Medicare Advantage Plans Utah 2026

Curious about Medicare Advantage Plans Utah? This guide covers the different plans available, the possible costs, and the enrollment periods. This article will also look at top-rated options and the potential benefits some plans could offer. Get all the details you need to choose the right plan for you.

Key Takeaways

- Medicare Advantage Plans in Utah will likely offer comprehensive coverage, combining Medicare Part A, B, and sometimes Part D, with about half of the state’s Medicare population enrolled in these plans as of 2023.

- Various types of Medicare Advantage Plans will likely be available in Utah, including HMO, PPO, SNPs, and PFFS, each designed to meet different healthcare needs and preferences.

- It is crucial to understand enrollment periods, possible costs, and potential benefits of Medicare Advantage Plans, as well as their differences from Original Medicare, to make informed decisions about coverage.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans in Utah

Medicare Advantage Plans, also known as Medicare Part C, could serve as an all-in-one solution for Medicare coverage, combining services covered by Medicare Part A and Part B, and sometimes including Part D and additional benefits. For Utah residents, these plans could offer a robust alternative to Original Medicare, possibly providing more comprehensive coverage options. Eligibility for a Medicare Advantage Plan requires having both Medicare Part A and Part B.

As of 2023, nearly half of Utah’s Medicare population was covered by Medicare Advantage Plans, reflecting their growing popularity. These plans are available in all areas of Utah, possibly ensuring that every resident has access to at least one Medicare Advantage Plan in 2024 and beyond. This widespread availability could mean that Utah residents can choose from a variety of plans tailored to their specific needs.

Medicare Advantage Plans in Utah are provided by various private insurance companies, each will likely offer different types of plans. The types and availability of these plans might depend on the insurance provider and the location within the state. Knowing the types of plans available and the enrollment periods will likely help in making an informed decision.

Types of Medicare Advantage Plans Available in Utah

In Utah, Medicare Advantage Plans will likely come in several types, each designed to meet different healthcare needs. The most prevalent type is the Health Maintenance Organization (HMO) plan, which requires beneficiaries to use in-network primary care providers. Preferred Provider Organization (PPO) plans, on the other hand, offer more flexibility by allowing beneficiaries to see out-of-network providers, though at a higher cost.

Special Needs Plans (SNPs) cater to individuals with specific health conditions or circumstances, providing additional benefits that may go beyond standard Medicare Advantage Plans.

Lastly, Private Fee-for-Service (PFFS) plans give beneficiaries the freedom to see any Medicare-approved doctor or hospital, but costs and coverage can vary widely.

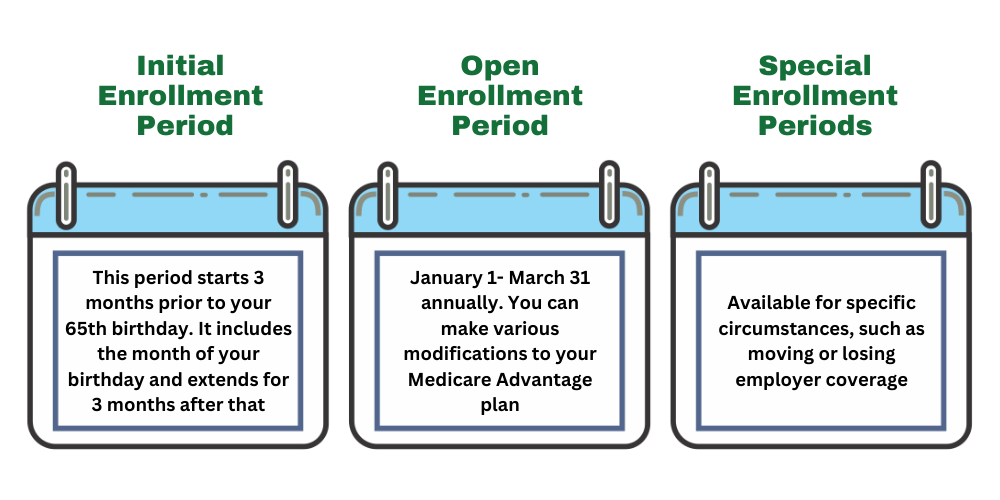

Enrollment Periods for Medicare Advantage Plans

Knowing the enrollment periods for Medicare Advantage Plans ensures timely and appropriate coverage. The Annual Enrollment Period for Medicare Advantage Plans spans from October 15 to December 7 each year, allowing beneficiaries to join, switch, or drop a plan. This period allows for making changes to your Medicare coverage.

The Medicare Advantage Open Enrollment Period occurs from January 1 to March 31. During this time, individuals already enrolled in a Medicare Advantage Plan can switch to a different plan or revert to Original Medicare. These enrollment periods provide flexibility for beneficiaries to adjust their plans based on changing healthcare needs.

Top-Rated Medicare Advantage Plans in Utah

Opting for a top-rated Medicare Advantage Plan could greatly enhance your healthcare experience. The Centers for Medicare & Medicaid Services (CMS) evaluates these plans annually, using a one to five-star rating system based on their performance. The highest rating a plan can receive is five stars, indicating excellent performance and high beneficiary satisfaction.

In 2024, several Medicare Advantage Plans in Utah received five-star ratings from CMS. These high-rated plans have been known for their comprehensive coverage, excellent customer service, and high levels of satisfaction among beneficiaries. Choosing a high-rated plan could potentially lead to better healthcare outcomes and a more positive overall experience.

Star ratings should also be an important consideration when selecting a Medicare Advantage Plan. High ratings often reflect superior plan performance, including effective management of chronic conditions, preventive care, and customer service. Taking the time to research and choose a top-rated plan can pay off in better health and peace of mind.

Possible Costs Associated with Medicare Advantage Plans in Utah

Knowing the potential costs associated with Medicare Advantage Plans is important for budgeting and managing healthcare expenses. Some plans might include various cost-sharing elements such as premiums, co-pays, and deductibles, which may vary significantly among different plans. Comparing these costs could help find the most economical option for your healthcare needs.

Monthly premiums for Medicare Advantage Plans in Utah may vary based on the plan and the insurance provider. Some plans may have no monthly premium, possibly making them attractive for budget-conscious beneficiaries. However, other costs like co-pays and deductibles should also be considered as they could add up over time.

In evaluating potential costs, remember to consider out-of-pocket maximums. Certain Medicare Advantage Plans may set a cap on annual out-of-pocket expenses, possibly offering financial protection not available with Original Medicare. Comparing these caps, along with premiums and co-pays, could help you choose a plan that fits your financial situation.

Potential Benefits of Medicare Advantage Plans

One of the potential advantages of certain Medicare Advantage Plans may be the additional benefits they could offer. Some plans might include prescription drug coverage, which could be a major cost-saving feature for beneficiaries. Beyond that, plans may also provide dental, vision, and hearing coverage, which are not typically included in Original Medicare.

When evaluating plans, consider the range of possible benefits offered. Such benefits could potentially provide valuable support for maintaining health and well-being, possibly making Medicare Advantage Plans an attractive option for many beneficiaries.

How to Choose the Best Medicare Advantage Plan in Utah

Choosing the best Medicare Advantage Plan in Utah will likely require careful consideration of several factors. Start by assessing your personal health needs and budget to ensure the plan aligns with your requirements. Some plans, for example, may have no monthly premium, which coudl be appealing if you’re looking to minimize monthly expenses.

Next, review the network of healthcare providers associated with each health insurance plan and hospital insurance. Ensuring that your preferred doctors and facilities are included in the plan’s network could help prevent unexpected healthcare costs. Not checking this may lead to higher out-of-pocket expenses and inconvenience.

Lastly, consider the potential benefits and star ratings of the plans. High-rated plans could provide better services and higher satisfaction levels. By carefully evaluating these factors, you can choose a Medicare Advantage Plan that offers the best combination of coverage, possible cost, and convenience.

Medicare Advantage vs. Original Medicare

Medicare Advantage Plans and Original Medicare serve similar purposes but differ in several key areas. Some Medicare Advantage Plans, provided by private insurers, may include benefits like vision and dental care, which might not be covered by Original Medicare. Some plans may also bundle prescription drug coverage, possibly eliminating the need for a separate Part D plan.

Another difference could be the out-of-pocket maximums set by certain Medicare Advantage Plans, which could provide financial protection against high medical costs. Original Medicare does not have a cap on annual out-of-pocket expenses, which may lead to higher costs for beneficiaries.

While Original Medicare allows beneficiaries to visit any doctor or hospital that accepts Medicare, certain Medicare Advantage Plans may restrict choices to in-network providers. This could be a consideration for those who prioritize flexibility in their healthcare provider options. Knowing these differences will likely aid in making an informed decision about your Medicare coverage.

Prescription Drug Coverage in Medicare Advantage Plans

Prescription drug coverage could be a vital component of certain Medicare Advantage Plans. Some plans may include Part D medicare prescription drug coverage, although it’s essential to verify this before enrolling. Each plan has a formulary, which is a list of the prescription drugs it covers. Checking the formulary for your necessary medications could prevent unexpected costs.

Prescription drug coverage could offer significant cost-saving feature for beneficiaries. Additionally, the Extra Help program assists individuals with limited income in potentially reducing costs related to Medicare Part D prescription drugs.

Eligibility for Extra Help will likely be based on income and assets, and individuals can apply at any time before or after enrolling in Part D. This program could provide substantial savings on prescription drug costs, potentially making it an invaluable resource for those who qualify. Checking that your plan covers necessary prescription drugs and exploring financial assistance options could help manage medication expenses effectively.

Financial Assistance Programs for Medicare Beneficiaries

Financial assistance programs will likely play a crucial role in making Medicare coverage affordable for beneficiaries. Medicaid, for instance, might assist Medicare beneficiaries in Utah by helping with certain Medicare premiums and covering services not included in Medicare, such as long-term care. Federal assistance programs may also help lower the costs associated with certain premiums for eligible beneficiaries.

For individuals with limited resources, the Extra Help program may also provides additional savings on certain Medicare drug costs (Part D). Many people might mistakenly assume they cannot afford Medicare coverage due to their income levels, but financial assistance is available for those who qualify. Exploring these programs could provide significant financial relief and ensure access to necessary healthcare services.

Knowing your eligibility for financial assistance programs and applying for them can substantially ease healthcare costs. These programs are designed to support Medicare beneficiaries, ensuring that everyone has access to the care they need regardless of financial circumstances.

Summary

Medicare Advantage Plans will likely offer a comprehensive and flexible alternative to Original Medicare, with potential benefits like dental, vision, and prescription drug coverage. Understanding the types of plans available, enrollment periods, and possible costs could crucial for making informed decisions about your Medicare coverage. By choosing a top-rated plan and exploring financial assistance programs, you can ensure that you receive the best possible care while managing your healthcare expenses effectively.

Navigating Medicare Advantage Plans in Utah will likely require careful consideration of your healthcare needs, budget, and provider preferences. With the right information and resources, you can choose a plan that provides comprehensive coverage, potential benefits, and financial protection. Stay informed, compare your options, and make the best choice for your health and well-being.

Frequently Asked Questions

→ What are Medicare Advantage Plans?

Medicare Advantage Plans, or Medicare Part C, integrate Medicare Part A and Part B services and sometimes offer extra benefits such as prescription drug coverage, dental, vision, and hearing care. These plans could provide a comprehensive alternative to original Medicare.

→ When is the Annual Enrollment Period for Medicare Advantage Plans?

The Annual Enrollment Period for Medicare Advantage Plans is from October 15 to December 7 each year, during which beneficiaries can join, switch, or drop a plan.

→ How do I choose the best Medicare Advantage Plan in Utah?

To choose the best Medicare Advantage Plan in Utah, evaluate your health needs, budget, and provider network while also reviewing the potential benefits and star ratings. This comprehensive approach will likely ensure you select a plan that best meets your coverage and cost requirements.

→ What additional benefits could Medicare Advantage Plans offer?

Some Medicare Advantage Plans may include extra benefits like dental, vision, and hearing coverage, as well as prescription drug coverage. These enhancements could significantly improve your overall healthcare experience.

→ Are there financial assistance programs for Medicare beneficiaries in Utah?

Yes, Medicare beneficiaries in Utah may access financial assistance programs such as Medicaid and the Extra Help program, which could help with premiums and potentially lower costs for certain Medicare Part D prescription drugs. Eligibility varies based on income and resources.

ZRN Health & Financial Services, LLC, a Texas limited liability company