Medicare Advantage Plans by State

Navigating the world of Medicare Advantage plans might seem overwhelming, but it doesn’t have to be. With a little guidance, you could find the perfect plan tailored to your needs and preferences.

By understanding the possible differences in plans across states, potential factors to consider when comparing them, and the various enrollment periods, you will likely be well on your way to making an informed decision. Read on to demystify the process and gain valuable insight into Medicare Advantage plans by state.

Key Takeaways

- This article will likely provide an overview of Medicare Advantage plans by state, which may include regional variations in the potential coverage and benefits.

- When selecting a plan, consider factors such as the possible coverage, provider networks, and potential costs to ensure the best fit for individual needs.

- Financial assistance programs might be available to help cover some of the cost of Medicare Advantage plans based on income and family size.

Compare Plans in One Step!

Enter Zip Code

State-by-State Guide to Medicare Advantage Plans

Some of the Medicare Advantage plans will likely be offered by private insurance companies and provide the same coverage as Original Medicare (Part A and Part B), some might come with additional benefits.

However, a majority of these plans may vary substantially based on the company, plan, and geographic region. Examining and comparing the possible Medicare Advantage offerings in your state could be necessary for selecting the plan that aligns with your needs and preferences.

Eligible individuals may be able to benefit from the convenient coverage options that will likely be offered by Medicare Advantage plans, which could include those with chronic health conditions and specific coverage requirements.

Some of these Medicare Advantage plans may include prescription drug coverage, and some could even offer additional benefits like dental and vision care. Remember, seeking advice from your employer, union, or other benefits administrator regarding their potential regulations is important before opting for a Medicare Advantage Plan.

Possible Regional Variations in Medicare Advantage Offerings

The regional disparities in Medicare Advantage plans throughout the US might be significant, with enrollment rates varying from 2% to 60% across states.

The potential coverage of certain Medicare Advantage plans may also differ by state, as does the number of plans available to beneficiaries. For example, in Alaska, about 99% of Medicare Advantage enrollees are in group plans, while in Michigan, at least 40% are in group plans.

The possible benefits of certain Medicare Advantage plans may also vary across states, and the availability of certain providers may differ from one region to another.

When considering enrollment, it’s necessary to compare and evaluate the specific offerings and possible benefits of each Medicare Advantage plan in your state. Understanding the regional variations in Medicare Advantage offerings could help you make a more informed decision when selecting a plan.

State-Specific Rules and Regulations

Each state will likely have specific rules and regulations concerning Medicare Advantage Plans. These may include:

- The necessity of an out-of-pocket limit for services covered under Parts A and B

- The requirement for prior approval or authorization for coverage of certain treatments or services

For instance, in California, some of the specific rules and regulations for Medicare Advantage Plans will likely be found on the California Department of Health Care Services website. In Florida, Medicare Advantage Plans must include all the benefits of Original Medicare Parts A and B and might need to include additional benefits such as prescription drug coverage and extra services.

Being aware of state-specific rules and regulations for Medicare Advantage Plans could help you choose a plan that best aligns with your needs and complies with your state’s requirements.

Comparing Medicare Advantage Plans: Possible Factors to Consider

Comparing the potential Medicare Advantage plans will likely require consideration of several key factors, which may include coverage, provider networks, and costs. Understanding the differences in coverage between various Medicare Advantage plans might help you find the one that best suits your needs. For instance, some of the specifics of the coverage, which could include medical services, prescription drugs, and additional benefits, may differ from plan to plan.

Another possible factor to consider when selecting a Medicare Advantage plan may be the provider network, which could determine the doctors, hospitals, and other healthcare providers that may be included in the plan’s network. Certain Medicare Advantage plans might have a network of preferred providers that could potentially offer services at a reduced cost to plan members.

Verifying that your preferred doctors and healthcare providers may be included in the plan’s network is important to potentially avoid inflated out-of-pocket costs or the need to seek care from an alternative provider.

Possible Coverage and Benefits

Some of the Medicare Advantage plans may offer comprehensive coverage for medical services, prescription drugs, and other benefits, such as dental, vision, and hearing coverage. Some plans could potentially combine Part A and Part B coverage into a single plan, which could provide a convenient and more cost-effective option than traditional Medicare.

Keep in mind that the potential benefits offered by certain Medicare Advantage plans will likely differ. Some plans may include:

- Prescription drug coverage (Medicare Part D)

- Vision care

- Dental care

- Hearing aids

By comparing the potential coverage and benefits of various Medicare Advantage plans, you may determine the one that best meets your healthcare needs and preferences.

Network of Providers

The provider network of a Medicare Advantage plan could play a significant role in the selection process. A provider network will likely be a group of doctors, specialists, hospitals, and other healthcare providers that have an agreement with the plan to provide services to its members.

In-network providers might have a pre-established rate with the plan and may offer lower costs for members, while out-of-network providers may have higher costs or may not be covered at all.

When selecting a Medicare Advantage plan, it’s important to review the provider networks of various plans in your region to confirm that your preferred healthcare providers are included. If a provider is not part of the network, you may have to pay increased out-of-pocket costs or look for care from an alternate provider.

Taking the time to research and compare provider networks could help you find a plan that best meets your healthcare needs.

Possible Costs and Premiums

The costs and premiums that might be associated with certain Medicare Advantage plans could differ significantly.

Certain factors such as geographic location, health status, and healthcare usage might influence the potential costs and premiums of these plans. Comparing the costs of different Medicare Advantage plans in your state will likely be necessary to identify the most suitable option for you.

While some of these Medicare Advantage plans might offer lower premiums compared to traditional Medicare plans, some of the out-of-pocket costs for certain Medicare Advantage plans may be more expensive. It’s essential to take into account both the potential premiums and the potential out-of-pocket expenses when evaluating the costs of these two types of plans.

By understanding the costs and premiums that may be associated with a Medicare Advantage plan, you may make a more informed decision when selecting a plan.

Enrollment Periods and Deadlines

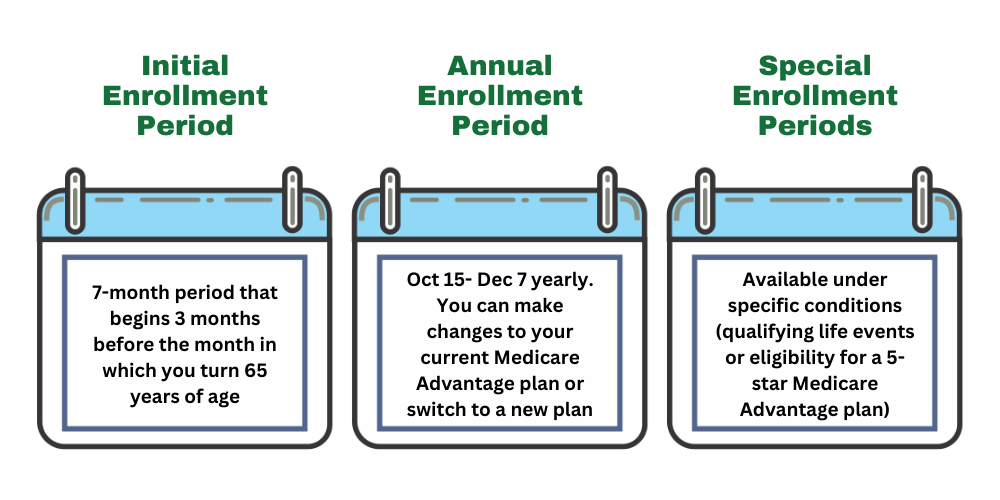

Understanding the different enrollment periods and deadlines for Medicare Advantage plans is crucial to ensure you don’t miss your chance to enroll or make changes to your plan. There are three primary enrollment periods for Medicare Advantage plans: the Initial Enrollment Period, the Special Enrollment Period, and the Annual Election Period.

It’s important to be aware of these enrollment periods and deadlines to avoid penalties and ensure you have the appropriate coverage when you need it. By familiarizing yourself with the various enrollment periods, you’ll be better prepared to make timely decisions regarding your Medicare Advantage plan.

Initial Enrollment Period

The Initial Enrollment Period (IEP) for Medicare Advantage plans is a seven-month period when you are first eligible for Medicare.

This period starts three months before your 65th birthday, includes your birthday month, and ends three months after your birthday month. The IEP is your first opportunity to enroll in a Medicare Advantage plan.

If you fail to take advantage of the IEP for Medicare Advantage, you may be eligible to sign up at a later date without incurring a penalty, provided you qualify for a special enrollment period. However, if there is a continuous period of 63 days or more after the end of the IEP, you may incur a late enrollment penalty.

Being aware of the IEP and enrolling in a Medicare Advantage plan during this period is important to avoid possible penalties and ensure you have the necessary coverage.

Special Enrollment Period

A Special Enrollment Period (SEP) for Medicare Advantage plans allows you to enroll in or switch plans outside of the initial enrollment period, usually due to specific life events or circumstances.

The SEP lasts for eight months, starting from the month following the termination of your group health plan coverage or current employment.

Some examples of circumstances that may qualify you for a SEP include losing your job-based health coverage, moving out of your plan’s service area, or losing coverage through a spouse’s plan due to divorce or death. Understanding the conditions that qualify for a SEP can help you make timely changes to your Medicare Advantage plan and avoid potential penalties.

Annual Election Period

The Annual Election Period (AEP) for Medicare Advantage plans is held from October 15th to December 7th each year.

During the AEP, you have the opportunity to make changes to your Medicare Advantage plan, such as switching plans, adding or dropping coverage, or changing from a Medicare Advantage plan back to Original Medicare.

If you neglect to participate in the AEP, you may be reenrolled in your current plan, but the prices may vary.

Assessing your options during the AEP is important to ensure you have the most suitable plan for your needs. By staying informed about the AEP and making changes as needed, you can ensure that your Medicare Advantage plan continues to meet your healthcare needs and preferences.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Top Medicare Advantage Providers by State

Now that you have a better understanding of the various factors to consider when choosing a Medicare Advantage plan, it’s time to explore the top Medicare Advantage providers in each state.

Some of these providers may offer a range of plans with different benefits, coverage options, and provider networks that could best suit your needs and preferences.

Comparing the leading Medicare Advantage providers in your state, regulated by the federal government, will likely aid in making a well-informed decision about the right plan for you. Remember that the top providers may differ from one state to another, so it’s essential to research and compare the specific offerings in your state.

Provider Overview

Some of the most noteworthy Medicare Advantage providers nationwide may include:

- Blue Cross Blue Shield

- Humana

- Aetna

- UnitedHealthcare

- Cigna

- Anthem

These providers might offer comprehensive health plans, possibly ensuring coverage for medical services, prescription drugs, and other benefits such as dental, vision, and hearing coverage. Furthermore, some providers might provide access to a wide network of healthcare providers.

Keep in mind that the leading Medicare Advantage providers may differ among states. For example, Aetna Life Insurance Company will likely be one of the top providers in Alabama, while Sierra Health and Life could be a top provider in Alaska.

To find the top providers in your state, consult your state’s Medicaid office or visit the CMS website for more information.

Plan Comparison

When comparing the top Medicare Advantage plans that may be offered by different providers in your state, it’s essential to consider possible factors such as:

- Star ratings

- Provider networks

- Plan benefits

- Cost

Customer satisfaction ratings might also provide valuable insight into the quality and performance of different Medicare Advantage plans. According to J.D. Power’s survey, overall satisfaction with a majority of Medicare Advantage plans is generally good, with a score of 652 out of 1,000.

Comparing the potential coverage, benefits, and costs of different Medicare Advantage plans and Medigap plans in your state could help you decide which plan best aligns with your healthcare needs and preferences.

Navigating Financial Assistance and Medicaid Services

If the potential costs that will likely be associated with certain Medicare Advantage plans concern you, be aware that financial assistance options and Medicaid services may be available for assistance. For those who qualify for both Medicare and Medicaid, these programs might work together and could potentially provide additional benefits and financial assistance.

Understanding the eligibility requirements and application procedures for financial assistance programs and Medicaid services might greatly benefit those seeking help with the costs of Medicare Advantage plans.

Medicaid Services

Medicaid services could potentially help to cover some of the costs of certain Medicare Advantage plans for eligible individuals. For those who are eligible for both Medicare and Medicaid, these programs may work together to possibly provide additional benefits and financial assistance, which may cover premiums, deductibles, and coinsurance.

Eligibility requirements for Medicaid services when enrolled in Medicare Advantage plans may vary. Generally, Medicaid eligibility is determined by income and family size, while Medicare is available for individuals who are 65 or older, or those with disabilities or End-Stage Renal Disease.

By understanding the eligibility requirements for Medicaid services, you could determine whether you qualify for additional financial assistance that may help cover some of the costs of your Medicare Advantage plan.

Other Financial Assistance Programs

In addition to Medicaid services, there will likely be other financial assistance programs that could be available to help with the costs of certain Medicare Advantage plans. Some of these programs may include the Qualified Medicare Beneficiary (QMB) program, Medicare Savings Programs, and Extra Help (Low-Income Subsidy).

To apply for financial assistance for Medicare Advantage plans, you can call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST, and talk to one of our licensed agents.

Exploring these potential financial assistance options might provide the support necessary to manage some of the costs of your Medicare Advantage plan.

Summary

Understanding the potential differences in Medicare Advantage plans by state, possible factors to consider when comparing plans, and various enrollment periods may help you make a more informed decision about your healthcare coverage.

By researching the top providers in your state, exploring financial assistance options, and staying up-to-date on enrollment deadlines, you may confidently navigate the world of Medicare Advantage plans and find the perfect plan tailored to your needs and preferences.

Frequently Asked Questions

→ Are Medicare Advantage plans different in each state?

Some of the Medicare Advantage Plans could vary both by state and by zip code. Some of these plans might be offered by private companies and will likely have different price points and services depending on the plan and company you choose, with many companies only serving their local area.

→ Why are people choosing Medicare Advantage plans?

Some people might choose Medicare Advantage plans due to the lack of prior authorization and quick payments from insurers.

→ What is the biggest advantage of Medicare Advantage?

One of the biggest advantages of Medicare Advantage plans could be their broad range of choices for certain providers and the abundant range of potential benefits compared to Original Medicare. Additionally, some plans may offer reduced out-of-pocket costs than Original Medicare.

→ What are the primary differences between Original Medicare and Medicare Advantage plans?

Original Medicare will likely provide a fixed standard of coverage and costs across the country, while Medicare Advantage plans could vary in their offerings based on plan, company, and region.

Additionally, Medicare Advantage plans combine Part A and Part B and could potentially provide additional benefits that may not be available under Original Medicare.

→ How can I find financial assistance to help with the costs of my Medicare Advantage plan?

Financial assistance might be available through BenefitsCheckup.org, the Social Security website, or by contacting Social Security at 800-772-1213. You could also contact your State Health Insurance Assistance Program for help with completing the application.

ZRN Health & Financial Services, LLC, a Texas limited liability company