UnitedHealthcare Medicare Advantage Plans Colorado 2025

Navigating the potential UnitedHealthcare Medicare Advantage plans in Colorado doesn’t have to feel like a trek through the Rockies.

From the possible plan benefits to enrollment steps, this article may bring you the essential information you need about the potential UnitedHealthcare Medicare Advantage plans in Colorado. By the end of this article, you’ll have a clear understanding of your options without any overpowering sales pitches – just straightforward guidance.

Key Takeaways

- UnitedHealthcare offers a diverse range of Medicare Advantage plans in Colorado, including HMO, PPO, and Special Needs Plans, tailored to meet the healthcare needs and preferences of beneficiaries.

- Some of the UnitedHealthcare Medicare Advantage plans may include additional benefits that may go beyond Original Medicare, such as prescription drug, vision, dental, and hearing coverage.

- The costs that might be associated with certain UnitedHealthcare Medicare Advantage plans may vary, with options that could include lower premium plans, different out-of-pocket costs, and financial assistance might be available for eligible individuals.

Compare Plans in One Step!

Enter Zip Code

Understanding the Potential UnitedHealthcare Medicare Advantage Plans in Colorado

UnitedHealthcare will likely emerge as a prominent figure, potentially offering a selection of Medicare Advantage plans that could be tailored to the diverse needs of Coloradans. A majority of these plans could demonstrate UnitedHealthcare’s commitment to health and wellness while providing the flexibility and potential benefits that Medicare beneficiaries may desire.

With options that span from HMO to PPO to Special Needs Plans, UnitedHealthcare will likely foster a network of local doctors and hospitals that could be designed to optimize the healthcare experience for every Medicare member.

What is a Medicare Advantage Plan?

Also known as Medicare Part C in the healthcare field, a Medicare Advantage Plan may be able to provide an alternative to the traditional Original Medicare. It’s a course charted by private insurance companies, like the UnitedHealthcare Insurance Company, and will likely be sanctioned by Medicare to potentially provide all-encompassing coverage. In addition to Medicare Advantage, some individuals may opt for an AARP Medicare Supplement Plan, which could further enhance their coverage.

This possible coverage may extend beyond Medicare Part A (Hospital Insurance) and Part B (Medical Insurance), which may ensure that beneficiaries may be able to enjoy comprehensive healthcare services under a single umbrella.

The Role of UnitedHealthcare Insurance Company

UnitedHealthcare, a seasoned navigator of the Medicare Advantage landscape, will likely continue to operate under the strict guidance and requirements set forth by their Medicare contract. As a Medicare Advantage Organization, it might offer a spectrum of potential UnitedHealthcare Medicare options, each with its own set of benefits that could go beyond those of Original Medicare.

Some of these benefits could potentially be essential features that could enhance the quality of life for insured members, which may ensure that their healthcare journey could be as smooth as the serene Colorado rivers.

Comparing UnitedHealthcare Medicare Advantage Plans

UnitedHealthcare will likely offer a diverse array of Medicare Advantage plans that could cater to different preferences and needs. Whether you’re nestled in the urban heart of Denver or the rural tranquility of the Eastern Plains, you may be able to find a plan structured to your lifestyle. From HMO to PPO and even Special Needs Plans, UnitedHealthcare provides a tailored approach, ensuring that every Medicare journey is personalized and fulfilling.

So, what makes these plans distinct, and how do you determine the right one for you? Let’s delve into that.

HMO Plans

UnitedHealthcare’s HMO plans are akin to a carefully woven tapestry of local physicians and hospitals, each thread representing a contracted provider within a cohesive network. As a member, you’re encouraged to utilize these in-network services, save for emergencies where out-of-network care is permitted. The plan’s structure promotes coordinated care and often requires you to choose a primary care physician as your healthcare guide.

Nonetheless, some plans provide the option to see specialists without referrals, broadening your healthcare options.

PPO Plans

For those who seek broader horizons, UnitedHealthcare’s PPO plans provide a more extensive range with the freedom to choose healthcare providers both within and beyond the network. These plans, which include local and regional PPOs, afford you the flexibility to receive care from any provider that accepts Medicare patients—often without the need for specialist referrals.

Such flexibility is especially useful for frequent travelers within Colorado or beyond, as it guarantees uninterrupted coverage across different regions.

Special Needs Plans (SNPs)

UnitedHealthcare also offers Special Needs Plans (SNPs), which are custom-tailored to support individuals with particular healthcare or financial requirements. These plans are comprehensive, always encompassing prescription drug coverage as a standard feature.

Whether you’re managing a chronic condition or navigating the complexities of dual eligibility for Medicare and Medicaid, SNPs are designed to address your unique circumstances with focused care and additional support services.

Possible Benefits and Services

In addition to the basic hospital and medical services coverage, certain UnitedHealthcare Medicare Advantage plans in Colorado may also provide a plethora of extra benefits.

Some of these benefits, which could extend beyond what Original Medicare provides, may be crafted to elevate the overall healthcare experience. These extra benefits might include:

- Additional services for managing chronic conditions

- Prescription drug coverage

- Vision and dental coverage

- Hearing aids and hearing exams

UnitedHealthcare may strive to go above and beyond for its members by potentially providing additional insured member services, possible Medicaid extra benefits, and other advantages.

Prescription Drug Coverage

Navigating the maze of medications could be daunting, which is why UnitedHealthcare could potentially integrate Medicare Part D prescription drug coverage into some of its Medicare Advantage plans. This potential integration may be more than a convenience; it will likely be the cohesive approach to managing your health, possibly combining medical and prescription drug services under one Medicare prescription drug plan. To make this process even smoother, consider using a Medicare journey chat to get personalized guidance and support.

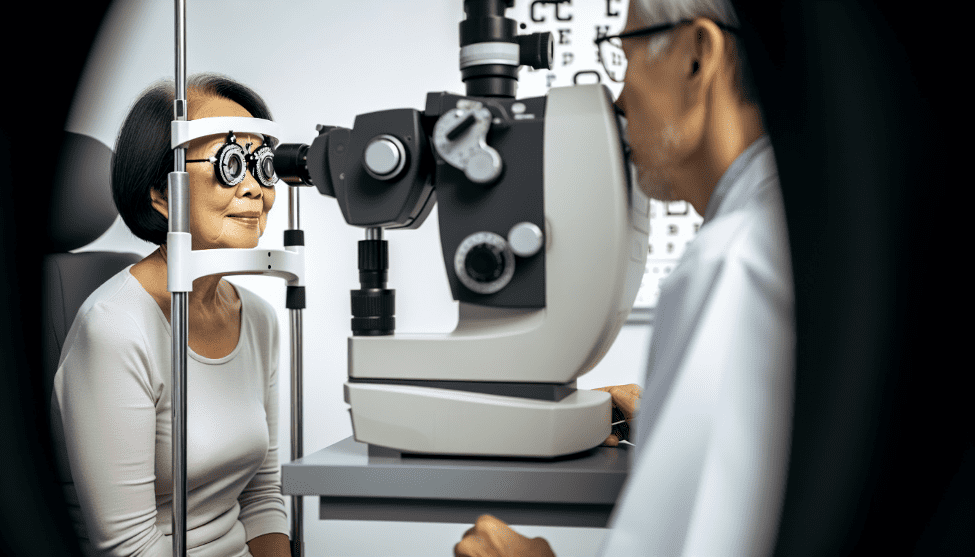

Potential Vision, Dental, and Hearing Coverage

UnitedHealthcare’s commitment to comprehensive care may be further exemplified by the potential inclusion of vision, dental, and hearing coverage in some of its Medicare Advantage plans. These possible benefits may address aspects of health that might often overlooked yet are vital to our overall well-being.

Possible Cost Considerations for UnitedHealthcare Medicare Advantage Plans

The potential costs may be a significant factor to consider when choosing a Medicare Advantage plan. UnitedHealthcare understands this and may offer transparent and varied pricing options that could be designed to fit different budgets.

UnitedHealthcare could potentially offer aid in navigating the financial aspects of healthcare, which could ensure that members may be protected from unexpected expenses and could be equipped with the knowledge to make informed decisions about their healthcare spending.

Potential Premiums

The monthly premium may play a key role in financially planning your healthcare journey. Some of the UnitedHealthcare Medicare Advantage plans in Colorado could potentially offer a range of premium options, which might be a game-changer for those seeking affordability.

It’s important to remember that even if you choose a plan that may offer a low monthly premium, you may still be responsible for paying your Medicare Part B premium unless it is covered by another third party.

Possible Out-of-Pocket Costs

Some of the out-of-pocket costs in certain UnitedHealthcare Medicare Advantage plans will likely be made out of a combination of deductibles, copayments, and coinsurance. These potential costs may be capped by an out-of-pocket maximum, possibly offering protection from soaring expenses and providing peace of mind. To further enhance coverage, some individuals may consider a Medigap plan to complement their Medicare Advantage plan.

With UnitedHealthcare, the unknowns of healthcare costs could become navigable, potentially allowing you to focus on what truly matters—your health.

Financial Assistance

UnitedHealthcare acknowledges the significance of financial aid for those managing healthcare on a tight budget. Certain programs like the federal Medicare program, Medicare Savings Programs, and Medicaid could potentially play a crucial role in covering certain Medicare costs, possibly offering a lifeline to beneficiaries who may need it most.

Some of these potential insurance programs may be designed to alleviate some of the financial burden of healthcare expenses, possibly ensuring that every UnitedHealthcare member could have access to the care they deserve.

How to Enroll in a UnitedHealthcare Medicare Advantage Plan in Colorado

Grasping the enrollment process is vital, given it’s your path to obtaining the comprehensive coverage some of these plans may provide. With an array of enrollment periods, the process will likely be designed to be as smooth and stress-free as possible, possibly ensuring that you can focus on what’s important—your well-being.

Eligibility Requirements

The road to enrollment in a UnitedHealthcare Medicare Advantage plan begins with eligibility. To be eligible, you must:

- Be entitled to Medicare Part A

- Be enrolled in Medicare Part B, ensuring that you have the foundational Medicare coverage in place.

- Reside within the plan’s service area—a requirement that ensures your access to the network of providers that your chosen plan offers.

Enrollment Periods

When enrolling in a Medicare Advantage plan, timing is of the essence. There are specific windows during which you can enroll, such as the Initial Enrollment Period surrounding your 65th birthday and the Annual Enrollment Period from October 15 to December 7. Additionally, life events can trigger Special Enrollment Periods, providing opportunities to enroll outside the standard timeframes.

Navigating these periods might be key to securing your healthcare coverage without delay.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. There, one of our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Summary

As our exploration of the potential UnitedHealthcare Medicare Advantage plans in Colorado comes to a close, we reflect on the wealth of options that could be available to you. Some of these plans may be designed with your health, lifestyle, and financial well-being in mind, potentially offering a comprehensive suite of benefits that might extend well beyond the scope of Original Medicare.

With the possibility of having additional services like prescription drug coverage and financial assistance, UnitedHealthcare could potentially stand as a pillar of support for Medicare beneficiaries in Colorado. This guide could lead you to a decision that might enrich your life and ensure your access to quality healthcare.

Frequently Asked Questions

→ Is the UnitedHealthcare Medicare Advantage Plan any good?

A majority of UnitedHealthcare’s Medicare Advantage Plan has received ratings ranging from 4.0 to the NCQA for different locations, and its member experience ratings are above average.

→ Can I switch from one UnitedHealthcare Medicare Advantage Plan to another?

Yes, you can switch from one UnitedHealthcare Medicare Advantage Plan to another during the Annual Enrollment Period from October 15 to December 7 each year, or a Special Enrollment Period if you experience a qualifying life event.

→ Does UnitedHealthcare offer plans for Medicare beneficiaries in Colorado?

Yes, UnitedHealthcare may offer Group Medicare Advantage Plans for Medicare beneficiaries in Colorado, potentially providing a variety of healthcare benefit plan choices, which may include more benefits than Original Medicare.

→ What are the key differences between HMO and PPO plans offered by UnitedHealthcare?

The key differences between HMO and PPO plans offered by UnitedHealthcare are that HMO plans require members to use a network of local healthcare providers and often select a primary care physician, while PPO plans offer more flexibility, allowing members to seek services from providers both within and outside of the network without the need for referrals.

→ Are prescription drugs covered under UnitedHealthcare Medicare Advantage plans?

Yes, prescription drugs might be covered under some of the UnitedHealthcare Medicare Advantage plans if those plans include Medicare Part D prescription drug coverage. This could potentially offer a convenient and cost-effective solution for managing medication needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company