Medicare Advantage Plans Comparison Chart

Navigating the world of healthcare coverage might be overwhelming, especially when it comes to choosing the right Medicare Advantage plan.

With numerous factors to consider, such as potential plan types, provider networks, and the possible inclusion of prescription drug coverage, it’s essential to make an informed decision that best suits your needs and budget.

This comprehensive guide will walk you through the process of comparing Medicare Advantage plans using a medicare advantage plans comparison chart, ensuring that you can select the best plan to support your health and well-being.

Key Takeaways

- Comparing Medicare Advantage plans will likely require analyzing various factors to make an informed decision.

- Understanding different plan types and associated provider networks might be essential for selecting the most suitable plan.

- Examining the potential coverage levels, cost-sharing arrangements, possible benefits, and costs across different plans could help determine the best option for individual needs.

Compare Plans in One Step!

Enter Zip Code

Navigating Your Medicare Advantage Plan Comparison Chart

Comparing Medicare Advantage plans will likely involve understanding key aspects such as the potential plan types and their networks, possible coverage levels and cost-sharing, and any possible benefits. Each plan could be unique, and your choice should reflect your healthcare needs, preferred providers, and financial situation.

A careful evaluation of these potential factors could equip you to make a decision that aligns with your healthcare priorities.

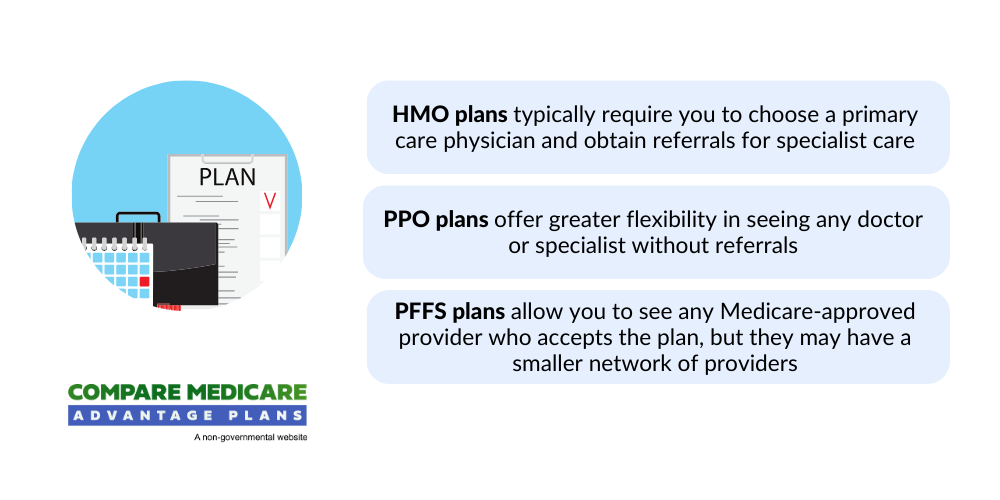

Understanding Possible Plan Types and Their Networks

Some Medicare Advantage plan types include:

- Medicare Advantage HMO (Health Maintenance Organization)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

Each plan type comes with different provider networks and referral requirements, which can impact your overall healthcare costs.

For example, HMO plans are generally more cost-effective for those who primarily visit their primary care physician and require less specialist care. On the other hand, PPO plans offer more flexibility for seeking specialist care without referrals.

Grasping the distinctions between these plan types and their provider networks is key in determining the most suitable Medicare Advantage plan for you.

Deciphering Potential Coverage Levels and Cost Sharing

Coverage levels and cost-sharing arrangements may vary across Medicare Advantage plans, and could affect the potential premiums, deductibles, and out-of-pocket costs.

A close examination of these costs could help you understand the financial implications of each plan and make a better decision.

Assessing Possible Benefits

- Dental coverage may encompass preventive and comprehensive services

These additional benefits could promote a healthy lifestyle for seniors.

Considering these potential benefits may help you gauge the value of each plan and determine the most comprehensive coverage for your needs.

Comparing the Potential Costs Across Different Medicare Advantage Plans

Comparing the possible Medicare Advantage costs will likely be fundamental when selecting a plan, as the following factors could vary considerably:

- Premiums

- Deductibles

- Copayments

- Out-of-pocket limits

A close examination of these costs might help you identify a plan that could align with your financial situation and healthcare needs.

Additionally, keep in mind that some cost-sharing may differ based on the specific healthcare services you require, so it’s crucial to take these factors into account when comparing plans.

Premiums and Deductibles: What You’ll Pay

Premiums and deductibles could play a significant role in determining your monthly and annual healthcare costs. Higher deductibles might result in reduced monthly premiums but could lead to increased out-of-pocket expenses when accessing medical services.

Conversely, lower deductibles may lead to higher monthly premiums but might include reduced out-of-pocket expenses for medical services. Grasping the possible trade-offs between premiums and deductibles could assist you in making a knowledgeable choice regarding your Medicare Advantage plan.

Possible Out-of-Pocket Costs and Spending Limits

Some of the out-of-pocket costs and spending limits could be important considerations in protecting against high medical expenses. Some of the Medicare Advantage plans may impose a limit on the amount one could pay out-of-pocket each year, unlike Original Medicare, which might not feature an out-of-pocket maximum.

This limit might offer a safety net for beneficiaries, possibly ensuring that they’re not burdened with exorbitant medical bills. Additionally, a medical savings account could provide further financial security for healthcare expenses.

Reviewing the potential out-of-pocket costs and spending limits for each plan could help you choose a plan that might provide financial security in the face of unexpected healthcare costs.

Possible Prescription Drug Coverage in Detail

Prescription drug coverage will likely be a significant aspect of certain Medicare Advantage plans. With numerous factors to consider, like formularies and pharmacy networks, a thorough analysis of each plan’s prescription drug coverage might be necessary to ensure your medications may be covered and to determine potential drug costs.

A careful evaluation of these elements could help you select a plan that best supports your medication needs and budget.

Formulary Analysis: Ensuring Your Medications are Covered

A formulary is an inventory of all the generic and brand-name prescription drugs that might be included within a plan’s coverage. Analyzing a plan’s formulary may be essential to ensure that your medications are covered and to determine the potential drug costs.

It’s important to familiarize yourself with the tier structure and possible cost-sharing requirements of the formulary, as this could impact your out-of-pocket expenses for prescription drugs.

Thoroughly assessing the formulary could lead to a knowledgeable decision about which plan may provide the most comprehensive coverage for your medication needs.

Pharmacy Networks and Convenience

Pharmacy networks may also play a significant role in the convenience and accessibility of certain prescription medications.

Some of these networks could include a group of pharmacies that have agreed to provide prescription drugs to plan members at a negotiated rate. Some plans may also offer mail-order pharmacy services, possibly providing added convenience by delivering medications directly to your home.

Examining each plan’s pharmacy network could help you gauge the convenience and accessibility of your prescription medications, possibly ensuring that you could obtain your medications without hassle.

Enrollment Periods and Eligibility Criteria

Grasping enrollment periods and eligibility criteria is key for timely and successful enrollment in Medicare Advantage plans. Familiarizing yourself with key enrollment dates and the requirements for enrolling in Medicare Advantage Plans may ensure a smooth transition and continuous coverage.

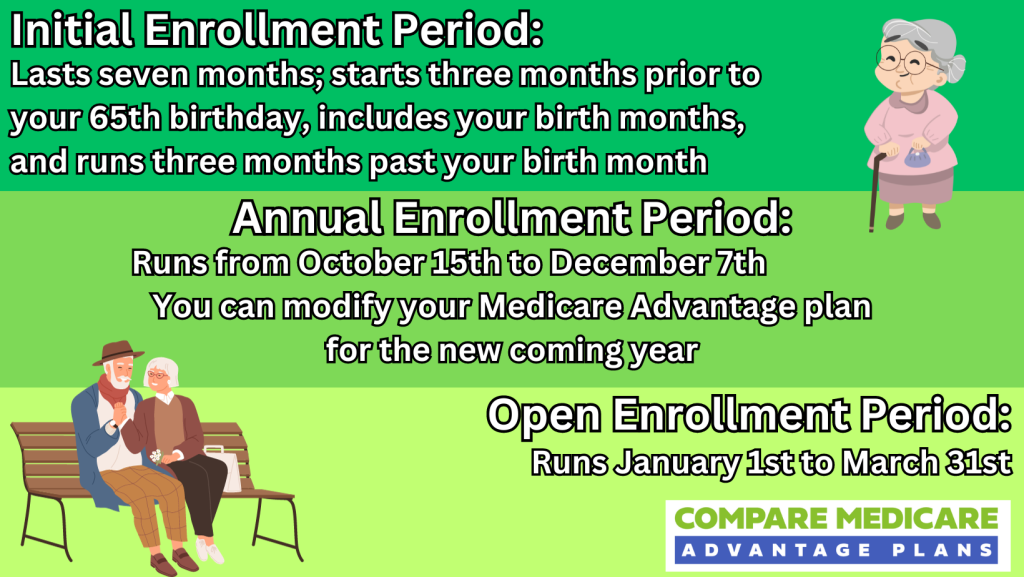

Timing Your Enrollment: Key Dates to Remember

Key enrollment dates include:

- Initial Enrollment Period: Occurs during the three months preceding and succeeding your 65th birthday, as well as your birthday month.

- Annual Enrollment Period: Runs from October 15th to December 7th, during which you can modify your Medicare Advantage plan.

- Open Enrollment Period: Occurs from January 1st to March 31st, allowing you to switch Medicare Advantage plans if needed.

Keeping these important dates in mind can ensure that you don’t miss any vital enrollment windows.

Qualifying for Medicare Advantage

To qualify for Medicare Advantage, you must be enrolled in Medicare Parts A and B, which generally requires individuals to be 65 years of age or older and either a U.S. citizen or a legal permanent resident for at least five years.

Grasping these eligibility criteria can assist in determining whether you qualify for Medicare Advantage and aid in making a knowledgeable decision about your healthcare coverage options.

Quality Ratings and Customer Experience

Quality ratings and customer experience could be important factors in choosing a Medicare Advantage plan. The Centers for Medicare & Medicaid Services (CMS) will likely assign Star Ratings based on a plan’s performance and quality, which could help you compare different plans and select one that offers the highest quality of care.

Additionally, considering the input of family, friends, and trusted advisors might provide valuable insights into the customer experience and support that may be offered by various plans.

Interpreting CMS Star Ratings

CMS Star Ratings measure the quality and performance of Medicare Advantage plans, with ratings ranging from one to five stars. These ratings will likely be determined based on a plan’s performance on various quality measures, which may include:

- screenings

- tests

- vaccines

- chronic conditions management

- member experience

- plan administration

Understanding and considering CMS Star Ratings when comparing plans might aid in selecting a high-quality plan that meets your healthcare needs.

Importance of Customer Support

Customer support may also play a significant role in overall satisfaction with a Medicare Advantage plan. Good customer support might facilitate:

- Increased customer engagement

- Care navigation

- Improved customer experiences

- Better health outcomes

Evaluating different plans that may be involved by considering factors such as star ratings, consumer experience, and satisfaction surveys, and accreditation to gauge the quality of customer support and make a knowledgeable decision.

Health Plan Provider Accessibility

Health plan provider accessibility could affect the availability and access to in-network health care providers and care outside the network. In-network providers tend to offer lower costs and coordinated care within a plan’s network, while out-of-network care may be available at a higher cost, depending on the plan type.

Evaluating provider accessibility could assist in choosing a plan that aligns with your healthcare needs and preferences.

In-Network Providers: Availability and Access

In-network providers will likely offer some of the following benefits to Medicare Advantage plan members:

- Cost savings

- Comprehensive coverage

- Coordinated care

- Predictable costs

An evaluation of a plan’s network might lead to a better understanding of the coverage and costs associated with in-network services, ensuring that you can have access to the care you need at an affordable price.

Seeking Care Outside the Network

Out-of-network care refers to receiving medical services from healthcare providers who do not have a contract with your Medicare Advantage plan.

While some plans may still cover out-of-network services, they might come with higher out-of-pocket costs for the beneficiary. Before seeking care outside your plan’s network, consider the potential risks, such as higher costs, limited provider access, and denial of coverage.

Understanding the potential implications of out-of-network care could aid in making knowledgeable decisions about your healthcare and choosing a plan that may best suit your needs.

Special Considerations for Unique Health Needs

When choosing a Medicare Advantage plan, it’s important to consider any unique health needs you may have, such as chronic conditions, coordinated care, and lifestyle and wellness benefits. Some plans may be tailored for these needs and could potentially offer better care coordination, management, and additional benefits that might enhance overall well-being.

Taking these special considerations into account could assist in selecting a plan that addresses your specific healthcare needs and supports your long-term health goals.

Chronic Conditions and Coordinated Care

Some Medicare Advantage plans may be tailored for chronic conditions and could offer better care coordination and management, potentially providing resources and benefits that may be designed to meet the needs of individuals with chronic conditions. These plans may offer:

- Chronic care management services

- Coordinated care

- Personalized care plans

- Access to a team of healthcare professionals

Selecting a plan that caters to your chronic conditions could ensure that you receive comprehensive and integrated care tailored to your unique health needs.

Lifestyle and Wellness Benefits

Lifestyle and wellness benefits could potentially enhance overall well-being and support healthy aging.

Considering these potential benefits when comparing your Medicare Advantage plans could lead to selecting a plan that not only addresses your healthcare needs but may also promote a healthy lifestyle and optimal well-being.

Summary

Comparing Medicare Advantage plans will likely be a crucial step in selecting the best plan for your healthcare needs and financial situation.

By carefully evaluating plan types, potential provider networks, coverage levels, cost-sharing, prescription drug coverage, enrollment periods, eligibility criteria, quality ratings, customer experience, provider accessibility, and special considerations for unique health needs, you could make an informed decision that supports your long-term health goals.

Remember, the right Medicare Advantage plan might make all the difference in ensuring your health and well-being for years to come.

Frequently Asked Questions

→ Who has the highest star-rated Medicare Advantage plans?

Based on data from previous years, the Humana Insurance Company will likely have the highest star-rated Medicare Advantage plans.

→ Why are people choosing Medicare Advantage plans?

Some people may choose Medicare Advantage plans due to the lack of prior authorization and quick payments from insurers.

→ How can I compare different Medicare Advantage plans?

To compare Medicare Advantage plans, you may look at the potential plan types, provider networks, coverage levels, cost-sharing, prescription drug coverage, and potential benefits.

→ What is the difference between HMO and PPO Medicare Advantage plans?

HMO Medicare Advantage plans might have more restrictive provider networks and require referrals for specialist care, while PPO plans could allow for greater flexibility to use both in-network and out-of-network providers without needing referrals.

→ How do I know if my medications are covered by a Medicare Advantage plan?

Review the plan’s formulary to confirm if your medications are covered by the Medicare Advantage plan.

ZRN Health & Financial Services, LLC, a Texas limited liability company