Compare Medicare Advantage Plans Side by Side for 2024

Navigating the world of Medicare Advantage plans may be difficult.

With so many options and potential factors to consider, it’s crucial to arm yourself with the right information to make the best decision for your healthcare needs.

This article will guide you through how to compare Medicare Advantage plans side by side in 2024, understand different plan types, and evaluate the potential costs and benefits, so you can confidently choose the right plan for your unique situation.

Key Takeaways

- Compare some of the top Medicare Advantage companies for 2024, including UnitedHealthcare, Aetna, Blue Cross Blue Shield, and Humana.

- Understand different types of plans such as HMOs and PPOs to select the best option that meets healthcare needs.

- Be aware of enrollment periods & deadlines when looking for a plan. Consider star-ratings and the potential costs before making an informed decision with help from a Licensed Insurance Agent.

Compare plans & rates for 2024!

Enter Zip Code

Some of the Best Medicare Advantage Companies for 2024

Some of the top Medicare Advantage companies for 2024, as determined by Forbes Health’s editorial team, have been:

- UnitedHealthcare

- Aetna

- Blue Cross Blue Shield

- Humana

These providers will likely stand out in terms of reputation and member satisfaction, potentially offering a wide range of plan options that could suit various needs.

UnitedHealthcare

Based on data from previous years, UnitedHealthcare is the biggest provider of Medicare Advantage coverage among all companies.

Their Medicare Advantage HMO plans will likely be available in 49 states and Washington, D.C., which may give them a wide geographic reach. UnitedHealthcare collaborates with AARP, potentially assuring the Medicare products that bear the AARP name.

With their Medicare Advantage plans having an average customer satisfaction rating of 3.87 stars out of 5, the vast network and AARP partnership could make UnitedHealthcare an appealing option for many.

Aetna

Aetna, a CVS Health company, may offer a range of benefits for their Medicare Advantage members, such as dental, hearing, and vision coverage.

With a member experience score of 3.79, some of Aetna’s plans may be above average and could potentially help reduce Medicare Part B premium costs for eligible members.

Some potential benefits of certain Aetna plans may include:

- Cost assistance with dental, vision, and hearing care

- Access to a consultant for local resources and activities

- Help manage prescription drug costs

These potential benefits might make some of the Aetna plans an attractive choice for those who may be looking for comprehensive coverage.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a collective of 33 distinct companies, many of which are geographically specific, and could provide advantages that may be tailored to local members. With a member experience rating of 3.39, BCBS services will likely be above average in terms of satisfaction.

Some of their best Medicare Advantage plans may include medical, prescription drug, dental, vision, and hearing Medicare benefits all in one plan.

Additionally, a Medicare supplement plan could potentially be included for those who may be seeking extra coverage.

Humana

Some of the Humana plans will likely provide:

- Widely accessible and highly acclaimed plans in numerous states, Washington, D.C., and Puerto Rico

- An average Medicare star rating of 4.34 out of 5

- 96% of Humana’s Medicare Advantage members are in plans rated 4 stars or higher in 2023.

The potential Humana Medicare Advantage plans in 2025 might offer coverage for medical, vision, dental, and hearing care, which could make them an attractive option for those seeking affordable yet comprehensive coverage.

Highmark

Highmark has garnered high ratings and achieved high levels of satisfaction among its members.

Some of their Medicare Advantage plans have had high Medicare star ratings and high member experience scores, as reported by the Centers for Medicare & Medicaid Services (CMS).

Highmark offers a selection of Medicare Advantage plans, including HMO, PPO, and HMO-POS plans.

If you reside in Pennsylvania, West Virginia, or Delaware, Highmark might be worth considering for its highly-rated plans and member satisfaction.

Medicare Advantage Plan Types

Some of the most common Medicare Advantage plans include:

- Health Maintenance Organization Plans (HMO)

- Preferred Provider Organization Plans (PPO)

- Private Fee-for-Service Plans (PFFS)

- Special Needs Plans (SNPs)

Health Maintenance Organizations (HMOs)

HMO plans are characterized by their strict physician networks and requirement for referrals to see specialists.

These plans focus on managed care and generally necessitate the utilization of providers and facilities within the plan’s network, except in cases of emergency.

HMO plans provide comprehensive coverage and additional benefits such as prescription drug coverage, making them a popular choice for those seeking a cost-effective option.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers and do not require referrals to see specialists.

However, out-of-network care typically comes with higher out-of-pocket costs.

PPO plans are ideal for those willing to pay a little extra for the freedom to choose their doctors and specialists, without the restrictions of an HMO plan.

Private Fee-for-Service Plans (PFFS)

PFFS plans grant members the flexibility to see any Medicare-approved provider, as long as they accept the plan’s terms and conditions.

The downside is that not all providers accept PFFS plans, which may limit your choices when seeking care.

PFFS plans are suitable for those who prioritize flexibility in choosing providers but are willing to accept the potential limitations in provider acceptance.

Special Needs Plans (SNPs)

SNP plans to cater to specific groups of people, such as those with chronic conditions or those who are dual-eligible for Medicare and Medicaid. These plans offer additional support and care coordination to assist individuals in managing their chronic conditions effectively. SNP plans are an excellent option for those who require specialized care and support tailored to their unique healthcare needs.

You may qualify for one of these plans for conditions such as:

- Alcohol dependence

- Various autoimmune disorders

- End-stage renal disease (ESRD) requiring dialysis

- HIV/Aids

- Many more. Call us for more information on these plans and to see if you qualify

Compare plans & rates for 2024!

Enter Zip Code

Comparing Costs: Medicare Advantage vs. Medigap

It may be necessary to contrast the potential costs between Medicare Advantage and Medigap plans when considering your options.

The decision could be influenced by various factors such as location, anticipated healthcare costs, and personal preferences for financial risk exposure or risk protection.

While some Medicare Advantage plans may offer lower monthly premiums, they may come with higher copayments or coinsurances when utilizing a doctor, hospital, or health services.

On the other hand, certain Medigap policies may provide more flexibility in choosing healthcare providers but could also have higher premiums.

Evaluating Possible Benefits

One of the potential advantages of certain Medicare Advantage plans could be the potential array of additional benefits they might offer. These may include:

- Dental coverage

- Vision coverage

- Hearing coverage

When looking for a plan, members may want to consider these extra features and weigh their importance to their specific healthcare needs. For example, if a member may require extensive dental work or vision coverage, it might be more advantageous to obtain a stand-alone policy or explore additional insurance coverage options.

How to Choose the Right Medicare Advantage Plan

Choosing the right Medicare Advantage plan will likely necessitate a thorough evaluation of potential factors like coverage, costs, the network of providers, and potential benefits.

You should ascertain that your preferred healthcare providers are in the plan’s network, scrutinize the plan’s potential coverage and benefits, review your current medications, and study the plan’s star rating to make a well-considered decision.

By taking these factors into account, you can confidently choose a plan that aligns with your healthcare needs and preferences.

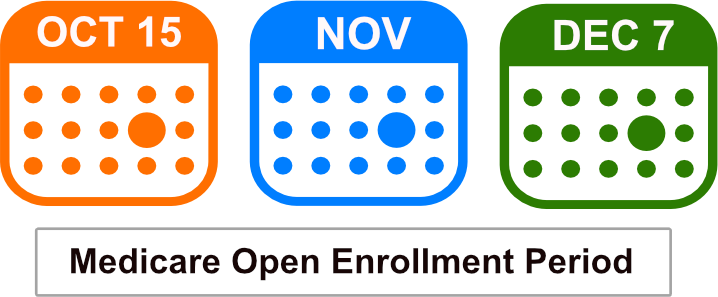

Enrollment Periods and Deadlines

It is important to know the enrollment periods and deadlines when contemplating a Medicare Advantage plan. The initial enrollment period for signing up is when you first become eligible for Medicare.

The Medicare Advantage open enrollment period is an annual event. It runs from January 1 to March 31, during which you can:

- Enroll in a Medicare Advantage plan

- Drop your current Medicare Advantage plan and return to your Original Medicare

- Switch from one Medicare Advantage plan to another

Additionally, the annual enrollment period spans from October 15 to December 7, providing another opportunity to make changes to your plan.

Keep these deadlines in mind to ensure you don’t miss the opportunity to enroll in or adjust your Medicare Advantage plan.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Tips for Choosing Medicare Advantage Plans

It might be important to analyze various options while shopping for Medicare Advantage plans to find the most suitable one. Members could utilize tools like this website to contrast the potential plan benefits, coverage, and costs. Consider checking star ratings, which could provide a measure of the plan’s overall quality, to help guide your decision.

Additionally, keeping your medication needs and preferred doctors in mind as you compare plans, will likely ensure the plan you choose aligns with your healthcare priorities.

Working with a Licensed Insurance Agent

Collaborating with one of our licensed insurance agents could streamline the process of selecting the most suitable Medicare Advantage plan tailored to your needs.

Our agents possess comprehensive knowledge of Medicare and the various plan options available, and can evaluate your specific healthcare needs to direct you in selecting a plan that best meets your requirements.

Licensed insurance agents have access to multiple plans from different insurance companies, allowing them to compare and present choices that align with your preferences and budget.

Collaborating with a licensed insurance agent could provide invaluable guidance and support as you navigate the complex world of Medicare Advantage plans and Medicare supplement options.

Summary

Finding the best Medicare Advantage plan will likely require careful consideration of various factors, including provider networks, costs, coverage, and potential benefits.

By comparing top companies, understanding different plan types, and seeking guidance from licensed insurance agents, you can confidently choose a plan that aligns with your unique healthcare needs and preferences.

Frequently Asked Questions

Why are people choosing Medicare Advantage plans?

People may be choosing Medicare Advantage plans due to flexible network availability or the broad range of coverage for non-preventative services such as dental, vision, and hearing. These advantages could potentially result in reduced fees for out-of-network care.

What is the tool to compare Medicare plans?

By entering your zip code into any of the zip code boxes on this website, you can compare the different Medicare Advantage and Prescription Drug Plans, focus on finding drug coverage and costs for the perfect fit for your healthcare needs, input your information, and sort through a variety of plans, and weigh the potential pros and cons of each based on your situations.

What is the best Medicare plan that covers everything?

There is no “best” Medicare plan, as everyone’s situation is different. The best Medicare Advantage plans would be the ones that can cover your specific needs.

Can I see any doctor with a Medicare Advantage plan?

People may visit doctors within their Medicare Advantage plan network to potentially save money. While some plans may allow you to see providers outside of your network, the cost might be higher. Check with your plan to see their policy regarding this matter.

ZRN Health & Financial Services, LLC, a Texas limited liability company