Medicare Advantage Plans Connecticut 2026

Curious about the potential Medicare Advantage Plans in Connecticut for 2026? This guide covers the available plan types, possible benefits, costs, and enrollment processes, ensuring you have all the information needed to make an informed choice for your healthcare.

Key Takeaways

- Medicare Advantage plans in Connecticut will likely provide comprehensive coverage, including medical services, and sometimes prescription drugs, and additional benefits like dental, hearing, and vision care.

- There are various types of plans available, including HMO, PPO, and Special Needs Plans, each suited to different healthcare needs and preferences.

- Enrollment in Medicare Advantage plans follows specific periods throughout the year, with clear guidelines to help beneficiaries select and switch plans as needed.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans in Connecticut for 2026

Medicare Advantage plans in Connecticut could potentially enhance the accessibility and affordability of healthcare for seniors and individuals with disabilities. Some plans, also known as Medicare Part C, may incorporate prescription drug coverage, and additional benefits like dental, vision, and hearing coverage. With these potential benefits, these plans could encourage healthier lifestyles among members while making healthcare more affordable and accessible.

Medicare Advantage plans likely offers comprehensive coverage that could potentially surpasses traditional Medicare, possibly necessitating the selection of a primary care provider from the plan’s network.

Types of Connecticut Medicare Advantage Plans Available

Connecticut will likely offer a variety of Medicare Advantage plans, each designed to meet different healthcare needs. The primary types include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan has unique features and benefits, catering to different preferences and requirements of Medicare beneficiaries.

Exploring these options could aid in selecting the plan that aligns best with your healthcare needs.

HMO Plans

HMO plans in Connecticut typically require members to select a primary care physician (PCP) who coordinates their care and provides referrals to specialists when needed. These plans might offer lower premiums and out-of-pocket costs compared to other plan types, possibly making them an attractive option for many.

Some HMO plans may also come with additional benefits like dental, vision, and hearing coverage, possibly enhancing the plan’s overall value.

PPO Plans

PPO plans offer greater flexibility by allowing members to see any healthcare provider without needing a referral, though costs might be lower when using in-network providers. This flexibility might make PPO plans a popular choice for those who want more control over their healthcare decisions. However, this added freedom may also come with higher premiums and out-of-pocket costs compared to HMO plans.

PPO plans provide access to a wide range of healthcare providers, likely ensuring members can receive the care they need, whether in-network or out-of-network.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are designed for individuals with specific health conditions or needs, such as chronic illnesses or dual eligibility for Medicare and Medicaid. These plans could offer specialized care and support tailored to the unique requirements of their members.

Overview of Connecticut Medicare Advantage

Connecticut’s Medicare Advantage plans could potentially provide a diverse array of options that could meet various healthcare needs and budgets. Some plans might include additional benefits like dental, vision, and hearing coverage.

Possible Services and Benefits

Medicare Advantage plans include hospital stays, outpatient care, and sometimes preventive services. Prescription drug coverage could potentially offer members access to a wide range of medications.

Potential Benefits

Some Medicare Advantage plans may offer an variety of potential health services that could enhance member well-being. These may include:

- Dental services

- Vision services

- Hearing services

Furthermore, some plans may also include coverage for annual eye exams and allowances for glasses or contact lenses, possibly ensuring comprehensive eye care.

Enrollment Process for Medicare Advantage Plans in Connecticut

Enrolling in a Medicare Advantage plan is a straightforward process that can be completed by using this website or by calling our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. If your current plan is being discontinued, it’s crucial to enroll in a new plan before the end of the year to maintain continuous coverage.

Understanding the different enrollment periods and taking timely action will help you secure the best plan for your needs.

When to Enroll

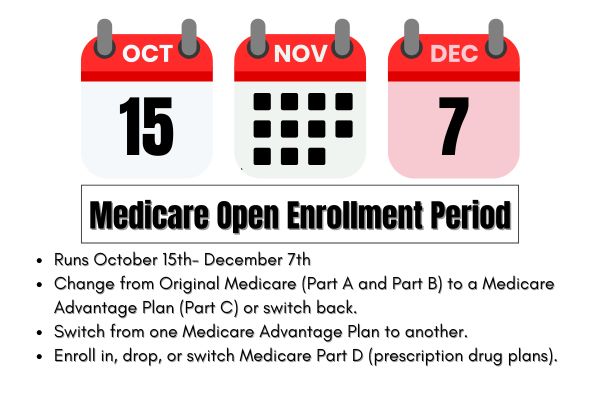

The enrollment period for Medicare Advantage plans begins three months before you turn 65 and extends to three months after your birthday. The Annual Enrollment Period, which runs from October 15 to December 7, allows beneficiaries to sign up for new plans or make changes to their existing coverage.

Additionally, there is an Open Enrollment Period from January 1 to March 31, during which you can make a one-time change to your Medicare Advantage plan. Special Enrollment Periods are also available for major life events, such as moving or losing other health coverage, providing flexibility in enrolling or changing plans.

Different Enrollment Periods

Medicare beneficiaries can enroll or make changes to their Medicare Advantage plans during specific periods throughout the year. The Initial Enrollment Period spans three months before and after your eligibility for Medicare.

The Annual Enrollment Period, from October 15 to December 7, allows beneficiaries to join, switch, or drop plans. The Special Enrollment Period runs from December 8 to February 28, for those affected by plan discontinuation.

Additionally, the Medicare Advantage Open Enrollment Period, from January 1 to March 31, permits individuals to switch plans or return to Original Medicare.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) allows Medicare beneficiaries to make changes to their plans from January 1 to March 31 each year. This period is ideal for those who missed the Annual Enrollment Period (AEP) or wish to make adjustments after the AEP ends on December 7.

During the OEP, you can switch to a different Medicare Advantage plan or revert to Original Medicare, but only one change is allowed during this period. Special Enrollment Periods (SEP) will likely be available for individuals experiencing specific life events, such as losing employer coverage, providing additional opportunities to enroll or make changes outside the regular periods.

Potential Costs Associated with Medicare Advantage Plans

Certain Medicare Advantage plans might offer lower out-of-pocket expenses compared to Original Medicare, possibly making them an attractive option for many beneficiaries. Grasping the potential cost structure of various plans could enable members to make informed decisions about healthcare coverage.

Premiums and Co-Pays

Some Medicare Advantage plans might offer competitive monthly premiums. Co-pays for certain services might vary based on the specific plan and type of service received.

Out-of-Pocket Maximums

Some Medicare Advantage plans might offer a maximum out-of-pocket limit, possibly providing a financial safeguard against excessive healthcare costs. This potential limit may vary by plan but could potentially protect members from unexpected high medical expenses. Some plans may also provide a cap out-of-pocket spending, possibly providing added protection and peace of mind, likely ensuring healthcare costs could remain manageable year-round.

Potential Services and Benefits

Medicare Advantage plans in Connecticut will likely provide comprehensive coverage, including hospital stays, outpatient care, and occasionally additional services such as dental, vision, and hearing coverage.

Emergency services are also covered, providing peace of mind in critical situations.

How to Qualify for Connecticut Medicare Advantage Plans

To qualify for Connecticut Medicare Advantage plans, you must be enrolled in both Medicare Part A and Part B. Additionally, you must reside in the service area of the plan you wish to join. Some plans, particularly Special Needs Plans (SNPs), may have specific health requirements.

Applicants must provide documentation, such as a Medicare card and proof of residency, to verify eligibility.

Contracted Network and Access to Care

Medicare Advantage plans likely offer access to a broad network of healthcare providers, possibly reducing certain out-of-pocket costs for members. While PPO plans allow for out-of-network care without referrals, they typically come at a higher cost. HMO plans, on the other hand, require coordinated care through a primary care provider within the network.

Regardless of the plan type, Medicare Advantage plans include emergency and urgent care services globally, ensuring access to necessary care even when traveling.

Comparing Connecticut Medicare Advantage Plans to Original Medicare

Some Medicare Advantage plans in Connecticut may offer several advantages over Original Medicare, particularly in terms of potential benefits and cost savings. Certain plans might provide services not covered by Original Medicare, such as vision, dental, and hearing care. Moreover, some Medicare Advantage plans might incorporate prescription drug coverage, possibly providing a more integrated and convenient healthcare solution.

Recognizing these possible differences could assist in selecting the plan that best meets your healthcare needs.

Cost Comparisons

Out-of-pocket costs may vary significantly between Medicare Advantage plans and Original Medicare, likely depending on the specific plan chosen. Some Medicare Advantage plans might feature varying premiums, deductibles, and copay structures, which will likely influence overall cost comparisons.

The annual out-of-pocket maximums in certain Medicare Advantage plans could potentially offer a financial safeguard that Original Medicare lacks.

Emergencies and Referrals

Medicare Advantage HMO plans, obtaining a referral from your primary care provider is generally required to see specialists. However, during public health emergencies, may temporarily lower out-of-network costs to match in-network rates and waive referral requirements to facilitate quicker access to necessary care.

Such adjustments ensure timely care without usual constraints during critical situations.

Summary

The Medicare Advantage plans in Connecticut for 2026 will likely offer a comprehensive array of options tailored to meet diverse healthcare needs. From HMO and PPO plans to Special Needs Plans, there will likely be a plan for everyone. Some plans may also provide extensive benefits, including prescription drug coverage, dental, vision, and hearing services. Understanding the enrollment process, possible costs, and potential differences between Medicare Advantage and Original Medicare could be crucial in making an informed decision. As you explore your options, consider the possible benefits and coverage each plan might offer to find the best fit for your healthcare needs in 2026.

Frequently Asked Questions

→ What are the different types of Medicare Advantage plans available in Connecticut?

Medicare Advantage plans including Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), and Special Needs Plans (SNPs), each designed to meet various healthcare needs. Members should choose the plan that best suits their health requirements and preferences.

→ What additional benefits could Medicare Advantage plans offer?

Some Medicare Advantage plans in Connecticut might offer additional benefits such as dental, vision, and hearing coverage, and sometimes prescription drug coverage. This potential support could enhance your overall health management.

→ How can I enroll in a Connecticut Medicare Advantage plan?

You can enroll in a Connecticut Medicare Advantage plan by using this website or by calling our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST during the designated enrollment periods. Make sure to choose the method that is most convenient for you.

→ What costs may be associated with Medicare Advantage plans?

Some Medicare Advantage plans could potentially entail costs such as premiums, co-pays, and out-of-pocket maximums, which might vary significantly between plans. It’s important to compare different options, as some may offer lower premiums and low co-pays.

→ How could Medicare Advantage plans compare to Original Medicare?

Certain Medicare Advantage plans might provide extra benefits like dental and vision care, and possibly offering lower out-of-pocket costs compared to Original Medicare. This could make these plans a compelling option for individuals seeking more comprehensive coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company