will likely be one of many providers offering Medicare Advantage plans.

Other top providers in the state include Blue Cross Blue Shield, Cigna, and Anthem, along with Aetna, UnitedHealthcare, and the market-leading Humana.

Evaluating Plan Options: Aetna vs. Competitors

Aetna will likely advocate for a thorough comparison of options when deciding on a Medicare Advantage plan. By utilizing comparison tools and worksheets, members may be able to evaluate Aetna’s Medicare Advantage plans against competitors to ensure alignment with their individual health goals.

Blue Cross Blue Shield will likely offer robust local support to its Medicare Advantage members in North Carolina, an important contrast to consider when comparing with Aetna’s offerings. While Humana is recognized for its low-cost plan options and high overall CMS Star Rating, Aetna encourages out-of-network physicians to engage with their Member Services to possibly join their network.

Feedback and Ratings: What Members Say About Aetna

Member feedback and ratings could serve as valuable indicators of a Medicare Advantage plan’s quality. Some of Aetna’s Medicare Advantage plans in North Carolina have an above-average member experience rating, with a score of 3.79 out of 5, indicating a high level of satisfaction among members.

The rating scale used by CMS for rating Medicare Advantage and Part D plans ranges from one to five stars, providing a benchmark for comparing plan quality. When considering a plan, it’s important to look at the CMS Star Rating but also to review member feedback and new tab feedback to get a comprehensive understanding of the plan’s quality.

Maximizing Your Medicare Advantage Plan

After selecting a Medicare Advantage plan, the subsequent step involves leveraging its potential benefits to the fullest. Whether you’re managing healthcare costs or staying in-network for care, understanding your plan’s coverage and benefits could help you make the most out of your plan.

Keeping Possible Healthcare Costs in Check

Grasping the potential coverage and costs that may be associated with some of the Aetna Medicare Advantage plans could be key to effective healthcare expense management. Aetna’s secure website may enable members to view detailed information on their potential healthcare costs, the extent of coverage provided by the plan, deductible status, and possible out-of-pocket maximums.

Aetna’s Medicare Advantage Plans cover all Medicare services, providing comprehensive medicare coverage, including Part A and Part B benefits, but some plans may offer additional benefits that may arise from new laws or Medicare policy decisions. These plans could also offer coverage for things Original Medicare might not cover, such as vision, hearing, and dental services.

Some Medicare Advantage Plans may even tailor their benefit packages to potentially offer additional benefits specifically for chronically ill enrollees, with certain benefits that could be customized to treat specific conditions.

Staying In-Network: Finding Doctors and Hospitals

Opting for in-network providers may also serve as another effective strategy to derive maximum benefit from your Medicare Advantage plan. Aetna’s online directory will likely make it easy for members to find in-network:

- doctors

- hospitals

- urgent care centers

- pharmacies

For the most accurate provider search results, members should access the directory through their secure member account, which tailors search results to their plan type.

Members may also:

- Change their primary care physician anytime through their secure online account or by contacting Aetna directly

- If a primary care physician departs from the Aetna network, members are prompted to select a new in-network physician

- Staying in-network could potentially lead to lower out-of-pocket costs and a more coordinated healthcare experience, as in-network providers may easily share medical records and communicate with each other.

Summary

Navigating the world of Medicare Advantage plans may be complex, but with Aetna, members in North Carolina could potentially enjoy a variety of plans that could be designed to cater to their diverse healthcare needs. From HMO to PPO and PFFS plans, Aetna will likely offer comprehensive coverage, potential benefits, and the flexibility to choose providers that best fit your healthcare preferences.

Choosing a healthcare plan is a significant decision, and Aetna may provide the resources and support services you need to make an informed choice. Aetna may go above and beyond to ensure members have everything they need to maximize their health and wellness.

Frequently Asked Questions

→ What is the difference between Aetna Medicare and Aetna Medicare Advantage?

Aetna Medicare Advantage plans, also known as Part C plans, are offered by private insurance companies like Aetna Medicare and some plans may include extra benefits that Original Medicare does not offer.

→ Why are people choosing Medicare Advantage plans?

Some people may choose Medicare Advantage plans due to the lack of prior authorization and quick payments from insurers.

→ What types of Medicare Advantage plans does Aetna offer in North Carolina?

Aetna offers Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS) Medicare Advantage plans in North Carolina, providing a range of options for beneficiaries.

→ How can I enroll in an Aetna Medicare Advantage plan?

You can enroll in an Aetna Medicare Advantage plan by calling a licensed agent at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. To be eligible, you must first be enrolled in Original Medicare Parts A and B.

→ What prescription drug coverage could Aetna offer?

Some of the Aetna Medicare Advantage plans may provide comprehensive prescription drug coverage through a formulary that will likely include details about drug tiers, requirements, and mail-order availability.

ZRN Health & Financial Services, LLC, a Texas limited liability company