Medicare Advantage Plans Oklahoma 2026

Wondering what the Medicare Advantage plans in Oklahoma

Key Takeaways

- Some Oklahoma Medicare Advantage Plans might include additional coverage options that could go beyond Original Medicare, including services like dental, vision, and hearing coverage.

- There will likely be several Medicare Advantage plans available in Oklahoma, including various types like HMO, PPO, and Special Needs Plans, each with unique benefits and structures.

- Annual enrollment periods will likely be crucial for beneficiaries to reassess their Medicare Advantage options and ensure their coverage meets their healthcare needs, including Open Enrollment from October 15 to December 7.

Compare Plans in One Step!

Enter Zip Code

Understanding Oklahoma Medicare Advantage Plans 2026

Oklahoma Medicare Advantage Plans could offer beneficiaries a variety of coverage options, potentially including additional benefits that might to beyond traditional Medicare. Some plans may provide coverage for dental, vision, and hearing services. This means that enrollees could potentially access a broader spectrum of healthcare services, likely promoting overall well-being and proactive health management.

Medicare Advantage Plans in Oklahoma must cover all services included in Original Medicare, although rules and costs may differ. This likely guarantees beneficiaries access to essential healthcare services, sometimes with additional benefits. Knowing these details could help maximize your healthcare benefits.

Types of Oklahoma Medicare Advantage Plans Available

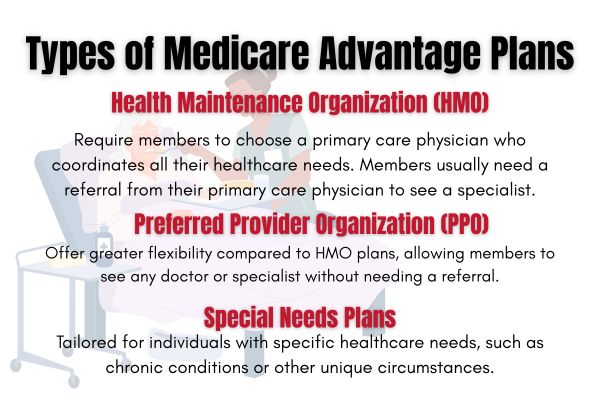

There will likely be several Medicare Advantage Plans in Oklahoma, likely catering to diverse healthcare needs, with options including HMO, PPO, and Special Needs Plans (SNPs).

Each plan type has distinct benefits and structures, so it’s crucial to understand their differences to select the best fit for your healthcare needs.

HMO Plans

Health Maintenance Organization (HMO) plans typically require members to use a network of doctors and hospitals for coverage. This approach could help manage costs effectively while ensuring coordinated care. Members of HMO plans generally need to choose a primary care physician who acts as a gatekeeper for all healthcare services. Referrals may be required for specialist visits, which promotes a structured and managed care pathway.

HMO plans may also necessitate members to select a primary care provider who coordinates their healthcare within a specified network. Focusing on preventative services, these plans will likely promote proactive health management, likely resulting in better long-term health outcomes.

PPO Plans

Preferred Provider Organization (PPO) plans offer more flexibility in choosing healthcare providers and do not require referrals for specialists. This flexibility allows members to see any doctor or specialist without a referral, though they might incur higher costs when using network providers. PPO plans could be particularly beneficial for those who travel frequently or prefer a wider choice of healthcare providers.

PPO Medicare Advantage plans grant flexible access to a broad network of healthcare providers without the need for referrals. However, visiting out-of-network providers may result in higher out-of-pocket costs compared to in-network ones.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific conditions, including chronic illnesses. These plans are designed for individuals with specific healthcare needs or those who are dual eligible for Medicare and Medicaid. SNPs will likely provide tailored benefits and care coordination services that address the unique requirements of their members.

Members must continue to meet the special eligibility criteria to remain enrolled in an SNP.

Overview of Oklahoma Medicare Advantage Plans 2026

Beneficiaries should review their plans annually to ensure they meet their evolving healthcare needs. The Oklahoma Insurance Department aids individuals in understanding their Medicare options and any changes that may occur.

These plans could provide comprehensive coverage and support for managing chronic health conditions. These plans will likely be structured to potentially reduce out-of-pocket expenses and simplify health insurance management for retirees.

Potential Services and Benefits

Medicare Advantage plans include a range of healthcare services such as hospitalization and outpatient care. Some plans may offer access to additional services like dental, vision, and hearing care, possibly enhancing members’ overall health coverage. Prescription drug coverage may also be bundled within certain plans, possibly ensuring members receive essential medications.

By providing a comprehensive suite of services, these plans aim to improve overall health outcomes for their members.

Possible Benefits of Oklahoma Medicare Advantage Plans 2026

Some Oklahoma Medicare Advantage Plans might feature lower monthly premiums compared to other coverage options. Certain plans may also offer additional coverage, such as dental, vision, and hearing services. This comprehensive approach could help members manage their healthcare more efficiently and affordably.

Some Oklahoma Medicare Advantage plans may also include a maximum out-of-pocket limit, which could help protect members from high medical expenses. These plans could potentially enhance access to healthcare services in the community by providing a network of local providers.

Potential Health Services

Dental care under certain plans might include services such as oral exams, cleanings, and coverage for fillings and extractions. Vision coverage may include an annual eye exam and assistance for purchasing eyeglasses or contact lenses.

Hearing services could potentially consist of an annual hearing exam along with coverage for hearing aids.

Enrollment Process for Oklahoma Medicare Advantage Plans 2026

Medicare beneficiaries are encouraged to review their current coverage annually within the calendar year to assess potential changes in their plans.

Knowing when and how to enroll ensures you get the best coverage for your needs.

When to Enroll

Beneficiaries should be aware that the Open Enrollment Period allows for adjustments to Medicare Advantage plans every year. The Open Enrollment Period for Medicare Advantage plans typically occurs from October 15 to December 7 each year. During this time, members can make changes to their plans to better suit their healthcare needs.

The Initial Enrollment Period spans seven months, starting three months before an individual’s 65th birthday and ending three months after. This period is critical for new beneficiaries to sign up for Medicare Advantage plans.

Additionally, the Annual Enrollment Period (AEP) allows changes to Medicare coverage from October 15 to December 7 each year. For those whose plans are discontinued, a Special Enrollment Period from December 8 to February 28 is available.

Different Enrollment Periods

There are specific times during the year designated for enrollment changes, including the Open Enrollment Period and Special Enrollment Periods. The Initial Enrollment Period allows new beneficiaries to enroll in a Medicare Advantage Plan, starting three months before they receive Medicare and ending three months after.

The Open Enrollment Period occurs annually from October 15 to December 7, allowing beneficiaries to switch plans or change their coverage. A Medicare Advantage Open Enrollment Period runs from January 1 to March 31, designed for individuals already enrolled in a Medicare Advantage Plan to make changes.

Certain life events, like moving or losing other health coverage, trigger Special Enrollment Periods, allowing adjustments to Medicare plans outside standard enrollment times.

OEP, APE, and Special enrollment

The Open Enrollment Period (OEP) and Annual Enrollment Period (AEP) are critical for beneficiaries to modify their Medicare Advantage plans. The Annual Enrollment Period (AEP) runs from October 15 to December 7, allowing beneficiaries to change their Medicare plan options for the upcoming year.

During the Medicare Advantage Open Enrollment Period (MA OEP), which annually takes place from January 1 to March 31, current Medicare Advantage enrollees can switch plans or revert to Original Medicare. Special Enrollment Periods may be available for individuals who experience qualifying life events, allowing them to enroll outside standard periods.

If an individual misses these enrollment periods, they must typically wait until the next enrollment period to make changes to their Medicare coverage.

Potential Costs Associated with Oklahoma Medicare Advantage Plans 2026

Costs for Oklahoma Medicare Advantage plans could vary significantly based on the plan type and provider. Knowing these costs could help in budgeting and planning your healthcare expenses.

Premiums and Co-Pays

Some Medicare Advantage plans might require a monthly premium in addition to the standard Medicare Part B premium. Co-pays for certain services under Medicare Advantage plans may differ based on the plan selected.

Variations in premiums and co-pays could significantly affect your overall healthcare costs, so choosing a plan that aligns with your financial and healthcare needs is important.

Out-of-Pocket Maximums

Certain Medicare Advantage plan may offer a maximum out-of-pocket limit, which could potentially protect members from excessive healthcare costs in a given year.

After reaching the out-of-pocket maximum, beneficiaries will likely not face further cost-sharing for Part A or Part B covered services for the remainder of the year.

Potential Services and Benefits

Medicare Advantage plans offer coverage for a range of medical services, including hospital stays, outpatient care, and preventive services. Additional benefits may include dental, vision, and hearing services, which are not typically covered by Original Medicare. These potential enhancements could provide members with comprehensive healthcare services tailored to their needs.

Care management and support services will likely be included, assisting members with chronic conditions through personalized resources. These robust benefits could make Medicare Advantage plans a valuable option for many beneficiaries.

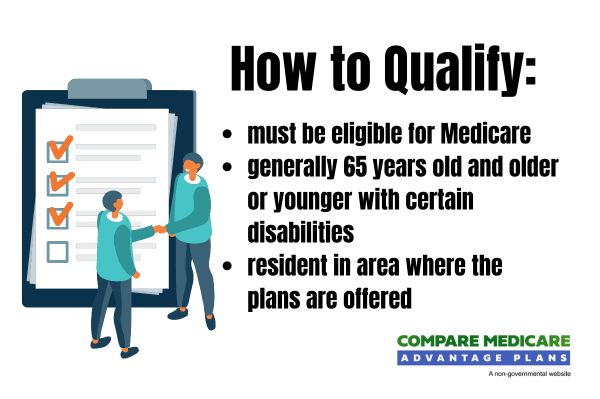

How to Qualify for Oklahoma Medicare Advantage Plans 2026

To be eligible for Oklahoma Medicare Advantage plans, individuals must first enroll in Medicare Part A and Part B. Applicants must also reside in the service area of the Medicare Advantage plan they wish to enroll in. These basic eligibility requirements guarantee access to the healthcare services provided by these plans.

Individuals can enroll in Medicare Advantage plans during specific periods:

- Initial Enrollment Period: Begins three months before one turns 65 and extends for three months after.

- Annual Enrollment Period: Runs from October 15 to December 7 each year.

- Special Enrollment Periods: Available under certain circumstances.

During the Medicare Advantage Open Enrollment Period, which lasts from January 1 to March 31, individuals can change plans or switch to Original Medicare, providing flexibility to adjust their coverage as needed.

Contracted Network and Access to Care

Medicare Advantage plans could potentially offer flexibility by allowing members to choose providers both in and out of their network, particularly with PPO plans. This flexibility may be crucial for managing healthcare expenses, as members may incur lower costs by utilizing in-network providers. However, Medicare Advantage HMO plans typically require members to have a primary care provider who coordinates their care.

In HMO plans, access to specialists may require referrals, indicating a structured approach to specialist care. Emergency services and urgent care are covered worldwide for Medicare Advantage members, highlighting the plan’s global reach. This comprehensive network likely ensures that members could access necessary care wherever they are.

Comparing Oklahoma Medicare Advantage Plans to Original Medicare

In Oklahoma, Medicare Advantage plans are provided by private insurers, possibly offering a variety of coverage options that might include additional benefits not available in Original Medicare. These plans cover all Original Medicare services while sometimes adding extra benefits, likely making them a compelling choice for many beneficiaries.

Coverage Differences

Some Medicare Advantage plans might include services such as dental, vision, hearing, and prescription drug coverage, which are typically not covered by Original Medicare.

Cost Comparisons

Costs for services might vary widely, possibly making them financially accessible for many seniors. These cost structures could potentially provide significant financial benefits compared to Original Medicare, which might have higher expenses.

Emergencies and Referrals

Medicare Advantage PPO plans allow members to see any provider who accepts Medicare without needing a referral. This flexibility could be crucial during emergencies when timely access to care is essential. In emergencies, members can access urgent care services without pre-authorization from their primary care provider, likely ensuring they receive the necessary care promptly.

For non-emergency specialist visits, the need for a referral might vary depending on the specific Medicare Advantage plan chosen. During declared emergencies, Medicare Advantage plans may waive referral requirements to ensure timely access to care. These provisions guarantee that members receive the necessary care without unnecessary delays.

Summary

Oklahoma Medicare Advantage Plans

Choosing the right Medicare Advantage plan in Oklahoma likely requires careful consideration of the potential costs, benefits, and coverage options. With the right plan, you can enjoy a healthier, more secure future. Take control of your healthcare today and explore the options that best suit your needs.

Frequently Asked Questions

→ What are the potential benefits of Oklahoma Medicare Advantage Plans?

Some Oklahoma Medicare Advantage Plans may provide additional services such as dental, hearing, vision, and prescription drug coverage. These potential benefits could make these plans an attractive option for many beneficiaries.

→ When can I enroll in a Medicare Advantage Plan?

You can enroll in a Medicare Advantage Plan during the Initial Enrollment Period, which spans seven months around your 65th birthday, the Annual Enrollment Period from October 15 to December 7, or during Special Enrollment Periods triggered by qualifying life events.

→ What types of Medicare Advantage Plans are available in Oklahoma?

Oklahoma offers HMO plans, PPO plans, and Special Needs Plans through Medicare Advantage, allowing you to choose according to your healthcare preferences and needs.

→ How do out-of-pocket maximums work with Medicare Advantage Plans?

Some Medicare Advantage Plans might feature an out-of-pocket maximum that could limit your annual expenses for covered services. Once you reach this limit, you likely won’t have to pay any more cost-sharing for Part A or Part B services for the remainder of the year.

ZRN Health & Financial Services, LLC, a Texas limited liability company