Molina Medicare Advantage Idaho

Wondering if Molina Medicare Advantage Idaho plans could meet your healthcare needs? This article will cover the potential benefits, plan types, possible costs, and how to enroll in these plans to help you decide.

Key Takeaways

- Molina Medicare Advantage Plans in Idaho will likely offer a comprehensive healthcare solution, which may include additional benefits like dental, hearing, and vision coverage, possibly enhancing member care.

- Eligibility for Molina Medicare Advantage requires being at least 65 years old, a resident of Idaho, and enrolled in Medicare Parts A and B.

- These plans will likely be competitively priced, sometimes with lower monthly premiums and out-of-pocket costs compared to other providers, possibly making them an attractive option for seniors.

Compare Plans in One Step!

Enter Zip Code

Overview of Molina Medicare Advantage Plans in Idaho

Molina Medicare Advantage plans in Idaho will likely provide a comprehensive healthcare solution, sometimes integrating extra benefits that could be tailored to diverse member needs. Unlike Original Medicare, these plans could potentially provide a more holistic healthcare experience, possibly covering services such as dental, vision, and hearing coverage.

These plans will likely cater to variety of member requirements, from regular medical care to specialized services, possibly ensuring there’s a suitable option for everyone. The main objective might be to provide necessary care promptly while minimizing high out-of-pocket expenses.

Molina Medicare Advantage plans will likely feature an extensive network of healthcare providers, such as primary care physicians and specialists, to help offer a wide range of medical services.

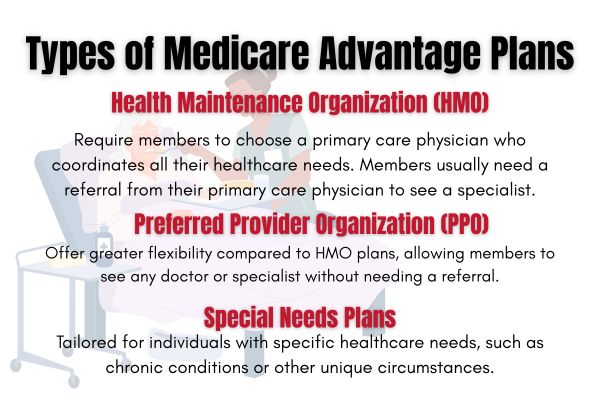

Types of Coverage Offered by Molina Medicare Advantage

Molina Medicare Advantage will likely provide various plans to address different healthcare needs, each offering unique features and benefits.

Health Maintenance Organization (HMO) Plans include the following features:

- Members must choose a primary care physician who coordinates their healthcare.

- Referrals might be needed to see specialists.

- This system could help in managing and streamlining care.

Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility compared to HMO plans. Possible features might include:

- Members have the freedom to choose their healthcare providers.

- No referrals may be needed to see specialists.

- This could be particularly beneficial for those who need specialized care regularly.

Special Needs Plans (SNP): Designed for individuals with specific health conditions, SNPs could provide tailored benefits that meet the unique needs of these groups. These plans might include additional services that could be crucial for managing chronic conditions.

Regardless of the plan type, some Molina Medicare Advantage plans might include extra benefits that could go beyond what Original Medicare offers. This might include comprehensive vision, dental, and hearing coverage, likely making them a well-rounded choice for seniors.

Eligibility Requirements for Molina Medicare Advantage in Idaho

To enroll in a Molina Medicare Advantage plan in Idaho, you must meet certain eligibility criteria. First and foremost, you need to be at least 65 years old. This is a standard requirement for most Medicare-related plans.

Residency is another crucial factor. You must be a resident of Idaho to enroll in these plans. This ensures that you can access the network of healthcare providers and services available in the state.

Additionally, you must be enrolled in Medicare Parts A and B. This is a prerequisite for all Medicare Advantage plans, including those offered by Molina. Depending on the specific plan you choose, there might be additional eligibility requirements, but these are the primary criteria you need to fulfill.

Comparing Molina Medicare Advantage Plans with Other Providers

When comparing Molina Medicare Advantage Plans to those of other providers, several differences might stand out. One of the most notable may be the inclusion of additional benefits like vision and dental coverage, which might not always be available with other plans.

Molina’s plans may also offer a wider range of in-network healthcare providers. This extensive network could potentially enhance access to services, likely making it easier for members to find the care they need. Whether you require routine check-ups or specialized medical attention, Molina’s network will likely be designed to meet these needs effectively.

Prescription drug coverage might be another area where Molina could excel. Certain plans might include robust prescription drug benefits. This could be particularly beneficial for individuals who rely on medications for chronic conditions.

How to Enroll in Molina Medicare Advantage Plans in Idaho

Enrolling in a Molina Medicare Advantage plan is a straightforward process, but it requires careful attention to eligibility and timing. To start, you must meet the eligibility requirements, such as being 65 years or older or qualifying under certain disabilities.

Important enrollment periods to keep in mind include the Annual Enrollment Period, which runs from October 15 to December 7 each year. New eligible beneficiaries have an Initial Enrollment Period that lasts seven months, starting three months before they turn 65.

To complete your enrollment, you’ll need to provide a valid form of identification and documentation proving your eligibility, such as a Medicare card. You can enroll online or by phone, making the process as convenient as possible.

Possible Costs Associated with Molina Medicare Advantage Plans

The cost of enrolling in a Molina Medicare Advantage plan might vary, but these plans may be competitively priced. For instance, the average monthly premium might be lower than those of other major providers, like UnitedHealthcare and Humana.

One of the potential advantages of some of Molina’s plans might be the maximum out-of-pocket limit. This could potentially lead to substantial cost savings for enrollees, particularly those who might require frequent medical care. Lower out-of-pocket costs likely mean you can access the care you need without the financial burden.

Overall, Molina Medicare Advantage plans will likely offer a cost-effective solution for comprehensive healthcare coverage, possibly making them an attractive option for seniors in Idaho.

Network of Healthcare Providers for Molina Medicare Advantage

Another potential advantage of certain Molina Medicare Advantage plans might be the extensive network of healthcare providers. This network will likely include a variety of services through an established system, likely ensuring that members have access to the care they need.

Primary care physicians within Molina’s network might act as the first point of contact, possibly offering essential healthcare services and coordinating any necessary specialized care.

Molina may also partner with numerous hospitals to provide both inpatient and outpatient services, possibly ensuring members could have broad access to quality care.

Medicare Advantage VS Medicare Supplement

Understanding the difference between Medicare Advantage and Medicare Supplement Plans will likely be crucial for making an informed decision. Medicare Advantage plans bundle Medicare Part A and Part B and sometimes include additional benefits like vision, hearing, and dental coverage.

On the other hand, Medicare Supplement plans, also known as Medigap, will likely be designed to cover out-of-pocket expenses not paid by Original Medicare, such as deductibles and copayments. While certain Medicare Advantage plans might include Part D drug coverage, Medicare Supplement plans do not cover prescription drugs but may be paired with a standalone drug plan.

Another possible difference might be that Medicare Supplement plans will likely allow you to choose any doctor or hospital that accepts Medicare, possibly offering more flexibility. However, you cannot hold both Medicare Advantage and Medicare Supplement plans simultaneously. Each serves a different role in your healthcare coverage, so it’s essential to choose the one that best fits your needs.

Summary

Molina Medicare Advantage plans in Idaho will likely offer comprehensive coverage that could go beyond what Original Medicare provides. With a variety of plan types, additional benefits, and an extensive network of healthcare providers, Molina might stand out as a strong contender for your healthcare needs.

Choosing the right healthcare plan will likely be a significant decision. By understanding the options available and considering your specific needs, you could make an informed choice that ensures you receive the best care possible. Consider Molina Medicare Advantage for a healthcare plan that prioritizes your well-being.

Frequently Asked Questions

→ What types of plans does Molina Medicare Advantage offer?

Molina Medicare Advantage provides HMO, PPO, and Special Needs Plans (SNP) to address various healthcare needs effectively. Each plan type will likely be designed to offer various benefits for specific circumstances.

→ What are the eligibility requirements for enrolling in Molina Medicare Advantage plans in Idaho?

To enroll in Molina Medicare Advantage plans in Idaho, you must be at least 65 years old, a resident of Idaho, and enrolled in Medicare Parts A and B.

→ How might Molina Medicare Advantage plans compare to other providers?

Molina Medicare Advantage plans might stand out due to additional benefits such as vision, hearing, and dental coverage, a broad selection of in-network providers, and the potential integration of prescription drug plans. This could make them a competitive choice compared to other providers.

→ What is the cost of enrolling in a Molina Medicare Advantage plan?

The cost of enrolling in a Molina Medicare Advantage plan might include competitive premiums and lower out-of-pocket limits compared to other options. It’s advisable to review specific plan details to understand all associated costs.

→ How can I enroll in a Molina Medicare Advantage plan?

To enroll in a Molina Medicare Advantage plan, you can do so online or by phone during the Annual Enrollment Period or your Initial Enrollment Period. Make sure to choose the method that is most convenient for you.

ZRN Health & Financial Services, LLC, a Texas limited liability company