Exploring What Part of Medicare Is Not Covered by Medigap Plan L

When evaluating what part of Medicare remains uncovered by Medigap Plan L, it’s crucial to approach the coverage landscape with clarity and precision. Although Plan L is structured to fill many gaps left by Original Medicare, there are still certain costs, benefits, and types of coverage where you’ll be responsible for out-of-pocket payments. Understanding these gaps makes it easier to assess how this plan covers your healthcare needs and what part of your overall expenses will still fall to you.

First, one notable part not covered by the Medigap Plan L is the Medicare Part B deductible.

While some other plans might offer coverage for this expense, Plan L does not pay any part of it. So, regardless of the remaining coverage, you’ll need to budget for the full Part B deductible each year. Additionally, Plan L offers no protection against Part B excess charges. If your provider charges more than the Medicare-approved amount, you’re responsible for any part that exceeds the standard.

This gap in coverage can be an important consideration for anyone regularly visiting specialists or providers who don’t accept assignment.

Another limitation appears with foreign travel emergency coverage. Medigap Plan L doesn’t include any part of benefits for health situations that occur outside the United States. For international travelers, this uncovered part can be significant, since some other supplement plans do offer a measure of emergency coverage abroad.

Dental, vision, hearing, and long-term care are also excluded from coverage. Medigap Plan L doesn’t help with these services, much like the rest of the Medigap landscape.

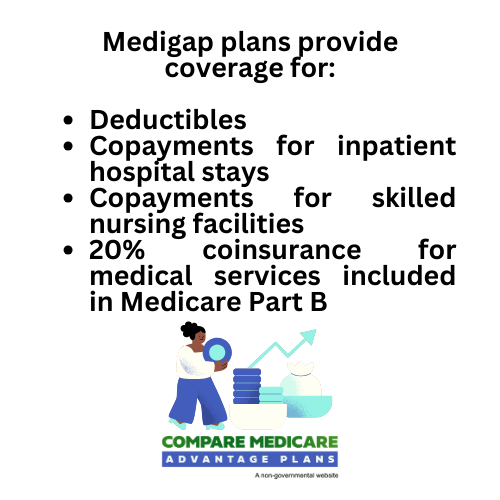

The plan covers a robust part of your Medicare-covered costs, skilled nursing facility coinsurance, hospice care coinsurance, and most of the Part A deductible, but covers each at 75%, not in full. You’ll still be responsible for the uncovered part of costs until you reach the plan’s annual out-of-pocket maximum, after which Plan L covers 100% of the approved services.

Notably, it doesn’t cover routine prescription drugs (Part D), so you’d need a separate plan for medication coverage.

CompareMedicareAdvantagePlans.org enables you to see these distinctions clearly by offering comprehensive plan comparisons, so you can determine not only what part Medigap Plan L covers but also the specific remaining part you’ll need to pay. This transparent comparison makes it easier to identify a plan that fits your health needs, budget, and coverage priorities.

For help clarifying any confusing part or understanding what the plan covers or leaves uncovered, licensed insurance agents are just a call or online chat away to simplify your Medicare decision process and find reliable, thorough coverage for all your healthcare needs.

How to Use This Website to Compare Plan Costs and Enroll Online

Navigating your Medigap choices doesn’t have to be complicated. At CompareMedicareAdvantagePlans.org, you’ll find tools designed to streamline the process of finding and comparing supplement plans, including Medigap Plan L, so you can make educated decisions about your health and financial protection.

Whether you’re searching for plan eligibility details, policy resources, or looking to compare Medigap options side by side, this website connects you with all the critical information and enrollment tools you’ll need. Explore comprehensive plan profiles, cost breakdowns, and eligibility requirements, or match your healthcare priorities with plans that suit your needs, all within one easy online platform.

Getting Personalized Assistance from Licensed Insurance Experts

As an insurance expert, I know firsthand how overwhelming it can be to sort through the array of Medigap plans, review eligibility requirements, and decipher enrollment options. That’s why leveraging personalized guidance is so valuable, and CompareMedicareAdvantagePlans.org puts this power directly at your fingertips.

When you use resources on this site, you aren’t limited to self-directed plan comparisons; you also gain access to licensed insurance experts who understand both Medigap insurance and the nuances of each policy available, including Plan L. This team is here to help you find coverage that fits your health goals and financial comfort, and they’re experienced in navigating everything from open enrollment to special eligibility rules.

Here, you’ll find no shortage of helpful support. Licensed professionals can walk you through the entire process, from evaluating your eligibility under federal and state guidelines, explaining the critical differences between each Medigap plan, and matching those options to your health profile and financial strategy.

If you prefer to compare Medigap insurance independently, interactive online resources empower you to research plans, check specific policy benefits, and review costs and coverage side by side. But if you run into questions about a plan’s details, eligibility, or enrollment steps, expert help is only a call or chat away.

This personalized assistance can be especially crucial when reviewing new policy updates, understanding how enrollment periods affect your choices, or if you’re navigating unique health circumstances that might impact eligibility for specific plans. Experts can clarify how Medigap insurance fits alongside other health policies, such as Medicare Advantage, and point out the exact policy features and resources that meet your preferences for coverage and budget in 2026.

They’ll also help you explore policy rider options, explain what makes each plan distinctive, including the special cost-sharing and out-of-pocket maximums of Plan L, and ensure you don’t miss critical enrollment windows that could limit your plan options down the line.

Comparing Medigap plans via this website means you aren’t left to guesswork or generic policy summaries; instead, you’ll find tailored recommendations suited to your health needs, lifestyle, and financial expectations. By leaning on both the self-serve comparison tools and licensed insurance experts, you gain a comprehensive view of each plan, clear insights into eligibility, improved confidence in selecting a Medigap policy, and step-by-step assistance through the enrollment process.

This approach not only saves you time but ensures you’re equipped to make fully informed decisions about your Medigap coverage, maximizing both your health advantages and peace of mind for the years ahead.

Choosing the right Medigap Plan L is a significant step in securing your healthcare future. By understanding the benefits, coverage details, and eligibility requirements, you can make informed decisions that suit your medical needs and budget. Whether you’re starting your Medicare journey or reviewing your supplement options, take the time to compare Medigap Plan L with other plans.

Explore resources, consult with experts, and use our website to get quotes or personalized assistance.

Prioritizing thorough research today ensures peace of mind and financial protection for tomorrow’s medical expenses.