What is Medicare Part C?

Healthcare is a fundamental right, and ensuring its accessibility is paramount. But, navigating through the myriad of health insurance options can be a maze. The key? Understanding the offerings and making informed decisions.

One such offering is Medicare Part C, commonly known as Medicare Advantage. Medicare Advantage has been gaining popularity as a comprehensive, all-in-one alternative to Original Medicare.

Offering an array of benefits that extend beyond basic Medicare, this could be the guiding light you’ve been seeking in your healthcare journey.

Key Takeaways

- Medicare Part C combines Parts A, B, and D with additional benefits such as vision and dental care.

- Understand plan types like HMOs & PPOs to select a suitable Medicare Advantage plan for you.

- Maximize your coverage by comparing different plans, attending informational events & navigating other coverage options.

Compare Plans in One Step!

Enter Zip Code

Unlocking the Benefits of Medicare Part C

Think of Medicare Advantage as a buffet of healthcare coverage. It amalgamates the benefits of Parts A and B, and often Part D, into a single plan, with added perks provided by private insurance companies.

It’s like having a dedicated team, where each player brings unique skills to the table, creating a formidable lineup to tackle your healthcare needs.

What makes Medicare Advantage distinct from traditional Medicare Parts A, B, and D? The differentiation comes from the extra benefits and all-encompassing coverage it offers. Medicare Part C consolidates Part B medical insurance, hospital insurance, and prescription drug coverage, along with additional benefits such as dental, vision, and hearing services.

into one plan. Essentially, Medicare Advantage serves as a comprehensive solution for your healthcare needs, eliminating the need to manage multiple plans.

What’s Included in Medicare Advantage Plans

Medicare Advantage plans are like a safety net, catching all the services included in traditional Medicare under Part A and extending the coverage even further. These plans are obligated to cover all hospital services, certain home health, and hospice care. They’re like a multi-tool, equipping you with a wide array of services, including:

- Hospital care

- Preventive services

- Prescription drug coverage

- Vision and dental care

- Hearing aids

- Fitness programs

- Transportation services

All under one roof.

Notably, these plans offered by the insurance company, which is one of the private companies in the industry, extend beyond basic coverage. They incorporate extra benefits including:

- Dental services

- Vision services

- Hearing services

- Wellness programs that encompass fitness programs, nutrition benefits, preventive care, and other wellness services

So, with a Medicare Advantage plan, you’re not just covered for the essentials, but also for the extras that keep you healthy and happy.

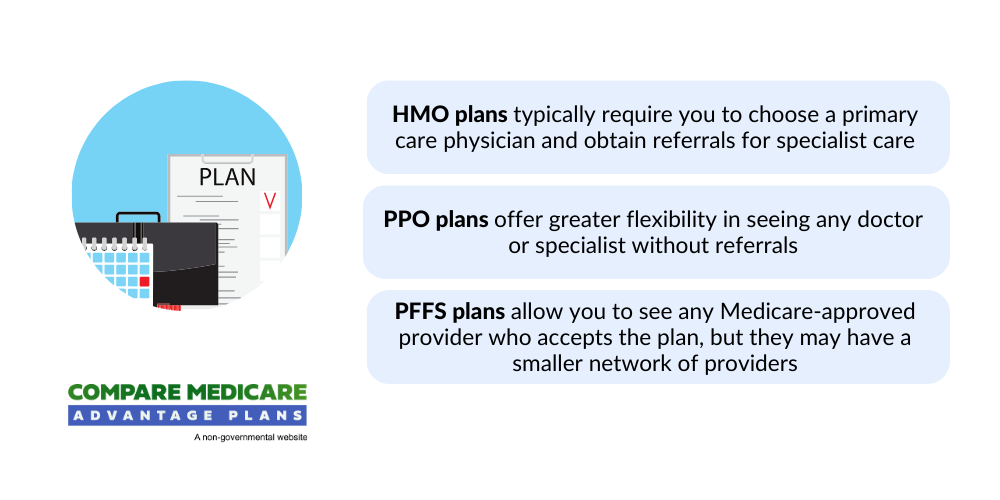

Understanding Plan Types: HMOs, PPOs, and More

Medicare Advantage plans vary in their structure and offerings. The variety includes:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Dual Eligible Special Needs Plans (D-SNPs)

- Chronic Condition Special Needs Plans (C-SNPs)

It’s like choosing a vehicle; each model has its unique features and specifications, and the best one for you depends on your specific needs and preferences.

HMO plans are more suitable for in-network care, whereas PPO plans generally allow for access to care outside of the network without a referral. It’s like the difference between a city car and an all-terrain vehicle. With the former, you’re more limited to city roads, but it’s more cost-efficient.

The latter allows you to venture off-road, providing more flexibility, but at a higher cost. Thus, understanding your healthcare needs and preferences is key to choosing the right Medicare Advantage plan.

Prescription Drug Coverage Integration

Medicare Advantage plans often integrate Part D prescription drug coverage into their benefits package. This integration simplifies your healthcare management, much like a smartphone consolidating multiple devices into one.

Medicare Part D, also known as the drug coverage part, assists in covering the costs of prescription drugs, acting as a safety net for your medication costs.

With most Medicare Advantage plans integrating this coverage, your plan becomes a one-stop-shop for your healthcare needs, including your prescription medications. This integration saves you the hassle of managing multiple plans and ensures that you have comprehensive coverage for your healthcare needs.

Navigating Costs with Medicare Part C

While Medicare Advantage offers a wide range of benefits, it’s equally significant to comprehend the associated costs. Understanding the potential financial commitments, from premiums to out-of-pocket expenses, aids in making a sound decision.

All Medicare Advantage plans have an annual limit on out-of-pocket expenses, acting like a financial safeguard, ensuring that your healthcare costs don’t spiral out of control. The average premium for Medicare Part C plans is $18 per month, making it a cost-effective solution for comprehensive healthcare coverage.

However, it’s important to bear in mind that Medicare Part C plans may have additional out-of-pocket costs, such as copayments and deductibles, which must be taken into account when comparing the overall cost. It’s like shopping for a car; the sticker price may be appealing, but you also need to consider the running costs.

Comparing Out-of-Pocket Costs

When it comes to healthcare coverage, out-of-pocket costs can often be a deciding factor. Comparing these costs between Original Medicare and Medicare Advantage plans can provide a clearer picture of your potential expenses.

Studies indicate that Medicare Advantage plans typically have lower out-of-pocket costs in comparison to Original Medicare. Furthermore, Medicare Advantage plans feature an out-of-pocket limit, acting as a safety net to protect you from excessive healthcare costs. This is one of the reasons why medicare pays more attention to Medicare Advantage plans.

It’s like having a speed limiter on your car, ensuring that your healthcare expenses don’t exceed your budget.

Premiums and Savings Opportunities

While premiums are a significant part of your healthcare costs, there are potential savings opportunities with Medicare Advantage plans that can help to offset these costs.

The average premium for Medicare Advantage Plans varies based on the plan, with the average premium estimated to be $18.50 per month for 2024 plans. However, there are subsidies and assistance programs available to aid with these costs, much like financial aid for education, making comprehensive healthcare coverage more accessible.

By identifying these opportunities and incorporating them into your financial planning, you can reduce your Medicare Advantage plan premiums and make the most of your healthcare budget.

Enrollment Periods and Eligibility

Understanding the timeline and process for enrolling in a Medicare Advantage plan is as significant as comprehending its benefits and costs. With specific enrollment periods and eligibility requirements, it’s important to mark your calendar and ensure that you meet the criteria to join a plan.

The Medicare Advantage Open Enrollment Period runs annually from January 1 to March 31, offering a window for those enrolled in a Medicare Advantage plan to modify their Medicare coverage. It’s like a yearly health check, providing an opportunity to review your plan and make necessary adjustments.

To be eligible for a Medicare Advantage Plan, one must first be enrolled in Original Medicare (Part A and Part B) and reside in the service area of a Medicare Advantage plan. It’s like applying for a membership at a local club, where you need to be a resident of the area and meet certain criteria to join.

Initial Steps to Join a Medicare Advantage Plan

Joining a Medicare Advantage plan can be a straightforward process, provided you know the initial steps and eligibility requirements.

To join a Medicare Advantage Plan, you must first enroll in Medicare Part A and Part B. Upon receipt of your Medicare card and the effective dates, you may proceed with signing up directly with the private insurer or contact 800-MEDICARE for enrollment assistance. It’s like signing up for a marathon; you first need to register and receive your bib number, and then you can prepare for the race.

To be eligible, you must possess both Medicare and Medicaid eligibility. It’s like a two-step verification process, ensuring that you meet all the requirements before joining the plan.

Changing or Updating Your Plan

Understanding how and when to change or update your Medicare Advantage plan is crucial, as your healthcare needs may evolve over time.

Understanding how and when to change or update your Medicare Advantage plan is crucial, as your healthcare needs may evolve over time.

The initial enrollment period spans from January 1 to March 31, offering a window for individuals with a Medicare Advantage plan to switch plans.

It’s like a spring cleaning period for your healthcare coverage, providing an opportunity to review and update your plan.

To switch from Medicare Advantage to Original Medicare, you may contact 800-MEDICARE or get in touch with your plan provider to disenroll.

It’s like moving houses; you can choose to switch to a different neighborhood if it better suits your lifestyle and preferences.

Specialized Medicare Advantage Options

Beyond the standard Medicare Advantage options, there are specialized plans designed to cater to specific healthcare needs. Just as a custom-made outfit fits precisely, these specialized plans like Dual Eligible SNPs and Chronic Condition SNPs are designed to meet your specific healthcare needs.

Dual Eligible SNPs (D-SNPs) are designed for individuals who are eligible for both Medicare and Medicaid, providing additional support and extended coverage. On the other hand, Chronic Condition SNPs (C-SNPs) are tailored for individuals with severe or disabling chronic conditions, offering additional support and extended coverage for those with qualifying chronic health conditions.

It’s like having a specialized personal trainer, providing a tailored workout regimen to cater to your specific fitness goals.

Delving into Dual Eligible SNPs (D-SNPs)

Dual Eligible Special Needs Plans (D-SNPs) combine the benefits of Medicare and Medicaid for individuals who qualify for both, creating a comprehensive healthcare safety net.

D-SNPs offer exclusive benefits, such as prescription drug coverage, and facilitate dual-eligible individuals to access and coordinate their healthcare services easily. Eligibility for these plans is dependent on both Medicare and Medicaid benefits, and they may also provide specialized care and wrap-around services.

Imagine having a VIP pass at a concert, giving you access to all areas and exclusive perks.

Chronic Conditions and C-SNPs

Chronic Condition Special Needs Plans (C-SNPs) are designed to provide tailored care for individuals with specific chronic health conditions. C-SNPs customize care to individual health conditions by providing personalized care plans that accommodate the unique needs of individuals with chronic conditions.

They focus on care coordination and provide services specifically designed to manage and address the difficulties associated with these conditions. Some key features of C-SNPs include:

- Personalized care plans

- Care coordination

- Disease management programs

- Specialized provider networks

- Prescription drug coverage

These plans are designed to help individuals with chronic conditions receive the care and support they need to manage their health effectively.

It’s like having a specialized cookbook, providing recipes tailored to your specific dietary requirements.

How to Choose the Right Medicare Advantage Plan for You

Selecting an appropriate Medicare Advantage plan is akin to finding the perfect pair of shoes; it should match your needs, offer comfort, and deliver necessary support. This section will guide you on how to choose the right Medicare Advantage plan by assessing your healthcare needs and comparing benefits beyond basic Medicare covered services.

There are various factors to consider when selecting a Medicare Advantage plan, such as:

- Premiums

- Deductibles

- Copayments

- Coinsurance

- Network of healthcare providers

- Prescription drug coverage

- Maximum out-of-pocket costs

Evaluating these factors can assist in making an informed decision. It’s like choosing a vacation destination; you need to consider the cost, the activities available, and the overall experience.

Assessing Your Healthcare Needs

Just as you would assess your needs before purchasing a car or a house, evaluating your healthcare needs is essential in selecting the right Medicare Advantage plan.

Factors to consider when evaluating your healthcare requirements for Medicare Advantage include:

- Coverage

- Cost

- Network

- Prescription drugs

- Additional benefits

- Quality of care

- Health risk assessment

It’s like creating a shopping list before heading to the grocery store, ensuring you have a clear idea of what you need.

Comparing Benefits Beyond Basic Medicare Covered Services

Beyond the basic Medicare covered services, Medicare Advantage plans offer additional benefits that can enhance your healthcare coverage. Comparing these benefits can help you maximize your coverage and get the most out of your plan.

The additional benefits available through Medicare Advantage plans may include:

- Coverage for prescription drugs

- Dental and vision care

- Hearing aids

- Fitness programs

- Telehealth services

It’s like an all-you-can-eat buffet, offering a variety of options beyond the main course, allowing you to enjoy a comprehensive dining experience.

Navigating Other Coverage Options

Though Medicare Advantage offers all-inclusive Medicare health coverage, there exist other Medicare coverage options that can augment your Medicare benefits.

Exploring these options can help you maximize your healthcare coverage and meet your specific healthcare needs.

Medicare Supplement Insurance (Medigap) is an additional insurance that helps cover expenses associated with Original Medicare.

It’s like having an umbrella, providing an extra layer of protection against unexpected healthcare costs.

On the other hand, Medicare Part D is a prescription drug coverage available to all individuals with Medicare, offering a safety net for your medication costs.

It’s like having a book cover, protecting your precious book from wear and tear.

Maximizing Your Medicare Advantage Benefits

Having familiarized yourself with Medicare Advantage, it’s now time to learn strategies to optimize your benefits. From attending informational events to comparing plans and understanding your coverage options, there are several ways to make the most of your Medicare Advantage benefits.

Attending complimentary events offered by Anthem, for example, can help you understand how Anthem Medicare plans can assist in covering expenses that Original Medicare does not cover. It’s akin to attending a workshop, where you gain insights and practical skills.

Also, comparing different Medicare Advantage plans can assist in maximizing benefits by allowing you to evaluate the coverage and costs of each plan. It’s like window shopping, helping you find the best deal that meets your needs.

Summary

In conclusion, Medicare Advantage offers a comprehensive healthcare coverage solution that can meet a wide variety of healthcare needs. From basic coverage to additional benefits, specialized plans, and various cost-saving opportunities, Medicare Advantage presents a viable alternative to Original Medicare.

By understanding the benefits, costs, eligibility requirements, and enrollment periods, and by assessing your healthcare needs and comparing different plans, you can choose the right Medicare Advantage plan that fits you like a glove.

So, gear up and embark on your journey towards comprehensive, all-in-one healthcare coverage with Medicare Advantage.

Frequently Asked Questions

→ What is the difference between Medicare Part C and D?

Medicare Part C is an alternative to original Medicare and provides additional benefits like vision and dental care. Medicare Part D, on the other hand, is a plan offering prescription drug coverage that helps with the cost of medication. Medicare Advantage plans typically include Part D coverage.

→ Does Medicare Part C pay everything?

Medicare Advantage (Part C) includes everything Original Medicare does, such as Part A and Part B coverage, plus added benefits like prescription drugs, vision, hearing, and dental care. However, there may be some restrictions on which drugs or services are covered and you may need approval from your plan.

→ What is the difference between Medicare Part A and C?

Medicare Part A covers inpatient/hospital services, while Part C provides an alternate way to receive all Medicare benefits including outpatient/medical coverage and prescription drug coverage.

→ What is medicare part b?

Medicare Part B, also known as Medical Insurance, helps pay for covered medical services and items that are medically necessary. It also covers preventive services such as exams, lab tests, and screening shots to help prevent, find or manage a medical problem.

In addition, it covers services from doctors and other health care providers, outpatient care, home health care, and durable medical equipment.

→ What are the benefits of Medicare Advantage plans?

Medicare Advantage plans provide coverage for all traditional Medicare services and offer additional benefits such as dental, vision, and hearing care and wellness programs, making them an attractive option for those seeking additional coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.