Medicare Advantage Plans

Medicare Advantage Plans, or Part C, are private insurance options that cover everything Original Medicare does, plus extras may include prescription drugs, dental, vision, and hearing. This guide will explain what these plans offer, their benefits, and how to choose the right one.

Key Takeaways

- Medicare Advantage Plans (Part C) provide private insurance options combining Medicare Parts A and B benefits with additional services that might be included such as prescription drug coverage, dental, vision, and hearing care.

- There will be various types of Medicare Advantage Plans in 2026 offered by several companies, including HMO, PPO, and Special Needs Plans, each with distinct coverage structures and requirements catering to different healthcare needs.

- Enrollees must regularly review their Medicare Advantage Plans during specific enrollment periods to ensure optimal coverage and manage costs effectively. This includes assessing premiums, out-of-pocket expenses, and provider networks.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans

Medicare Advantage Plans, often referred to as Part C, are private insurance options that replace the hospital and outpatient benefits provided under Original Medicare. These plans are offered by private companies approved by Medicare and include all the benefits of Parts A and B, plus additional services may include prescription drug coverage, dental, vision, and hearing benefits.

What sets Medicare Advantage Plans apart is their ability to provide comprehensive coverage through a single plan. These plans are designed to integrate seamlessly with Medicare Parts A and B, often featuring lower cost sharing and maximum out-of-pocket costs compared to Original Medicare.

Here, we break down the basics of Medicare Part C and how these plans operate.

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, is a way for individuals to receive their Medicare benefits through private insurance plans. These plans provide all Part A and Part B services, plus additional services not covered by Original Medicare, such as prescription drug coverage, dental, vision, and hearing benefits. Typically, Medicare Advantage Plans include a broad network of physicians and hospitals, offering beneficiaries a wide range of healthcare providers.

To enroll in a Medicare Advantage Plan, individuals must be enrolled in both Medicare Part A and Part B. These plans are financed through fixed monthly payments from the government based on geographic location and the enrollee’s health. Options for choosing a Medicare Advantage Plan include HMO, PPO, D-SNP, and C-SNP, each catering to different healthcare needs and preferences.

How Medicare Advantage Plans Work

Medicare Advantage Plans typically require members to use a network of providers and often mandate referrals to see specialists. This network-based approach helps decrease costs while ensuring beneficiaries receive coordinated care. However, the specifics of accessing services, such as the necessity for referrals, can differ between plans.

These plans are designed to integrate with Medicare Parts A and B, providing additional benefits beyond Original Medicare. For instance, many Medicare Advantage Plans include built-in prescription drug coverage, allowing beneficiaries to obtain both healthcare and medication under a single plan. Grasping these details helps in maximizing the benefits of Medicare Advantage.

Types of Medicare Advantage Plans

Medicare Advantage Plans come in various forms, each with unique structures and coverage rules. The most common types include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Knowing the differences between these types aids in selecting the plan that best matches your healthcare needs.

Each type of Medicare Advantage Plan offers distinct advantages and caters to different healthcare preferences and requirements:

- HMO plans typically offer lower out-of-pocket expenses but require members to use a specific network of providers.

- PPO plans provide more flexibility in choosing healthcare providers but may come with higher costs for out-of-network services.

- Special Needs Plans are tailored for individuals with specific health needs or conditions.

HMO Plans

Health Maintenance Organization (HMO) plans are popular among Medicare beneficiaries due to their lower out-of-pocket expenses. These plans typically offer low monthly premiums and low copayments for services. However, members are required to use a specific network of providers and choose a primary care provider who coordinates their care and provides referrals to specialists.

HMO plans can significantly reduce healthcare costs for members through network-based care. By limiting services to in-network providers, these plans ensure that care is both efficient and cost-effective. This structure helps keep overall healthcare expenses down while providing comprehensive coverage.

PPO Plans

Preferred Provider Organization (PPO) plans offer greater flexibility compared to HMO plans. Beneficiaries can seek care from both in-network and out-of-network providers, although out-of-network services typically come at a higher cost. This flexibility allows members to choose their healthcare providers more freely, making PPO plans a suitable option for those who want more control over their healthcare choices.

One of the significant advantages of PPO plans is that members do not need referrals to see specialists. Direct access to specialized healthcare benefits individuals with specific medical needs or conditions requiring frequent specialist visits.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health needs, including chronic conditions, disabilities, or those eligible for both Medicare and Medicaid. There are different types of SNPs to cater to various needs. Dual Special Needs Plans (D-SNPs) are designed for those eligible for both Medicare and Medicaid, while Chronic Condition SNPs (C-SNPs) cater to beneficiaries with chronic health issues like diabetes, heart conditions, lung disease, and kidney disease.

Institutional Special Needs Plans (I-SNPs) are for individuals who expect to be in a long-term care or skilled nursing facility, or need intermediate care for an extended period. These plans provide specialized care that addresses the unique health challenges faced by these groups, ensuring comprehensive and tailored healthcare services.

Coverage Options in Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, provide a combination of benefits from Medicare Parts A and B along with extra services. These plans are an alternative to Original Medicare, combining both hospital and medical insurance into one comprehensive plan. Beyond the standard benefits, Medicare Advantage Plans often include valuable extras such as dental, vision, and hearing coverage.

Aetna Medicare Advantage Plans, for instance, offer total health benefits and services focused on comprehensive care, which are detailed in the Evidence of Coverage document. Coverage options and benefits can vary by service area, so it’s essential to review the specific offerings of each plan.

Prescription Drug Coverage

Most Medicare Advantage Plans provide integrated prescription drug coverage, often categorized as Part D. This integration allows beneficiaries to obtain both healthcare and prescription drugs under a single plan, simplifying the process of managing their medical needs. In 2024, about 75% of individuals in Medicare Advantage Plans with prescription drug coverage do not pay any premium beyond the Part B premium.

However, some plans may require a separate deductible for prescription drug coverage, in addition to any general plan deductible. Copayments and coinsurance for services under Medicare Advantage Plans can vary widely based on plan design and service type.

It’s crucial to identify your regular medications and ensure they are covered by the plan to avoid unexpected costs.

Additional Benefits

Medicare Advantage Plans may include lower out-of-pocket costs compared to traditional Medicare with additional benefits like dental and vision coverage. The plans include preventive and comprehensive dental services. These services consist of cleanings, fluoride treatments, fillings, crowns, root canals, extractions, and dentures. Vision benefits often include low-cost eye exams and an allowance for eyewear.

Hearing coverage is another significant benefit, providing savings on thousands of brand-name hearing aids and often including low-cost routine hearing exams.

These extras can significantly enhance the overall value of the plan, making it more than just a replacement for Original Medicare.

Emergency Situations

Medicare Advantage Plans generally cover emergency services, regardless of whether the provider is in the network. This ensures that beneficiaries can access emergency care when needed, providing a sense of security during urgent health situations.

Emergency care coverage is a critical aspect of these plans, ensuring that beneficiaries are protected in urgent situations.

Comparing Costs and Savings

When it comes to Medicare Advantage Plans, understanding the cost structure is essential. Each plan can have varying out-of-pocket costs and service rules. The average monthly premium for Medicare Advantage Plans ranges depending on coverage and insurer. Evaluating different Medicare Advantage Plans involves looking at factors like premiums, out-of-pocket costs, and additional benefits offered.

It’s crucial to compare costs like premiums, deductibles, and copayments between different plans to find the best fit for your budget. Not just focusing on premiums, but also considering out-of-pocket costs and included benefits can help you lower costs and make an informed decision.

This section will guide you through the various financial considerations to keep in mind when comparing Medicare Advantage Plans.

Monthly Premiums and Deductibles

Medicare pays a fixed monthly amount to companies for providing care under Medicare Advantage Plans. The monthly premiums for these plans can be affected by the region and county you live in.

In addition to the Medicare Advantage Plan costs, a Part B insurance premium is required. There may also be a separate monthly premium for the Medicare Advantage Plan itself.

Members receive an Annual Notice of Change each year that summarizes updates to costs and benefits for the upcoming year. Regular annual reviews can help identify potential changes in premiums and benefits that could affect your healthcare costs.

Cost Sharing Amounts

Cost-sharing refers to the portion of healthcare costs that beneficiaries are required to pay on top of their premiums, which includes:

- Copayments, which are a fixed dollar amount that beneficiaries pay for a specific service

- Coinsurance, which is the percentage of costs that the beneficiary is responsible for after the deductible has been met

- Deductibles, which are the amounts beneficiaries must pay out-of-pocket before their insurance starts to cover costs

In Medicare Advantage Plans, copayments can vary based on the type of service, such as a visit to a primary care doctor versus a specialist. Coinsurance typically applies to more expensive procedures and can range from 10-30% of the total cost depending on the specific plan details. For instance, a common copayment for a doctor’s visit under a Medicare Advantage Plan could be $20, while a hospital stay might involve coinsurance of 20% after the deductible.

Annual Out-of-Pocket Limits

Each Medicare Advantage Plan has an annual limit on out-of-pocket expenses, providing a cap on potential healthcare costs.

This annual limit ensures that beneficiaries have a safety net for their healthcare expenses.

Enrollment and Eligibility

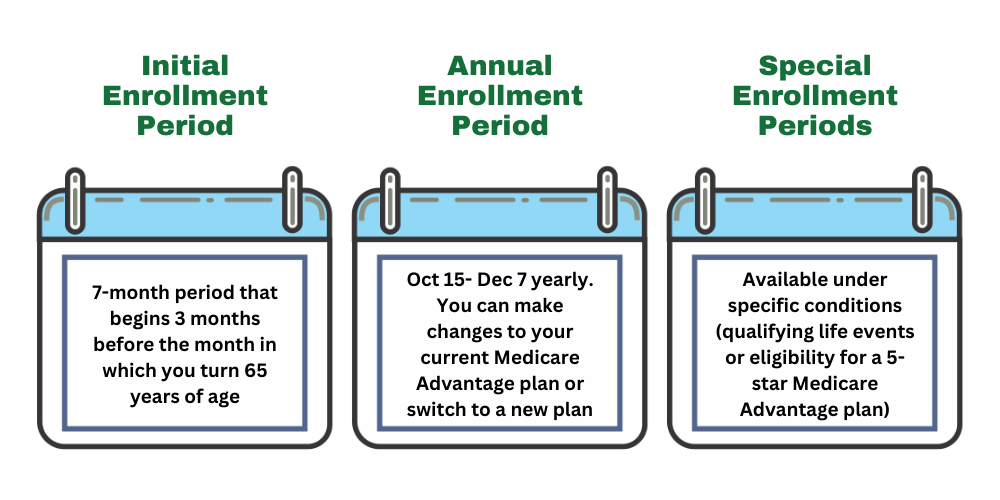

Enrolling in a Medicare Advantage Plan can only be done during specific periods throughout the year, including the Initial Enrollment Period and the Open Enrollment Period. Understanding these enrollment periods is crucial for ensuring you don’t miss the window to apply or make changes to your plan.

The eligibility criteria for enrolling in a Medicare Advantage Plan require individuals to be enrolled in both Medicare Part A and Part B. The following will detail the different enrollment periods and qualifications for enrolling in a Medicare Advantage Plan.

Initial Enrollment Period

The Initial Enrollment Period spans seven months, starting three months before and ending three months after the month of turning 65. This period is critical for new beneficiaries to sign up for Medicare Advantage Plans. During this time, individuals can apply for Medicare Advantage, ensuring they don’t miss out on the benefits these plans offer.

Individuals turning 65 can sign up for Medicare Advantage during the month of their birthday, alongside the three months before and three months after. This enrollment window allows for ample time to review and choose the best plan to meet their healthcare needs.

Special Enrollment Period

A Special Enrollment Period (SEP) allows individuals to enroll in a Medicare Advantage Plan outside the usual enrollment periods due to certain qualifying events. Qualifying events for an SEP can include losing employer-based health coverage or moving out of a plan’s service area. For instance, individuals who switch jobs and lose their employer-sponsored coverage or those who relocate to a different state can qualify for an SEP.

The SEP typically allows a person to enroll in a Medicare Advantage Plan for 60 days before or after experiencing a qualifying life event. Other qualifying life events may include becoming divorced or losing existing health coverage. This flexibility ensures that individuals facing unexpected changes in their healthcare situation can still access Medicare Advantage Plans.

Qualifying for Medicare Advantage

To qualify for Medicare Advantage Plans, individuals must be enrolled in both Medicare Part A and Part B. This dual enrollment is a prerequisite for accessing the comprehensive benefits offered by Medicare Advantage Plans. Ensuring that you meet this requirement is the first step towards benefiting from the enhanced coverage these plans provide.

Once enrolled in both Medicare Part A and Part B, individuals can choose from various Medicare Advantage Plan options that suit their healthcare needs and preferences. This eligibility criterion ensures that beneficiaries are well-positioned to take full advantage of the integrated services offered by Medicare Advantage.

Choosing the Right Plan

Selecting the right Medicare Advantage Plan involves a careful assessment of your healthcare needs and preferences. Identifying your specific healthcare needs and financial situation is essential for choosing a suitable plan. It’s crucial to regularly assess your Medicare Advantage Plan to ensure it aligns with your current healthcare needs.

We will guide you through evaluating coverage needs, comparing plan options, and checking provider networks. Understanding these factors helps you make a well-informed decision that fits your health requirements and budget.

Evaluating Coverage Needs

Assessing how often you visit doctors and what types of specialists you require is vital for understanding your coverage needs. Consider your current medical conditions and the frequency of needed care. This evaluation will help determine which type of Medicare Advantage Plan aligns with your medical conditions and treatment preferences.

By thoroughly assessing your healthcare requirements, you can ensure that the plan you choose provides adequate coverage for your specific needs. This evaluation is key to maximizing the benefits of your Medicare Advantage Plan.

Comparing Plan Options

Comparing different Medicare Advantage Plans is crucial to finding a plan that meets your healthcare needs. You can compare plans on this website by entering your zip code into the Plan Finder tool.

Checking Provider Networks

It’s essential to verify that your preferred doctors and specialists are in-network to minimize out-of-pocket expenses. This verification helps avoid higher costs associated with out-of-network services. Checking that primary care providers and specialists are included in a Medicare Advantage Plan’s network is crucial to avoid unexpected out-of-pocket expenses.

By ensuring that your healthcare providers are part of the plan’s network, you can avoid unexpected costs and ensure continuity of care. This step is vital for maintaining a cost-effective and comprehensive healthcare plan.

Maintaining Your Medicare Advantage Plan

Maintaining your Medicare Advantage Plan requires regular reviews and updates to ensure it continues to meet your healthcare needs. Conducting an annual review helps identify any changes in coverage or costs that may affect your healthcare.

This section will guide you through the importance of annual reviews and making changes during open enrollment.

Annual Review

Annual reviews help ensure your Medicare Advantage Plan continues to meet your evolving healthcare needs. By reviewing your plan annually, you can identify any gaps in coverage or benefits that may need updating. This regular assessment ensures better alignment of your healthcare plan with your individual needs.

An annual review helps identify potential changes in premiums and benefits that could impact your healthcare costs. This proactive approach ensures that your plan remains cost-effective and comprehensive.

Making Changes During Open Enrollment

The Open Enrollment Period for Medicare Advantage runs from October 15 to December 7, during which beneficiaries can modify their plans. This period allows beneficiaries to switch, drop, or enroll in new Medicare Advantage Plans. Adjusting your plan during this period ensures it continues to meet your healthcare needs and preferences.

Taking advantage of the Open Enrollment Period allows members to adjust their existing coverage options to better align with their healthcare needs. This flexibility ensures that you can adapt your plan as your healthcare requirements change.

Summary

In conclusion, Medicare Advantage Plans offer a comprehensive alternative to Original Medicare, providing additional benefits and integrated services. Understanding the different types of plans, coverage options, and cost structures is crucial for making an informed decision. Regular reviews and adjustments during enrollment periods ensure that your plan continues to meet your healthcare needs. By following this guide, you can navigate the complexities of Medicare Advantage Plans and choose the one that best suits your needs.

Frequently Asked Questions

→ What is the difference between Medicare Advantage Plans and Original Medicare?

Medicare Advantage Plans, or Part C, provide coverage through private companies and encompass all benefits of Original Medicare (Parts A and B) while often including extra services such as prescription drug coverage, dental, vision, and hearing benefits. In contrast, Original Medicare solely covers hospital and medical services without these additional benefits.

→ How do I enroll in a Medicare Advantage Plan?

To enroll in a Medicare Advantage Plan, you can do so during the Initial Enrollment Period around your 65th birthday or during the Open Enrollment Period from October 15 to December 7. Be sure to act during these times to secure your coverage.

→ What are the costs associated with Medicare Advantage Plans?

Medicare Advantage Plans have costs that may include monthly premiums, deductibles, copayments, and coinsurance. It’s essential to review specific plan details to understand your total potential costs.

→ What additional benefits do Medicare Advantage Plans offer?

Medicare Advantage Plans provide valuable extra benefits such as dental, vision, and hearing coverage. These enhancements can significantly improve your overall healthcare experience.

→ Can I change my Medicare Advantage Plan?

Yes, you can change your Medicare Advantage Plan during the Open Enrollment Period from October 15 to December 7, or during a Special Enrollment Period for qualifying life events. It’s important to stay informed about these timelines to ensure you have the best coverage for your needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company