Medicare Advantage Plans in Sioux Falls for 2025

Seeking Medicare Advantage plans in Sioux Falls? This article provides a direct look into the possible options for Medicare Part C in the area. With a breakdown of providers, possible plan types, potential benefits, and costs, this article could offer clarity.

This overview may prepare you for the choices ahead in Medicare Advantage Plans Sioux Falls.

Key Takeaways

- Some of the Medicare Advantage Plans, also known as Medicare Part C, may provide a range of options for Sioux Falls residents, as they might offer essential benefits aligned with Original Medicare (Parts A and B), and some plans including Part D prescription drug coverage and additional perks like dental and vision care.

- Enrollment in Medicare Advantage Plans is subject to eligibility criteria, specific enrollment periods such as the Initial Coverage Election Period and Annual Election Period, and potential eligibility for assistance through Medicare Savings Programs for qualifying low-income seniors.

- There are various types of Medicare Advantage Plans available in Sioux Falls, including HMO, PPO, PFFS, and SNPs, each with different benefits, costs, and provider network structures, requiring careful review to ensure they meet individual healthcare needs and budget constraints.

Compare Plans in One Step!

Enter Zip Code

Discovering Your Medicare Advantage Plan Options in Sioux Falls

Medicare Advantage Plans, also known as Medicare Part C, will likely be health plans offered by Medicare-approved private companies that contract with Medicare to provide both Part A (hospital insurance) and Part B (medical insurance) benefits to enrollees.

In South Dakota, these plans will likely be accessible to individuals who are enrolled in both Medicare Part A and Part B.

The beauty of the Medicare Advantage Plans in Sioux Falls is the diversity of options they might offer. Whether seeking a basic health plan or one that may have additional benefits, members can choose from a wide variety of plans.

Read on for a detailed exploration of the potential plan options, the private providers that could offer them, and the possible benefits and additional perks that might come with them.

Navigating Sioux Falls Medicare Advantage Providers

Though navigating through the multitude of Medicare Advantage providers in Sioux Falls might seem daunting, rest assured this article can guide you through the process. There will likely be several private health insurance providers who could offer Medicare Advantage plans in South Dakota, including:

- Aetna Medicare

- HealthPartners

- Humana

- Medica

- Sanford Health Plan

- UnitedHealthcare

- Wellmark Advantage Health Plan

Each of these private insurance companies will likely offer unique plan options that could cater to a myriad of health needs.

However, it’s not all about the number of options available. Each insurance provider may also set its own rules about how the potential benefits could be accessed and paid for, which is why understanding these rules may be crucial when comparing costs.

Potential Benefits and Additional Perks of Local Plans

All Medicare Advantage plans in Sioux Falls are required to cover the same hospital and medical benefits as Original Medicare Parts A and B. This means that even at the basic level, every Medicare Advantage plan will likely provide you with essential health coverage.

However, some of these plans may offer additional perks. Some of the Medicare Advantage plans in Sioux Falls might include prescription drug coverage, equivalent to Part D in Original Medicare. Furthermore, certain plans may also offer additional benefits not included in Original Medicare, such as vision, and dental care, which could lead to a higher premium.

As you choose a plan, it’s important to consider how each plan could cover the essential benefits of Original Medicare along with the supplemental benefits.

Understanding Plan Types Available in Sioux Falls

Residents in Sioux Falls can choose from four main types of Medicare Advantage Plans, including:

- Preferred Provider Organization (PPO)

- Private Fee-For-Service (PFFS)

These options could provide a range of coverage and flexibility for residents in the area, including Medicaid services. These plans will likely be designed to cater to a wide range of health needs, which could give beneficiaries the freedom to choose a plan that best suits their unique circumstances.

However, each plan type comes with its own set of pros and cons. PFFS plans in Sioux Falls, for example, are known for allowing beneficiaries to use any Medicare-approved provider that accepts the plan’s payment terms without a referral or a primary care doctor, offering flexibility in and out-of-network care.

On the other hand, a potential limitation for Medicare Advantage plan members in Sioux Falls could come from the required use of a network of providers, with the possibility of yearly network alterations impacting the continuity of care.

The following sections will dissect each plan type, providing you with a deeper understanding of their features and costs.

Health Maintenance Organization (HMO) Plans Explained

Health Maintenance Organization (HMO) plans are a popular choice among Medicare Advantage beneficiaries. But what exactly are they? HMO plans in Sioux Falls require beneficiaries to receive most of their health services from a network of local providers.

In essence, they are designed to facilitate coordinated care, ensuring that all your health services are centralized within one network.

The benefits of HMO plans extend beyond coordinated care. They also come with additional features such as coverage for prescription drugs and specialist referrals, which are key features of Medicare Advantage HMO plans.

However, it’s worth noting that the requirement to use in-network providers might limit your freedom to choose your preferred healthcare providers.

Preferred Provider Organization (PPO) Plans Uncovered

If flexibility is a top priority for you, then Preferred Provider Organization (PPO) plans might be the right fit. PPO plans offer beneficiaries the choice to use out-of-network providers, often at a higher cost.

This means you have the freedom to see any healthcare provider you choose, regardless of whether they are in-network or out-of-network.

Special Needs Plans (SNP) Tailored for Sioux Falls Residents

Special Needs Plans (SNPs) are designed with a specific group of individuals in mind. SNPs in Sioux Falls are Medicare Advantage Plans specifically designed for individuals with certain diseases or characteristics, offering targeted care and benefits.

These plans enhance member healthcare with tailored benefits such as specialized provider networks and care coordination, aiding in the comprehensive management of conditions.

SNPs cater to beneficiaries with specific needs, including those with chronic conditions like diabetes or heart failure and individuals who are dual-eligible for Medicare and Medicaid or institutionalized.

However, eligibility for SNPs is strictly for individuals meeting the specific conditions they serve, and while these plans are subject to Medicare rules for enrollment changes.

Enrollment Insights: Joining a Sioux Falls Medicare Advantage Plan

To be eligible for a Medicare Advantage Plan in Sioux Falls, individuals must:

- Be enrolled in both Medicare Part A and Part B

- Be 65 years old or have a qualifying disability (typically after receiving 24 Social Security or Railroad Retirement Board (RRB) Disability Insurance payments)

- Have End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS)

Enrolling in a Medicare Advantage Plan allows you to access comprehensive Medicare health coverage under Medicare Advantage.

Enrollment in a Medicare Advantage Plan is governed by specific periods. The Initial Coverage Election Period for those newly eligible includes the three months before turning 65, the month of the 65th birthday, and the three months following.

If eligible due to disability, the Initial Coverage Election Period occurs three months before or after the 25th month of receiving disability benefits.

There’s also the Annual Election Period running from October 15 to December 7, which allows individuals to switch from Original Medicare to a Medicare Advantage Plan or change between Medicare Advantage Plans.

Special Enrollment Periods are provided for circumstances such as losing current health coverage or moving out of the plan’s service area.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Possible Cost Considerations for Sioux Falls Medicare Advantage Enrollees

Taking into account the possible cost implications could be vital when considering a Medicare Advantage Plan.

Low-income seniors in Sioux Falls may be eligible for Medicare Savings Programs, which may be able to assist with certain costs of some of the Medicare Advantage plans, potentially saving on expenses like premiums, deductibles, and coinsurance.

However, some Medicare Advantage beneficiaries may face financial challenges due to the way copays and deductibles are structured, which might lead to unexpected costs and the denial of benefits for certain types of care. We will explore the details of these costs further.

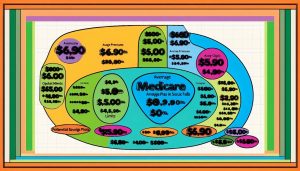

Analyzing Potential Monthly Premiums and Out-of-Pocket Expenses

One of the potential cost considerations of Medicare Advantage Plans will likely be the monthly premium and out-of-pocket expenses. Some Medicare Advantage plans may provide an out-of-pocket limit for services covered under Parts A and B, which traditional Medicare might not offer.

Some studies have indicated that about half of Medicare Advantage enrollees could pay more than traditional Medicare beneficiaries during a seven-day hospital stay. Furthermore, enrollees might encounter unexpectedly high costs when requiring services from out-of-network providers.

Comparing Potential Costs Across Sioux Falls Advantage Plans

Beyond the potential premiums and out-of-pocket expenses, it’s crucial to compare costs across various Sioux Falls Medicare Advantage plans when selecting one.

However, some of the Medicare Advantage Plans in South Dakota might offer innovative benefits, which may add value to plan selections. However, the possibility of having additional benefits may lead to higher premiums, and enrollees should be aware that some Medicare Advantage plans might come with a mandatory out-of-pocket limit for covered services that will likely distinguish them from traditional Medicare.

When selecting a plan, beneficiaries might want to consider the following:

- Types of plans available, such as HMOs and PPOs

- How some plans may cover the benefits of Original Medicare Parts A, B, and often D

- Any additional services that might not be covered by Original Medicare

By comparing these factors, beneficiaries can make an informed decision about their healthcare coverage.

Potential Prescription Drug Coverage in Sioux Falls Medicare Advantage Plans

Some of the Medicare Advantage Plans may include prescription drug coverage, but the specifics of this coverage could vary from plan to plan. Certain Medicare Advantage Prescription Drug plans in Sioux Falls will likely have formularies, which are lists of covered drugs that may vary from plan to plan.

These plans structure drug coverage into tiers, which could influence cost-sharing for beneficiaries with different levels of costs for each tier.

Beneficiaries in Sioux Falls may also have access to extensive pharmacy networks, such as the one that might be offered by Sanford Health Plan’s Align PPO. PPO plans commonly include Part D prescription drug coverage, offering an integrated solution for beneficiaries’ health care needs.

Similarly, Medicare Advantage Special Needs Plans (SNPs) are typically required to offer Medicare Part D prescription drug coverage.

For PFFS plans that do not include Part D, Sioux Falls beneficiaries can enroll in a separate Medicare drug plan to gain prescription coverage. Bundling Parts A, B, and often D in a single Medicare Advantage plan can simplify health coverage for Sioux Falls beneficiaries, potentially lowering copays and negating the need for supplemental Medigap insurance.

Possible Advantages and Limitations of Sioux Falls Medicare Advantage Plans

While some Medicare Advantage Plans could come with numerous advantages, it’s important to be aware of the potential limitations as well.

Some plans might:

- rated annually, with some plans achieving ratings of 4.0 stars or higher, allowing beneficiaries to gauge the quality of each plan

- offer additional benefits over Original Medicare, such as prescription drug coverage

However, while some plans may offer extra services, the majority of Medicare Advantage Plans may also come with increased premiums, possibly necessitating a careful assessment of the balance between desired benefits and affordability.

Furthermore, these plans will likely have specific limitations. For instance, Private Fee-for-Service (PFFS) plans cannot exceed Original Medicare costs for certain services, and enrollees must stay informed on the constraints of their chosen plan.

Expert Assistance and Resources for Sioux Falls Beneficiaries

You don’t have to navigate the Medicare Advantage landscape alone. Sioux Falls residents may seek assistance from licensed insurance agents who can help them understand and choose Medicare Advantage plans. Counselors in South Dakota may also offer guided help to individuals in comparing and choosing the most suitable Medicare Advantage Plans.

Certified Senior Advisor Kelly Blackwell will likely be among healthcare professionals dedicated to aiding seniors with their Medicare Advantage Plan decisions.

Beneficiaries could also make use of available online resources to understand the various plans. For instance, this website is a great tool that allows Sioux Falls residents to search for, compare, and understand the different plans that might be available in their area.

Summary

Some of the Medicare Advantage Plans in Sioux Falls could offer a wide range of options that will likely cater to various health needs. From understanding your potential plan options and navigating providers to learning about the enrollment process and possible cost considerations, it’s important to have a comprehensive understanding of these plans before making a decision.

Remember, the best plan for you is not necessarily the most expensive or the one with the most benefits but the one that best suits your unique health needs and financial circumstances. So, take your time, weigh your options, and make an informed decision.

Frequently Asked Questions

→ Is Medicare Advantage cheaper than Medicare?

Some of the Medicare Advantage plans might cost less than Original Medicare due to the maximum out-of-pocket limit that will likely be implemented in Medicare Advantage plans, possibly making them a more affordable option for many.

It’s important to compare the possible costs and benefits to determine the most suitable option for your individual needs.

→ What are 4 types of Medicare Advantage plans?

Medicare Advantage plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service Plans, and Special Needs Plans (SNPs). Each type operates differently, so it’s important to compare them before making a choice.

→ Does South Dakota offer Medicare Advantage plans?

Yes, South Dakota will likely offer Medicare Advantage plans, with four available providers in 2025.

→ What are the eligibility requirements for a Medicare Advantage Plan in Sioux Falls?

To be eligible for a Medicare Advantage Plan in Sioux Falls, individuals must be enrolled in both Medicare Part A and Part B. They can enroll at 65 or if they have a qualifying disability, and individuals with ESRD or ALS are also eligible.

→ What types of Medicare Advantage Plans are available in Sioux Falls?

In Sioux Falls, residents have access to four main types of Medicare Advantage Plans: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-For-Service (PFFS), and Special Needs Plans (SNP).

Consider exploring the options to find the best fit for your healthcare needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.