Best Medicare Advantage Plans Texas 2025

Selecting the right Medicare Advantage plan in 2025 could make a significant difference in the quality of healthcare and the potential costs associated with it.

The Lone Star State may offer a wide range of Medicare Advantage plans, each with its potential benefits, costs, and networks.

This article could guide you through the complexities of Medicare Advantage plans in Texas, helping you make an informed decision tailored to your individual needs and preferences.

Key Takeaways

- This article explores the different types of Medicare Advantage plans that may be available in Texas, as well as possible factors to consider when selecting a plan.

- Resources such as state and local health insurance assistance programs, online tools, and how our licensed insurance agents may help you find the best plan for individual needs.

- Potential factors that could influence costs may include plan type, coverage area & location. Resources from CMS & HHS may also be available to make informed decisions about healthcare coverage.

Compare Plans in One Step!

Enter Zip Code

Exploring Potential Medicare Advantage Plans in Texas

Some Medicare Advantage plans in Texas could offer a wide variety of options to address individual healthcare needs. With an estimated 376 plans available in 2024, there will likely be no shortage of choices for Texas residents.

These plans may be administered by private insurance companies contracted with the federal government, and could potentially offer a variety of benefits that may go beyond Original Medicare.

We will examine the different types of Medicare Advantage plans in Texas and the potential factors you should consider when choosing the most suitable plan.

Types of Medicare Advantage Plans Offered

Texas Medicare Advantage plans are offered in four varieties:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

Each plan will likely have unique features, benefits, and costs. HMO plans typically require the use of in-network doctors and hospitals, while PPO plans offer more flexibility in accessing providers outside the network.

PFFS plans allow beneficiaries to visit any Medicare-approved provider that agrees to the plan’s payment terms. SNPs are tailored plans for individuals with specific health conditions or those eligible for both Medicare and Medicaid.

The potential associated costs with these different plan types may vary significantly. Here is a breakdown of the cost considerations for each plan type:

- HMO plans generally have lower out-of-pocket costs but require referrals for specialist services.

- PPO plans provide flexibility in selecting healthcare providers but come with higher out-of-pocket costs.

- PFFS plans have predetermined fees for services, which can potentially lead to increased costs.

- SNP plans to cater to individuals with specific health conditions and may have unique cost structures.

Weighing the potential benefits, coverage, and costs of each plan type could be a key step toward making a decision that suits your needs.

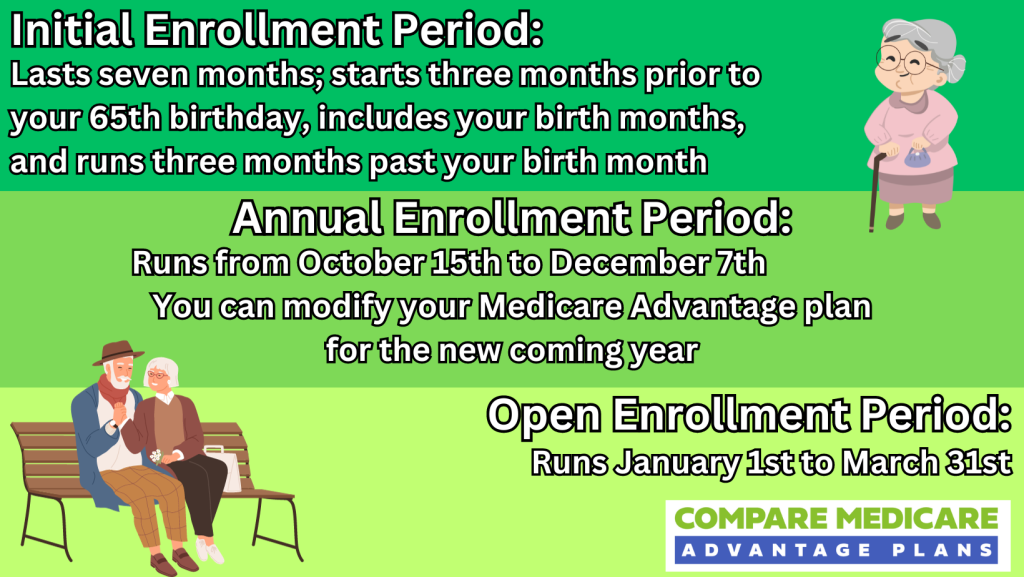

Enrollment Periods to Keep in Mind

Enrollment periods play a vital role in securing a Medicare Advantage plan in Texas. The Initial Enrollment Period is a 7-month window that begins three months before your 65th birthday and ends three months after turning 65. This is the time when you can first enroll in a Medicare Advantage plan.

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31. It is an essential enrollment period for those eligible. During this time, you can switch from one Medicare Advantage plan to another or return to Original Medicare.

The Medicare Annual Election Period, from October 15 to December 7, offers another window to switch between Medicare Advantage plans and Original Medicare. Be sure to mark these dates on your calendar to avoid missing out on enrollment opportunities.

Assessing Plan Networks and Coverage Areas

Considering the potential plan networks and coverage areas is a crucial part of selecting a Medicare Advantage plan in Texas. A Medicare Advantage Plan network is a group of healthcare providers who may agree to provide services to members of a specific plan.

The size and coverage area of some of these networks may vary, potentially impacting the availability and choice of plans.

Living in a rural area versus an urban area could influence the availability of certain Medicare Advantage plans in Texas. Enrollment in Medicare Advantage plans may be lower in rural areas compared to more populated regions.

However, bundling urban and rural areas in Texas will likely improve carrier and plan choice and potential premiums. When living in a rural area, considering the potential availability and accessibility of Medicare Advantage plans is necessary.

The Intersection of Medicare Advantage and Prescription Drug Coverage

Prescription drug coverage may be an essential component of many Texas Medicare Advantage plans.

We will look at the potential formularies and cost-sharing structures that could vary among plans and how they may influence plan selection.

Evaluating Prescription Drug Formularies

A prescription drug formulary is a list of generic and brand-name prescription drugs that may be covered by a Medicare Advantage plan. Some formularies in Texas Medicare Advantage plans may vary, with each plan having its unique list of covered drugs. Reviewing the specifics of each plan’s formulary to understand which medications might be covered and their possible costs is necessary.

Some prescription drugs in Medicare Advantage plans will likely be tiered, with different tiers potentially having distinct cost-sharing requirements, such as copayments or coinsurance.

The specific drugs that may be included in each tier will likely be determined based on clinical assessments and negotiated prices obtained by the plans. When selecting a plan that meets your prescription medication needs, understanding the tier system and formulary differences among plans is key.

Understanding Potential Cost-Sharing for Medications

Cost-sharing could be a crucial aspect of Medicare Advantage plans that may directly impact out-of-pocket expenses for beneficiaries. The cost-sharing requirements for medications in Texas Medicare Advantage plans may vary depending on the specific plan and the tier of the drug.

Reviewing the plan handbook provided by Medicare and staying updated on potential changes in drug coverage or costs may help you manage cost-sharing for medications effectively.

Utilizing the Medicare Plan Finder tool may also help you view the potential premiums and costs of Medicare health and prescription drug plans that could be available in your area.

Possible Benefits of Texas Medicare Advantage Plans

Some Texas Medicare Advantage plans may offer benefits that could potentially significantly improve the quality of healthcare received by beneficiaries.

Some of these plans may include additional benefits that may not be covered by Original Medicare, such as dental, vision, and hearing coverage.

We will examine the potential extra benefits that may offered by some of these plans and their potential effect on provider choices in Texas.

Potential Benefits Offered by Plans

In addition to the benefits provided by Medicare Advantage plans, some of these plans in Texas might offer extra coverage for:

- Dental services

- Vision services

- Hearing services

- Over-the-counter drug coverage

These potential additional benefits could significantly enhance the coverage that may be provided by some Medicare Advantage plans, possibly including Medicare Advantage HMO, which may address specific healthcare needs beyond Original Medicare.

When evaluating a Medicare Advantage plan in Texas, you should review the plan details to understand the dental, vision, and hearing coverage that may be offered.

Some plans may offer these benefits as part of the plan, while others could require the purchase of an optional supplemental package. By understanding the additional benefits that may be offered, you could choose a plan that best meets your healthcare requirements.

Navigating Provider Choices

Provider choices play a vital role in determining access to healthcare services under a Medicare Advantage plan in Texas. The provider choices among Texas Medicare Advantage Plans may differ based on the insurer.

Examples of providers offering certain Medicare Advantage plans in Texas may include Aetna Medicare and Alignment Health Plan. Researching and comparing various plans will likely be necessary to determine which provider may offer the coverage most suitable to your needs.

When selecting a plan, it’s important to understand the provider network that may be associated with a Medicare Advantage plan.

A provider network is a group of healthcare providers, such as doctors, hospitals, and other healthcare providers, that have agreed to provide services to members of a specific plan.

Be sure to check if your preferred medical provider is within the plan’s network before enrolling in a Medicare Advantage plan.

Selecting the Best Medicare Advantage Plan for Your Needs

With so many Medicare Advantage plans available in Texas, selecting the best plan for your needs could be challenging. By considering possible factors such as monthly premiums, out-of-pocket expenses, and plan ratings, you could make an informed decision when choosing a plan.

We will examine some of these factors and how they may assist you in finding the most suitable Medicare Advantage plan.

Comparing Potential Monthly Premiums and Out-of-Pocket Expenses

The potential monthly premiums and out-of-pocket expenses are important factors to consider when selecting a Medicare Advantage plan in Texas.

Reviewing the plan details to understand the potential costs, deductibles, copays, and coinsurance that could be associated with each plan is crucial.

Comparing the monthly premiums and out-of-pocket expenses of various plans may help you comprehend the potential overall costs associated with each plan and choose the one that aligns with your financial situation.

Checking Plan Ratings and Reviews

Plan ratings and reviews may be a valuable source of information when selecting a Medicare Advantage plan in Texas. Medicare Advantage plans are assigned ratings on a one-to-five scale by the Centers for Medicare and Medicaid Services (CMS).

These ratings may be based on criteria such as quality of care and customer service. In Texas, some companies like KelseyCare Advantage and UnitedHealthcare have achieved five-star ratings, highlighting their excellent performance.

Besides CMS ratings, considering member satisfaction reviews could be vital when selecting a plan. These reviews may provide insight into the experiences of other beneficiaries with the plan, which may include their satisfaction with:

- drug services

- drug safety

- pricing accuracy

- overall plan satisfaction

Considering plan ratings and reviews may provide insight into the performance and member satisfaction of different Medicare Advantage plans in Texas.

Resources and Assistance for Texas Medicare Beneficiaries

Navigating the world of Medicare Advantage plans in Texas may be complex, but fortunately, there are resources and assistance that may be available to help you make an informed decision.

Texas Medicare beneficiaries could access state and local health insurance assistance programs, online tools, and licensed insurance agents for guidance and support.

We will examine these resources and how they could assist you in finding the most suitable Medicare Advantage plan among most Medicare Advantage plans by helping you compare Medicare Advantage plans.

State and Local Health Insurance Assistance

Some state and local health insurance assistance programs may play a crucial role in providing guidance and support for Medicare beneficiaries.

The Texas Health Insurance Assistance Program (SHIP) could offer one-on-one assistance, counseling, and education to Medicare beneficiaries and their families, potentially providing support in understanding possible Medicare benefits, and coverage options, and navigating the Medicare system.

SHIP may also provide information and assistance to individuals aged 60 and above, as well as their caregivers, to access various community services.

In addition, Texas Area Agencies on Aging may also facilitate this process. These agencies may be able to help beneficiaries understand their Medicare coverage options and make informed decisions regarding their healthcare.

Utilizing these state and local resources could provide you with the guidance and support necessary to help find the most suitable Texas Medicare Advantage plan.

Online Tools and Licensed Insurance Agents

Certain online tools and licensed insurance agents may be able to provide valuable assistance when navigating Medicare Advantage plan options and enrollment processes.

Websites such as the Texas Department of Insurance, Forbes, and MedicarePlans.com will likely offer tools for comparing top Medicare plans from major carriers, possibly providing up-to-date and accurate information on different plans, potential costs, and coverage options.

Licensed insurance agents could provide personalized guidance and expertise to help you choose a Medicare Advantage plan in Texas. They may be able to explain the different plan options available, compare potential coverage and costs, and determine which plan could best meet your healthcare needs.

Utilizing online tools and consulting with a licensed insurance agent may help you make a decision that ensures alignment with your healthcare goals.

Customizing Your Medicare Advantage Plan

Customizing your Medicare Advantage plan could be an important aspect of ensuring the plan meets your unique healthcare needs.

By adding potential benefits or aligning with Special Needs Plans, you could tailor your plan to provide the coverage and possible benefits that may be the most important to you.

We will examine some of the options for tailoring your Medicare Advantage plan in Texas.

Potentially Adding Supplemental Benefits

Some Supplemental benefits may enhance your Medicare Advantage plan coverage and could address specific healthcare needs. Some Texas Medicare Advantage plans may offer additional benefits such as:

- Dental, vision, and hearing services

- Wellness programs

- Over-the-counter drug coverage

- Transportation to medical appointments

By adding these potential benefits to your plan, you may be able to receive more comprehensive healthcare coverage tailored to your individual needs.

When thinking about adding the potential supplemental benefits to your Medicare Advantage plan in Texas, reviewing the plan details and costs that may be associated with each benefit is crucial.

Some plans may offer these benefits as part of the plan, while others may require the purchase of an optional supplemental package. By understanding the potential costs and coverage of possible supplemental benefits, you could customize your plan to better suit your healthcare requirements.

Aligning with Special Needs Plans (SNPs)

Special Needs Plans (SNPs) cater to individuals with specific health conditions or circumstances, offering tailored coverage options that address their unique healthcare needs.

Special Needs Plans (SNPs) cater to individuals with specific health conditions or circumstances, offering tailored coverage options that address their unique healthcare needs.

SNPs provide the benefits of Original Medicare along with additional services designed to meet the specific needs of their target population.

In Texas, there are various Medicare Advantage plans available, including Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans, which may be combined with SNPs to provide customized coverage.

Aligning with a Special Needs Plan could offer benefits such as:

- Customized coverage

- Enhanced benefits

- Coordinated care

- Access to specialized providers

- Potential cost savings

If you have a qualifying health condition or are eligible for both Medicare and Medicaid, considering a Special Needs Plan may be an excellent option to customize your Medicare Advantage plan in Texas.

Potential Medicare Advantage Costs in Texas

Understanding the costs that may be associated with certain Medicare Advantage plans in Texas is crucial when selecting a plan that meets your financial and healthcare needs.

Various factors could influence plan costs, and Medicare Advantage plans may help manage healthcare expenses through structured premiums and out-of-pocket costs.

We will look at the factors that might influence plan costs in Texas and how these plans could assist in managing healthcare expenses.

Potential Factors Influencing Plan Costs

Plan type, coverage, and location may all be factors that could affect the cost of Medicare Advantage plans in Texas.

For example, HMO plans typically have lower out-of-pocket costs but require referrals for specialist services, while PPO plans offer more flexibility in provider selection at the expense of higher out-of-pocket costs.

The coverage that may be provided by some Medicare Advantage plans could also impact its cost. Some factors to potentially consider include:

- All Original Medicare services are covered by Medicare Advantage plans

- Some plans may also provide extra coverage such as prescription drugs, vision, hearing, dental, or wellness services

- The cost of the plan may differ depending on the level of coverage provided and the specific benefits offered by the plan.

Managing Healthcare Costs with Medicare Advantage

Some Medicare Advantage plans may be an effective tool in managing healthcare expenses. These plans could potentially offer an out-of-pocket maximum limit that might protect beneficiaries from high medical costs and may often have lower premiums and out-of-pocket expenses than Original Medicare.

Choosing a plan with structured premiums and manageable out-of-pocket costs might help beneficiaries control their healthcare expenses and ensure optimal care.

In addition to selecting a plan that may offer structured costs, it is essential to understand the various resources and assistance that will likely be available to Medicare beneficiaries in Texas.

Some state and local health insurance assistance programs, online tools, and licensed insurance agents may provide valuable guidance and support in navigating possible plan options and managing healthcare costs.

Leveraging these resources and carefully considering the potential plan costs and coverage could help you choose a Medicare Advantage plan that meets both your financial and healthcare needs.

Accessing Medicare Resources in Texas

As a Texas Medicare beneficiary, it is essential to know the resources that could be available to help you make informed decisions about your healthcare coverage.

The Texas Health and Human Services and the Centers for Medicaid & Medicare Services will likely offer support and resources for Medicare beneficiaries in the state. We will examine these resources and how they could help you navigate the Medicare Advantage landscape in Texas.

Utilizing the Texas Health and Human Services

The Texas Health and Human Services offers a wealth of support and resources for Medicare beneficiaries in the state.

The Texas Health Insurance Assistance Program (SHIP) may provide local one-on-one counseling and assistance to individuals with Medicare, possibly helping them understand their potential benefits, and coverage options, and navigate the Medicare system.

Consulting with SHIP could provide beneficiaries with the guidance and support required to find the most suitable Texas Medicare Advantage plan.

SHIP may also provide information and assistance to individuals aged 60 and above, as well as their caregivers, to access various community services.

In addition, Texas Area Agencies on Aging may also facilitate this process. Utilizing the resources that will likely be provided by Texas Health and Human Services may help you make informed decisions about your potential Medicare Advantage plan options in Texas.

Leveraging the Centers for Medicaid & Medicare Services (CMS)

The Centers for Medicaid & Medicare Services (CMS) is another valuable resource for Texas Medicare beneficiaries.

CMS provides information and guidance on Medicare Advantage plans and enrollment, including a comprehensive website with resources and tools to assist you in understanding your options and navigating the enrollment process.

In addition to the CMS website, the Medicare Plan Finder tool on Medicare.gov allows you to search for plans available in your area and compare options based on costs, coverage, and network providers.

Leveraging the resources provided by CMS may help you make an informed decision and select a Medicare Advantage plan that aligns with your healthcare goals.

Summary

Navigating the world of Texas Medicare Advantage plans may be complex, but with the right resources and guidance, you can make informed decisions that best suit your healthcare needs.

By exploring different plan types, understanding coverage options, comparing the potential costs, and utilizing the available resources, you might find the ideal plan for your situation. Take control of your healthcare coverage and embrace the possible benefits of a tailored Medicare Advantage plan in Texas.

Frequently Asked Questions

→ What is the biggest advantage of Medicare Advantage?

The biggest advantage of Medicare Advantage may be its broad range of provider networks, which may create lower out-of-pocket costs due to potential deductibles, copayments, and the lower cost of out-of-network care.

→ What are 4 types of Medicare Advantage plans offered in Texas?

Medicare Advantage plans are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), as well as Private Fee-For-Service (PFFS).

→ How do I enroll in a Medicare Advantage plan in Texas?

Enroll in a Medicare Advantage plan during your Initial Enrollment Period (three months before to three months after turning 65) or the Open Enrollment Period (January 1-March 31).

→ What additional benefits can I expect from a Texas Medicare Advantage plan?

Some of the Texas Medicare Advantage plans may offer additional benefits such as dental, vision, hearing, and over-the-counter drug coverage, possibly giving you access to a wide range of services.

Compare Medicare Advantage Plans by County:

Compare Medicare Advantage Plans by City:

ZRN Health & Financial Services, LLC, a Texas limited liability company