How Can Medicare Advantage Plans Cost $0?

Imagine not having to pay a monthly premium for your Medicare Advantage plan while still receiving comprehensive health coverage. Sounds too good to be true?

The reality is that $0 premium Medicare Advantage plans do exist, and they can offer valuable benefits for eligible individuals. But how can Medicare Advantage plans cost 0? Let’s dive into the world of $0 Medicare Advantage plans and uncover the secrets behind their existence.

In this blog post, we’ll explore the factors that enable the availability of $0 premium Medicare Advantage plans, weigh the pros and cons, and discuss different types of Medicare Advantage plans. We’ll also provide tips for choosing the best plan for your individual needs and help you navigate the eligibility and enrollment process.

Key Takeaways

- Government subsidies and private insurance companies enable the availability of $0 Medicare Advantage plans, with associated costs such as copayments, coinsurance, and deductibles.

- Careful evaluation of all related costs is essential for selecting a plan that meets individual healthcare needs.

- Comparison tools are available to help users make an informed decision on the best Medicare Advantage plan for their needs.

Compare Plans in One Step!

Enter Zip Code

The Reality of $0 Medicare Advantage Plans

$0 Medicare Advantage plans are not a myth; they are indeed available due to government subsidies and the involvement of private insurance companies.

These plans offer value-added health coverage, including an annual limit on out-of-pocket costs and part b coverage for services beyond Part A.

However, keep in mind that these Medicare Advantage plans are not entirely free since they come with extra costs like copayments, coinsurance, and deductibles.

Medicare Advantage plans are a type of Medicare supplement plan that receives a set rate per person, per year from the government. The government pays an estimated $12,000 per person, per year to insurance companies offering Medicare Advantage plans.

This financial support allows private insurance companies to manage their costs and maintain their provider networks, making $0 premium Medicare Advantage plans a reality.

Government Subsidies

The government significantly contributes to subsidizing $0 premium Medicare Advantage plans by providing a fixed rate per person, annually. This financial support comes from federal funding, subscriber premiums, and Medicare Parts A, B, and D.

The government, with its established rate, empowers insurance companies to provide $0 premium Medicare plans to qualifying individuals.

Role of Private Insurance Companies

Private insurance companies can offer $0 premium Medicare Advantage plans due to the fixed sum of money they receive from Medicare to cover Part A and Part B expenses. These companies manage costs by implementing strategies such as:

- Risk adjustment

- Provider networks

- Care coordination

- Utilization management

- Value-based care

As a result, private insurance companies can maintain their provider networks and offer Medicare Advantage plans with varying premiums, including $0 options.

Evaluating $0 Premium Medicare Advantage Plans

Opting for a $0 premium Medicare Advantage plan mandates meticulous evaluation of all related costs, like:

- deductibles

- coinsurance

- copays

- coverage

Also, it’s important to assess the quality of the plan’s provider network and the possibility of higher out-of-pocket costs.

Most Medicare Advantage plans also include prescription drug coverage, but the specifics vary by plan. For a well-rounded decision, you should compare different plan options, considering factors such as out-of-pocket costs, provider networks, and prescription drug coverage.

Out-of-Pocket Costs

Although zero premium medicare Advantage plans don’t have a monthly premium, they may still incur costs such as copayments, coinsurance, and deductibles. These cost-sharing amounts apply to covered medical services, which individuals need to consider when selecting zero premium plans.

Provider Networks

Limited provider networks are a common feature of $0 premium Medicare Advantage plans, helping to control costs while offering comprehensive health coverage. These networks consist of doctors, hospitals, and other healthcare providers contracted with the plan.

However, using out-of-network providers may result in higher costs or may not be covered at all.

Therefore, it’s important to ensure that your preferred healthcare providers are included in the plan’s network before selecting a $0 premium Medicare Advantage plan.

Prescription Drug Coverage

Most Medicare Advantage plans offer prescription drug coverage as part of their benefits package through Medicare Part D.

However, coverage details may vary by plan, and there may be restrictions for prescription drug coverage in $0 premium Medicare Advantage Plans.

Reviewing the plan details for a clear understanding of the coverage and any existing restrictions is advisable.

Pros and Cons of $0 Premium Medicare Advantage Plans

Before deciding on a zero premium Medicare Advantage plan, it’s essential to weigh the benefits and drawbacks.

These plans offer financial advantages, such as no monthly plan premium and potential cost savings compared to other plans.

These plans offer financial advantages, such as no monthly plan premium and potential cost savings compared to other plans.

They also provide additional benefits beyond Original Medicare, such as prescription drug coverage.

However, $0 premium Medicare Advantage plans may have limitations, such as restricted provider networks and higher out-of-pocket costs.

Additionally, the monthly cost for Medicare Part B still applies, which includes the Medicare Part B premium.

Considering these factors will enable individuals to make a well-rounded decision on whether a $0 premium Medicare Advantage plan best suits their healthcare needs.

Benefits

$0 premium Medicare Advantage plans can save money on monthly Medicare costs and may include additional benefits such as prescription drug coverage, dental coverage, vision coverage, hearing coverage, fitness and wellness programs, and over-the-counter allowances.

In comparison, Medicare supplement plans offer different coverage options and are designed to work alongside Original Medicare.

These health insurance plan options offer value for eligible individuals who desire comprehensive health coverage without excessive costs.

Drawbacks

While $0 premium Medicare Advantage plans offer financial savings and additional benefits, there are potential drawbacks to consider. Limited provider networks may restrict healthcare options, and higher out-of-pocket costs could be a concern for some individuals.

It’s necessary to meticulously review the plan details and consider these potential drawbacks before deciding on a $0 premium Medicare Advantage plan.

Types of Medicare Advantage Plans

There are three main types of Medicare Advantage plans: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Medical Savings Accounts (MSA). Understanding the differences between these plans can help you select the best option for your healthcare needs.

HMO plans typically require you to receive care from in-network providers and may necessitate a primary care physician (PCP). PPO plans offer more flexibility in choosing healthcare providers, allowing you to visit any Medicare-approved doctor without a referral, but you may pay less if you use providers within the plan’s network.

MSA plans combine a high-deductible health plan with a savings account, giving you more freedom to choose your healthcare providers but requiring you to pay for services until you reach the deductible.

Health Maintenance Organization (HMO)

The majority of Medicare Advantage plans are HMOs, which have a restricted provider network.

These plans focus on managed care and coverage of care from in-network doctors, hospitals, and other healthcare providers, which is beneficial for cost control and care coordination for Medicare beneficiaries.

However, using out-of-network providers may result in higher costs or may not be covered at all.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers than HMO plans.

PPO plans offer more flexibility in choosing healthcare providers than HMO plans.

You can visit any doctor or specialist without a referral, and you will pay less if you use providers within the plan’s network.

PPO Medicare Advantage plans typically have higher monthly premiums but provide greater freedom in selecting healthcare providers and accessing specialized care when necessary.

Medical Savings Accounts (MSA)

MSAs are a type of Medicare Advantage plan with the following features:

- No monthly premiums

- High deductible

- The government deposits funds into a savings account for medical expenses associated with the plan, which can be used for any medical expenses, including the deductible.

MSAs provide more freedom in choosing healthcare providers but require you to pay for services until you reach the deductible.

Eligibility and Enrollment in Medicare Advantage Plans

To avail a Medicare Advantage plan, enrollment in Original Medicare is a prerequisite. This enrollment is mandatory to become eligible for a Medicare Advantage plan.

Enrollment in Original Medicare is typically required for individuals aged 65 or older, but certain individuals may be eligible prior to age 65 if they have a disability or End-Stage Renal Disease.

Enrollment in Medicare Advantage plans is confined to certain times of the year.

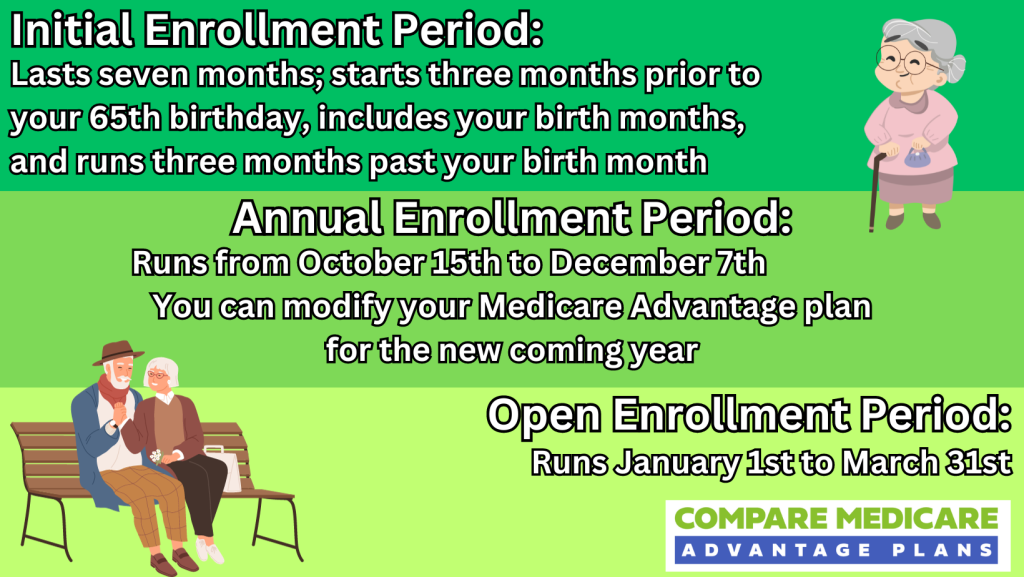

The Medicare Advantage open enrollment period occurs annually from January 1st through March 31st, and the general enrollment period is a 7-month window that starts 3 months before the month you turn 65 and ends 3 months after your 65th birthday. Special enrollment periods may also apply depending on your situation.

Qualifying for Medicare Advantage

Eligibility for Medicare Advantage requires:

- Enrollment in Original Medicare (Parts A and B), which makes individuals Medicare Advantage enrollees

- Generally, individuals aged 65 or older are eligible for Medicare Advantage, but there may be exceptions for those with disabilities or End-Stage Renal Disease

- U.S. citizenship or permanent legal residency for at least five continuous years is also required.

Enrollment Periods

Enrollment in Medicare Advantage plans is restricted to certain times of the year, including the open enrollment period from January 1st through March 31st and the general enrollment period, which is a 7-month period surrounding your 65th birthday.

Special enrollment periods may also apply depending on your situation, such as if you sign up for Part A and/or Part B due to an exceptional circumstance or if you have employer coverage.

Tips for Choosing the Right Medicare Advantage Plan

Choosing the most suitable Medicare Advantage plan for your individual needs entails evaluating your personal needs and comparing plan options. Consider factors like:

- Premiums and cost-sharing

- Health status and healthcare usage

- Supplemental coverage and premiums for that coverage

- Medicare Advantage plan benefits

- Network of providers and pre-authorization requirements

By evaluating your needs and preferences, you can make an informed decision about the best Medicare Advantage plan for you.

The Medicare.gov comparison tool or the Medicare Plan Finder on Medicare.gov are useful resources for comparing different Medicare Advantage plan options.

These tools allow you to evaluate plan benefits, prescription drug coverage, and costs. Additionally, consider factors such as the type of plan (HMO, PPO, etc.) and any specific needs or preferences you may have when choosing a Medicare Advantage plan.

Assessing Personal Needs

When selecting a Medicare Advantage plan, considering your healthcare needs, budget, and preferred providers is vital. By taking your individual needs into account, you can ensure that you select a plan that accommodates your requirements and provides the most value for your money.

If you have a chronic illness or require regular medication, it’s crucial to choose a plan that provides the necessary coverage and access to the healthcare providers you trust and prefer.

Comparing Plan Options

To compare different Medicare Advantage plan options, utilize the Medicare.gov comparison tool or the Medicare Plan Finder on Medicare.gov.

These tools enable you to evaluate plan benefits, prescription drug coverage, and costs. Additionally, it’s essential to consider factors such as the type of plan (HMO, PPO, etc.) and any particular needs or preferences you may have.

A comprehensive comparison of plan options allows you to make a well-rounded decision on the best Medicare Advantage plan for your individual needs.

Summary

$0 premium Medicare Advantage plans offer a unique opportunity for eligible individuals to receive comprehensive health coverage without a monthly premium. However, it’s crucial to weigh the benefits and drawbacks of these plans, such as limited provider networks and potential out-of-pocket costs.

By understanding the differences between HMO, PPO, and MSA plans, assessing personal needs, and comparing plan options, you can make an informed decision about the best Medicare Advantage plan for your healthcare needs.

Ultimately, the right Medicare Advantage plan for you will depend on your individual healthcare needs, budget, and preferred providers. By carefully evaluating your options and taking advantage of available resources, you can confidently choose a plan that provides the best coverage and value for you.

Frequently Asked Questions

→ How do zero dollar Medicare Advantage plans work?

Zero dollar Medicare Advantage plans have no monthly premium, and Medicare pays a fixed amount of money to the insurance company for coverage. These plans can include lower copays and no deductibles, as well as additional benefits such as prescription drug coverage and routine dental services.

→ What is the biggest disadvantage of Medicare Advantage?

The biggest disadvantage of Medicare Advantage is having limited choices for doctors and medical offices, as well as restrictions on services that require prior authorization.

→ How do government subsidies contribute to the availability of $0 premium Medicare Advantage plans?

Government subsidies enable private insurance companies to provide $0 premium Medicare Advantage plans to eligible individuals by providing a set rate per person, per year to cover Part A and Part B expenses.

→ What are the differences between HMO, PPO, and MSA Medicare Advantage plans?

HMO plans require in-network providers and a primary care physician, whereas PPO plans offer more flexibility in provider selection and MSA plans combine a high-deductible health plan with a savings account.

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the open enrollment period from January 1st through March 31st, the general enrollment period, or depending on your situation, a special enrollment period.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.