Does Medicare Cover Rehab After Stroke?

Recovery from a stroke often requires rehabilitation, and an immediate concern for many is the cost of such care. You’re probably asking: does Medicare cover rehab after stroke? Yes, Medicare does help mitigate these costs by covering necessary rehab services.

We’ll unpack exactly what that entails, what you need to know about different Medicare plans, and tips for managing any out-of-pocket expenses.

Key Takeaways

- Medicare provides comprehensive stroke rehabilitation coverage, including inpatient and outpatient services such as physical, occupational, and speech therapy, contingent upon medical necessity and with limits on duration and coverage.

- Medicare Advantage plans may offer additional benefits beyond Original Medicare for stroke rehab, which can include extended therapy services and ancillary services, while Medigap plans assist with out-of-pocket costs like copayments and deductibles.

- Medicare covers preventative screenings and services to reduce the risk of future strokes and provides benefits for durable medical equipment and up to 100 days in Skilled Nursing Facilities post-stroke, highlighting the critical importance of understanding coverage specifics to optimize benefits.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Coverage for Stroke Rehabilitation

Medicare’s coverage for stroke rehabilitation is comprehensive, covering both inpatient and outpatient services. This includes physical, occupational, and speech therapy services. The objective of these therapy sessions is to facilitate the recovery of muscle strength, coordination, speech skills, and other essential functions to support stroke survivors on their recovery journey.

The landscape of Medicare coverage might seem complex, but its primary aim for stroke rehabilitation is to facilitate the necessary medical care and rehabilitation for stroke recovery. Whether it’s outpatient care or inpatient rehabilitation, the right coverage can greatly support the recovery process.

Inpatient Rehabilitation Facilities and Medicare

Navigating the nuances of Medicare Part A and its coverage for inpatient rehabilitation services for stroke patients can seem daunting. Yet, understanding the criteria for coverage can help stroke survivors optimally utilize these benefits.

In order to qualify for Medicare Part A coverage of inpatient rehabilitation for stroke patients, it is necessary for the doctor to determine that the rehabilitation is medically essential for treating the patient following the stroke.

It’s also vital to comprehend the duration and costs linked to this coverage. Medicare provides coverage for up to 90 days of inpatient rehab following a stroke, which can greatly benefit stroke survivors during their recovery process. However, it’s important to be aware of applicable deductibles, coinsurances, and limits when Medicare is the sole insurance for inpatient rehabilitation.

Outpatient Rehabilitation Services Under Medicare Part B

Medicare Part B significantly contributes to the recovery of stroke patients by covering outpatient rehabilitation services like physical and occupational therapy. However, for Medicare to provide coverage, a doctor is required to certify that the outpatient physical therapy is medically necessary.

While there is a cap on the number of therapy sessions, Medicare may extend coverage beyond these limits if it is deemed medically necessary and approved, which can be beneficial for stroke survivors.

However, beneficiaries must be prepared to cover the 20% coinsurance of the Medicare-approved amount for the outpatient rehabilitation services, in addition to any excess charges.

Speech Therapy and Stroke Recovery

The essential role of speech therapy in stroke rehabilitation includes:

- Assessing and supporting stroke survivors to minimize aspiration and choking risks

- Providing dysphagia therapy

- Utilizing singing therapy to retrain the brain and help patients regain the ability to speak.

Speech therapy services for stroke patients are covered by Medicare Part B if they are considered medically necessary and administered by qualified healthcare professionals. With Medicare Part B typically covering 80% of the expenses for medically necessary speech therapy sessions related to stroke recovery, it provides significant relief for stroke survivors.

The Role of Medicare Advantage Plans in Stroke Rehab

Authorized private insurance companies provide Medicare Advantage plans, acting as an alternative to Medicare Supplement Insurance for those recovering from a stroke. These plans offer significant benefits for stroke patients, including:

- Comprehensive coverage of services

- Longer-term therapy

- Ancillary services for regaining mobility and functionality

- Access to specialized neurology and rehabilitation experts

In addition to the extensive coverage, many Medicare Advantage plans offer extended coverage beyond the scope of Original Medicare, encompassing vision, dental, and hearing services, which can be especially advantageous post-stroke. A Medicare Advantage plan can provide these additional benefits, making it a popular choice for many beneficiaries.

Comparing Medicare Advantage Plans

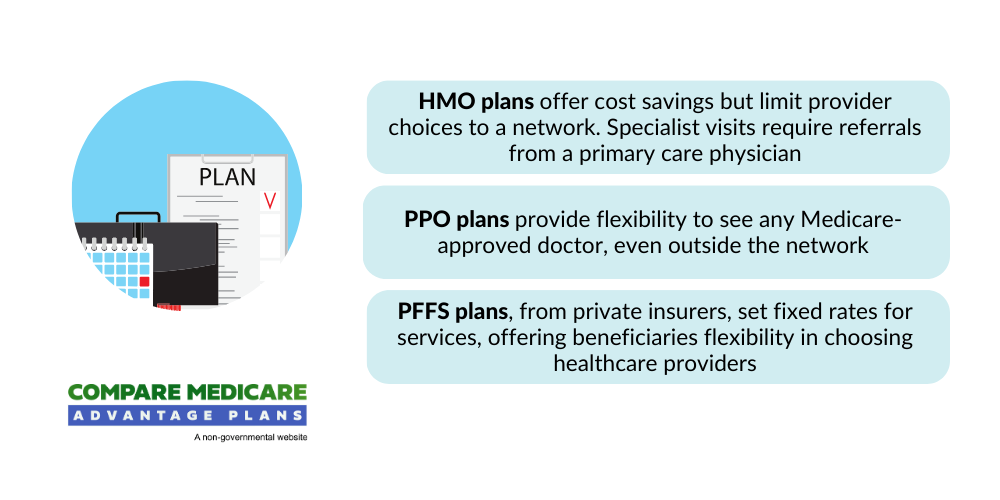

Medicare Advantage plans that provide coverage for stroke rehabilitation consist of:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Each of these plans provides distinct benefits related to inpatient and outpatient stroke rehab care.

The costs linked with stroke rehab can significantly fluctuate for Medicare Advantage Plans. Hence, before enrolling, evaluating the inclusion of preferred providers and rehabilitation facilities within the plan’s network is crucial.

Supplementing Your Stroke Rehab Coverage with Medigap

Medicare Supplement plans, also known as Medigap, help to provide medicare cover for expenses like copayments and deductibles that Original Medicare doesn’t cover. This can be of considerable help to Medicare beneficiaries, especially stroke survivors who may require additional Medicare Supplement Insurance.

The most comprehensive Medicare Supplement plans provide extensive coverage for strokes, assisting in covering the cost-sharing of services that are not fully paid by Original Medicare. Medigap plans offer assistance in lowering medical expenses by providing coverage for supplementary costs like copayments, coinsurance, and deductibles that may not be included in Original Medicare.

Medigap Plan C and Medigap Plan F cover the Medicare Part B deductible, offering financial assistance for individuals facing substantial medical expenses.

Durable Medical Equipment for Stroke Patients

Durable Medical Equipment (DME) often plays a significant role in the recovery journey of stroke patients. Medicare covers DME such as walkers and wheelchairs for stroke patients, provided they have a doctor’s prescription.

Grasping the criteria for Medicare’s coverage of DME is vital. Medicare provides coverage for a portion of the expenses for walkers that are recommended as a means of mobility following a stroke. Generally, both 2-wheel and 4-wheel walkers are eligible for coverage, with Medicare assuming 80% of the overall expense.

Managing Costs: Understanding Out-of-Pocket Expenses

The first-year cost of stroke rehabilitation is estimated to be approximately $17,000, with medication expenses surging over $5,000 and possible rehabilitation service costs surpassing $11,000. Out-of-pocket payments may include meeting the Medicare Part A deductible and covering coinsurance expenses.

Medicare Part B helps in covering outpatient rehabilitation services, which embrace physical, occupational, and speech therapy. Although this can lower out-of-pocket costs, it’s important to note that there is still a deductible of $203, along with potential coinsurance or additional fees that Medicare Part B may not cover.

Preparing for Potential Future Strokes

Risk factors for recurrent strokes include:

- Hypertension

- Dyslipidemia

- Diabetes

- Age

- Atrial fibrillation

- Smoking

- Prior cerebrovascular events

Embracing lifestyle changes can notably diminish the risk of conditions like clogged arteries and atherosclerosis, consequently aiding in the prevention of future strokes.

Medical tests and procedures can aid in predicting future stroke risks. Medicare includes coverage for preventive services and screenings for stroke, bolstering endeavors in stroke prevention and overall health upkeep.

Navigating Skilled Nursing Facilities After a Stroke

Some patients may need skilled nursing care after a stroke. Medicare Part A covers Skilled Nursing Care when it’s deemed medically vital post-stroke, and the patient meets the Skilled Nursing Facility (SNF) criteria.

Medicare provides coverage for up to 100 days of care in a Skilled Nursing Facility for stroke recovery, contingent upon the patient’s need for medically necessary inpatient rehab as determined by a physician.

However, Medicare does not provide coverage for long-term care in skilled nursing facilities if that is the sole type of care required by the stroke patient.

Maximizing Outpatient Care Benefits

Medicare Part B covers vital outpatient rehabilitation services for stroke patients. This includes physical therapy, occupational therapy, and speech therapy, depending on the medical necessity as established by a physician.

While there is a cap on the number of therapy sessions, Medicare may extend coverage beyond these limits if it is deemed medically necessary and approved, which can be beneficial for stroke survivors.

Summary

Navigating the healthcare system after a stroke can be challenging. But understanding the coverage provided by Medicare and its different parts, along with the supplemental coverage options, can offer relief and support during the recovery journey.

In conclusion, whether you’re exploring inpatient rehabilitation facilities, outpatient rehabilitation services, or benefits of speech therapy, Medicare provides a comprehensive coverage that can significantly aid in the recovery journey. It’s all about understanding the right coverage for your specific needs.

Frequently Asked Questions

→ How many days will Medicare pay for rehab after a stroke?

Medicare will cover up to 90 days of inpatient rehab after a stroke, after which you may use your lifetime reserve days to continue coverage.

→ How much does it cost to recover from a stroke?

The direct medical costs of recovering from a stroke in the United States can range from $30,000 to $120,000 per patient, depending on the severity and complications, covering hospitalization, diagnostic tests, medications, and rehabilitation services.

→ What does Medicare cover for stroke rehabilitation?

Medicare covers comprehensive stroke rehabilitation, including inpatient and outpatient services such as physical, occupational, and speech therapy.

→ Does Medicare cover durable medical equipment for stroke patients?

Yes, Medicare covers durable medical equipment like walkers and wheelchairs for stroke patients with a doctor’s prescription.

→ What is a Medigap plan and how can it benefit stroke survivors?

A Medigap plan, also known as a Medicare Supplement plan, can benefit stroke survivors by helping to cover expenses like copayments and deductibles that Original Medicare may not fully cover. This additional coverage can be particularly helpful for stroke survivors who may have ongoing medical needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.