Medicare Advantage Plans Tennessee 2026

Curious about the potential Medicare Advantage plans in Tennessee

Key Takeaways

- Medicare Advantage Plans in Tennessee include various types such as HMO, PPO, and Special Needs Plans, catering to diverse healthcare needs across the population.

- Beneficiaries could potentially access additional services like dental, vision, and hearing services not covered by Original Medicare, possibly enhancing overall healthcare coverage.

- Enrolling in Medicare Advantage in Tennessee requires being enrolled in Medicare Part A and B, with the Annual Enrollment Period running from October 15 to December 7 each year.

Compare Plans in One Step!

Enter Zip Code

Understanding Tennessee Medicare Advantage Plans 2026

Medicare Advantage plans in Tennessee will likely encompass a variety of options, each designed to cater to the unique needs of the state’s residents. Residents eligible for these plans must be over 65 or have specific disabilities, likely ensuring that the plans cater to those who need them most. Furthermore, these plans may be offered by various private health insurance companies, which may include well-known providers such as Aetna, Blue Cross Blue Shield, and Cigna.

One of the potential advantages of a Medicare Advantage plans might be that all Medicare beneficiaries in Tennessee can opt for a plan. This diversity could potentially mean that even individuals on a tight budget could access the benefits of a Medicare Advantage plan.

Some plans may be designed to offer more comprehensive coverage compared to Original Medicare, which might include additional benefits such as dental, vision, and hearing coverage. This could make them an attractive option for those seeking a more holistic approach to member’s healthcare needs.

Types of Tennessee Medicare Advantage Plans Available

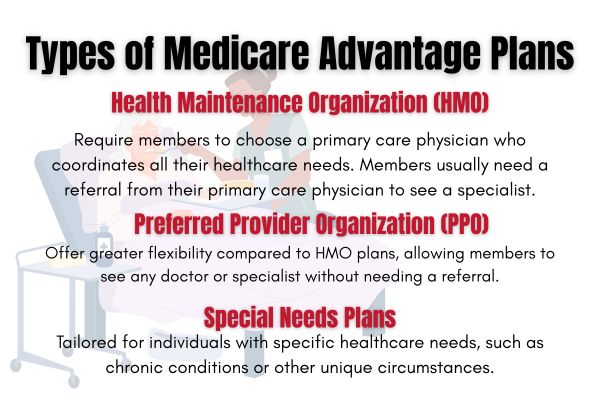

Tennessee will likely offer a variety of Medicare Advantage plans to suit different healthcare needs. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan comes with its unique features and benefits, catering to the diverse requirements of Medicare beneficiaries.

Understanding the potential differences between these plans could help you make an informed decision about which plan may be right for you.

HMO Plans

HMO plans in Tennessee typically require members to select a primary care physician (PCP) and get referrals to see specialists, likely ensuring coordinated and efficient care. Some HMO plans could potentially offer reduced premiums, possibly making them an attractive option for budget-conscious individuals.

PPO Plans

PPO plans offer greater flexibility, permitting visits to any Medicare-approved provider without referrals. This will likely allow members to see specialists directly, providing more freedom in healthcare choices.

PPO plans might have higher premiums but offer out-of-network services. In 2024, about 99% of Medicare beneficiaries had access to at least one PPO plan in their area, likely ensuring widespread availability.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) cater to specific groups, such as those with chronic conditions or dual eligibility for Medicare and Medicaid. SNPs come in different types, including Dual Eligible SNPs (D-SNP), Chronic Condition SNPs (C-SNP), and Institutional SNPs (I-SNP), each with distinct eligibility criteria.

Overview of Tennessee Medicare Advantage Plans 2026

Based on data from recent years, Tennessee had approximately 1.47 million residents enrolled in Medicare, likely reflecting the reliance on these plans for healthcare coverage.

Medicare beneficiaries in Tennessee will likely have access to Medicare Advantage plans. This accessibility could potentially ensure that a wide range of residents, regardless of their financial situation, could benefit from the comprehensive coverage these plans may offer.

Certain plans may be designed to provide more than just basic medical coverage, possibly incorporating additional benefits such as dental, vision, and hearing coverage. These benefits could potentially enhance the overall health and well-being of the enrollees, likely making Medicare Advantage plans a popular choice among Tennessee residents.

Potential Services and Benefits

Some Medicare Advantage plans in Tennessee will likely cover a wide range of services and benefits. Certain plans may include prescription drug coverage, dental, vision, and hearing services. This comprehensive coverage will likely address the diverse healthcare needs of Medicare beneficiaries, possibly providing essential tools for maintaining and improving health.

These additional services will likely highlight the value of Medicare Advantage plans, possibly making them a preferred choice for many Tennessee residents seeking comprehensive healthcare coverage.

Possible Benefits

Some Medicare Advantage plans in Tennessee may offer a variety of additional health services that could go beyond traditional medical coverage, such as dental, vision, and hearing services.

Dental services may include oral exams, cleanings, X-rays, and potentially fillings and extractions. Vision coverage might include an annual eye exam and financial assistance for eyeglasses or contact lenses. Hearing services may also cover annual hearing exams along with support for hearing aids.

Enrollment Process for Tennessee Medicare Advantage Plans 2026

Enrolling in a Medicare Advantage plan for 2026 in Tennessee involves selecting from a variety of plans during designated enrollment periods throughout the year. These plans are governed by specific periods defined by Medicare, making it essential for beneficiaries to understand the timelines and requirements for enrollment.

Understanding when and how to enroll ensures seamless coverage and access to the comprehensive benefits of Medicare Advantage plans.

When to Enroll

Individuals can enroll in Medicare plans around their 65th birthday, with a seven-month window that includes three months before, the month of, and three months after their birth month. This initial enrollment period allows new beneficiaries to select a plan that best suits their needs.

The Annual Enrollment Period (AEP) runs from October 15 to December 7 each year, permitting beneficiaries to make changes to their coverage. The Medicare Advantage Open Enrollment Period (OEP) from January 1 to March 31 allows those already enrolled in a Medicare Advantage plan to switch to another plan or revert to Original Medicare.

Different Enrollment Periods

The general enrollment period for Medicare Advantage plans runs annually from January 1 to March 31, while the open enrollment period lasts from October 15 to December 7 each year. During the AEP, individuals can switch, drop, or enroll in a Medicare Advantage plan.

The Initial Enrollment Period (IEP) spans seven months around one’s 65th birthday, and Special Enrollment Periods (SEPs) allow for plan changes due to specific life events, such as moving out of a coverage area or losing employer-sponsored insurance.

OEP, AEP, and Special Enrollment

Special Enrollment Periods (SEPs) are available for individuals who lose employer coverage or experience qualifying life changes, allowing them to enroll outside of the standard periods. The Medicare Advantage Open Enrollment Period (OEP) from January 1 to March 31 enables beneficiaries to make changes to their plans.

These periods provide flexibility and ensure continuous coverage, accommodating various life circumstances with guidance over time.

Potential Costs Associated with Tennessee Medicare Advantage Plans 2026

Understanding the potential costs associated with Medicare Advantage plans is crucial for beneficiaries. The potential affordability of these plans might make them an attractive option for many residents, possibly offering comprehensive coverage at a reasonable cost.

However, it’s essential to consider all potential expenses, including premiums, co-pays, and out-of-pocket maximums, to make an informed decision.

Premiums and Co-Pays

The monthly premiums and copays for Tennessee Medicare Advantage plans may vary depending on the chosen plan benefits and services.

Out-of-Pocket Maximums

Certain Tennessee Medicare Advantage plans might set an out-of-pocket maximum, possibly limiting the amount members pay in a year for covered services. This limit could potentially mean that enrollees might not have to pay additional costs for covered services for the rest of the year, possibly providing financial protection.

The specific out-of-pocket maximum might vary by plan, possibly offering different levels of coverage based on individual needs.

Potential Services and Benefits

Certain Medicare Advantage plans may provide comprehensive coverage that might include prescription drug benefits, as well as dental, vision, and hearing services. Dental benefits might cover routine checkups, cleanings, and necessary X-rays. Vision coverage could include an annual eye exam and assistance with glasses or contact lenses. Hearing services may feature coverage for hearing aids, fitting exams, and annual checkups to enhance auditory health. These additional benefits could potentially ensure that beneficiaries receive well-rounded healthcare coverage.

How to Qualify for Tennessee Medicare Advantage Plans 2026

To qualify for Medicare in Tennessee, individuals must be residents, U.S. citizens or permanent residents, aged 65 or older, or any age with specific disabilities. Enrollment occurs during the initial seven-month period around one’s 65th birthday.

Tennessee features two main enrollment periods: general enrollment from January 1 to March 31, and open enrollment from October 15 to December 7. Missing the initial enrollment period without qualifying for special enrollment due to a life change may result in a late enrollment penalty.

Contracted Network and Access to Care

Medicare Advantage plans include options such as HMO, PPO, and HMO-POS, allowing members to choose providers in or out of their network. Using in-network providers could potentially lower out-of-pocket costs for Medicare Advantage plan members. Medicare Advantage PPO plan members do not require referrals to see specialists.

Comparing Tennessee Medicare Advantage Plans to Original Medicare

Tennessee residents may choose between Original Medicare and various Medicare Advantage plans, each offering different coverage options. Some Medicare Advantage plans may provide more comprehensive health coverage, which may include additional benefits like vision, hearing, and dental coverage.

Understanding these differences could help beneficiaries make informed decisions about their healthcare coverage.

Coverage Differences

Some Medicare Advantage plans may include additional benefits like vision, hearing, and dental care, which Original Medicare does not cover.

Certain Medicare Advantage plans may also incorporate prescription drug coverage, unlike Original Medicare, which separates these services.

Cost Comparisons

Medicare Advantage plans may have varying monthly premiums, deductibles, and out-of-pocket maximums, likely affecting overall costs. Additional benefits like dental and vision coverage may also influence their cost-effectiveness.

Comparing total costs, including premiums and out-of-pocket expenses, could help determine the best financial option among Medicare Advantage plans.

Emergencies and Referrals

Medicare Advantage PPO plans allow members to visit any provider who accepts Medicare, without needing a referral for specialist visits. In-network visits might cost less with certain plans, but members can still seek care outside the network, especially in emergencies. All Medicare Advantage plans cover emergency services without requiring prior authorization.

Summary

Medicare Advantage plans in Tennessee will likely offer a comprehensive range of benefits that might extend beyond traditional Medicare, possibly including additional services like dental, vision, and hearing coverage. These plans will likely be accessible to all Medicare beneficiaries, with various options to suit various budgets and healthcare needs.

Understanding the enrollment process, potential costs, and coverage differences between Medicare Advantage and Original Medicare could help beneficiaries make informed decisions about their healthcare coverage. Remember, the right plan could significantly impact your overall health and well-being, so choose wisely.

Frequently Asked Questions

→What are the main types of Medicare Advantage plans available in Tennessee?

The main types of Medicare Advantage plans available in Tennessee are HMO, PPO, and Special Needs Plans (SNPs). These options cater to different healthcare needs and preferences.

→When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the Initial Enrollment Period, the Annual Enrollment Period from October 15 to December 7, and the Medicare Advantage Open Enrollment Period from January 1 to March 31. Additionally, Special Enrollment Periods are available for qualifying life events.

→What additional benefits could Medicare Advantage plans offer compared to Original Medicare?

Some Medicare Advantage plans may provide extra benefits like vision, dental, hearing services, which are not offered by Original Medicare. These potential benefits could potentially improve your overall healthcare experience.

→What should I do if I need emergency care while traveling?

If you need emergency care while traveling, you can seek services worldwide, as Medicare Advantage plans cover these without prior authorization. While in-network visits may be more cost-effective, feel free to access care outside the network in emergencies.

ZRN Health & Financial Services, LLC, a Texas limited liability company