Is Molina Healthcare Medicaid or Medicare?

When you’re trying to figure out if Molina Healthcare is Medicaid or Medicare it’s important to get a straight answer. Molina Healthcare may provide both Medicaid and Medicare health plans, focusing on delivering healthcare services to individuals eligible under these government-sponsored programs.

This article will explore the specific ways Molina may operate within Medicaid and Medicare, including the potential benefits offered, eligibility criteria, and how to enroll.

Key Takeaways

- Molina Healthcare will likely provide health plans within both Medicaid and Medicare systems, potentially offering healthcare services to eligible individuals under state and federal programs, which may include personalized care plans and risk assessments.

- Medicaid managed care through Molina will likely include a variety of healthcare services for low-income individuals and families, while some Medicare Advantage plans may offer health benefits to eligible older adults and some younger individuals with certain conditions, focusing on care coordination and predictable expenses.

- Eligibility for Medicaid and Medicare with Molina Healthcare may vary by potential factors such as income, age, and disability, and requires specific documents for enrolment, with differing deadlines and processes to address enrollment inquiries.

Compare Plans in One Step!

Enter Zip Code

Deciphering Molina Healthcare: Medicaid or Medicare?

Through contractual agreements with state governments, Molina Healthcare will likely operate as a health plan within the Medicaid and Medicare systems, possibly providing a myriad of healthcare services to eligible individuals under government-sponsored programs.

Some of the primary distinctions in the management of Medicaid and Medicare by Molina Healthcare may revolve around the range of services that could be provided and the criteria for eligibility.

Molina Healthcare will likely offer Medicaid, a service that may encompass benefits not usually covered by Medicare.

What is Medicaid?

Medicaid, a public health insurance program, was designed to provide individuals with low-income access to a wide array of medical services. Its primary goal has been to provide essential healthcare coverage to those who meet the eligibility criteria. The eligibility for Medicaid will likely encompass low-income families, qualified pregnant women, and children, following federal regulations for state Medicaid programs.

Medicaid coverage may also encompass a diverse range of services, including but not limited to:

- Prescription drugs

- Eyeglasses

- Dental care

Overseen by individual states and aligned with federal directives, Medicaid will likely operate as an entitlement program. Its funding may also be a collaborative effort, with states potentially receiving federal matching funds to sustain the program.

What is Medicare?

Medicare, a federal health insurance program, will likely be tailored for individuals aged 65 and older, along with certain younger individuals with disabilities and those battling End-Stage Renal Disease.

The potential Medicare benefits may be accessible to individuals who are 65 years of age or older. Additionally, eligibility may also be extended to younger individuals who have disabilities or those diagnosed with End-Stage Renal Disease.

Medicare could also provide coverage for a wide variety of services delivered by healthcare professionals and doctors.

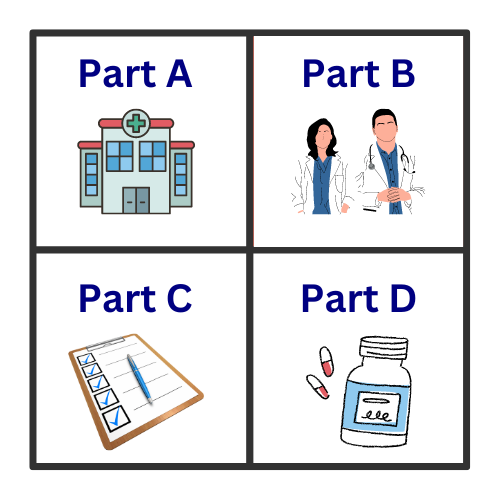

Medicare encompasses four components:

- Part A covers inpatient and hospital services

- Part B caters to outpatient and medical services

- Part C includes Medicare Advantage Plans

Molina Healthcare’s Role

The establishment of Molina Healthcare has been centered around the goal of providing reliable, efficient, and cost-effective healthcare to those most in need.

Unlike traditional Medicaid and Medicare providers, Molina Healthcare might differentiate itself by conducting a health risk assessment to identify each member’s specific needs, followed by the development of a personalized care plan. This methodology could facilitate management for both Traditional Medicaid and Non-Traditional Medicaid, possibly resulting in a more personalized healthcare journey.

In collaboration with the government, Molina Healthcare may also provide programs like Medicaid, Medicare, and the Health Insurance Exchange. Additionally, these programs may form partnerships with local organizations, such as Wayne Health, to potentially expand healthcare access to under served communities, possibly ensuring that government-supported healthcare reaches those in greatest need.

The Scope of Molina’s Services

Under Medicaid Managed Care, Molina Healthcare will likely provide a comprehensive range of free health coverage, which may include various Medicaid services and benefits for eligible adults and families.

To effectively manage and coordinate patient care, Molina Healthcare may also offer a comprehensive Care Management program to all eligible health plan members.

Conversely, some of Molina Healthcare’s Medicare Advantage plans, which operate as a health maintenance organization (HMO) and may require the use of a specific network of doctors and hospitals, could sometimes provide prescription drug coverage.

Medicaid Managed Care

Designed to manage cost, utilization, and quality effectively, Medicaid Managed Care is a healthcare delivery system. It will likely be the primary method through which states could provide services to Medicaid enrollees.

Molina Healthcare may have entered into a contractual agreement with the State Department of Health to address the healthcare requirements of individuals with Medicaid. They will likely collaborate with a designated network of healthcare providers, which includes:

- physicians

- specialists

- hospitals

- laboratories

Enrolling in Molina’s Medicaid Managed Care may also offer comprehensive health coverage at no or low-cost for eligible individuals. Molina Healthcare will likely implement quality improvement strategies to ensure high-quality care in its Medicaid Managed Care services, including maintaining a Quality Improvement (QI) Program and demonstrating a strong commitment to member protection and care.

Medicare Advantage Plans

A Medicare Advantage Plan, approved by Medicare and offered by a private company, provides coverage for most Part A and Part B benefits as a potential alternative to Original Medicare. Some of the plans may also encompass Part D prescription drug coverage. However, there may be certain out-of-pocket costs that might be associated with this type of plan.

Users may also be able to derive benefits from selecting Molina’s Medicare Advantage Plans due to the provision of predictable out-of-pocket expenses, preventive care, care coordination, and prescription drug coverage. Some of Molina Healthcare’s Medicare Advantage Plans might encompass benefits such as dental care, hearing services, and vision care.

The Medicare Advantage Plans that may be provided by Molina Healthcare may also include foreseeable out-of-pocket expenses, such as copayments, coinsurance, and deductibles.

Eligibility and Enrollment Process

The eligibility requirements for Molina Healthcare’s Medicaid managed care may encompass potential factors such as:

- income

- age

- disability

- parental or caregiver status

However, these criteria may differ by state, so it is recommended to refer to Molina Healthcare’s website for state-specific details.

When enrolling in Molina Healthcare’s Medicaid program, specific documents such as a W-9 form, a Disclosure and Ownership Form (if enrolling a facility), and an NYS License may also be required.

To enroll in Molina Healthcare’s Medicare Advantage Plans, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Qualifying for Molina Medicaid

Eligibility for Molina Medicaid might include potential factors such as:

- 65 years of age or older

- under 19

- living with a disability

- a parent/adult caring for a child

Molina Healthcare may also assess Medicaid eligibility by considering income limits. Applicants could utilize an eligibility calculator to ascertain if their income falls within the specified limits. The income thresholds necessary for Molina Medicaid eligibility will likely be linked to the Federal Poverty Level.

Signing Up for Molina Medicare

The deadline for enrolling in Molina Medicare is December 15. To address any inquiries about Medicare enrollment, it is recommended to contact one of our licensed agents, as they can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare

Protecting Our Users: Understanding Potential Plan Restrictions

Molina Healthcare’s site may deny access if a user attempts to access their site from a restricted region, or if their request appears to be automated, as mirroring patterns may be associated with computer viruses or spyware applications.

To mitigate the risks posed by computer viruses or spyware, Molina Healthcare will likely use regular risk assessments and maintain a specialized Computer Security Division (CSD) responsible for overseeing IT risks and vulnerabilities.

Site from a Blocked Region

Some of the possible factors that might lead to Molina Healthcare restricting access from specific regions may include:

- Geo-blocking

- Legal restrictions

- Service availability issues such as insufficient insurance coverage, healthcare staffing shortages, and limited healthcare facilities

Molina Healthcare’s action of blocking access from specific regions may be attributed to non-compliance with legal prerequisites or exceptions in privacy laws. Nevertheless, this course of action could result in legal repercussions.

The potential restriction of access from certain regions could also have a significant impact on users as it:

- Prohibits them from accessing the website and its services

- Leads to user frustration and inconvenience

- Obstructs their ability to obtain necessary information and resources.

Request from a Computer Virus or Spyware

A computer virus is specifically crafted to contaminate programs and files with harmful code, altering the functioning of a computer and spreading through interconnected systems. Its influence on internet usage will likely be manifested through the infection of files or system areas of hard drives and routers, followed by self-replication.

On the other hand, spyware is a form of malicious software that has been surreptitiously installed without consent, enabling unauthorized access to sensitive information, which could be then transmitted to third parties.

Its effect on web experiences has been demonstrated through the tracking of browsing history and passwords, as well as the manipulation of browser settings and search engine results. To protect your computer from these threats, it is essential to use a reliable virus or spyware application.

Molina Healthcare will likely utilize an Anti-Fraud Program, similar to an automated system, to examine fraud allegations. Moreover, their Claims Examiners receive training to recognize unusual billing practices, helping to expose fraud, waste, and abuse.

Furthermore, spyware detection tools may also be utilized to detect unfamiliar programs by comparing them with established spyware signatures, especially when a query looks similar to known malicious patterns.

Molina Healthcare has established information security and cybersecurity measures to protect our users and safeguard their information systems. This may include managing requests from devices infected with viruses or spyware, to preserve the integrity and security of their network and data.

Navigating Coverage Issues

Some of the potential coverage issues with Molina Healthcare may stem from potential factors like:

- Adverse benefit denial

- Disapproval or limit of requested services

- Delays in claims processing

- Denials due to lack of prior authorization or referral

- Denials due to an out-of-network provider

- Denials due to services deemed medically unnecessary

Users can report coverage issues to Molina Healthcare by contacting their Member Services Department or by completing a Grievance form via their online portal.

When Your Access to Our Site Is Denied

Possessing the authority to deny services or prematurely shorten or terminate them may lead to the denial of site access.

To determine if access to the Molina Healthcare site has been denied due to a technical problem or security requirement, one can contact Molina Healthcare’s Member Services department at (800) 869-7165, TTY 711, or submit an appeal request via fax to (877) 814-0342.

To address a denial of access to the Molina Healthcare site, individuals can follow the following steps:

- Fax the required information to (425) 424-1172.

- Within 72 hours, a written confirmation of the appeal’s receipt will be provided.

- If assistance is needed in filing the appeal, individuals can call (800) 869-7165 (TTY 711).

Apologize for the Inconvenience: Resolving Errors

As part of the grievance process, members may also file a complaint to Molina Healthcare to report errors. These complaints will likely be resolved by the end of the next business day. Alternatively, members may also send a detailed letter by mail to Molina Healthcare outlining the issue.

Molina Healthcare may resolve reported errors within a 30-day period, following a structured process that could enable members to file grievances or appeals related to their concerns. Molina Healthcare will likely be dedicated to promptly addressing all errors and user complaints within a specified time frame.

They guarantee that all appeals and complaints raised by members are handled with diligence and resolved expeditiously, typically within 30 days.

Summary

Molina Healthcare will likely offer extensive services under the Medicaid and Medicare systems. Their Medicaid Managed Care and Medicare Advantage programs could provide comprehensive health coverage to eligible individuals. Despite potential challenges such as geographical restrictions and cybersecurity threats, Molina Healthcare will likely remain committed to ensuring a seamless experience for its users.

The organization’s dedication to resolving errors and addressing user complaints promptly could be a testament to their commitment to service excellence.

Frequently Asked Questions

→ Is Molina Medical or Medicare?

Molina Healthcare may offer Medicare Advantage plans for individuals with Medicare or both Medicare and Medicaid coverage, potentially providing medical insurance.

→ What type of insurance is Molina Healthcare?

Molina Healthcare will likely be a Medicaid health plan that could provide complete, no-cost health coverage to children and adults with low income.

→ What is the difference between Medicaid and Medicare?

The main difference between Medicaid and Medicare is that Medicaid may be for individuals with low income, while Medicare is primarily for individuals aged 65 and older, as well as for certain younger people with disabilities and those with End-Stage Renal Disease.

→ How can I enroll in Molina Medicare?

To enroll in Molina Medicare, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

→ What should I do if my access to Molina Healthcare’s site is denied?

If your access to Molina Healthcare’s site is denied, you should contact Molina Healthcare’s Member Services department at (800) 869-7165 or submit an appeal request via fax to (877) 814-0342.

ZRN Health & Financial Services, LLC, a Texas limited liability company