Community Blue Medicare Advantage Plans 2026

Curious about the potential Community Blue Medicare Advantage Plans

Key Takeaways

- Some of the Community Blue Medicare Advantage Plans may introduce additional benefits, such as prescription drug coverage, and dental, vision, and hearing services to promote healthier lifestyles.

- Consulting with our licensed agents can simplify the enrollment process, ensuring individuals understand their options and choose the best plan for their unique health requirements.

- There are various plan options, including HMO, PPO, and Special needs Plans (SNPs), each designed to meet different healthcare needs and preferences.

Compare Plans in One Step!

Enter Zip Code

Possible Benefits for Community Blue Medicare Advantage Plans

Some of the Community Blue Medicare Advantage Plans may bring a host of possible benefits likely aimed at improving healthcare access and affordability. Certain plans may feature lower costs for certain prescription drugs, and dental, hearing, and vision services designed to support healthier lifestyles.

These possible enhancements will likely aim to provide a holistic approach to healthcare. Addressing various aspects of health, from medications to preventive services, some plans could potentially provide comprehensive care tailored to members’ needs.

Prescription Drug Coverage

One of the possible advantages in certain Community Blue Medicare Advantage Plans may be the potential inclusion of prescription drug coverage. Members could potentially benefit from reduced copays for generic prescription drugs, possibly making essential medications more affordable and accessible.

Additionally, brand-name prescription drugs may also see reduced copays, which could further reduce certain out-of-pocket costs for members. These potential changes will likely be designed to alleviate the financial burden of high drug costs, possibly ensuring that more people can adhere to their prescribed treatments without financial strain.

Possible Dental and Vision Coverage

Some plans may also include dental and vision coverage. Members could potentially gain access to comprehensive dental benefits that will likely cover routine check-ups and major procedures, likely offering peace of mind and better oral health.

Vision coverage might offer access to necessary eye exams and discounts on eyewear. These potential perks could significantly enhance the overall value of a Medicare Advantage plan, possibly providing comprehensive care that may extend beyond traditional medical services.

Special Supplemental Benefits for the Chronically Ill

For those with chronic illnesses, some Community Blue Medicare Advantage Plans may offer special supplemental benefits designed to meet their unique needs. These benefits will likely focus on improving health and functionality, possibly providing additional support to manage chronic health conditions effectively.

These special supplemental benefits could be tailored to enhance the quality of life for chronically ill individuals. Focusing on specific health requirements likely ensures that members could receive the necessary care and support to maintain their health and independence.

Eligibility and Enrollment Periods for 2026

Understanding the eligibility and enrollment periods for Medicare Advantage plans is crucial for ensuring timely and appropriate coverage. Individuals must meet specific criteria to qualify for enrollment, with designated periods assigned for sign-ups and plan changes.

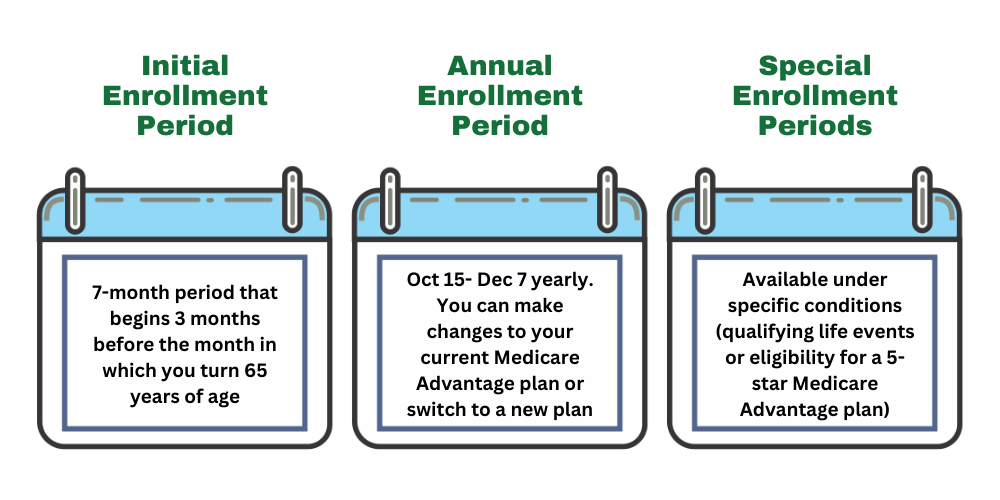

The key enrollment periods include the Initial Enrollment Period, Annual Enrollment Period, and Special Enrollment Periods. Knowing these timelines helps beneficiaries manage their healthcare coverage effectively and avoid gaps in their insurance.

Initial Enrollment Period

The Initial Enrollment Period is a crucial time for those turning 65. This seven-month period begins three months before an individual’s 65th birthday and extends three months after, allowing new enrollees to establish their Medicare Advantage coverage.

During this period, individuals can apply for Medicare coverage, ensuring they have the necessary healthcare services as they age. It’s important to take advantage of this window to avoid any delays or penalties in coverage.

Annual Enrollment Period

The Annual Enrollment Period for Medicare Advantage plans runs from October 15 to December 7 each year. During this time, beneficiaries can switch plans, drop their coverage, or enroll in a new Medicare Advantage plan.

This period is an opportunity for beneficiaries to review their current healthcare needs and make necessary adjustments to their plans. Ensuring the plan aligns with their health requirements and financial situation is essential for optimal coverage.

Special Enrollment Periods

Special Enrollment Periods allow individuals to enroll in Medicare Advantage plans outside the standard enrollment periods. These periods are triggered by qualifying life events, such as moving, losing other health coverage, or qualifying for extra help.

These special periods provide flexibility for those who experience significant life changes, ensuring they can access necessary healthcare coverage without waiting for the standard enrollment periods.

Integrated Care for Dual Eligible Special Needs Plans (D-SNP)

Dual Eligible Special Needs Plans (D-SNP) could offer integrated care for individuals eligible for both Medicare and Medicaid. These plans provide comprehensive management of both medical and behavioral health needs, possibly ensuring a holistic approach to healthcare.

The possible integration of Medicare and Medicaid services could potentially streamlines access to benefits and may reduce barriers to care for dual-eligible members. This coordinated approach could potentially enhance the overall healthcare experience for these individuals.

Coordination Between Medicare and Medicaid

Coordination between Medicare and Medicaid will likely be a key feature in D-SNP plans. This possible integration could ensure that dual-eligible members receive comprehensive and coordinated services that address their full range of health needs.

Streamlining services likely improves accessibility, ensuring members could receive necessary care without gaps or redundancies in their coverage.

Additional Support Services for Dual-Eligible Members

Additional support services for dual-eligible members might include comprehensive management of both medical and behavioral health needs. These services could ensure a holistic approach to healthcare, likely addressing all aspects of a member’s health.

The potential integration of Medicare and Medicaid might not only improve access to care but could also provide a streamlined experience for members, possibly reducing barriers and enhancing the overall quality of care.

Midyear Statements and Transparency Improvements

Some Medicare Advantage plans might provide personalized notifications to beneficiaries detailing any unused supplemental benefits. This initiative will likely aim to enhance beneficiary awareness and possibly ensure that members utilize all available services.

These midyear statements will likely be part of a broader effort to improve transparency and help beneficiaries track their use of supplemental benefits. These statements could potentially enhance members’ understanding and utilization of available services.

Midyear Statements

Members will likely receive detailed notifications about any unused supplemental benefits they have not accessed. These potential updates could help beneficiaries make the most of their Medicare Advantage plans.

Midyear statements could enhance beneficiary awareness and utilization of available services, possibly ensuring members receive their full entitled benefits.

Customer Service and Support Options

Customer service is a crucial aspect of the Community Blue Medicare Advantage Plans. Members will have access to our licensed agents, who can assist with inquiries related to plan benefits and services. Our agents can ensure that members can easily get the help they need, enhancing their overall experience.

Our licensed agents can provide comprehensive support tailored to individual member needs. This approach ensures that members receive timely and accurate information, helping them navigate their healthcare options effectively.

Online Resources

This website, Comparemedicareadvantageplans.org , can be an excellent resource and provide support tailored to individual member needs. Members can utilize the plan finder tool on this website to compare and manage their health and benefits conveniently.

This website offers a convenient way for members to access information and support, helping them make informed decisions about their healthcare coverage and services.

Dedicated Support Teams

Dedicated support teams are designed to address the specific health needs of members within Community Blue Medicare Advantage Plans. These teams provide specialized guidance and support, ensuring that members receive the care and assistance they need.

These dedicated teams offer tailored support, helping members navigate healthcare options and maximize their Medicare Advantage plans, thereby enhancing their overall healthcare experience.

How to Choose the Right Plan for You

Choosing the right Medicare Advantage plan will likely involve assessing personal health needs and financial capabilities. It’s essential to find a plan that aligns with your individual requirements and offers the best value for your healthcare needs.

By carefully evaluating different plans, comparing costs, and reviewing potential benefits, you can select a Medicare Advantage plan that meets your health and financial needs, likely ensuring comprehensive and affordable coverage.

Assessing Your Health Needs

Understanding your health needs is the first step in choosing the right Medicare Advantage plan. Consider possible factors such as existing medical conditions, required medications, and preferred healthcare providers to find a plan that could offer the necessary coverage.

Be sure to take advantage of enrollment periods like the Initial Enrollment Period and Special Enrollment Periods to secure the best coverage for your needs. Being aware of these timelines helps ensure you have continuous and appropriate healthcare coverage.

Comparing Plan Costs

When comparing plan costs, it’s important to analyze the total potential expenses, which may include premiums, co-pays, and out-of-pocket maximums. This comprehensive approach could help identify the most cost-effective plan for your budget.

Enter your zip code into the zip code box on this website to compare prices for various medical services and procedures. This information can help you make informed decisions and choose a plan that fits your financial situation.

Reviewing Potential Benefits

Reviewing the potential benefits could be crucial when selecting a Medicare Advantage plan. Look for plans that might offer additional perks such as prescription drug coverage, or dental, vision, and hearing benefits.

Consider the value of these potential benefits and how they might align with your health needs and lifestyle. Choosing a plan that may offer these benefits could enhance your overall healthcare experience and provide better value for your money.

Summary

The Community Blue Medicare Advantage Plans

By understanding the possible updates and potential benefits of these plans, you can make informed decisions about your healthcare coverage. Take advantage of the enrollment periods, assess your health needs, compare costs, and review extra benefits to choose the best plan for you. Embrace the opportunities these plans could bring and take proactive steps towards better health and financial security.

Frequently Asked Questions

→ What are the potential benefits of the 2026 Community Blue Medicare Advantage Plans?

Some of the Community Blue Medicare Advantage Plans may feature prescription drug coverage, and dental, vision, and hearing coverage that could enhance healthcare access and affordability. These potential benefits will likely aim to provide better support for members’ overall health needs.

→ How could I benefit from prescription drug coverage?

Unfortunately, the plan details

→ How could the integration of Medicare and Medicaid services benefit dual-eligible members?

The potential integration of Medicare and Medicaid services could benefit dual-eligible members by simplifying access to care and possibly ensuring comprehensive management of their medical and behavioral health needs. This approach could potentially reduce certain barriers to services, possibly enhancing overall health outcomes.

→ What customer service options are available in 2026 ?

Members can access personal assistance by calling our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our agents can help members with inquiries regarding plan benefits and services, enhancing accessibility and support for members.

ZRN Health & Financial Services, LLC, a Texas limited liability company