Medicare Advantage Plans Virginia 2026

If you’re exploring the potential Medicare Advantage Plans in Virginia

Key Takeaways

- Some Virginia Medicare Advantage plans may provide comprehensive healthcare solutions, potentially combining hospital and medical services with additional benefits, such as dental, vision, and hearing coverage.

- Several types of plans are available, including HMO, PPO, and Special Needs Plans (SNPs), each offering unique benefits tailored to specific healthcare needs.

- Enrollment in Medicare Advantage requires having Medicare Part A and B, with multiple enrollment periods available, including Initial Enrollment and Annual Enrollment, allowing flexibility in plan selection.

Compare Plans in One Step!

Enter Zip Code

Understanding Virginia Medicare Advantage Plans 2026

Some Medicare Advantage plans in Virginia may offer a comprehensive healthcare solution by potentially combining hospital and medical services with additional benefits in a single plan. These plans, also known as Medicare Part C, will likely be provided by private insurers approved by the Centers for Medicare & Medicaid Services (CMS).

These plans will likely be tailored to meet diverse healthcare needs, offering options like Health Maintenance Organization (HMO) plans and Preferred Provider Organization (PPO) plans, among others. Enrollment typically requires participants to use a network of doctors and hospitals, especially in HMO plans. Knowing these structures could aid in making informed healthcare coverage decisions.

Types of Virginia Medicare Advantage Plans Available

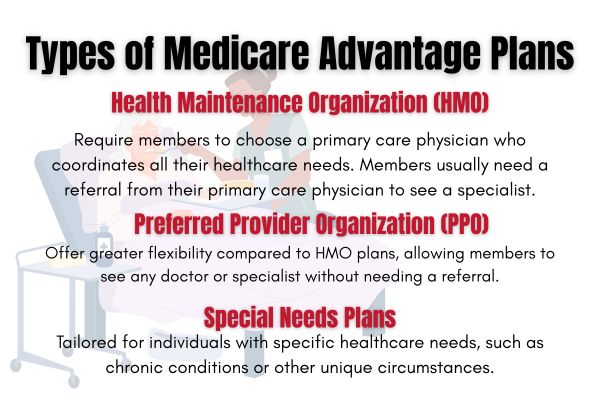

Virginia offers several types of Medicare Advantage plans, each catering to different healthcare needs and preferences. The main types include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs).

Each plan type offers unique features and benefits aimed at comprehensive coverage and specific healthcare needs.

HMO Plans

Health Maintenance Organization (HMO) plans have been a popular choice among Medicare Advantage plans in Virginia in recent years. These plans typically require members to select a primary care physician (PCP) from an in-network provider list, who will coordinate all their healthcare needs. Referrals from the PCP may be required to see specialists, ensuring that care is well-coordinated and managed. While these plans might offer some out-of-network benefits, the costs may be generally higher if members seek care outside the Medicare Advantage organization network.

PPO Plans

Preferred Provider Organization (PPO) plans offer more flexibility in choosing healthcare providers compared to HMO plans. Members can see any doctor or specialist without needing a referral, although staying within the network could potentially result in lower out-of-pocket costs. This flexibility will likely be one of the main attractions of PPO plans, as it could allow members to access a broader range of healthcare providers.

The blend of flexibility and comprehensive coverage could make PPO plans valuable for many beneficiaries.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are designed for individuals with specific health needs, such as chronic conditions or those eligible for both Medicare and Medicaid. These plans will likely provide tailored benefits and services to meet the distinct requirements of their members. SNPs may require members to have a primary care doctor to coordinate their care, ensuring well-managed health services.

SNPs can either be HMO or PPO types and cover the same Medicare Part A and Part B benefits as standard Medicare Advantage Plans. Moreover, all SNPs must include Medicare drug coverage under Part D.

These plans may be particularly beneficial for individuals with chronic diseases or special health care needs, as they could offer enhanced care coordination and access to specialized services.

Overview of Virginia Medicare Advantage Plans 2026

Based on data from recent years, approximately 1.5 million seniors, representing about 17% of Virginia’s population, were enrolled in Medicare Advantage plans.

The availability, monthly premiums, and out-of-pocket costs of these plans might vary significantly by location, with several private health insurance providers likely offering Medicare Advantage plans in the state. Some of Virginia’s top-rated plans boast 4.5-star ratings from the Centers for Medicare and Medicaid Services (CMS).

Potential Services and Benefits

Some of Virginia’s Medicare Advantage plans may offer additional services and benefits, such as vision, dental, and hearing. This extensive coverage could potentially guarantee that beneficiaries could have access to essential healthcare services that may go beyond Original Medicare.

Enrollment Process for Virginia Medicare Advantage Plans 2026

Enrolling in a Medicare Advantage plan in Virginia requires beneficiaries to first have Medicare Part A and Part B. The state offers a variety of plans, with several Medicare Advantage options available.

Understanding the enrollment process is crucial to ensure you benefit from these comprehensive health plans.

When to Enroll

The initial enrollment window for Medicare is a seven-month period that includes three months before, the month of, and three months after an individual’s 65th birthday. This period is essential to ensure continuous coverage and avoid late enrollment penalties. Individuals who are eligible due to age or certain disabilities can also qualify.

Additionally, the Annual Enrollment Period, occurring annually from October 15 to December 7, allows beneficiaries to modify their Medicare coverage.

Special Enrollment Periods are available for life changes like moving or losing previous health coverage. If your Medicare Advantage plan is being discontinued, you have options. You can enroll in a new plan during a Special Enrollment Period from December 8 to February 28.

Different Enrollment Periods

Enrollment for Medicare Advantage plans occurs during several distinct periods, including the Initial Enrollment Period, the Annual Enrollment Period, and Special Enrollment Periods. The Initial Enrollment Period lasts for seven months, encompassing three months before and after one’s 65th birthday. This period is crucial for new enrollees to start their coverage without delays.

The Open Enrollment Period for Medicare Advantage occurs annually from October 15 to December 7 each year, allowing beneficiaries to switch plans or make changes to their coverage. Additionally, the Medicare Advantage Open Enrollment Period runs from January 1 to March 31, enabling current enrollees to switch plans or revert to Original Medicare.

Specific life changes trigger Special Enrollment Periods, permitting beneficiaries to enroll or switch plans outside regular enrollment windows.

OEP, AEP, and Special Enrollment

The Annual Enrollment Period (AEP) allows individuals to make changes to their Medicare Advantage plans each year, typically running from October 15 to December 7. During this time, beneficiaries can join, switch, or drop a Medicare Advantage plan based on their needs.

The Open Enrollment Period (OEP) for Medicare Advantage plans is from January 1 to March 31, permitting existing enrollees to switch plans or return to Original Medicare.

Special Enrollment Periods (SEPs) provide opportunities for individuals to change their Medicare plans due to specific life events, like moving or losing other coverage. For instance, moving to a new address outside your current plan’s service area qualifies you for a SEP, during which you can switch to a new Medicare Advantage plan.

Potential Costs Associated with Virginia Medicare Advantage Plans 2026

Depending on the specific plan chosen, some Medicare Advantage plans may offer varying premiums, copay, and deductible. Knowing these costs will likely be essential to selecting the most affordable and beneficial plan.

Premiums and Co-Pays

Premiums and co-pays for Medicare Advantage plans may vary significantly based on the specific plan chosen. Out-of-pocket costs may also vary, which may have fixed co-pays that differ from the 20% coinsurance required by Original Medicare.

Some plans may also set an out-of-pocket spending limit, and once this limit is reached, the plan will likely cover the remaining covered health services for the year.

Out-of-Pocket Maximums

Some Medicare Advantage plans in Virginia might include an out-of-pocket maximum that could protect beneficiaries from excessive costs. This annual limit could potentially cap the total expenses for covered services within a year.

The cap resets annually, possibly safeguarding against high healthcare costs from serious health issues.

Potential Services and Benefits

Some Medicare Advantage plans may encompass a wide range of benefits that could be tailored to individual needs. Members could potentially access dental services, such as check-ups and cleanings, which are not typically covered by Original Medicare. Vision benefits may include annual eye exams and allowances for glasses or contact lenses, possibly ensuring comprehensive eye care. Hearing coverage might include exams and coverage for hearing aids and fittings.

How to Qualify for Virginia Medicare Advantage Plans 2026

To qualify for a Medicare Advantage plan in Virginia, individuals must be enrolled in either Medicare Part A or Part B. Medicare eligibility generally requires individuals to be 65 or older, although younger individuals with specific disabilities or health conditions like end-stage renal disease or amyotrophic lateral sclerosis may also qualify.

Additionally, those who have received Social Security Disability Insurance benefits for at least 24 months are eligible for Medicare. Virginia residents must be U.S. citizens or legal residents for at least five years to qualify. Certain life events can trigger a special enrollment period, allowing individuals to sign up for Medicare outside standard enrollment times.

Contracted Network and Access to Care

Medicare Advantage plans might offer flexibility by allowing members to visit out-of-network providers, although costs may be higher. In-network primary care providers could play a significant role in coordinating care for HMO Medicare Advantage plans, likely ensuring that members receive comprehensive and well-managed healthcare. Access to a broader network of healthcare providers might help Medicare Advantage members manage their healthcare expenses effectively.

Enrollees in Medicare Advantage PPO plans do not need referrals for specialist visits, possibly enhancing access to specialized care. Emergency care services are covered worldwide, ensuring access to necessary care even when traveling outside the network or country. This comprehensive coverage could potentially ensure that members receive the care they need, wherever they are.

Comparing Virginia Medicare Advantage Plans to Original Medicare

Some Virginia Medicare Advantage plans may provide additional benefits compared to Original Medicare, including dental, vision, and hearing coverage. While Medicare Advantage plans must include all benefits provided by Original Medicare, some might offer more comprehensive coverage options, possibly making them an attractive choice for many beneficiaries.

Coverage Differences

Medicare Advantage plans will likely include a coordinated care approach, which may lead to better health outcomes due to the emphasis on preventive care and regular check-ups.

Certain Medicare Advantage plans may include additional benefits like dental, vision, and hearing coverage, which are not typically included in Original Medicare. These supplemental benefits, combined with comprehensive Medicare Part A and Part B coverage, could make Medicare Advantage plans a robust alternative to Original Medicare.

Cost Comparisons

While Original Medicare has no Part A monthly premium, beneficiaries still face Part B costs, whereas some Medicare Advantage plans could potentially offer reduced monthly premiums. Annual out-of-pocket maximums for Medicare Advantage plans could differ significantly depending on the chosen plan.

These cost comparisons will likely highlight the potential financial benefits of Medicare Advantage plans. Members can use this website to evaluate the costs and coverage of different Medicare Advantage plans side by side.

Emergencies and Referrals

For Medicare Advantage plans, emergency services do not require a referral, allowing immediate access to care. In the case of an emergency, beneficiaries may receive treatment from any provider, regardless of whether they are part of the network, likely ensuring that urgent needs are met promptly. Worldwide emergency and urgent care coverage is also included, providing peace of mind for members traveling abroad.

However, when using out-of-network providers for non-emergency care, members may incur higher costs. Certain plans may require referrals for specialist visits, depending on the plan type, to ensure coordinated and managed care. Additionally, some plans offer urgent care services that do not require a referral, enhancing access to timely medical assistance.

Summary

Navigating the various Medicare Advantage plans in Virginia might be overwhelming, but understanding the potential benefits, costs, and enrollment processes can make the decision easier. From the flexibility and comprehensive coverage offered by PPO plans to the coordinated care of HMO plans, there will likely be a plan to suit every member’s need. Special Needs Plans provide tailored services for those with specific health conditions, possibly ensuring that all beneficiaries receive the care they need.

Virginia Medicare Advantage plans could offer a wealth of benefits, which might include lower out-of-pocket costs, additional health services, and extensive coverage options not available in Original Medicare. By understanding the different types of plans, the enrollment process, and the potential costs, you could make an informed decision and select the plan that best meets your healthcare needs. Remember, your health is your most valuable asset, and choosing the right Medicare Advantage plan is a crucial step in protecting it.

Frequently Asked Questions

→ What are the main types of Medicare Advantage plans available in Virginia?

The main types of Medicare Advantage plans available in Virginia are Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs), each designed to meet various healthcare requirements. Choosing the right plan depends on your specific health needs and preferences.

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the Initial Enrollment Period around your 65th birthday, the Annual Enrollment Period from October 15 to December 7, or during Special Enrollment Periods due to specific life events. Make sure to choose the timing that best fits your circumstances.

→ What additional benefits could Medicare Advantage plans offer compared to Original Medicare?

Some Medicare Advantage plans may provide additional benefits like dental, vision, and hearing coverage, which are not available with Original Medicare. These potential benefits could enhance your healthcare experience and overall well-being.

→ How might costs for Medicare Advantage plans compare to Original Medicare?

Unfortunately, the plan details for 2026 have not been released, but make sure to check back in to this article/website for updated information for the 2026 calendar year.

→ Are emergency services covered under Medicare Advantage plans?

Yes, Medicare Advantage plans cover emergency services without requiring a referral, providing worldwide access to necessary care, even while traveling.

ZRN Health & Financial Services, LLC, a Texas limited liability company