Medicare Advantage Plans Utah 2026

Curious about what the Medicare Advantage plans in Utah could offer

Key Takeaways

- Some Medicare Advantage Plans in Utah

2026 may offer additional benefits that could extend beyond Original Medicare, possibly covering dental, vision, and hearing services.

- Medicare Advantage Plans in Utah offers various options (HMO, PPO, SNP) each catering to different healthcare needs.

- Enrollment deadlines are critical; beneficiaries must enroll by December 31 to avoid coverage interruptions, with options for Special Enrollment if plans are discontinued.

Compare Plans in One Step!

Enter Zip Code

Understanding Utah Medicare Advantage Plans 2026

Utah has seen a significant increase in the number of Medicare Advantage plans, with approximately 47 different options available in 2024, up from 28 in previous years. This growth likely reflects the expanding choices for residents seeking comprehensive healthcare coverage. Eligibility for Medicare plans in Utah generally includes individuals aged 65 and older, or those with certain disabilities or chronic health conditions.

Utah’s Medicare coverage options include Original Medicare (Parts A and B) and sometimes Medicare Advantage (Part C) plans, which may be provided by private insurers. Certain plans may also offer additional benefits that could go beyond what Original Medicare provides, possibly making these plans an attractive option for many residents.

When exploring the potential Medicare coverage options, understanding the differences between plans could help members meet their specific healthcare needs.

Types of Utah Medicare Advantage Plans Available

Utah offers a diverse range of Medicare Advantage plans, including HMO, PPO, and Special Needs Plans (SNPs). Each type of plan has its own set of features and benefits, catering to different healthcare needs and preferences.

These options could help in selecting a plan that best fits your lifestyle and medical requirements.

HMO Plans

Health Maintenance Organization (HMO) plans require members to select a primary care physician (PCP) who coordinates their care and provides referrals to specialists. This approach likely promotes better health outcomes by having all aspects of healthcare managed through the PCP.

However, these plans typically do not allow out-of-network care, meaning members must stay within the designated network of providers to receive full plan benefits. This structure could potentially help maintain lower costs, but requires members’ careful consideration of the network’s coverage.

PPO Plans

Preferred Provider Organization (PPO) plans offer greater flexibility in choosing healthcare providers and do not require referrals for specialists. This could mean that members could see any provider who accepts Medicare, possibly providing more freedom to access care as needed.

While PPO plans allow for out-of-network care, choosing out-of-network providers might result in higher costs compared to in-network services. Monthly premiums and deductibles for these plans may vary based on the specific plan details, offering options to fit different budgets and healthcare needs.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are designed specifically for individuals with certain health conditions, providing specialized care and services tailored to their unique needs. These plans will likely be available for individuals with chronic conditions, those eligible for both Medicare and Medicaid, and residents of long-term care facilities. SNPs could offer focused benefits and services to help manage chronic health issues effectively.

Eligibility for SNPs includes having Medicare Part A and B, living within the plan’s service area, and meeting specific criteria for one of the three SNP types. These plans may be either HMO or PPO types and cover the same basic Medicare benefits as other Medicare Advantage plans.

Overview of Utah Medicare Advantage

Utah residents will likely have access to about 47 different Medicare Advantage plans, a significant increase from the 28 options available the previous years. This growth likely reflects the expanding choices for residents seeking comprehensive healthcare coverage.

Based on data from recent years, Medicare Advantage Plans in Utah have served over 460,000 residents, including those aged 65 and older and individuals with certain disabilities. With a variety of plans and benefits available, residents could find a plan that suits their healthcare needs and budget.

Possible Services and Benefits

Some Medicare Advantage plans may offer a wide range of additional services and benefits, which may include:

- Prescription drug coverage options

- Additional benefits like dental checkups, cleanings, and X-rays

- Vision benefits such as annual eye exams and assistance with eyewear

- Hearing coverage, which may include support for hearing aids and annual hearing exams

These potential benefits could help ensure comprehensive care for members.

Potential Benefits of Utah Medicare Advantage Plans 2026

Some Medicare Advantage plans in Utah may offer additional benefits that might go beyond Original Medicare, possibly making them an attractive option for many residents. These plans may include additional benefits such as vision, dental, and hearing coverage, which are not available under Original Medicare. Additionally, certain plans might include coverage for prescription drugs, potentially reducing the need for separate Part D plans and possibly simplifying healthcare management.

Potential Health Services

Dental services might include routine oral exams, cleanings, and procedures like fillings and extractions. Vision benefits could cover an annual eye exam and may include the cost of eyeglasses or contact lenses, possibly helping members maintain their eye health.

Hearing services will likely encompass annual hearing tests and coverage for hearing aids under certain plans, possibly ensuring comprehensive care for all aspects of health.

Enrollment Process for Utah Medicare Advantage Plans

Enrolling in a Utah Medicare Advantage plan involves providing personal information, such as proof of age and citizenship. Individuals must enroll in a new Medicare Advantage plan by December 31. This is necessary to avoid interruption in coverage if their current plan is being discontinued.

Knowing the different enrollment periods ensures timely and effective enrollment.

When to Enroll

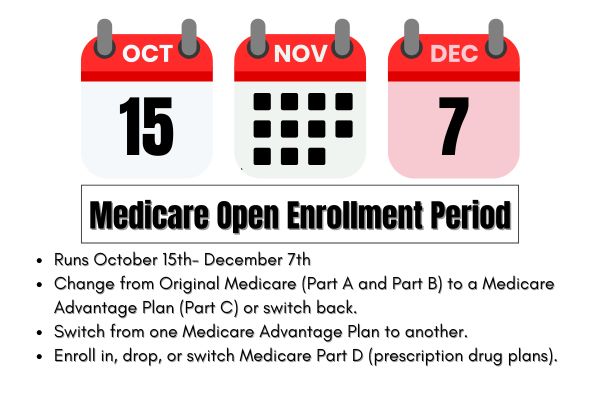

The Annual Enrollment Period (AEP) begins on October 15 and ends on December 31 each year. During this time, beneficiaries can enroll in new plans or make changes to their existing coverage. Individuals turning 65 have a seven-month period around their birthday to enroll in a Medicare Advantage plan. Enrolling by December 31 avoids losing current coverage if your plan is discontinued.

A Special Enrollment Period (SEP) is available for individuals affected by plan discontinuations. This period runs from December 8 to February 28. This period allows for adjustments to new plans and ensures continuous coverage. Enrollment for a new Medicare Advantage plan can begin on October 15 during the AEP.

Different Enrollment Periods

The Initial Enrollment Period (IEP) lasts for seven months, starting three months before you become eligible for Medicare and ending three months after. The AEP allows all beneficiaries to make changes to their Medicare plans from October 15 to December 7 each year.

The Medicare Advantage Open Enrollment Period (OEP) from January 1 to March 31 allows individuals to switch plans or revert to Original Medicare.

Special Enrollment Periods arise from circumstances such as moving, losing other health coverage, or qualifying for specific programs. These periods offer beneficiaries the flexibility to adjust their coverage as needed. Coverage from new plans generally starts on the first day of the month following the plan’s acceptance of your enrollment request.

OEP, AEP, and Special Enrollment

During the AEP, beneficiaries can change or enroll in Medicare Advantage plans, while the SEP provides flexibility for those affected by plan discontinuations or qualifying life events. The SEP is available for individuals who experience significant life events, such as moving or losing other coverage, allowing them to enroll or change plans outside regular enrollment times.

If a plan’s contract with Medicare ends, members can switch to another plan starting two months before and ending one month after the contract termination. Those who lose their Medicaid eligibility have a three-month window to enroll in a Medicare Advantage Plan.

The 5-star SEP allows eligible individuals to switch to a Medicare plan with a star ratings quality rating.

Potential Costs Associated with Utah Medicare Advantage Plans

The potential costs associated with Utah Medicare Advantage plans may vary significantly, influenced by the type of plan and benefits included.

Premiums and Co-Pays

Certain Medicare Advantage plans may offer lower premiums compared to Original Medicare, depending on the specific plan chosen.

Since various private insurers provide these plans, there will likely be different premium structures and co-pay amounts, giving beneficiaries the flexibility to select a plan that aligns with their financial and medical needs.

Out-of-Pocket Maximums

The maximum out-of-pocket costs for Medicare Advantage plans in Utah may vary depending on the plan selected. Medicare Advantage plans will likely be designed to help cap out-of-pocket expenses, possibly protecting members from excessive healthcare costs in a given year.

Plans with lower monthly premiums might have higher out-of-pocket maximums, while those with higher premiums might offer lower maximum limits. This structure could provide financial predictability for enrollees, possibly ensuring that their healthcare expenses remain manageable.

How to Qualify for Utah Medicare Advantage Plans 2026

To qualify for Medicare Advantage plans in Utah, individuals must be permanent residents of the state and enrolled in Original Medicare. They must be at least 65 years old or have a chronic health condition or disability to qualify for these plans. Those of any age with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) are also eligible for Medicare Advantage plans in Utah.

Enrollment typically coincides with the initial enrollment period, which spans seven months around an individual’s 65th birthday. Additionally, individuals may qualify for a special enrollment period under specific circumstances, such as moving or losing employer-sponsored benefits.

Understanding these eligibility criteria likely ensures that residents can access the healthcare coverage they need.

Contracted Network and Access to Care

Medicare Advantage plans in Utah will likely include a mix of HMO and PPO options, possibly providing flexible access to a wide range of healthcare providers. Members can easily check if their healthcare providers are part of the network, ensuring they receive covered care. Medicare Advantage plans in Utah have established a large network of doctors and hospitals, likely offering broad access to care for their Medicare Advantage members.

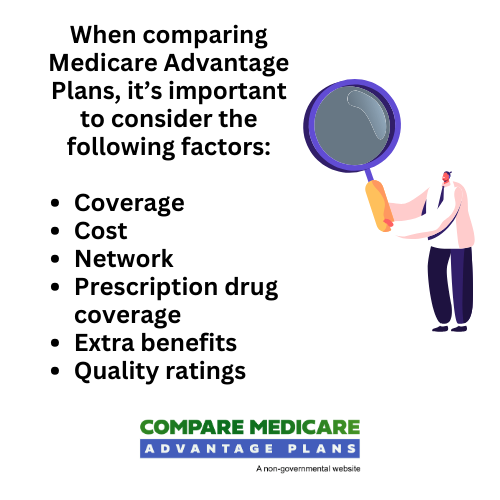

Comparing Utah Medicare Advantage Plans to Original Medicare

Some Medicare Advantage plans might include additional benefits that could go beyond what Original Medicare offers, such as routine dental and vision coverage. Comparing these plans to Original Medicare could highlight the differences in coverage and costs, likely helping beneficiaries make informed decisions about their healthcare.

Coverage Differences

With Original Medicare, beneficiaries have access to any doctor who accepts Medicare, but Medicare Advantage plans might restrict coverage to a specific network of providers. Some Medicare Advantage plans may also incorporate drug coverage, while Original Medicare does not include prescription drug benefits unless a separate Part D plan is purchased.

Some Medicare Advantage plans may also include extra benefits such as dental, vision, and hearing coverage.

Cost Comparisons

Unlike Original Medicare, which does not have an out-of-pocket spending limit, some Medicare Advantage plans may feature an annual cap on certain out-of-pocket expenses. This cap could provide financial predictability for enrollees, possibly ensuring that their healthcare expenses remain manageable.

The potential costs associated with Medicare Advantage plans may vary significantly, which might include varying premiums, deductibles, and out-of-pocket maximums compared to Original Medicare.

Emergencies and Referrals

In a public health emergency, Medicare benefits are accessible without referrals, ensuring timely care. In the case of disasters, Medicare Advantage plans may implement immediate changes to benefit members, bypassing the usual notification period. Medicare Advantage plans provide worldwide emergency and urgent care coverage, ensuring that members are protected no matter where they are.

Within PPO plans, members do not require a referral to consult a specialist, offering more flexibility in accessing care.

Summary

Utah Medicare Advantage plans

Frequently Asked Questions

→ What are the different types of Medicare Advantage plans available in Utah ?

In Utah, the types of Medicare Advantage plans available include HMO, PPO, and Special Needs Plans (SNPs), each designed to accommodate various healthcare requirements and preferences.

→ When is the Annual Enrollment Period for Medicare Advantage plans?

The Annual Enrollment Period for Medicare Advantage plans is from October 15 to December 7 each year. During this time, you can enroll, switch, or drop Medicare Advantage plans.

→ What additional benefits could Medicare Advantage plans offer compared to Original Medicare?

Some Medicare Advantage plans may offer additional benefits like dental, vision, and hearing coverage, possibly enhancing member’s overall healthcare experience.

→ How do Medicare Advantage plans handle emergencies and referrals?

Medicare Advantage plans typically allow members to access emergency care without referrals, and during public health emergencies, out-of-network costs may be adjusted to in-network rates. Additionally, PPO plans do not require referrals for specialist visits.

ZRN Health & Financial Services, LLC, a Texas limited liability company