How Medicare Advantage Plans Work

Navigating the world of healthcare coverage might be overwhelming, but understanding your options could be crucial for making the best decision for your needs.

Some of the Medicare Advantage Plans may offer an alternative to traditional Medicare, possibly providing a comprehensive solution that might combine hospital, outpatient, and prescription drug coverage through private insurance companies.

Read on to learn more about how Medicare Advantage Plans work and the potential benefits they may offer to help you make an informed choice.

Key Takeaways

- Medicare Advantage Plans, or Part C, are private health insurance plans that provide coverage of the same benefits as traditional Medicare and sometimes extra services such as vision, hearing, and dental.

- Members will likely want to consider their potential healthcare needs when selecting a plan to make an informed decision.

Compare Plans in One Step!

Enter Zip Code

The Basics of Medicare Advantage Plans

Medicare Advantage Plans are often referred to as Part C. They provide a private health insurance option that could cover many of the same Medicare benefits as traditional Medicare and Medicare supplement insurance.

These plans encompass hospital insurance (Part A), medical insurance (Part B), and some may even offer prescription drug coverage (Part D). Offered by private insurers, some of these Medicare Advantage Plans may include additional benefits not covered by Original Medicare, such as vision, hearing, and dental services.

What is a Medicare Advantage Plan?

A Medicare Advantage Plan is a private health insurance plan that offers coverage for Medicare Part A, Part B, and sometimes Part D, in addition to other benefits.

These plans include the same benefits as Medicare Part A and Part B. Some may even cover prescription drug coverage, offered by Medicare Part D. Other additional benefits that might not be covered by Medicare may also be included, such as routine dental care, eye exams and glasses, and hearing aids.

How Do Medicare Advantage Plans Differ from Traditional Medicare?

While both traditional Medicare and Medicare Advantage Plans could provide essential health coverage, there will likely be some key differences between the two. Some of the main differences may include:

- Medicare Advantage Plans tend to have provider networks, meaning you may need to use doctors and hospitals within the plan’s network to receive coverage.

- Medicare Advantage Plans may sometimes provide extra benefits like dental, vision, and hearing services that may not be covered by traditional Medicare.

- The potential cost structures of certain Medicare Advantage Plans may vary, as they are provided by private insurance companies, while traditional Medicare is administered by the federal government.

Components of Medicare Advantage Plans

Medicare Advantage Plans have been designed to provide comprehensive healthcare coverage, encompassing hospital insurance (Part A), medical insurance (Part B), and sometimes prescription drug coverage (Part D).

By offering these possible components in one plan, Medicare Advantage Plans could potentially simplify the healthcare process and may also include additional benefits not covered by traditional Medicare.

Hospital Insurance (Part A)

Part A of Medicare Advantage Plans covers the following hospital services:

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Some home healthcare services

All Medicare Advantage Plans are required to provide the same coverage for hospital services as traditional Medicare, possibly ensuring that enrollees can receive necessary care.

Medical Insurance (Part B)

Medicare Advantage Plans may also provide medical insurance through Part B, which could cover services such as doctors’ visits, outpatient care, and preventive services.

Unlike traditional Medicare, where Part B coverage may be provided by the federal government, in a Medicare Advantage Plan, Part B coverage will likely be provided by a private insurance company, which means coverage and costs may vary depending on the specific plan.

Prescription Drug Coverage (Part D)

Some of the Medicare Advantage Plans might offer prescription drug coverage through Part D, possibly ensuring that enrollees could have access to necessary medications. While Part D coverage might not be included in every Medicare Advantage Plan, some plans might offer this coverage, possibly making it an important consideration when choosing a plan.

Before enrolling in a Medicare Advantage Plan, you should confirm if Part D coverage is available.

Types of Medicare Advantage Plans

Medicare Advantage Plans come in various types, each with its own set of features and benefits. The most common types of plans include:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-for-Service (PFFS) plans, Special Needs Plans (SNPs)

- Medical Savings Account (MSA) plans

Grasping the differences between these plan types could be beneficial in choosing a plan that best matches your requirements.

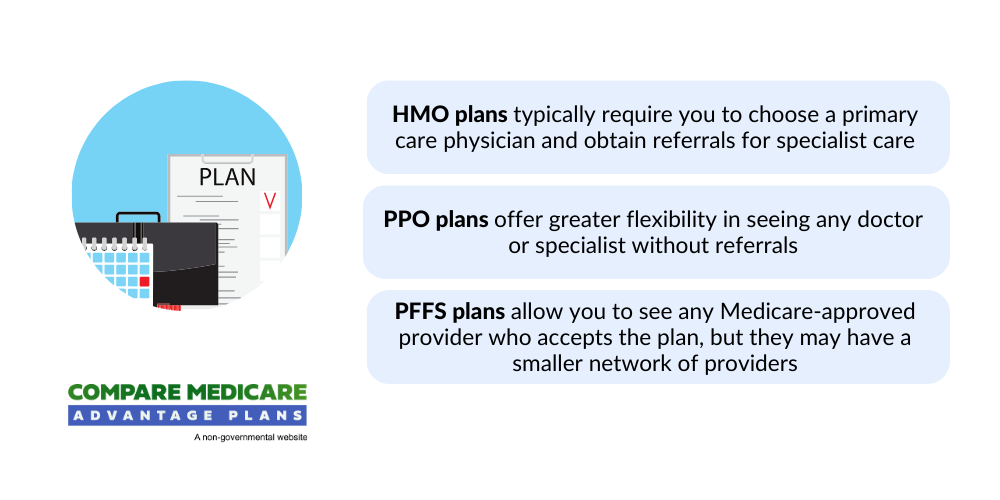

Health Maintenance Organizations (HMOs)

HMOs are a type of Medicare Advantage Plan that require members to use in-network providers and obtain referrals for specialist care. This means that you’ll need to receive care from doctors, hospitals, and other healthcare providers within the plan’s designated network to be eligible for coverage.

HMOs typically have lower out-of-pocket costs than other plan types but may offer less flexibility in choosing healthcare providers.

Preferred Provider Organizations (PPOs)

PPOs, on the other hand, offer more flexibility in choosing healthcare providers. In a PPO Medicare Advantage Plan, you have the option to see any doctor or specialist without a referral, although you may have higher out-of-pocket costs for out-of-network care.

PPOs give you more freedom in your healthcare choices but may come with higher premiums compared to other plan types, such as HMOs.

Other Medicare Advantage Plan Types

In addition to HMOs and PPOs, there are other types of Medicare Advantage Plans available. Private Fee-for-Service (PFFS) plans provide healthcare coverage through a network of contracted providers.

Special Needs Plans (SNPs) are designed for individuals with specific health conditions or needs, such as those eligible for both Medicare and Medicaid or those with chronic illnesses.

Medical Savings Account (MSA) plans combine a high-deductible health insurance plan with a medical savings account, allowing you to save money for healthcare expenses tax-free. Understanding the differences between these plan types can help you determine the best option for your healthcare needs.

Possible Benefits and Services

One of the potential advantages of certain Medicare Advantage Plans could be that some of them may include extra benefits and services not covered by traditional Medicare. These potential benefits might include:

- Dental coverage

- Vision coverage

- Hearing coverage

This potential coverage could help you maintain your health and well-being while possibly minimizing out-of-pocket expenses.

Dental, Vision, and Hearing

Certain Medicare Advantage Plans might offer Medicare coverage for:

- Routine dental services, including cleanings, fillings, crowns, and other preventive and restorative care

- Vision services, such as eye exams and an allowance for eyewear

- Hearing services, including coverage for hearing aids and related services

Some of these potential benefits could help you maintain your overall health and well-being.

Potential Costs and Out-of-Pocket Expenses

It’s important to understand the potential costs and out-of-pocket expenses that may be associated with certain Medicare Advantage Plans before enrolling. These costs may vary depending on the plan and might include:

- Premiums

- Deductibles

- Copayments

- Cost-sharing for covered services

Comprehending these costs could enable you to opt for a plan that aligns with your budget and healthcare requirements.

Premiums

Premiums for Medicare Advantage Plans may vary depending on the plan and location.

Some of the potential factors that could affect the premium cost may include health status, supplemental coverage, household income, and participation in wellness programs.

When choosing a Medicare Advantage Plan, members may want to compare the potential plan premiums and consider other costs like deductibles and copayments.

Deductibles and Cost-Sharing

Deductibles and cost-sharing may also vary by plan and will likely be essential components of your healthcare expenses.

Here are some key points to understand:

- Deductibles are the amounts you must pay out of pocket before your plan begins to cover medical expenses.

- Cost-sharing refers to the division of medical costs between the plan and the beneficiary.

- Cost-sharing can include copayments and coinsurance for covered services.

Comprehending these costs may aid in making a knowledgeable choice about which Medicare Advantage Plan to select.

Out-of-Pocket Maximums

Out-of-pocket maximums will likely be an important feature in certain Medicare Advantage Plans, as they could limit the amount you will pay for covered services in a year, possibly providing financial protection. Once you reach the out-of-pocket maximum, the plan will likely cover the costs for covered services for the remainder of the year.

Out-of-pocket maximums may vary depending on the plan, but they could provide a safeguard against high medical expenses and may help limit your financial liability.

Enrollment and Switching Plans

Enrolling in a Medicare Advantage Plan or switching between plans will likely require an understanding of the available enrollment periods and the specific circumstances under which you can make changes.

Being aware of the enrollment process and timings could guarantee access to the necessary coverage and benefits.

How to Enroll in a Medicare Advantage Plan

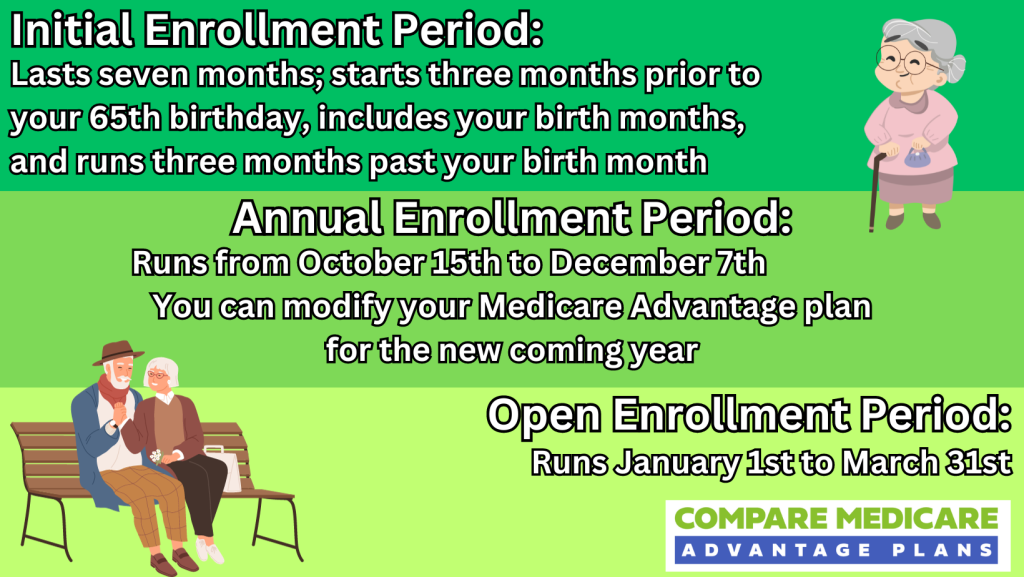

You can enroll in a Medicare Advantage Plan during the Initial Enrollment Period, Annual Enrollment Period, or Special Enrollment Period.

The Initial Enrollment Period is a 7-month period when you first become eligible for Medicare, typically starting 3 months before your 65th birthday and ending 3 months after your 65th birthday.

The Annual Enrollment Period runs from October 15th to December 7th each year, allowing you to enroll in or change Medicare Advantage Plans.

Special Enrollment Periods may be available under certain circumstances, such as moving out of the plan’s service area or losing other health coverage. Additionally, the Medicare Advantage Open Enrollment period offers another opportunity for plan changes.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

How to Switch Medicare Advantage Plans or Return to Original Medicare

If you wish to switch Medicare Advantage Plans or return to Original Medicare, you can do so during the Annual Enrollment Period or under specific circumstances, such as moving out of the plan’s service area or if your plan is no longer offered.

Understanding these enrollment periods and the reasons for switching can help you make the best decision for your healthcare needs.

Evaluating and Choosing a Medicare Advantage Plan

Evaluating and choosing a Medicare Advantage Plan will likely involve:

- Comparing your potential plan options

- Considering your healthcare needs

- Investing time to comprehend the different plan types, their costs, coverage options, and quality ratings

Comparing Plan Options

When comparing Medicare Advantage Plans, you may want to consider the possible factors:

- Coverage

- Costs

- Provider networks

- Quality ratings

Utilize tools like this website by entering your zip code into any of the zip code boxes to compare the potential benefits, prescription drug coverage, and possible costs of various plans.

You may also want to evaluate the provider network of the plan to confirm the inclusion of your preferred healthcare providers.

Considering Personal Healthcare Needs

It’s important to consider your personal healthcare needs when selecting a Medicare Advantage Plan. Some potential to consider:

- Preferred providers: Make sure the plan includes your preferred doctors and specialists.

- Prescription drug coverage: Check if the plan covers the medications you take regularly.

- Additional benefits: Consider any additional benefits you may require, such as dental or vision coverage.

By reflecting on your healthcare preferences and assessing the potential benefits and costs of different plans, you could choose a Medicare Advantage Plan that best suits your individual healthcare needs.

Summary

Some of the Medicare Advantage Plans may offer a comprehensive alternative to traditional Medicare, possibly providing hospital, outpatient, and prescription drug coverage through private insurance companies.

By understanding the different types of plans, their potential costs, coverage options, and enrollment periods, you could make an informed decision about which plan best meets your healthcare needs.

With careful consideration and research, you may select a Medicare Advantage Plan that provides the coverage and benefits you need to maintain your health and well-being.

Frequently Asked Questions

→ What are the advantages of having a Medicare Advantage Plan?

Some Medicare Advantage plans may offer flexible networks, low out-of-pocket costs, and a lack of prior authorization requirements, making it important to know your potential Medicare insurance options and consider current and future needs.

→ Why are people choosing Medicare Advantage plans?

People may choose Medicare Advantage plans due to the lack of prior authorization and quick payments from insurers.

→ Could Medicare Advantage plans save you money?

Some of the Medicare Advantage plans may offer lower copays, no deductible, and potentially $0 premiums, suggesting they could potentially help you save money compared to traditional Medicare plans.

However, they may also use financial tactics to increase their profits, which could result in higher costs for consumers.

→ What is the difference between Medicare Advantage Plans and traditional Medicare?

Medicare Advantage Plans will likely be offered by different provider networks and may include additional benefits, and cost structures compared to traditional Medicare.

→ How can I determine if a Medicare Advantage Plan includes prescription drug coverage (Part D)?

To determine if your Medicare Advantage Plan includes prescription drug coverage (Part D), you can talk to one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

ZRN Health & Financial Services, LLC, a Texas limited liability company