Medicare Advantage Plans Mississippi 2026

Curious about the potential Medicare Advantage plans in Mississippi for 2026? This article will explore the available plans, potential benefits, costs, and enrollment periods to help you make an informed choice.

Key Takeaways

- Enrollees could potentially benefit from comprehensive coverage such as dental, vision, and hearing services, and sometimes prescription drug coverage.

- Mississippi offers various types including HMO, PPO, and Special Needs Plans, each catering to different healthcare needs.

- Enrollment for Medicare Advantage can occur during specific periods, such as the Annual Enrollment Period from October 15 to December 7, 2024, to avoid coverage gaps and ensure access to needed health services.

Compare Plans in One Step!

Enter Zip Code

Understanding Mississippi Medicare Advantage Plans

Medicare Advantage plans, also known as MA plans or Part C, could act as an alternative to Original Medicare. These plans are offered by private insurance companies and must cover all the benefits included in Original Medicare. All residents eligible for Medicare in Mississippi can access a Medicare Advantage plan.

Given that Medicare Advantage plans are provided by private insurance companies, some plans may incorporate additional benefits such as dental, vision, and hearing services, which are not covered by Original Medicare.

Types of Mississippi Medicare Advantage Plans Available

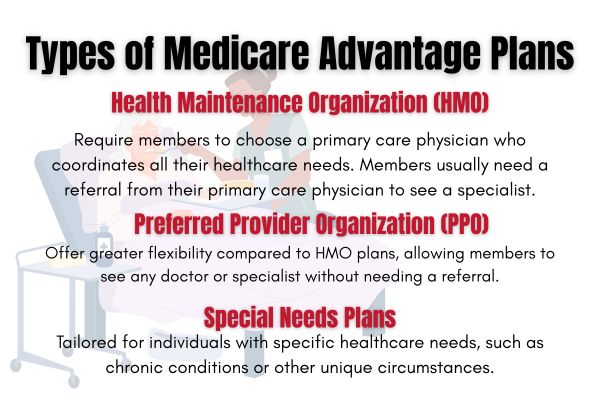

Mississippi will likely offer a variety of Medicare Advantage plans to meet the diverse needs of its residents. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan comes with its own set of benefits and requirements, catering to different healthcare needs and preferences.

HMO Plans

HMO plans have been a popular choice among Medicare beneficiaries due to their cost-effectiveness and emphasis on coordinated care. These plans often require members to choose a primary care physician (PCP) and obtain referrals to see specialists.

PPO Plans

PPO plans offer greater flexibility in choosing healthcare providers and do not require referrals to see specialists. These plans might have higher premiums but allow members to see any healthcare provider, including out-of-network providers.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) will likely be tailored for individuals with specific healthcare needs, including those with chronic conditions, disabilities, or who are dual eligible (qualify for both Medicare and Medicaid). These plans are structured to provide targeted care and must include Part D prescription drug coverage.

SNPs can be either HMO or PPO plans and are designed to meet the unique healthcare needs of their members.

Overview of Mississippi Medicare Advantage Plans

Mississippi will likely offer a variety of Medicare Advantage plans, which may include plans from major providers such as Aetna, Cigna, and UnitedHealthcare. This range could potentially ensure that all residents enrolled in Medicare have access to comprehensive healthcare coverage.

Potential Services and Benefits

Some Mississippi Medicare Advantage plans may cover a wide range of additional services and benefits, possibly going beyond what Original Medicare offers. Some plans may offer additional dental, vision, and hearing services, and sometimes prescription drug coverage.

Dental coverage might include oral exams, cleanings, and X-rays. Vision benefits may include annual eye exams and coverage for eyewear, such as glasses or contacts. Hearing services could potentially feature annual hearing exams and coverage for hearing aids.

Enrollment Process for Mississippi Medicare Advantage Plans

Enrolling in a Mississippi Medicare Advantage plan involves a straightforward process. First, individuals must be enrolled in Original Medicare (Parts A and B). If your current plan is being discontinued, it’s crucial to enroll in a new plan by December 31, 2024, to avoid any coverage gaps.

When to Enroll

Enrollment in Medicare can occur during specific times, such as three months before your 65th birthday or during the annual enrollment period. The Annual Enrollment Period for Medicare Advantage plans in 2025 runs from October 15, 2024, to December 7, 2024. The Initial Enrollment Period starts three months before the month you turn 65 and lasts for seven months.

Additionally, a Special Enrollment Period can be triggered by certain life events, such as moving out of a service area or losing other health coverage.

Different Enrollment Periods

There are multiple enrollment periods for Medicare Advantage plans, including the Initial Enrollment Period, Annual Enrollment Period, and Special Enrollment Periods. Special Enrollment Periods allow individuals to enroll in a new plan from December 8, 2024, to February 28, 2025, if their previous plan is no longer available.

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31, permitting those already enrolled in a Medicare Advantage plan to switch plans or revert to Original Medicare.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) allows beneficiaries to make changes to their Medicare Advantage plans from January 1 to March 31 each year. The Annual Enrollment Period (AEP) occurs from October 15 to December 7, during which individuals can enroll, switch, or drop Medicare plans.

Special Enrollment Periods (SEPs) allow beneficiaries to enroll in or change their Medicare plans due to qualifying life events, such as moving or losing other coverage. These opportunities to enroll in a Medicare plan often last for two full months after the qualifying event.

Possible Costs Associated with Mississippi Medicare Advantage Plans

The potential costs associated with Medicare Advantage plans in Mississippi could vary significantly based on the type of plan selected.

Premiums and Co-Pays

Some Medicare Advantage plans in Mississippi may offer reduced premiums, possibly allowing access to coverage without upfront costs. However, individuals must continue to pay their Medicare Part B premium along with any additional premiums specific to their chosen plan.

Cost-sharing for services might vary based on whether the provider is in-network or out-of-network.

Out-of-Pocket Maximums

Certain Medicare Advantage plans in Mississippi may offer an out-of-pocket maximum limit, possibly providing financial protection against high healthcare expenses. This limit, which may vary by plan, could help protect members from high medical costs by capping their financial responsibility.

Potential Services and Benefits

Medicare Advantage plans will likely provide various medicare coverage options, including HMO, PPO, and SNPs, reflecting the diverse health needs of members. These plans typically include essential medical services such as hospital stays, outpatient care, and preventive services. Some plans may also incorporate additional benefits like dental, vision, and hearing coverage.

Prescription drug coverage may also be integrated into certain plans, possibly helping members manage their medication needs.

How to Qualify for Mississippi Medicare Advantage Plans

To qualify for a Mississippi Medicare Advantage plan, individuals must meet the following criteria:

- Be enrolled in both Medicare Part A and Part B

- Be aged 65 or older

- Have qualifying disabilities

- Meet special conditions such as End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS)

These criteria ensure that individuals are eligible for these plans.

Enrollment occurs during specific periods: Initial Coverage Election Period, Annual Election Period, and Open Enrollment Period. Special enrollment periods are available for significant life changes like job loss or relocation.

Contracted Network and Access to Care

PPO plans allow members to seek care from any provider who accepts Medicare, while HMO plans typically require using network providers for non-emergency services. Choosing in-network providers might lead to lower costs compared to out-of-network options. With Medicare Advantage plans, referrals are generally not needed for specialist visits in PPO plans.

Comparing Mississippi Medicare Advantage Plans to Original Medicare

Mississippi Medicare Advantage Plans might offer additional benefits that could go beyond what Original Medicare covers, such as vision, dental, and hearing programs. Some plans may also provide more comprehensive coverage and financial protection through out-of-pocket maximums.

Coverage Differences

Unlike Original Medicare, which primarily covers hospital and medical services, certain Medicare Advantage plans may include extra services such as dental, vision, and hearing care.

Additionally, some Medicare Advantage plans might include a maximum out-of-pocket limit, possibly offering financial protection that Original Medicare lacks. Prescription drug coverage may also be included in certain Medicare Advantage plans, unlike Original Medicare, which requires separate Part D enrollment.

Cost Comparisons

Medicare Advantage plans could potentially offer lower out-of-pocket costs for certain services compared to Original Medicare, depending on the plan’s design and network restrictions. Some Mississippi Medicare Advantage plans may offer lower overall costs when considering premiums, deductibles, and additional coverage options.

Plans with higher star ratings likely correlate with better member experiences and satisfaction, impacting long-term costs for beneficiaries. Annual out-of-pocket maximums may also differ widely among plans, possibly influencing total yearly healthcare costs.

Emergencies and Referrals

Medicare Advantage plans cover emergency services globally, ensuring members can access necessary care anywhere. Members in HMO plans typically need a referral from their primary care physician to see specialists, but this requirement does not apply in emergency situations.

Medicare Advantage plans may offer limited out-of-network benefits, which can be utilized during emergencies. Access to urgent care facilities will likely be included, possibly ensuring members can receive immediate attention when necessary.

Summary

Mississippi Medicare Advantage plans for 2026 will likely offer a wide range of options and benefits that could potentially enhance healthcare coverage beyond what Original Medicare provides. Some plans may include additional services such as dental, vision, and hearing care, along with prescription drug coverage, Medicare Advantage plans will likely present a comprehensive solution for many beneficiaries. The flexibility of plan types, including HMO, PPO, and SNPs, could potentially ensure that individuals can find a plan that meets their specific healthcare needs.

As you consider your healthcare coverage options for 2026, it is crucial to weigh the potential benefits and costs of different Medicare Advantage plans. Understanding the enrollment periods, costs, and possible benefits could help you make an informed decision that best suits your health and financial needs. Remember, the right plan can provide not only comprehensive coverage but also peace of mind.

Frequently Asked Questions

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7, during your Initial Enrollment Period around your 65th birthday, or during a Special Enrollment Period for specific life events.

→ What are the possible costs associated with Medicare Advantage plans?

Medicare Advantage plans will likely have varied costs, including premiums, copays, and deductibles. However, you must continue to pay your Medicare Part B premium and may incur additional out-of-pocket expenses.

→ What benefits could Medicare Advantage plans offer that Original Medicare does not?

Some Medicare Advantage plans may provide valuable additional benefits like dental, vision, and hearing care, and prescription drug coverage that Original Medicare does not offer. This potential coverage could enhance your healthcare experience.

→ How do I qualify for a Medicare Advantage plan in Mississippi?

To qualify for a Medicare Advantage plan in Mississippi, you must be enrolled in both Medicare Part A and Part B, and be either 65 years or older or have a qualifying disability, such as ESRD or ALS.

ZRN Health & Financial Services, LLC, a Texas limited liability company