What Are Medicare Advantage Plans

Are you considering enrolling in a Medicare Advantage plan? With a variety of options available, it’s essential to understand what Medicare Advantage plans are, and their features, and make an informed decision.

In this article, we’ll explore the world of Medicare Advantage plans, discuss their potential benefits, and provide you with the information needed to choose the best plan for your healthcare needs.

Key Takeaways

- Medicare Advantage plans offer potential additional benefits and more coverage than traditional Medicare.

- Eligibility requirements include having Parts A & B of Medicare and residing in the designated service area

- When comparing plans it is important to consider costs, coverage, potential additional benefits offered as well as enrollment periods for making an informed decision.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans

Medicare Advantage plans, provided by private insurers, offer an alternate option to traditional Medicare coverage. They are a desirable choice for many people. These plans provide all Part A and B services, along with potential additional benefits such as wellness programs, hearing aids, and vision services.

They aim to reduce premium costs and offer more coverage, including preventive services, than traditional Medicare, making them a popular choice for many beneficiaries.

However, keep in mind that Medicare Advantage plans are only applicable in the state, region, or county where they were purchased, offering beneficiaries various Medicare coverage options based on their location.

To make the most of your Medicare Advantage plan, be sure to compare different plans and choose one that fits your specific needs.

What is Medicare Part C?

Medicare Advantage, also known as Part C, encompasses Parts A, B, and D into one comprehensive plan. This integration provides hospital, outpatient, and prescription drug coverage while replacing the coverage offered by Parts A and B of Medicare, with the exception of hospice care.

Most Medicare Advantage plans also include Part D prescription drug coverage, offering a complete healthcare package for beneficiaries.

These plans are insured by private companies that have contracted with Medicare. The integration of Parts A, B, and D into a single plan allows beneficiaries to receive comprehensive coverage while simplifying the process of managing their healthcare needs.

Eligibility Requirements

To be eligible for Medicare Advantage, individuals must possess Medicare Parts A and B, reside within the plan’s service area, and not have End-Stage Renal Disease (ESRD).

The plan’s service area refers to the designated geographic area where the plan offers medical services to its members.

However, beginning in 2021, all Medicare beneficiaries with End-Stage Renal Disease (ESRD) are permitted to enroll in Medicare Advantage.

By meeting these eligibility requirements, individuals can access a wide range of Medicare Advantage plans designed to cater to their healthcare needs.

Types of Medicare Advantage Plans

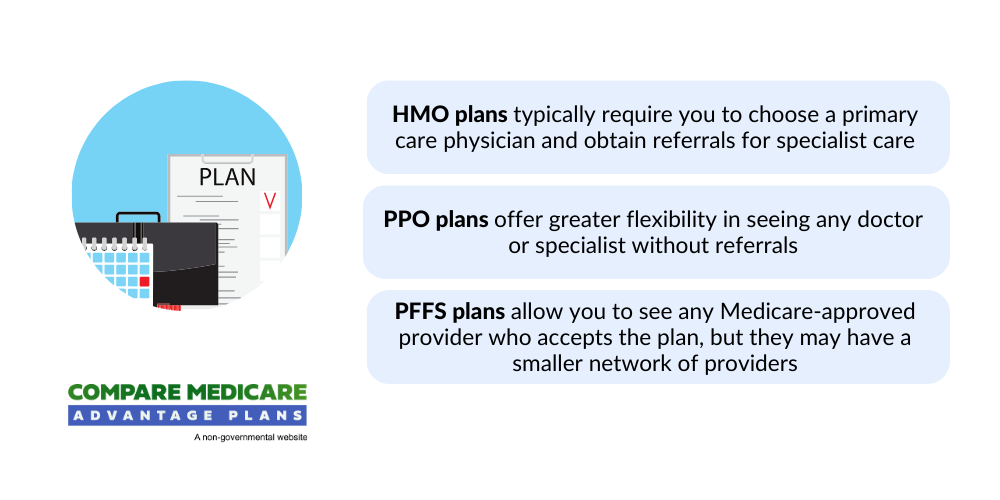

Medicare Advantage plans come in various forms, including:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Each type of plan offers distinct features and potential benefits within the plan’s network, catering to the diverse needs of Medicare beneficiaries.

Recognizing the differences between these plans is key to determining the best fit for your healthcare needs. We will now examine HMOs and PPOs in more detail, two of the most common Medicare Advantage plan types.

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations (HMOs) are an alternative method of receiving Original Medicare (Part A and Part B) benefits. HMOs provide healthcare services through a network of doctors, hospitals, and other healthcare providers.

By using in-network providers, HMOs can control costs and ensure organized and efficient care within a particular network of healthcare providers.

However, there are some drawbacks to HMOs. Limited choices and a smaller selection of providers, as well as restricted access to out-of-network care, are some disadvantages of utilizing in-network providers in an HMO. It’s important to balance the advantages and disadvantages of HMOs when considering a Medicare Advantage plan.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations (PPOs) offer more flexibility in choosing healthcare providers, including medical providers, compared to HMOs. PPOs provide a network of doctors, specialists, and hospitals from which Medicare beneficiaries can select.

These plans allow beneficiaries to receive care from both in-network and out-of-network providers, although using in-network providers generally results in reduced out-of-pocket costs.

While PPOs offer greater freedom in provider selection, out-of-network care may come with higher costs. It’s important to take these factors into account when selecting a Medicare Advantage plan that aligns with your healthcare needs and preferences.

Comparing Medicare Advantage Plans: Key Factors

When comparing Medicare Advantage plans, factors such as costs, coverage, and potential additional benefits need to be considered. Evaluating each plans:

- Premiums

- Deductibles

- Copayments

- Out-of-pocket maximums

- Coverage provided for various services

will help you make an informed decision.

Beyond cost and coverage, some Medicare Advantage plans may offer extra perks including dental, vision, and hearing coverage.

Be sure to compare these potential additional benefits, as well as medicare covered services, when choosing a Medicare Advantage plan that best suits your needs.

Costs and Coverage

The costs associated with Medicare Advantage plans can vary greatly depending on the plan type and location.

When evaluating costs and coverage, consider not only the monthly premiums but also the deductibles, copayments, and out-of-pocket maximums associated with each plan, including hospital insurance. This comprehensive approach will help you find a plan that offers the best value for your healthcare needs.

Additional Benefits

Some Medicare Advantage plans may offer extra benefits, such as dental, vision, and hearing coverage.

When you compare Medicare Advantage plans, be sure to consider Medicare supplement insurance and these potential additional benefits in your decision-making process. A plan that offers comprehensive coverage and potential additional benefits tailored to your needs can greatly enhance your healthcare experience.

Enrollment and Switching Periods

Enrolling in a Medicare Advantage plan can be done during the initial enrollment period or during the open enrollment period. The initial enrollment period is a seven-month window surrounding an individual’s 65th birthday or when they first become eligible for Medicare.

The open enrollment period runs from October 15 to December 7, allowing individuals to switch Medicare Advantage plans or return to Original Medicare.

Grasping these enrollment periods is important to ensure that you can enroll in the Medicare Advantage plan of your choice and make any necessary changes to your coverage.

Initial Enrollment Period

The initial enrollment period is a seven-month window that provides individuals with the opportunity to enroll in Medicare Advantage plans upon becoming eligible for Medicare.

The initial enrollment period is a seven-month window that provides individuals with the opportunity to enroll in Medicare Advantage plans upon becoming eligible for Medicare.

This period includes:

- The three months prior to the month you become eligible for Medicare

- The month you become eligible for Medicare

- The three months following the month you become eligible for Medicare

If you miss the initial enrollment period, you may be subject to a late enrollment penalty. However, if you are eligible for a special enrollment period, you may be able to sign up later without penalty.

Be sure to take advantage of the initial enrollment period to avoid any potential penalties and ensure you have the coverage you need.

Open Enrollment Period

The open enrollment period, which runs from October 15 to December 7, allows individuals to switch Medicare Advantage plans or return to Original Medicare. This period provides an opportunity for beneficiaries to review their existing coverage, compare available plans, and make any necessary changes to their healthcare plan.

If you decide to switch health plans during the open enrollment period, be sure to consider the costs, coverage, and potential additional benefits of each plan. This will help you find a health plan that best fits your healthcare needs and preferences.

Pros and Cons of Medicare Advantage Plans

Medicare Advantage plans are a form of medical insurance and may offer several advantages, such as potential additional coverage for dental, vision, or hearing care, increased plan flexibility, and fewer travel restrictions.

However, there are also some drawbacks to consider, such as potentially costly copayments if you are ill, a limited enrollment period, and ineligibility for Medigap coverage.

Balancing the pros and cons of Medicare Advantage plans is important when deciding which plan is the right choice for you. By considering all factors, including costs, coverage, and potential additional benefits, you can make an informed decision about your healthcare needs.

Navigating Medicare Star rating

The Medicare Star Ratings system evaluates Medicare Advantage plans on a scale of 1-5, based on 38 quality measures. These ratings provide helpful information about the overall quality of Medicare health and drug plans, aiding beneficiaries in comparing different plans and making knowledgeable choices.

The star ratings are updated annually, ensuring that the most up-to-date information is available for Medicare beneficiaries.

By utilizing the Medicare Star Ratings system, you can choose a plan with a high rating, indicating that it offers quality healthcare services and meets the needs of its members.

Preexisting Conditions and Medicare Advantage

Medicare Advantage plans may provide coverage for preexisting conditions without any alteration to the premium or potential benefits. This means that individuals with preexisting conditions can enroll in a Medicare Advantage plan without worrying about increased costs or limited coverage.

There may be a waiting period for coverage of preexisting conditions under Medicare Advantage plans, lasting up to six months. However, during this time, you may receive coverage for your preexisting conditions under the plan.

Comprehending how your chosen plan handles preexisting conditions is important to ensure you have the appropriate coverage for your healthcare needs.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are a type of Medicare Advantage plan specifically tailored to serve individuals with chronic or disabling conditions.

Special Needs Plans (SNPs) are a type of Medicare Advantage plan specifically tailored to serve individuals with chronic or disabling conditions.

These plans combine the benefits of Original Medicare (Parts A and B) with additional services and support to meet the unique needs of the enrollees.

SNPs are designed to provide comprehensive and coordinated care for individuals with special healthcare needs.

If you have a chronic or disabling condition or are eligible for both Medicare and Medicaid, you may qualify for a Special Needs Plan.

These plans offer targeted care and limit network providers to ensure that enrollees receive the specialized care they require, including Medicaid services. Be sure to explore the availability of SNPs in your area to determine if they are a suitable option for your healthcare needs.

Summary

In conclusion, Medicare Advantage plans offer a wide variety of options for individuals seeking comprehensive healthcare coverage. By understanding the different types of plans, considering costs and coverage, and utilizing tools such as the Medicare Star Ratings system, you can make an informed decision about the best plan for your healthcare needs.

Remember to stay vigilant during enrollment periods and be proactive in managing your healthcare coverage to ensure you receive the best possible care.

Frequently Asked Questions

→ What is the difference between Medicare and Medicare Advantage plans?

Medicare Advantage plans provide the same coverage as Original Medicare, as well as potential additional services such as vision care, hearing aids, and dental care. However, Original Medicare does not cover these extra benefits.

→ What are the advantages of a Medicare Advantage Plan?

Medicare Advantage plans offer comprehensive coverage for lower premiums.

→ Why do people choose Medicare Advantage over Medicare?

People choose Medicare Advantage for its simplicity of combining Part A and Part B coverage, plus potential additional benefits such as dental, vision, hearing care, and prescription drug coverage not included with original Medicare.

→ What are the four main types of Medicare Advantage plans?

Medicare Advantage plans come in three main types: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Private Fee-For-Service (PFFS).

→ Can I switch Medicare Advantage plans at any time?

You can only switch your Medicare Advantage plan during the open enrollment period, which runs from October 15 to December 7 each year.

ZRN Health & Financial Services, LLC, a Texas limited liability company