Anthem Medicare Advantage Plans for 2025

Have you been searching for a healthcare plan that might offer comprehensive coverage that could be tailored to your specific needs and preferences?

Look no further, as a majority of the Anthem Medicare Advantage Plans could provide a diverse range of options that may ensure you receive the best possible healthcare experience.

In this article, we will explore the various Anthem Medicare Advantage Plans, their unique features, and how to choose the right plan for you.

Key Takeaways

- Anthem Blue Cross and Blue Shield will likely offer comprehensive Medicare Advantage Plans and their potential premiums, copays, and deductibles.

- Compare HMO and PPO plans for coordinated care or provider choice respectively as well as Special Needs Plans (SNPs) that could be tailored to individual needs.

- Assess your potential healthcare needs, and compare the possible costs & benefits of certain Anthem Medicare Advantage Plans for 2025 during the Annual Enrollment Period from October 15 – December 7 each year. Seek assistance if needed.

Compare Plans in One Step!

Enter Zip Code

Understanding the Potential Anthem Medicare Advantage Plans

Some Medicare Advantage Plans, also known as Medicare Part C, could serve as an alternative to Original Medicare (Parts A and B). Some of these plans might be offered by private insurance companies, like Anthem Blue Cross and Blue Shield, and will likely be approved by the federal government.

Some of Anthem’s Medicare Advantage Plans could provide:

- Comprehensive coverage, combining Parts A, B, and D

- Possible benefits that may offer an enhanced healthcare experience

- Support for those eligible for state Medicaid programs

Anthem could offer various Medicare Advantage Plan options, such as Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. It’s necessary to compare these plans to find the most suitable option for your healthcare needs.

We will go over the main features of Anthem’s Medicare Advantage Plans, such as the possible comprehensive coverage, options, and the distinctions between HMO and PPO plans.

All-Inclusive Coverage

Some of Anthem’s Medicare Advantage Plans might provide all-inclusive coverage, which may include:

- Hospital (Part A) coverage

- Medical (Part B) coverage

- Prescription drug coverage (Part D)

- Additional benefits like dental, vision, and hearing services

Anthem will likely aim its comprehensive coverage to meet all your healthcare needs within one plan.

In addition to the core Medicare services, certain Anthem Medicare Advantage Plans may also include essential extra benefits that could cater to individual needs. For example, some of these plans might offer:

- Part D prescription drug coverage

- Dental benefits

- Vision benefits

- Hearing benefits

The possibility of having this comprehensive coverage could aim to provide you with an optimal healthcare experience.

Budget-Friendly Options

Anthem understands that healthcare may be expensive, which is why they could offer budget-friendly Medicare Advantage options.

For instance, Anthem might offer several cost-effective Medicare Advantage plans, such as the Medicare Advantage HMO, and Anthem MediBlue Preferred (HMO) that may have no premium and no charge for primary care physician visits.

By potentially offering cost-effective options, Anthem will likely aim to make quality healthcare available to all.

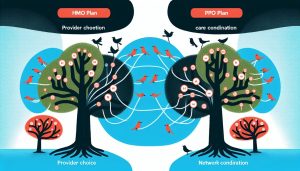

Comparing Anthem’s HMO and PPO Medicare Advantage Plans

Understanding the differences between Anthem’s HMO and PPO Medicare Advantage Plans is key to making a well-considered decision about your healthcare plan.

Both plan types provide comprehensive coverage, but they vary in terms of provider choice and care coordination.

We will cover the main differences between these two types of plans to help you figure out which one best suits your healthcare needs.

HMO Plans: Coordinated Care

Anthem’s HMO Plans focus on coordinated care through a primary care provider, offering lower out-of-pocket costs and a network of healthcare providers. With an HMO plan, you’ll choose a primary care provider (PCP) who will manage your healthcare needs and coordinate any specialist visits or additional services required.

In addition to coordinated care, HMO plans offer comprehensive coverage, including:

- A wide range of prescription drugs

- Medication Therapy Management (MTM) programs for complex health needs

- Preventive services, such as annual check-ups, immunizations, flu shots, certain tests, and screenings

With a focus on care coordination, Anthem’s HMO plans aim to help you uphold your health and well-being.

PPO Plans: Flexibility in Provider Choice

On the other hand, Anthem’s PPO Plans provide flexibility in choosing healthcare providers, both in-network and out-of-network, with varying costs based on provider choice. PPO plans offer the freedom to see any doctor or specialist without the need for a referral, giving you more control over your healthcare decisions.

With a PPO plan, you can visit doctors or utilize facilities that are out of network, provided they are participating with Original Medicare, although costs may be higher if an out-of-network provider is utilized. This flexibility enables you to receive care from the healthcare providers you prefer, aiming to meet your healthcare needs according to your preferences.

Delving into Anthem’s Special Needs Plans (SNPs)

Anthem will likely offer Special Needs Plans (SNPs) that could be tailored to individuals with specific healthcare needs, such as dual eligibility, chronic conditions, or institutional care requirements.

Some of these plans may be designed to provide comprehensive coverage and additional support services for those who may require specialized care.

We will look at the different types of SNPs that Anthem might offer and how they could address individual needs.

Dual Eligible SNPs (D-SNPs)

D-SNPs will likely cater to individuals eligible for both Medicare and the state Medicaid program, potentially providing comprehensive coverage and additional support services. Some of these plans may offer dental, vision, and hearing coverage, and prescription drug coverage for those who meet the necessary qualifications.

With the possibility of having Medicare Part D integrated into these plans, beneficiaries may be able to enjoy seamless prescription drug coverage.

Anthem’s D-SNPs may also offer customized benefits and dedicated care teams that could provide the necessary support to individuals with dual eligibility.

Chronic Condition SNPs (C-SNPs)

C-SNPs might be designed for people with chronic conditions, potentially offering tailored benefits and dedicated care teams that could help manage their healthcare needs. Some of these plans may provide specialized health care that could be tailored to individuals with specific severe or disabling chronic conditions, such as heart disease, diabetes, or lung disease.

Anthem’s C-SNPs will likely focus on the unique needs of individuals with chronic conditions, possibly aiming to provide personalized care and support.

Institutional SNPs (I-SNPs)

I-SNPs could be available for individuals requiring institutional care, potentially providing specialized coverage and support in select states. Some of these plans could be catered to Medicare-eligible individuals who have resided in an institution for 90 days or longer and might even offer tailored benefits and services that could meet the specific needs of individuals in these settings.

Anthem will likely offer I-SNPs to provide appropriate coverage and support to individuals in need of institutional care.

How to Choose the Right Anthem Medicare Advantage Plan

Choosing the right Anthem Medicare Advantage Plan will likely involve assessing your healthcare needs, comparing the possible costs and benefits, and considering potential factors such as provider networks and plan flexibility.

This article could guide you in evaluating your healthcare needs and comparing Anthem’s Medicare Advantage Plan options to help you find the option that best suits your budget and healthcare needs.

Assessing Your Healthcare Needs

To assess your healthcare needs, consider factors like:

- Your medical history

- Your current health status

- Your preferred healthcare providers

- Your current health conditions

- Your medications

- Specialists you may need to see

- Your healthcare utilization patterns

- Specific benefits you need from a healthcare plan

- Your budget

- Your previous experiences with healthcare plans

Reflecting on these potential factors could help you determine the best healthcare plan for your needs.

Assessing your healthcare needs may help you pinpoint the Anthem Medicare Advantage Plan that is most suitable for you, so it’s important to compare Medicare Advantage plans.

Comparing Possible Costs and Benefits

When comparing the costs and benefits of various Anthem Medicare Advantage Plans, you may want to review the potential coverage options, policy details, and cost of premiums. Keep in mind that Anthem’s HMO plans might have lower costs than their PPO plans, where care could be provided within the network.

To obtain the most accurate and up-to-date information, we suggest reviewing the details and pricing of the plans available on Anthem’s website.

In addition to potential costs, consider the possible benefits that might be offered by Anthem. Comparing some of Anthem’s Medicare Advantage plans with those that might be offered by other providers could be beneficial to ensure you are getting the best value for your needs.

Comparing the potential costs and other benefits could help you choose the Anthem Medicare Advantage Plan that best aligns with your healthcare needs and budget.

Enrollment and Support

Understanding eligibility and enrollment periods for Anthem Medicare Advantage Plans, as well as seeking assistance in choosing the right plan, can help ensure a smooth enrollment process.

We will go over the following topics:

- Eligibility requirements for Anthem Medicare Advantage Plans

- Enrollment periods and deadlines

- Support available for individuals interested in Anthem Medicare Advantage Plans

By familiarizing yourself with these details, you could make informed decisions and have a seamless enrollment experience.

Eligibility and Enrollment Periods

To qualify for Medicare Advantage Plans, individuals must be 65 years of age or older, a U.S. citizen or a legal permanent resident, and enrolled in Medicare Part A and Part B.

The Annual Enrollment Period for Medicare Advantage plans runs from October 15 to December 7 each year. Being aware of these enrollment periods is necessary to avoid missing important deadlines and potentially facing penalties for late enrollment.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. One of our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Seeking Assistance

Anthem offers various resources to assist you in selecting the right Medicare Advantage Plan. You can visit their website or contact their customer service at 1-855-817-5785 (TTY: 711) Monday through Friday from 8 a.m. to 8 p.m. for guidance.

Anthem representatives could provide tailored assistance to help you choose the plan that best meets your specific healthcare needs and preferences.

In addition to contacting Anthem representatives, consider attending free informational events where you may learn more about Anthem Medicare plans and ask any questions you may have.

Some of these events might offer useful information about how Anthem Medicare plans may cover expenses that might not be covered by Original Medicare, potentially aiming to help you make a well-considered decision about your healthcare plan.

Summary

Some of the Anthem Medicare Advantage Plans may offer comprehensive coverage and might offer tailored benefits that could fit your unique healthcare needs and preferences.

By understanding the differences between HMO and PPO plans, exploring Special Needs Plans, assessing your healthcare needs, comparing the potential costs and benefits, and seeking assistance from Anthem representatives or informational events, you can make an informed decision about the right Medicare Advantage Plan for you.

Embrace the opportunity to take control of your healthcare and choose the Anthem Medicare Advantage Plan that best aligns with your needs and budget.

Frequently Asked Questions

→ What changes are coming to Medicare Advantage plans?

In 2025, some of the Anthem Medicare Advantage Plans may offer dental, vision, and hearing benefits. For additional details about the plans for the 2025 calendar year, be sure to keep checking back to this website for updates;

→ What is the largest Medicare Advantage plan?

Based on data from previous years, UnitedHealthcare will likely continue to be the largest Medicare Advantage plan, boasting about 1.3 million physicians and care professionals and 6,500 hospitals and care facilities in its nationwide network. Humana may also have a large footprint with plans in most counties.

→ Is Medicare Advantage cheaper?

On average, some of these Medicare Advantage plans might be cheaper than traditional Medicare. For those with low or moderate medical needs, these plans might be the more affordable option after considering the potential plan cost and medical expenses.

→ What is Anthem Mediblue?

Anthem MediBlue Full Dual Advantage plan will likely be a Medicare Advantage and prescription drug plan that could combine hospital, medical, and prescription drug benefits in one plan. It might also offer Medicare Parts A and B and may even include Medicare Part D coverage, which may help you save money.

ZRN Health & Financial Services, LLC, a Texas limited liability company