Medicare Part B Deductible 2026

In 2026, the Medicare Part B deductible 2026 is projected to increase to $288, up from $257 in 2025. This article will explain why the deductible is increasing, how it impacts beneficiaries, and what you need to prepare.

Key Takeaways

- The Medicare Part B deductible is projected to increase by 12% in 2026, rising to $288, alongside a potential 11.6% rise in premiums, significantly affecting beneficiaries’ financial planning.

- Factors contributing to the deductible increase include heightened healthcare utilization, medical inflation, and advancements in medical technology, which are pressing challenges in the healthcare landscape.

- Beneficiaries should consider exploring Medicare Advantage plans for more predictable costs and additional benefits, while also preparing for changes in prescription drug coverage that aim to reduce out-of-pocket expenses.

Compare Plans in One Step!

Enter Zip Code

Medicare Part B Deductible for 2026

The anticipated Medicare Part B deductible for 2026 is projected to be $288, marking a significant increase of $31 from $257 in 2025. Key points include:

- A 12% increase in the deductible, reflecting broader trends in healthcare cost escalation.

- An ongoing rise in the financial burden on Medicare beneficiaries.

- The increase aligns with the projected rise in Medicare Part B premiums, expected to see an 11.6% hike.

- These changes contribute to higher overall costs for enrollees.

For Medicare enrollees, this means adjusting their budgets to accommodate the higher annual deductible and premiums, including the base beneficiary premium. These changes must be understood for effective financial planning and maintaining access to necessary healthcare services. The 11.2% increase in the Part B deductible is a clear indicator of the rising costs within the healthcare system, driven by factors like medical inflation and increased service utilization.

These changes are part of a broader trend affecting both Medicare Part B and Part D premiums. The projected increases in Medicare Part D premiums, estimated at around 6%, further underscore the escalating costs faced by beneficiaries. Keeping abreast of these changes and understanding their implications will help Medicare beneficiaries manage their healthcare expenses more effectively.

As we explore the reasons behind these increases, it becomes evident that several factors are at play. From healthcare utilization to medical inflation, various elements contribute to the rising costs. Understanding these underlying factors helps better prepare for the financial challenges ahead.

Why the Increase?

The rise in the Medicare Part B deductible is influenced by several factors, each contributing to the overall increase in healthcare costs:

- Healthcare utilization: more seniors access medical services, leading to higher overall costs.

- Medical inflation: general increase in healthcare prices.

- Advancements in medical technology: new technologies increase expenses, making healthcare more expensive for everyone involved.

Another significant factor is the increase in federal spending and inflation adjustments. Legislative changes and new healthcare policies can complicate the landscape, potentially leading to automatic cuts in Medicare funding if the national deficit continues to rise. This creates a ripple effect, influencing Medicare premiums and deductibles, and ultimately impacting beneficiaries’ pockets.

Longer life expectancy and higher drug costs also play a crucial role in this equation. As people live longer, they require more prolonged and often more expensive medical care. These combined factors underscore the importance of understanding and preparing for the financial implications of these increases, including the final figures. Changes in legislation and healthcare policies continue to add layers of complexity to this already intricate system, making it essential for beneficiaries to stay informed and adaptable.

Impact on Medicare Beneficiaries

For Medicare beneficiaries, the 12% rise in the Medicare Part B deductible presents a significant financial challenge, especially for those on fixed incomes. Adjusting budgets to accommodate these higher costs can be a daunting task, potentially leading to difficult trade-offs between healthcare and other essential expenses. The increase in the catastrophic threshold for Medicare Part D further complicates matters, raising out-of-pocket costs for seniors on high-cost medications.

This financial strain is particularly acute for those managing chronic conditions, as the higher deductible could limit their access to necessary healthcare services. For many seniors, the added expense may mean fewer doctor visits or delaying critical treatments, impacting their overall health and well-being. This highlights the delicate balance between maintaining health and managing finances for those who are chronically ill.

Moreover, the increased costs highlight the importance of exploring alternative options, such as Medicare Advantage plans, which can offer more predictable out-of-pocket expenses. These plans, provided by private companies, can help mitigate the financial impact of the deductible increase, offering a viable solution for many beneficiaries. However, it’s crucial to carefully evaluate the benefits and potential drawbacks of switching from Original Medicare to a Medicare Advantage plan to ensure it aligns with individual healthcare needs and financial situations.

Understanding the broader implications of these changes is vital for making informed decisions about healthcare coverage. Staying informed and proactive in managing healthcare costs can help beneficiaries navigate these challenges more effectively, ensuring they continue to receive the care they need without undue financial strain.

Income-Related Monthly Adjustment Amount (IRMAA)

The Income-Related Monthly Adjustment Amount (IRMAA) is a crucial consideration for higher-income Medicare beneficiaries. IRMAA adjusts the premiums for Part B and Part D based on income levels, meaning those with higher incomes pay more. In 2026, the income thresholds for IRMAA are expected to rise by approximately 1.02% based on the Consumer Price Index. This adjustment ensures that premiums reflect the beneficiaries’ ability to pay, aligning costs with income levels.

For individuals with a modified adjusted gross income above $500,000, the IRMAA premium hike will see a significant increase compared to lower income brackets. This means higher-income beneficiaries will face steeper costs, underscoring the importance of planning for these adjustments. Additionally, Part D surcharges for IRMAA are projected to increase by over 6% in 2026, adding to the overall financial burden.

Beneficiaries experiencing changes in their income can appeal their IRMAA determination to adjust their premiums accordingly. This process provides a mechanism for ensuring that premiums remain fair and manageable, reflecting any significant changes in financial circumstances. Understanding IRMAA and its implications, along with the ira related provisions, is essential for higher-income beneficiaries to effectively manage their Medicare costs.

Preparing for Higher Costs

As Medicare costs continue to rise, preparing for higher expenses becomes increasingly important for enrollees. One effective strategy is to explore supplemental insurance options that can help cover the higher Medicare Part B deductible and part b premium. These policies can provide additional financial support, reducing out-of-pocket expenses and offering peace of mind.

Budgeting strategies are also crucial in managing the increased costs. By planning ahead and setting aside funds specifically for healthcare expenses, beneficiaries can better handle unexpected medical bills and the rising costs associated with their care. Creating a realistic budget that accounts for the projected increases in premiums and deductibles ensures a reasonable expectation of future expenses.

Additionally, staying informed about changes in Medicare policies and costs can help beneficiaries make proactive decisions. Understanding the projected costs and planning accordingly can mitigate the financial impact, allowing for a smoother transition to the higher expenses expected in the subsequent year. By taking these steps, Medicare enrollees can maintain their overall financial health while ensuring continuous access to necessary medical care.

Medicare Advantage Plans as an Alternative

Medicare Advantage plans offer a viable alternative to Original Medicare, especially in light of the rising costs associated with the Part B deductible. These plans, provided by private companies, can help mitigate out-of-pocket expenses by offering more predictable costs. For many beneficiaries, this predictability allows for better financial planning and peace of mind amid inflation.

Selecting a suitable Medicare Advantage plan can protect against rising healthcare costs, ensuring beneficiaries receive the care they need without undue financial strain. However, it’s important to note that Medicare Advantage plans are expected to reduce their supplemental benefits, which may affect support for those with chronic conditions. This potential reduction underscores the importance of carefully evaluating plan options and understanding the implications for individual healthcare needs.

Medicare Advantage plans also p rovide an opportunity to access additional benefits not covered by Original Medicare, such as vision, dental, and hearing services. These extra benefits can enhance overall health care and reduce out-of-pocket expenses for beneficiaries, including special supplemental benefits. However, it’s crucial to weigh these benefits against the potential reduction in supplemental coverage to make an informed decision.

Ultimately, Medicare Advantage plans offer a structured and predictable alternative to Original Medicare and standard medicare, helping beneficiaries manage their healthcare expenses more effectively. By carefully considering the available options and selecting a plan that aligns with individual needs, beneficiaries can navigate the complexities of Medicare with greater confidence.

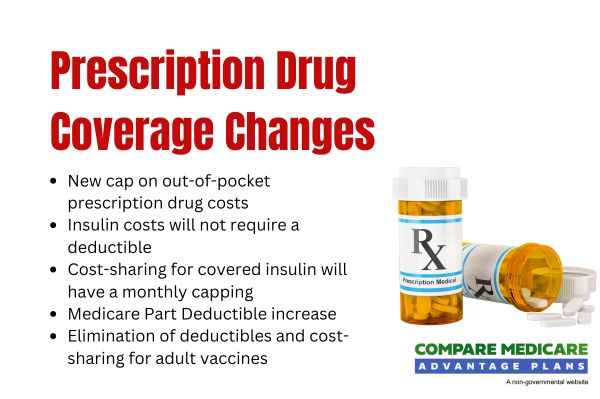

Prescription Drug Coverage Changes in 2026

Significant changes are coming to prescription drug coverage in 2026, with new policies aimed at reducing out-of-pocket costs for Medicare beneficiaries. One of the most notable changes is the establishment of a new cap on out-of-pocket prescription drug costs at $2,100, which aligns with the maximum fair price established for necessary medications. This cap aims to provide financial relief for beneficiaries, ensuring they do not face exorbitant expenses for necessary medications.

Starting in 2026, insulin costs will not require a deductible, and cost-sharing for covered insulin product will be capped at $35 per month. This change is particularly beneficial for beneficiaries managing diabetes, offering significant savings and greater access to essential medications. Additionally, the Medicare Part D deductible will increase to up to $615, reflecting broader trends in healthcare cost escalation.

Another important change is the elimination of deductibles and cost-sharing for adult vaccines under Medicare Part D, starting in 2026. This policy aims to improve vaccine accessibility and immunization practices, promoting better public health outcomes. The ma pd plan will also help beneficiaries manage out-of-pocket drug expenses by spreading costs throughout the year, including free vaccines.

Overall, these changes reflect a concerted effort to make prescription drugs more affordable for Medicare beneficiaries at maximum fair prices through a negotiated price, as outlined in the final rule. Understanding these new policies and planning accordingly help beneficiaries manage their healthcare expenses and access the medications they need without undue financial strain.

Staying Informed: Key Dates and Resources

Staying informed about Medicare changes and key dates is crucial for making proactive decisions about healthcare coverage. The Medicare Open Enrollment Period for 2026 runs from October 15 to December 7, 2025, providing an opportunity for beneficiaries to review and adjust their plans within the specified calendar days. They can switch from Original Medicare to a Medicare Advantage plan or switch from a Medicare Advantage plan back to Original Medicare.

Utilizing available resources can assist beneficiaries in understanding their options and making informed choices:

- Use the free Medicare Open Enrollment Toolkit.

- Save all Medicare-related mail.

- Create an online account to streamline the process and ensure access to needed information.

- Seek free assistance from Statewide Health Insurance Benefits Advisors (SHIBA) to help navigate Medicare options.

Reviewing coverage each year is essential, as costs, benefits, and providers can change. By staying informed and taking advantage of available resources, beneficiaries can make proactive decisions about paying that align with their healthcare needs and financial situations, including any renewal notice they may receive.

Summary

Navigating the changes to Medicare in 2026 can seem daunting, but understanding the key points can help beneficiaries prepare for the financial impacts. The increase in the Medicare Part B deductible and premiums reflects broader trends in healthcare costs, driven by factors such as medical inflation and legislative changes. These increases highlight the importance of exploring alternative options, such as Medicare Advantage plans, and staying informed about prescription drug coverage changes.

By taking proactive steps, such as budgeting for higher costs and utilizing available resources, beneficiaries can better manage their healthcare expenses and ensure continuous access to necessary services. Staying informed and making informed decisions will be crucial in navigating the complexities of Medicare in 2026 and beyond.

Frequently Asked Questions

→ What is the Medicare Part B deductible for 2026?

The Medicare Part B deductible for 2026 is expected to be $288, reflecting an increase from $257 in 2025.

→ Why is the Medicare Part B deductible increasing in 2026?

The Medicare Part B deductible is increasing in 2026 primarily due to rising healthcare utilization, medical inflation, and adjustments in federal spending. This change reflects ongoing shifts in the healthcare landscape.

→ How will the deductible increase impact Medicare beneficiaries?

The increase in the deductible will likely impose an added financial strain on Medicare beneficiaries, especially seniors on fixed incomes, and may restrict their access to necessary healthcare services.

→ What is IRMAA, and how does it affect higher-income beneficiaries?

IRMAA, or Income-Related Monthly Adjustment Amount, directly impacts higher-income beneficiaries by increasing their Medicare premiums based on their income levels. Consequently, those who earn above specific thresholds will face higher costs for their Medicare coverage.

→ What changes are coming to prescription drug coverage in 2026?

In 2026, prescription drug coverage will feature a cap on out-of-pocket costs at $2,100, eliminate deductibles for insulin, and limit insulin cost-sharing to $35 per month. These changes aim to enhance affordability and access to essential medications.

ZRN Health & Financial Services, LLC, a Texas limited liability company