Do Doctors Have to Accept Medicare Advantage Plans?

Navigating the world of healthcare may feel overwhelming, especially when it comes to choosing the right insurance plan. Some Medicare Advantage plans might have gained popularity as an alternative to Original Medicare, as they might offer additional benefits through private insurance companies.

But, do doctors have to accept Medicare Advantage plans? This article will explore the potential ins and outs of Medicare Advantage plans, doctor participation, and how it could impact patient costs and care.

Key Takeaways

- Some Medicare Advantage Plans may act as private insurance alternatives to Original Medicare that might offer additional benefits.

- Doctors will likely have the ability to choose whether or not to participate in a network, with various factors influencing their decision. They may not be required to accept any Medicare Advantage plans.

- It is important for enrollees of Medicare Advantage plans to understand and stay informed about their provider networks to potentially access quality care at lower costs.

Compare Plans in One Step!

Enter Zip Code

Medicare Advantage Plans Explained

Medicare Advantage plans, which could serve as an alternative to Original Medicare and Medicare Supplement Insurance, could offer additional Medicare-covered services and benefits through private insurance companies.

Some of these Medicare supplement insurance plans may include coverage for:

- Prescription medications

- Vision care

- Hearing aids

Given the availability of diverse plan types, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), comprehension of each plan’s nuances could be beneficial for optimal decision-making concerning your healthcare needs.

What is Medicare Advantage (Part C)?

Medicare Advantage (Part C), also known as medicare insurance, could be a private insurance alternative to Original Medicare, which may cover hospitalization, medical services, and often prescription drugs, dental, and vision care.

In contrast to Original Medicare, some of the Medicare Advantage plans will likely be offered by private insurance companies and may provide additional benefits.

With a designated primary care provider (PCP), patients could receive coordinated care, possibly ensuring all aspects of their healthcare could be managed efficiently and effectively.

Comparing Medicare Advantage to Original Medicare

Original Medicare and Medicare Advantage plans are two different plans. They have several differences that you should be aware of.

One significant distinction is provider selection. Some Medicare Advantage plans may require patients to choose providers within the plan’s network, whereas Original Medicare may allow patients to see any doctor who accepts Medicare assignment.

Certain Medicare Advantage plans may also frequently offer benefits like dental and vision care, which are typically not covered by Original Medicare. Besides, certain Medicare Advantage plans may also present lower out-of-pocket expenses compared to Original Medicare, which could indicate a difference in cost structures.

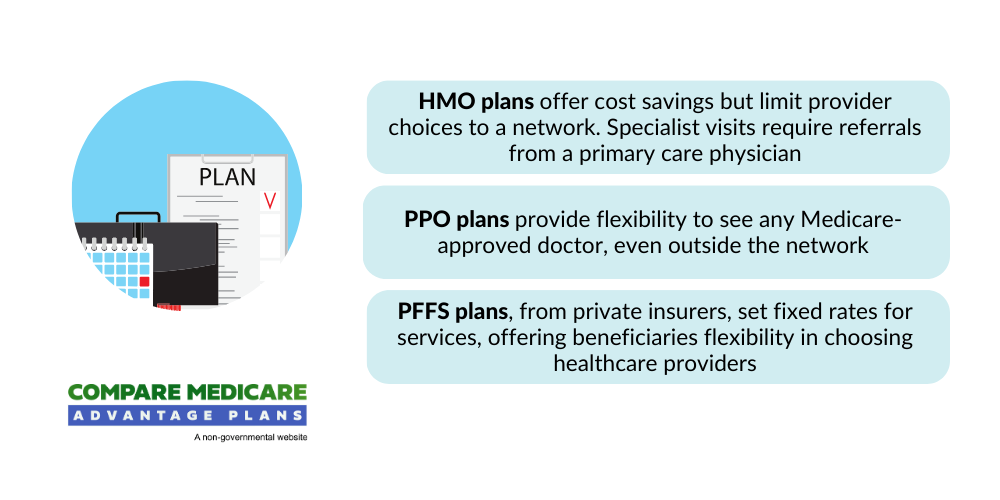

Types of Medicare Advantage Plans

Various types of Medicare Advantage plans may also cater to different needs and preferences. Some common types include:

- Health Maintenance Organizations (HMOs): These plans require patients to select a primary care provider within the plan’s network. The primary care provider oversees their care and refers them to specialists as needed.

- Preferred Provider Organizations (PPOs): PPO plans offer more flexibility, allowing patients to see any doctor within or outside the plan’s network. They do not require a referral to see a specialist.

- Private Fee-for-Service (PFFS) plans: PFFS plans enable patients to visit any provider who accepts the plan’s payment terms. They do not require patients to choose a primary care provider or obtain referrals for specialist care.

Grasping the differences between these health insurance plans could aid you in making a more educated decision about your healthcare coverage.

Doctor Participation in Medicare Advantage Networks

Doctors will likely have the option to participate in Medicare Advantage networks, with some choosing to opt out or limit their participation. Potential factors such as reimbursement rates, administrative tasks, and network restrictions could influence a doctor’s decision to join or leave a Medicare Advantage network.

Grasping the reasons for a doctor’s participation status may assist you in making more suitable choices about your healthcare providers and overall costs.

Reasons for Joining or Leaving a Network

Doctors may join or leave Medicare Advantage networks based on various factors. Reimbursement rates offered by the plan could play a significant role, as lower rates may not be financially viable for some providers.

Certain administrative burdens, such as paperwork and authorization requirements, may also impact a doctor’s decision to participate in a network.

Furthermore, the patient population’s size and demographics could influence a doctor’s choice, as some may prefer to work with specific age groups or medical conditions.

Participating vs. Non-Participating Providers

Participating providers in Medicare Advantage plans may accept the plan’s rates and terms, which may lead to lower costs for patients. Non-participating providers, however, may charge extra fees for services, which could increase overall healthcare costs.

Confirming whether a doctor is a participating provider within your plan’s network before receiving care is necessary to prevent unforeseen expenses.

Opt-Out Providers and Medicare Advantage

Opt-out providers, who have opted out of Medicare will likely:

- Do not accept Medicare Advantage plans

- Require patients to pay out-of-pocket for services

- May offer private contracts, outlining the services and fees for patients who choose to receive care outside of their Medicare Advantage plan.

While this option may provide more flexibility in provider choice, it may also result in higher costs for patients.

Finding a Doctor Who Accepts Your Medicare Advantage Plan

Locating a doctor who accepts your Medicare Advantage plan may be vital for receiving the required care without unnecessary expenses.

Using online directories, verifying in-network status, and considering switching plans if necessary could help you find the right provider for your healthcare needs.

Using Online Directories and Tools

Online tools like Medicare’s Physician Compare directory could help you find doctors who accept your Medicare Advantage plan.

These directories could provide information on providers within your plan’s network, their specialties, and whether they accept new patients. Using these tools will likely enable you to effectively find in-network providers and make educated decisions about your healthcare.

In-Network vs. Out-of-Network Providers

In-network providers may be part of your plan’s network and could potentially offer lower costs, while some out-of-network providers may charge higher fees or not accept your plan at all. Verifying a doctor’s in-network status before receiving care is necessary to avoid unforeseen costs.

If your preferred doctor is not part of your plan’s network, you may want to consider discussing your options with your insurance company or exploring alternative plans that may include your desired provider.

Switching Medicare Advantage Plans

If your doctor does not accept your Medicare Advantage plan, you may consider switching to a different plan during the annual enrollment period.

This period, which occurs from January 1st to March 31st, allows you to change your plan and ensure coverage for care from your preferred doctor. Before switching, consider potential factors such as network coverage, prescription drug coverage, and possible benefits that could make the best choice for your healthcare needs.

How Medicare Advantage Plans Could Affect Patient Costs

Some Medicare Advantage plans may be able to affect medicare patients’ costs through various factors, such as:

- Cost-sharing

- Deductibles

- Balance billing

- Provider choice

Understanding how these potential factors could influence your overall healthcare costs may aid you in making more informed decisions about your Medicare Advantage plan and care.

Cost Sharing and Deductibles

Cost-sharing and deductibles in certain Medicare Advantage plans may vary, possibly impacting out-of-pocket expenses for patients. Cost-sharing refers to the portion of healthcare services that beneficiaries are responsible for paying out of pocket, which may include copayments, coinsurance, and deductibles.

Deductibles are the amounts patients must pay for healthcare services or prescriptions before the plan covers the costs.

The specific cost-sharing requirements and deductible amounts may vary based on the plan, making it necessary to review and compare plans to find the one that aligns with your financial needs best.

Balance Billing and Extra Charges

Balance billing might occur when non-participating providers charge extra fees for services, which could potentially increase overall healthcare costs. These providers may charge up to 15% more than the Medicare-approved rate for a given service, possibly causing patients to pay more for their healthcare services.

Awareness of balance billing and the potential costs related to non-participating providers may also assist you in making more suitable decisions about your healthcare providers and plan.

The Potential Impact of Provider Choice on Overall Healthcare Costs

Choosing in-network providers may help lower overall healthcare costs for Medicare Advantage enrollees. In-network providers have agreed-upon rates with the insurance company, which could result in lower costs for patients.

Out-of-network providers, on the other hand, may charge higher fees or not accept your plan at all, which may lead to increased out-of-pocket expenses.

Carefully considering provider networks and selecting in-network providers could help you manage your healthcare costs more effectively.

Rights and Protections for Medicare Advantage Enrollees

Medicare Advantage enrollees may have rights and protections to ensure they receive quality care and fair treatment. These will likely include continuity of care provisions, the right to appeal decisions, and the potential ability to change providers within their network.

Continuity of Care Provisions

Continuity of care provisions will likely ensure that patients may continue receiving care from their current provider if they leave the network or if the plan changes. These provisions might include a minimum 90-day transition period when an enrollee is currently undergoing treatment, which may allow patients to continue receiving care without disruption.

Comprehending continuity of care provisions could aid in maintaining your healthcare relationships and potentially lead to a smooth transition if your provider or plan changes.

The Right to Appeal Decisions

Enrollees have the right to appeal decisions made by their Medicare Advantage plan, such as coverage denials or network changes.

The appeals process might include requesting reconsideration from the plan within a specified time frame and following the steps outlined by the plan and independent review entities. Enrollees need to know if their healthcare providers accept assignments and the Medicare-approved amount when dealing with a Medicare Advantage plan.

Changing Providers Within Your Network

Patients may be able to change providers within their network if they are dissatisfied with their current doctor or if their doctor leaves the network. Changing providers could help you find a doctor who better meets your healthcare needs and preferences while staying within your plan’s network.

To change providers, contact your Medicare Advantage plan for a list of available providers within their network, and select a new provider that aligns with your healthcare goals.

Tips for Navigating Medicare Advantage Provider Networks

Navigating Medicare Advantage provider networks will likely be simplified with effective communication, regular review of provider directories, and staying updated about network changes.

By implementing these strategies, you could better understand your plan’s options and make the most of your Medicare Advantage coverage.

Communicating with Your Healthcare Providers

Engaging in open and honest communication with your healthcare providers about your Medicare Advantage plan and any concerns or queries you may have is necessary.

Discussing your plan with your doctor could help ensure they understand your coverage and may even provide the appropriate care within your plan’s guidelines.

Additionally, communication could help you stay informed about any changes to your provider’s network status or participation in your plan.

Reviewing Your Plan’s Provider Directory

Regular review of your plan’s provider directory will likely be vital for staying updated about your plan’s network and any changes to provider participation. Provider directories could be accessed on your plan’s website or by contacting your plan’s customer service.

Keeping up-to-date with your plan’s provider directory may also help you avoid unexpected costs and ensure you receive care from in-network providers.

Staying Informed About Network Changes

Staying updated about potential changes to your Medicare Advantage plan’s network, including provider additions or departures, may be necessary to avoid unforeseen costs or disruptions in care.

Regular communication with your plan’s customer service, checking your plan’s website, and discussing any changes with your healthcare providers could help you stay informed and make the necessary adjustments to your healthcare plan as needed.

Summary

Understanding the intricacies of the potential Medicare Advantage plans and doctor participation may be essential for managing your healthcare needs and costs effectively.

By familiarizing yourself with the various plan types, navigating provider networks, and staying informed about your rights and protections, you can make the most of your Medicare Advantage coverage and ensure you receive the care you need and deserve.

Frequently Asked Questions

→ Why do some doctors not accept Medicare Advantage?

The primary challenge that doctors might face when working with Medicare Advantage plans is the referral and pre-authorization requirements, which could impede a patient’s care and might lead to some doctors not accepting these plans.

→ What is the biggest advantage of Medicare Advantage?

The biggest advantage of Medicare Advantage may be its broad range of choices for healthcare providers and the flexibility of coverage while traveling.

→ Why are people choosing Medicare Advantage plans?

Some People might choose a Medicare Advantage plan due to the lack of prior authorization and quick payments from insurers.

→ What are the differences between in-network and out-of-network providers in Medicare Advantage plans?

In-network providers in certain Medicare Advantage plans will likely be part of the plan’s network and might offer lower costs compared to out-of-network providers who may charge higher fees or not accept the plan at all.

→ What rights and protections do Medicare Advantage enrollees have?

Medicare Advantage enrollees will likely have the right to continuity of care, the ability to appeal decisions, and the option to change providers within their network.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.