Medicare Advantage Plans Louisiana 2026

Navigating the potential Medicare Advantage plans in Louisiana for 2026 might be challenging. This article explores the available plans, possible costs, potential benefits and enrollment periods to help you make an informed decision. Learn how to find the best plan to meet your healthcare needs.

Key Takeaways

- Medicare Advantage plans in Louisiana could act as alternatives to Original Medicare, and may provide additional benefits like dental and vision care.

- Cost considerations for Medicare Advantage plans in Louisiana might include varying premiums and out-of-pocket expenses, likely necessitating careful evaluation for financial planning.

- Louisiana’s Medicare Advantage plans might vary by type, including HMO, PPO, and Special Needs Plans, each with unique coverage features and costs, likely necessitating careful evaluation by beneficiaries.

Compare Plans in One Step!

Enter Zip Code

Understanding Louisiana Medicare Advantage Plans

Medicare Advantage plans in Louisiana could serve as an alternative to Original Medicare, with some plans offering comprehensive coverage that might include dental, vision, and hearing coverage. These plans could potentially provide more robust coverage compared to Original Medicare, addressing various health needs and giving beneficiaries more options.

Eligibility for Medicare plans in Louisiana includes individuals aged 65 and older, as well as younger individuals with certain disabilities or specific medical conditions.

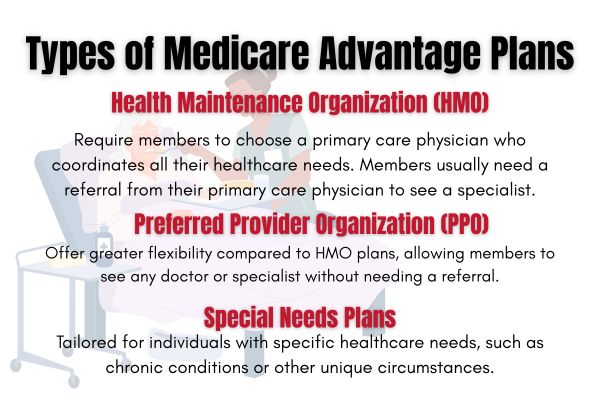

Types of Louisiana Medicare Advantage Plans Available

Louisiana offers various types of Medicare Advantage plans, including HMO, PPO, and Special Needs Plans, each catering to different healthcare needs. These plans provide flexibility and a range of benefits that could help accommodate diverse health conditions and preferences.

Recognizing these differences could aid beneficiaries in selecting the plan that suits their needs best.

HMO Plans

HMO plans in Louisiana require members to choose a primary care physician and obtain referrals for specialist services. This structure ensures coordinated care and may lead to lower out-of-pocket costs.

However, members must stay within the network for their healthcare needs, except in emergencies.

PPO Plans

PPO plans offer more flexibility by allowing members to see any healthcare provider without a referral, although staying in-network could potentially reduce costs. PPO plans typically offer a broader network of providers compared to HMO plans, likely making them suitable for individuals who travel frequently or live in multiple locations.

Special Needs Plans (SNPs)

Special Needs Plans will likely be designed to those with chronic illnesses or dual eligibility for Medicare and Medicaid, providing tailored benefits. SNPs may be tailored for individuals with specific health challenges or requirements, including Dual-Eligible Special Needs Plans (D-SNPs) for those who qualify for both Medicare and Medicaid.

Overview of Louisiana Medicare Advantage Plans 2026

Louisiana likely offers a variety of Medicare Advantage plans, including HMO and PPO options, each providing unique benefits and coverage options. Some plans may include additional benefits such as dental, vision, and hearing coverage, which are not typically covered by Original Medicare. This could make Medicare Advantage plans an attractive option for those seeking comprehensive healthcare coverage.

Enrollment for Louisiana Medicare Advantage plans typically aligns with the annual period from October to December. Since availability and benefits may vary by plan type, reviewing local options could be key to finding the best fit.

Potential Services and Benefits

Certain Medicare Advantage plans in Louisiana may cover a broader range of services and benefits than Original Medicare. Some plans may incorporate additional dental, vision, hearing, and prescription drug coverage.

Possible Benefits of Louisiana Medicare Advantage Plans

In recent years, Louisiana Medicare beneficiaries have had access to several Medicare Advantage plans, which likely provided a wide range of coverage options. Some plans may offer additional benefits like vision, dental, and hearing coverage, possibly enhancing their value.

Plan availability might vary throughout Louisiana, so members should carefully review their options. For instance, Chronic Condition Special Needs Plans (C-SNPs) could potentially offer specific benefits for individuals with chronic illnesses.

Enrollment Process for Louisiana Medicare Advantage Plans

Enrolling in Medicare Advantage plans in Louisiana is straightforward, though attention to specific timelines is necessary. Eligible individuals can select from various plans, including Medicare Advantage and Original Medicare.

Flexible enrollment periods allow beneficiaries to choose coverage that suits their needs.

When to Enroll

The initial enrollment period for Medicare plans begins three months before the applicant turns 65 and continues for three months after. The Annual Enrollment Period, from October 15 to December 7 each year, allows beneficiaries to adjust their Medicare Advantage coverage.

A Special Enrollment Period is available for individuals experiencing certain life events, like moving out of a plan’s service area or losing existing health coverage.

Members can enroll by using this website or by calling our licensed agents at 1-833- 641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Different Enrollment Periods

The general enrollment period for Medicare Advantage plans runs annually from January 1 to March 31. In 2025, new options include a Monthly Special Enrollment Period (SEP), allowing low-income individuals to change their Medicare coverage monthly instead of quarterly.

The Annual Election Period, from October 15 to December 7, allows enrollees to switch or drop their Medicare Advantage plans for the following year.

OEP, APE, and Special Enrollment

The Medicare Open Enrollment period runs from October 15 to December 7 each year, enabling beneficiaries to switch or enroll in plans. The Medicare Advantage Open Enrollment Period (OEP) allows beneficiaries to enroll or switch plans at specific times annually.

Special Enrollment Periods (SEPs) permit eligible individuals to enroll in or change their Medicare Advantage plan outside the OEP and AEP under specific circumstances.

Possible Costs Associated with Louisiana Medicare Advantage Plans

Medicare Advantage plans will likely have varying costs, such as premiums, copays, and out-of-pocket maximums, which may differ by the specific plan chosen.

Understanding these potential costs could be vital for making an informed decision about healthcare coverage.

Premiums and Co-Pays

Premiums, co-pays and out-of-pocket expenses may vary significantly across different Medicare Advantage plans. Understanding the structure of these costs will likely be crucial for selecting a plan that meets healthcare needs.

Out-of-Pocket Maximums

Some Medicare Advantage plans might provide an out-of-pocket maximum that could protect members from excessive annual healthcare costs. Out-of-pocket maximums could help ensure total annual costs do not exceed a set limit, the total amount a member spends on covered services annually. Understanding these potential limits could be key to managing healthcare expenses effectively.

Potential Services and Benefits

Medicare Advantage plans cover essential medical services such as hospital visits and physician services. Members may also benefit from additional services like dental, vision, and hearing care, which may be incorporated into some Medicare Advantage plans. These comprehensive benefits could potentially ensure that beneficiaries receive the necessary health support.

Some plans may also incorporate prescription drug coverage, likely offering access to a variety of generic and brand-name medications.

How to Qualify for Louisiana Medicare Advantage Plans

Enrollment in Original Medicare (Parts A and B) is required to qualify for a Medicare Advantage plan in Louisiana. Medicare eligibility generally starts at age 65, though certain disabilities may qualify individuals at a younger age. To enroll, one must be a U.S. citizen or a permanent legal resident who has lived in the U.S. for at least five consecutive years.

Individuals with end-stage renal disease or Amyotrophic Lateral Sclerosis qualify for Medicare Advantage regardless of age.

The Initial Enrollment Period for Medicare Advantage spans from three months before to three months after a beneficiary’s 65th birthday. Special Enrollment Periods can arise from personal circumstances affecting health insurance, like losing coverage or moving.

Contracted Network and Access to Care

PPO, HMO, and HMO-POS types will likely offer flexibility in choosing healthcare providers both in and out-of-network. Using in-network providers may result in lower out-of-pocket costs. This structure could potentially ensure coordinated and comprehensive healthcare services for members.

Some Medicare Advantage plans might require members to have a primary care provider to coordinate their healthcare. Depending on the plan type, referrals for specialist visits may be necessary.

Comparing Louisiana Medicare Advantage Plans to Original Medicare

Medicare Advantage plans in Louisiana offer all the benefits of Original Medicare, and sometimes offer additional coverage for services like dental, vision, and hearing. This could make them an attractive option for those seeking more comprehensive healthcare coverage.

Coverage Differences

Certain Medicare Advantage plans may include a broader range of services than Original Medicare. While Original Medicare covers hospital and outpatient services, some Medicare Advantage plans might incorporate dental, vision, hearing, and prescription drug coverage.

Beneficiaries enrolled in certain Medicare Advantage may also face lower out-of-pocket costs compared to those relying solely on Original Medicare.

Cost Comparisons

Some Medicare Advantage plans could potentially present lower costs compared to the combination of Original Medicare and Medigap policies. The cost-sharing structure, including copayments and deductibles, may vary significantly across different plans. Reviewing these details could be crucial to find a plan that fits both healthcare needs and budget.

Emergencies and Referrals

Medicare Advantage plans cover emergency services worldwide, allowing members to seek care without needing prior authorization. This provides peace of mind for members traveling or facing unexpected health issues. Emergency room visits are covered worldwide under Medicare Advantage plans, providing peace of mind for members traveling.

For non-emergency specialist visits within HMO plans, referrals from a primary care provider may be required. However, in PPO plans, members have the flexibility to see specialists without a referral, giving them more control over their healthcare decisions. Understanding these requirements could help ensure that members know when and how they can access necessary care.

Summary

Medicare Advantage Plans in Louisiana for 2026 will likely offer a wide range of options and benefits, possibly making them a viable alternative to Original Medicare. With various plan types such as HMO, PPO, and SNPs, there will likely be a plan that fits the needs of every beneficiary. The potential benefits, like dental, vision, and hearing coverage might might make these plans especially attractive.

As you consider your options, remember to review the specific costs, possible coverage differences, and enrollment periods to make an informed decision. Whether you are new to Medicare or looking to switch plans, understanding these elements will help you choose the best plan for your healthcare needs and financial situation. The journey through Medicare can be complex, but with the right information, you can navigate it with confidence.

Frequently Asked Questions

→ What are the main types of Medicare Advantage Plans available in Louisiana?

The primary Medicare Advantage Plans offered in Louisiana are HMO, PPO, and Special Needs Plans (SNPs). These options cater to different healthcare needs and preferences.

→ When is the best time to enroll in a Medicare Advantage Plan?

The optimal times to enroll in a Medicare Advantage Plan are during your Initial Enrollment Period, which begins three months before you turn 65 and continues for seven months, or during the Annual Enrollment Period from October 15 to December 7. Choosing these periods ensures you secure the coverage you need without missing important deadlines.

→ How might Medicare Advantage Plans differ from Original Medicare?

Some Medicare Advantage Plans may offer additional benefits like dental, vision, and hearing services, which are not covered by Original Medicare.

→ What are the costs associated with Medicare Advantage Plans?

The plan details for 2026 have not been released, but make sure to check back in to this article/website for updated information for the 2026 calendar year.

→ Are emergency services covered under Medicare Advantage Plans?

Yes, Medicare Advantage Plans generally cover emergency services, including those provided worldwide, giving members reassurance while traveling.

ZRN Health & Financial Services, LLC, a Texas limited liability company