Compare Medicare Advantage Plans Side by Side for 2025

Navigating the world of Medicare Advantage plans might feel overwhelming. However, by comparing these plans side by side, you can make an informed decision that best suits your healthcare needs and budget.

This article will guide you through the process of evaluating different types of Medicare Advantage plans, analyzing the potential costs and coverage, and making the most of available resources to choose the perfect plan for you. To do this, it’s important to compare Medicare Advantage plans side by side.

Key Takeaways

- Members may compare Medicare Advantage Plans by evaluating the potential costs in 2025, coverage, possible benefits, and provider networks.

- Members may want to consider monthly premiums and deductibles when selecting a plan that meets their healthcare needs and budget.

- Consult with medical professionals to make an informed decision while utilizing available resources for personalized plans.

Compare Plans in One Step!

Enter Zip Code

Comparing Medicare Advantage Plans: The Basics

Medicare Advantage plans come in five distinct types:

- Preferred Provider Organizations (PPOs)

- Special Needs Plans (SNPs)

- Medical Savings Account (MSA) plans

Grasping the potential pros and cons of each plan type could be key to making a suitable choice that aligns with your healthcare needs and preferences.

Each plan type will likely have its own set of characteristics, such as network restrictions, cost-sharing requirements, and additional benefits. This guide will provide an overview of these plan types, helping you to compare Medicare Advantage plans side by side and make the best choice for your unique circumstances.

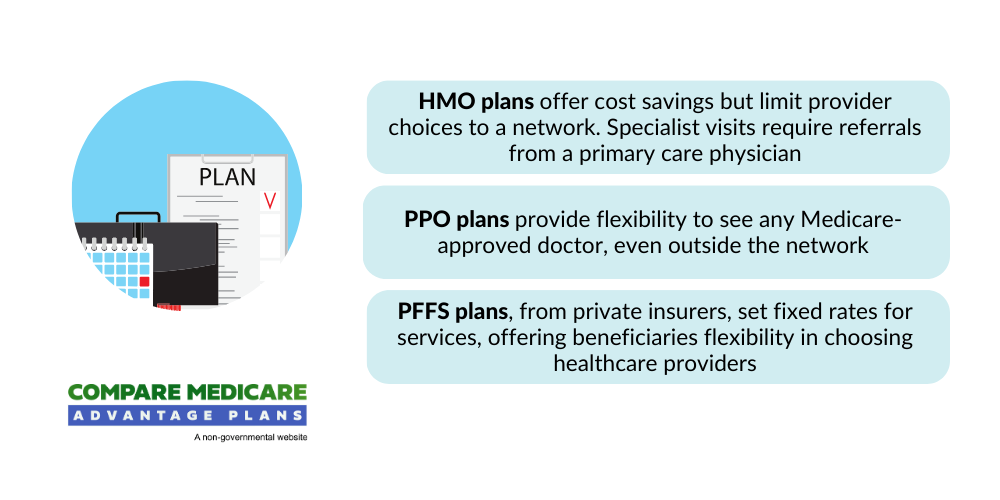

Health Maintenance Organization (HMO) Plans

HMO plans are renowned for their lower costs, but they also come with certain limitations. These plans involve a network of doctors, hospitals, and other healthcare providers, requiring you to:

- Select a primary care physician (PCP) who will coordinate your healthcare needs

- Obtain referrals from your PCP to consult specialists

- Receive out-of-network care only in emergencies, as it is generally not covered.

While HMO plans may be more cost-effective than other Medicare Advantage plan types, it’s imperative to balance the benefits with the limitations of a Medicare Advantage HMO. Some of the drawbacks include:

- Restrictive networks

- Limited provider choices

- The requirement for referrals to see specialists

- Potential out-of-pocket costs

Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility than HMO plans, including:

- Ability to receive care from both in-network and out-of-network providers within the plan’s network

- In-network care typically comes with reduced costs

- Out-of-network care can result in higher expenses

- No requirement to select a primary care doctor

- No need for referrals from specialists

While PPO plans grant more liberty in selecting healthcare providers, they might have higher monthly premiums and deductible costs than HMO plans. Assessing your healthcare needs and preferences is key when weighing the benefits and drawbacks of a PPO plan.

Private Fee-for-Service (PFFS) Plans

PFFS plans are a unique type of Medicare Advantage plan that offer the following benefits:

- Determine the amount paid to healthcare providers and hospitals

- Determine the amount you pay for care

- Offer flexibility, as they don’t require you to select a primary care doctor

- Don’t require you to obtain referrals to see specialists

If you are considering a PFFS plan, it’s important to verify its prescription drug coverage if required. Additionally, examine the plan’s prescription drug list to ensure your medications are covered.

PFFS plans can be a suitable option for those looking for more control over their healthcare decisions and provider choices.

Special Needs Plans (SNPs)

SNPs are Medicare Advantage plans specifically designed for certain groups with specific health conditions or income levels. These tailored plans often provide more comprehensive coverage for specialized care, such as treatment for heart disease or skilled nursing facility care.

While SNPs offer the same Medicare services as other plans, they may provide additional benefits or reduced rates depending on the plan. If you fall into one of the specialized groups that SNPs cater to, these plans can be a valuable option to consider for your healthcare needs.

Medical Savings Account (MSA) Plans

The MSA plans combine a high-deductible health plan with a medical savings account, offering more control over healthcare decisions for those comfortable with managing higher deductibles.

The plan deposits funds into the account, which can be used to pay for qualified medical expenses.

MSA plans have the following features:

- Higher deductible compared to other Medicare Advantage plans

- No network restrictions, allowing beneficiaries to visit any Medicare-approved provider

- Any unused funds in the savings account can roll over to the next year

MSA plans can be an appealing option for those seeking greater control over their healthcare expenses.

Analyzing Potential Costs, Coverage, and Extra Benefits

Comparing Medicare Advantage plans might require taking into account some of the following factors:

- Monthly premiums

- Deductibles

- Prescription drug coverage

- Potential benefits

Some of the more expensive plans might provide superior benefits, which could be advantageous if you have ongoing medical care requirements. On the other hand, a less expensive plan could save you money each month, but you may end up paying more each time you need medical care.

To select the plan that best fits your needs, it’s important to scrutinize each plan’s prescription drug coverage, out-of-pocket costs, and extra benefits, such as vision, dental, and hearing services. This could aid in making a choice that aligns with your healthcare needs and budget.

Monthly Premiums and Deductibles

Medicare Advantage plans may vary in terms of monthly premiums and annual deductibles, depending on the chosen plan.

Evaluating the potential plan costs will likely require considering the plan’s premium and the maximum out-of-pocket expense. By understanding the costs that might be associated with each plan, you can make an informed decision that best suits your healthcare needs and financial situation.

Prescription Drug Coverage

Prescription drug coverage could be a vital component of many Medicare Advantage plans, as medications may be costly, amounting to hundreds or thousands of dollars per month. When selecting a plan, it’s important to ensure that it may cover your prescriptions.

To contrast prescription drug coverage among various Medicare Advantage plans, consider the list of medications that might be covered by each plan. By selecting a plan that includes your prescriptions, you could potentially avoid high out-of-pocket costs and may be able to ensure that your healthcare needs are met.

Potential Benefits and Services

Some Medicare Advantage plans might provide a range of additional benefits. These could include vision and hearing care, and dental treatment.

Some of these additional benefits could potentially enhance your healthcare experience and provide valuable services that may not be covered by Original Medicare.

In comparing Medicare Advantage plans, members will likely want to consider the extra benefits and services that could be provided by each plan, along with any potential cost savings.

By taking into account these factors, you may choose a plan that not only covers your basic healthcare needs but could also offer valuable extras that could help improve your overall well-being. Conducting a thorough Medicare Advantage plan comparison could help you make the best decision for your needs.

Evaluating Provider Networks and Quality Ratings

Aside from costs and coverage, assessing Medicare Advantage plans may also involve evaluating their provider networks and quality ratings.

Understanding your plan’s network will likely be essential for continued access to care. Make sure your preferred healthcare providers, hospitals, and specialists are included in the plan’s network.

The accessibility of network providers could be an important factor when considering your healthcare experience. Possible factors such as proximity to your location and availability of appointments may also need to be taken into account.

By considering these factors, you can make an informed decision that best suits your healthcare needs and preferences.

Doctor and Hospital Networks

In evaluating Medicare Advantage plans, it’s important to confirm that your preferred doctors are part of the plan’s network. The decision of which doctors and hospitals to include in a plan’s network will likely be made by the respective Medicare Advantage company.

If you have a regular network of caregivers and medical facilities, it’s essential to determine whether the physicians, specialists, and facilities accept the specific Medicare Advantage plan you’re considering. This could help you maintain continuity of care and potentially avoid unexpected out-of-pocket costs.

Medicare Star Rating

Medicare Advantage plans are rated on a scale of 1 to 5 stars, assessing their quality and performance. These ratings are determined by the Centers for Medicare & Medicaid Services (CMS) using at least 40 measurements.

By taking into account the Medicare Star Ratings of various plans, you could decide the overall quality of the plan and its capacity to meet your healthcare needs.

This information could be invaluable in helping you choose a plan that aligns with your expectations for quality care and service.

Navigating Enrollment Periods and Deadlines

Comprehending the diverse enrollment periods and deadlines for Medicare Advantage plans may be key to ensuring a seamless transition, uninterrupted coverage, and the chance to make necessary modifications to your healthcare plan.

Initial enrollment periods and special enrollment periods offer varying windows of time for enrolling in or changing your Medicare Advantage plan.

Getting acquainted with these enrollment periods could help prevent missing deadlines and potentially ensure you have the necessary coverage when you need it.

This knowledge could help you make informed decisions about your healthcare and avoid any potential gaps in coverage or penalties for late enrollment.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Initial Enrollment Period

When you first become eligible for Medicare, the Initial Enrollment Period for Medicare Advantage plans begins. It is a seven-month period.

This period typically begins three months before your 65th birthday and ends either on the last day of the Part B initial enrollment period or on the last day of the month in which Medicare is attained.

Being cognizant of the dates for the Initial Enrollment Period could be crucial to ensure timely enrollment in a Medicare Advantage plan. Failing to enroll during the Initial Enrollment Period may result in penalties or the need to wait for a special enrollment period.

Special Enrollment Period

Special Enrollment Periods allow you to make changes to your Medicare Advantage plan due to specific life events or circumstances.

These events may include moving to a new address, losing other insurance coverage, or experiencing certain qualifying life events.

Being aware of the different Special Enrollment Periods and the events that could activate them is important.

By understanding these periods, you could make necessary changes to your Medicare Advantage plan when needed, ensuring that your healthcare coverage remains aligned with your evolving needs and life circumstances.

Making an Informed Decision: Personalizing Your Medicare Advantage Plan Choice

Choosing the best Medicare Advantage plan will likely involve evaluating your potential healthcare needs, seeking advice from healthcare professionals, and utilizing available resources and assistance programs.

By taking these factors into account, you could make an informed decision that may be tailored to your unique healthcare needs and preferences.

This final section will offer tips for personalizing your Medicare Advantage plan choice, potentially ensuring that you can select a plan that not only covers your basic healthcare needs but may also provide additional benefits and services that could enhance your overall well-being, all within the scope of your Medicare contract and considering the option of Medicare supplement insurance.

Assessing Personal Healthcare Needs

Choosing a Medicare Advantage plan will likely require considering your healthcare needs and preferences. This might include coverage for prescription drugs, major medical issues, and benefits that may not be included in traditional Medicare.

By assessing your potential medical needs and ensuring that the plan you choose fulfills those needs, you may be able to avoid high out-of-pocket costs and potentially ensure that your healthcare needs are met.

This personalized approach to selecting a Medicare Advantage plan could help you make the best choice for your unique healthcare requirements.

Consulting with Healthcare Professionals

Seeking advice from your doctors and specialists is an invaluable resource when selecting a Medicare Advantage plan.

They may provide personalized recommendations based on your medical history and needs, helping you choose a plan that is appropriate for your healthcare requirements.

Healthcare professionals could potentially offer insights into:

- The specific benefits and coverage options of different plans

- Understanding the network of healthcare providers that might be associated with each plan

- Advising on potential lifestyle benefits or additional services that may be important to consider

Their expertise could help you make an informed decision that is tailored to your individual healthcare needs.

Utilizing Available Resources and Assistance Programs

While navigating Medicare Advantage plans might be complex, numerous resources and assistance programs are available to help you make the best decision. Online tools, such as this website, can help you compare plans side by side and determine which plan offers the best coverage for your needs.

Just enter your zip code into any of the zip code boxes on this website and you can:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your situation

Additionally, our licensed agents and Medicare experts can provide personalized guidance and assistance in selecting the perfect plan for you.

State Health Insurance Assistance Programs (SHIPs) may also be available to provide unbiased advice and assistance in selecting a Medicare Advantage plan, helping you understand the different plans available in your area and compare their potential benefits and costs.

Summary

Comparing Medicare Advantage plans side by side could be essential to making an informed decision that best suits your healthcare needs and budget.

By carefully evaluating the different plan types, potential costs, coverage, provider networks, and quality ratings, you can choose a plan that offers the ideal combination of benefits and services for your unique healthcare requirements.

Don’t hesitate to consult with healthcare professionals and utilize available resources to ensure you make the best choice for your health and well-being.

Frequently Asked Questions

→ What is the tool to compare Medicare Advantage plans?

This website is the best tool for comparing Medicare Advantage plans. By entering your zip code into any of the zip code boxes, you can compare the different Medicare Advantage and Prescription Drug Plans, focus on drug coverage and costs that fit your healthcare needs, input your information, and sort through a variety of plans, and weight the potential pros and cons of each based on your needs.

→ Why are people choosing Medicare Advantage plans?

The lack of prior authorization and quick payments may cause people to choose Medicare Advantage plans.

→ What is the best Medicare Advantage plan?

Based on data from previous years, Humana will likely be the best Medicare Advantage plan due to its high-quality ratings, positive customer reviews, and widespread availability. Customers have reported a higher quality of health care with Humana compared to other providers like AARP/UHC.

→ What are the five types of Medicare Advantage plans?

Medicare Advantage plans consist of five types: HMOs, PPOs, PFFS plans, SNPs, and MSAs.

ZRN Health & Financial Services, LLC, a Texas limited liability company