Humana Medicare Advantage Plans North Dakota 2026

Looking for information on Humana Medicare Advantage Plans North Dakota

Key Takeaways

- Humana offers over 40 Medicare Advantage plans in North Dakota, catering to a range of healthcare preferences with options like HMO and PPO.

- Key benefits of Humana plans include additional coverage for vision, dental, and hearing services, as well as favorable prescription drug features like $0 copay for generics.

- The enrollment process for Humana plans requires eligibility for Medicare Part A and Part B, with options for online, phone, or local representative enrollment methods.

Compare Plans in One Step!

Enter Zip Code

Overview of Humana Medicare Advantage Plans in North Dakota for 2026

Humana offers an extensive range of Medicare Advantage plans in North Dakota, with over 40 options available for beneficiaries to consider. The popularity of Medicare Advantage plans continues to grow, with 54% of eligible Medicare beneficiaries enrolled in these plans as of 2024. This trend highlights the increasing preference for Medicare Advantage plans, which often provide more comprehensive coverage and additional benefits compared to Original Medicare.

The complexity of choosing the right plan can be overwhelming due to the multitude of options, each with unique costs and benefits. However, understanding the different types of plans and their coverage areas can help you make an informed decision.

Next, we explore the specific types of Humana Medicare Advantage Plans

Types of Plans Offered

Humana Medicare Advantage Plans in North Dakota

Most Humana Medicare Advantage Plans provide additional services not typically covered by Original Medicare, such as vision, dental, and hearing aids benefits. These plans aim to provide all-encompassing health coverage, catering to the diverse needs of Medicare beneficiaries.

Overall, Humana’s diverse range of Medicare Advantage plans ensures that there is an option for everyone, from those seeking basic coverage to those needing more extensive health services.

Coverage Areas

Humana Medicare Advantage Plans are accessible across a wide range of counties in North Dakota, ensuring that beneficiaries have localized healthcare options tailored to their specific regions. The availability of plans may vary by region, but Humana strives to provide comprehensive health coverage throughout the state, making it easier for Medicare beneficiaries to access the services they need.

Key Benefits of Humana Medicare Advantage Plans 2026

Humana Medicare Advantage Plans

Humana plans to improve access to behavioral health services

The following subsections will provide a detailed look at the additional benefits, prescription drug coverage, and preventive services offered by Humana Medicare Advantage plans.

Additional Benefits

Humana’s Medicare Advantage plans are designed to include a variety of additional benefits that cater to the diverse needs of Medicare beneficiaries. These supplemental benefits often cover vision and dental care, including allowances for glasses and contact lenses. Dental care is an essential aspect of overall health, and Humana’s plans ensure that beneficiaries have access to necessary dental services.

Wellness programs are another significant feature of Humana Medicare Advantage plans, promoting preventive care and overall health. These programs may include fitness memberships, nutrition counseling, and other services aimed at maintaining a healthy lifestyle.

Additionally, Humana covers various preventive services without additional costs, such as annual wellness visits and vaccinations, ensuring that beneficiaries can stay on top of their health without worrying about extra expenses.

Prescription Drug Coverage

Prescription drug coverage is a critical component of Humana Medicare Advantage plans, structured under Medicare Part D. Many Humana plans offer $0 copay for numerous generic drugs, making essential medications more affordable for beneficiaries. Cost-saving features like these are designed to ease the financial burden of prescription medications, particularly for those on fixed incomes.

For individuals managing chronic conditions like diabetes, Humana plans cap the out-of-pocket cost of insulin products at $35 per month, making essential medications more accessible.

Verifying if your preferred medications are covered by checking the plan’s formulary can help you avoid unexpected costs and ensure your medication needs are met.

Preventive Services

Preventive services are a cornerstone of Humana Medicare Advantage plans, aimed at maintaining and improving overall health. These services include routine health screenings for conditions such as diabetes, cancer, and cardiovascular diseases, as well as necessary immunizations.

Utilizing these preventive measures can significantly reduce health risks and improve well-being, aligning with Humana’s commitment to proactive healthcare.

Cost Structure and Affordability

Understanding the cost structure of Humana Medicare Advantage Plans

The following subsections will provide a detailed look at premiums and deductibles, out-of-pocket spending limits, and a comparison with Original Medicare to give you a comprehensive understanding of the financial aspects of these plans.

Premiums and Deductibles

The monthly fee for Medicare Advantage coverage, known as premiums, can vary significantly depending on the plan you choose. Some Humana Medicare Advantage Plans have low or even $0 monthly premiums, making them an attractive option for those looking to minimize their healthcare expenses. However, it’s essential to consider the overall cost, including deductibles, which is the amount you pay out-of-pocket for healthcare services before your coverage kicks in.

Being aware of both the monthly premiums and annual deductibles is vital for making informed health insurance coverage decisions. A thorough evaluation of these costs can help you identify a plan that aligns with your budget and healthcare needs.

Out-of-Pocket Spending Limits

One of the significant advantages of Medicare Advantage plans is the out-of-pocket spending limit, which protects beneficiaries from excessive healthcare costs. In 2024, the maximum out-of-pocket limit for in-network services is set at $8,850.

This cap ensures that once you reach a certain amount in out-of-pocket expenses, your plan covers 100% of the remaining costs for covered services, providing financial security and peace of mind.

Comparing Costs with Original Medicare

When comparing costs between Humana Medicare Advantage Plans and Original Medicare, it’s evident that Advantage plans often offer lower overall expenses. Many Humana plans do not charge additional premiums beyond the Medicare Part B premium, making them a cost-effective option for beneficiaries. Additionally, the deductible for Medicare Part B has been reduced to $226 in 2023, impacting the overall cost for beneficiaries and making Medicare Advantage plans even more appealing.

Three-quarters of individual Medicare Advantage plans with prescription drug coverage do not charge any additional premiums aside from the Medicare Part B premium. This cost-saving feature, combined with the benefits and additional services offered by Humana, makes Medicare Advantage plans a compelling choice for many Medicare beneficiaries.

Enrollment Process for Humana Medicare Advantage Plans

Enrolling in a Humana Medicare Advantage plan involves a few key steps, starting with understanding the eligibility criteria and important enrollment dates. This section will guide you through the process, ensuring you have all the information needed to make an informed decision and successfully enroll in a plan that meets your healthcare needs.

Eligibility Criteria

To be eligible for a Humana Medicare Advantage plan, individuals must be enrolled in Medicare Part A and Part B. Applicants must also be 65 years old or older, or under 65 with a qualifying disability. Additionally, eligibility requires residing in the service area of the Humana plan you wish to enroll in and not being currently incarcerated.

It’s important to note that you cannot be enrolled in another Medicare Advantage plan while applying for a new one. The enrollment process must occur during designated periods set by Medicare, ensuring that all beneficiaries have equal access to these plans.

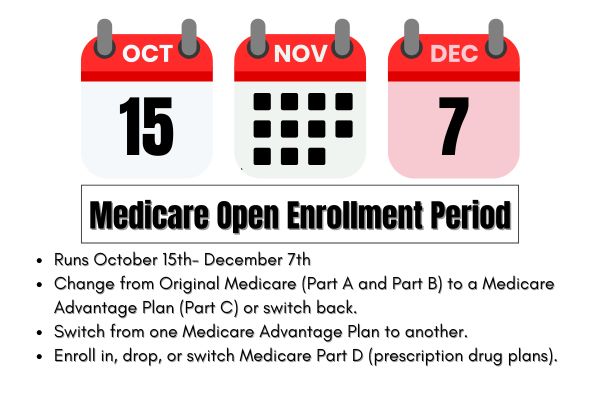

Important Enrollment Dates

Medicare beneficiaries can make changes to their plans during the Annual Enrollment Period (AEP), which runs from October 15 to December 7. This period allows beneficiaries to enroll in, switch, or drop their Aetna Medicare Advantage plans.

Additionally, Special Enrollment Periods (SEPs) are available for those who experience qualifying life events, providing flexibility for unexpected changes in circumstances.

How to Enroll

Enrolling in a Humana Medicare Advantage plan can be done online through the Humana website, by phone, or through a local representative. Additionally, individuals can submit a paper application via mail or enroll through licensed insurance agents who specialize in Medicare plans.

This variety of enrollment methods ensures that beneficiaries can choose the most convenient option for them, based on the available enrollment data.

Comparing Humana with Other Insurers in North Dakota

When it comes to Medicare Advantage plans, Humana is a significant player in North Dakota. In 2024, Humana held 18% of the Medicare Advantage market share in the state.

However, it’s essential to compare Humana’s offerings with those of other leading insurers such as UnitedHealthcare, Aetna, and Blue Cross Blue Shield. This comparison will help you understand the strengths and weaknesses of each provider, aiding in your decision-making process.

Competitor Analysis

UnitedHealthcare, Aetna, and Blue Cross Blue Shield are key competitors in the Medicare Advantage market, each offering a range of plans with unique benefits. UnitedHealthcare, for instance, has shown significant growth in Medicare Advantage enrollment, increasing its market share from 20% in 2010 to 29% in 2024.

Understanding these competitors’ strengths can provide valuable insights into what to expect and how Humana compares in terms of coverage and customer satisfaction.

Plan Ratings and Reviews

In 2025, Humana was recognized with the Highest Satisfaction award alongside Aetna, UnitedHealth, and Elevance Health. However, changes in the methodology for calculating star ratings by the Centers for Medicare & Medicaid Services (CMS) have made it increasingly difficult for insurers to maintain high ratings.

Despite this, Humana continues to engage in discussions with federal officials to address the consequences of its Medicare Advantage plan rating decline, aiming to improve and adapt its offerings.

Changes and Updates for 2026

As we approach 2026, Humana Medicare Advantage Plans are undergoing significant changes to reflect evolving market dynamics and beneficiary needs. These changes may impact beneficiaries’ choices and access to certain services, necessitating a carefully considered approach towards enrollment for 2026.

Understanding these updates will ensure that you are well-prepared to make the best decisions for your healthcare coverage.

New Plan Features

In 2026, Humana Medicare Advantage Plans will introduce new features for prescription drug coverage, which will significantly impact beneficiaries’ costs. Starting in 2025, drug manufacturers will be required to provide a 10% discount on brand-name drugs during the initial coverage phase.

Additionally, Medicare’s share of costs in the catastrophic phase for brand-name drugs will decrease from 80% to 20%, and for generic drugs from 80% to 40%. These changes aim to make prescription medications more affordable and accessible for beneficiaries.

Regulatory Changes

Regulatory changes are also on the horizon for Medicare Advantage plans in 2026. In 2025, approximately 40% of Medicare Advantage plans received four stars or higher in the ratings, indicating improvements in quality and consumer satisfaction.

These regulatory updates will shape the future of Medicare Advantage plans, ensuring beneficiaries receive high-quality care and services.

Tips for Choosing the Right Plan

Choosing the right Medicare Advantage plan can be challenging, but considering a few key factors can make the process easier. It’s essential to assess your personal health needs, consider the provider networks, and evaluate the associated costs of each plan.

These guidelines will assist you in finding a plan that offers optimal coverage for your specific needs.

Assessing Personal Health Needs

Evaluating individual health requirements is crucial when selecting a Medicare Advantage plan. Consider your current health status, any chronic conditions, and the types of healthcare services you frequently use. By understanding your health needs, you can choose a plan that provides the necessary coverage and benefits to maintain your well-being.

Considering Provider Networks

Checking if your preferred healthcare providers are part of the plan’s network is essential to ensure you have access to the necessary services. Most Medicare Advantage plans have specific provider networks, and choosing a plan that includes your doctors and specialists can help you avoid additional costs and inconveniences.

Evaluating Plan Costs

Analyzing all associated costs of a Medicare Advantage plan, including premiums, deductibles, and copayments, is crucial to understanding your total expenses. Comparing these costs across different plans can help you find an option that fits your budget while providing the coverage you need.

This careful evaluation will ensure that you make an informed decision that meets your financial and healthcare needs.

Summary

In summary, Humana Medicare Advantage Plans in North Dakota for 2026 offer a wide range of options designed to meet diverse healthcare needs. These plans provide comprehensive coverage, including additional benefits like vision, dental, and wellness programs. Understanding the cost structure and enrollment process is crucial for making informed decisions about your healthcare coverage.

As you consider your options, remember to assess your personal health needs, check provider networks, and evaluate the associated costs of each plan. By doing so, you can select a Medicare Advantage plan that provides the best coverage for your specific situation, ensuring that you receive the necessary healthcare services while managing your expenses effectively.

Frequently Asked Questions

→ What are the key benefits of Humana Medicare Advantage plans?

Humana Medicare Advantage Plans provide comprehensive coverage, including vision, dental, and hearing benefits, along with wellness programs and preventive services. This holistic approach enhances overall health management for enrollees.

→ What is the Annual Enrollment Period for Medicare Advantage plans?

The Annual Enrollment Period for Medicare Advantage plans occurs from October 15 to December 7, allowing beneficiaries to enroll, switch, or drop their plans. It’s essential to review your options during this time to ensure you have the coverage that best meets your needs.

→ How do Humana Medicare Advantage Plans compare to Original Medicare in terms of costs?

Humana Medicare Advantage Plans typically offer lower overall costs than Original Medicare, as many plans do not impose additional premiums beyond the Medicare Part B premium. This can lead to significant savings for enrollees.

→ What changes are expected for Humana Medicare Advantage Plans in 2026 ?

Expect significant changes in Humana Medicare Advantage Plans

ZRN Health & Financial Services, LLC, a Texas limited liability company